RSA Insurance 9-Month Core Written Premiums Fall 5%

November 05 2015 - 3:03AM

Dow Jones News

By Ian Walker

LONDON--RSA Insurance Group PLC (RSA.LN) Thursday reported a 5%

fall in core net written premiums for first the nine months of the

year to 4.41 billion pounds ($6.76 billion), but said this is up 1%

on a constant currency basis.

The insurance company added that insurance markets remain

challenging and financial markets volatile. However, costs continue

to fall as expected, while other operational improvement actions

showing good results.

"Within those constraints, RSA is making strong progress on the

path to high quality and sustained business outperformance," Chief

Executive Stephen Hester said.

RSA's economic capital surplus--a measure of financial

stability--fell to GBP1.0 billion at Sept. 30, from GBP1.7 billion

at June 30. Its tangible net asset value per share was 294 pence,

up from 282 pence at June 30, 2014.

Earlier this year, RSA, which started in a coffee shop in 1710,

held takeover talks with Swiss peer Zurich Insurance Group AG

(ZURN.VX). However, the discussions were called off in September by

Zurich due to the deterioration in the trading performance of its

general insurance business. The talks centered around a price of

550 pence per ordinary share, which RSA had been willing to

recommend to its shareholders.

At that time RSA said that trading results for July and August

had been positive and ahead of its expectations.

Shares closed Wednesday at 415 pence and are currently down 13%

over the past 12 months, having peaked at 528 pence in August.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 02:48 ET (07:48 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

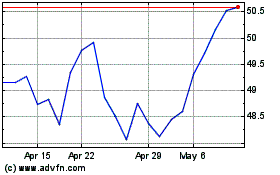

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From May 2024 to Jun 2024

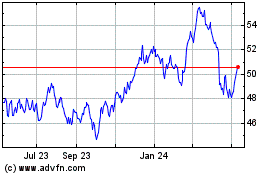

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jun 2023 to Jun 2024