Swiss Re Lifts Profit But Warns of Hefty China Claim

October 29 2015 - 5:30AM

Dow Jones News

ZURICH—Swiss Re AG on Thursday reported increased profit for the

third quarter, even as the reinsurance giant detailed losses

expected as a result of the deadly explosion in August at a port in

Tianjin, China.

Zurich-based Swiss Re said it expects a pretax loss of roughly

$250 million related to the disaster. In September, Zurich

Insurance Group AG said it expected losses of about $275 million

related to the explosion, which was caused by the improper storage

of hazardous chemicals and killed more than 100 people.

Swiss Re's net profit rose to $1.4 billion in the third quarter

from $1.23 billion in the same period last year, in part because of

the absence of large natural catastrophes. Premiums and fee income

fell to $7.85 billion from $8.31 billion, Swiss Re said.

Return on equity was 17.3% in the quarter, up from 14.8% a year

earlier.

Swiss Re's results this year have been solid, "especially when

taking into account the overall insurance market, which continues

to be challenging," chief financial officer David Cole told

reporters.

Swiss Re said it would start a share buyback program next month,

which it initially unveiled earlier this year. Mr. Cole said

details of the buyback are forthcoming.

The reinsurance firm's largest unit, the property and casualty

business, reported that net profit rose to $1.01 billion in the

third quarter from $842 million in the same period last year. That

came even as premiums earned fell to $4.1 billion from $4.3

billion. Swiss Re said the business benefited from strong

investment returns.

Swiss Re's Admin Re business, which has been in the process of a

revamp and is acquiring U.K.-based Guardian Holdings Europe Ltd. as

part of that effort, reported that net profit fell to $21 million

in the quarter from $54 million in the same period last year. The

company cited a poor investment performance in the U.K. market.

Separate from its financial results, Swiss Re said its board

will propose Paul Tucker, a former deputy governor of the Bank of

England, as a new director at the firm's annual shareholder meeting

next year.

Write to John Letzing at john.letzing@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 05:15 ET (09:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

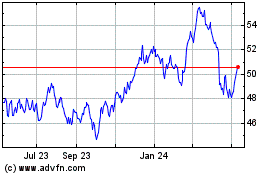

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jun 2024 to Jul 2024

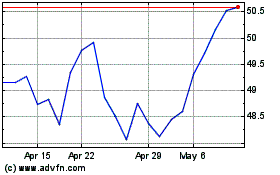

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jul 2023 to Jul 2024