Enticed By Low Yields, Companies Sell Debt In Risky Climate

April 10 2012 - 2:07PM

Dow Jones News

Four companies are wading into the U.S. debt markets Tuesday to

take advantage of the drop in corporate bond yields over the last

week, but investors are demanding higher yields to compensate them

in this risky climate.

Zurich Insurance Group Ltd. and U.S. retail chain Kroger Co.

(KR) are leading the new-issue market with benchmark-size deals,

along with smaller deals from Mack-Cali Realty Corp. (CLI) and the

Idaho Power Co.

The four issues follow the lightest week for volume in 2012,

according to Dealogic, and this week is shaping up to be even

softer. No borrowers tried issuing Monday in the wake of the soft

U.S. payrolls report Friday, but the environment was looking stable

Tuesday morning with a flat stock market and only minor weakening

in Markit's CDX North American Investment-Grade Index, a proxy for

risk sentiment.

Stocks have since tumbled and the CDX index had worsened 2.4%,

but companies are attracted by the low Treasury rates that

corporate bonds are based upon. The 10-year Treasury rate has now

dropped at 1.98%, or 0.25 percentage point down from the 2.23% rate

just before the payrolls report.

That's a big motivator. Though corporate bonds haven't kept pace

with the Treasury rally, causing spreads to widen, absolute yields

have dropped in the Barclays investment-grade index. Average yields

finished Monday at 3.37%, compared with 3.47% on April 3, even as

spreads widened 0.08 point in the week.

"All-in yields are the reason these companies are getting in,"

said Vincent Murray at Mizuho Securities. "That's got to be

attractive for anyone who needs to issue debt, but it's a toss-up

because fast-money accounts start to step back when things get

shaky."

A counterweight to falling yields is that investors could start

demanding higher "concessions"--the extra yield on new bonds--to

mitigate potential losses in a riskier environment.

Kroger might be an example of that. Early pricing guidance

suggests it is selling 10-year and 30-year bonds at 1.50 and 1.85

percentage points over Treasury rates. Its outstanding 30-year bond

due 2040 traded Monday at 1.58 points over Treasurys, suggesting

investors are picking up 0.22 point by purchasing the new bond.

But Mack-Cali Realty recently launched its 10-year offering at

2.55 points over Treasurys, a slightly better level than the

2.60-point spread reported earlier, and the deal was enlarged by

$50 million to $300 million.

"Investors are realizing they could get burned on these low

rates, so they want to be compensated for the risk, but at the same

time there isn't enough attractive debt out there to put money to

work, leading to these competing forces," said Jody Lurie,

corporate credit analyst at Janney Capital Markets.

Even before the payrolls report, actively traded new deals were

weakening in the secondary market, according to Scott Kimball,

portfolio manager at Miami-based BMO TCH Corporate Income Fund,

which holds $7.3 billion in assets under management.

"The performance following new issuance is the weakest it has

been in a long time," he said. "The new-issue market is feeling

saturated. If spreads go wider, equity markets remain weak, and

Treasurys rally, we'll have to see bigger concessions to get deals

done."

Since the French media company Vivendi SA (VIVEF, VIV.FR) sold

$800 million of 10-year bonds on April 3 at 2.50 percentage points

over the Treasury rate, spreads have jumped 0.15 point to 2.65

points, according to MarketAxess.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

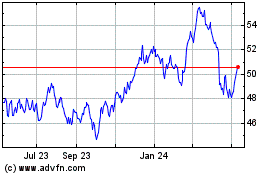

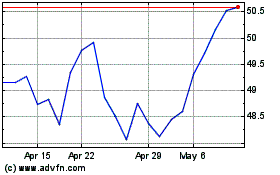

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jul 2023 to Jul 2024