Form

10-K

x

ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Fiscal Year Ended July 31, 2009

¨

TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Transition Period from _____ to _____

Commission

File Number 333-130295

WELLSTAR

INTERNATIONAL, INC.

(Exact

name of small business issuer as specified in its charter)

|

Nevada

|

|

20-1834908

|

|

(State

or other jurisdiction of incorporation

or

organization)

|

|

(IRS

Employer Identification

No.)

|

|

6911

Pilliod Road

Holland,

Ohio

|

|

43528

|

|

419-865-0069

|

|

(Address

of principal executive office)

|

|

(Postal

Code)

|

|

(Issuer's

telephone

number)

|

Securities

registered under Section 12(b) of the Exchange Act: None

Securities

registered under Section 12(g) of the Exchange Act: None

Indicate

by check mark if the registrant is a wll-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes

¨

No

x

Indicate

by check by mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act. Yes

¨

No

x

Indicate

by check mark whether the registrant (1) filed all reports required to be filed

by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for

such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes

x

No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

¨

|

Accelerated

filer

¨

|

|

|

|

|

Non-accelerated

filer (Do not check if a smaller reporting company)

¨

Smaller

reporting company

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes

¨

No

x

State

issuer's revenues for its most recent fiscal year: $0.

The

aggregate market value of the voting stock held by non-affiliates as of November

12, 2009 was $1,434,665.

Number of

outstanding shares of the registrant's par value $0.001 common stock as of

November 12, 2009: 14,346,647,175

WELLSTAR

INTERNATIONAL, INC.

FORM

10-K

For

the Fiscal Year Ended July 31, 2009

|

|

|

Page

|

|

|

|

|

|

Part

I

|

|

2

|

|

|

|

|

|

Item

1. Description of Business.

|

|

2

|

|

|

|

|

|

Item

1A. Risk Factors

|

|

11

|

|

|

|

|

|

Item

1B. Unresolved Staff Comments

|

|

11

|

|

|

|

|

|

Item

2. Description of Property.

|

|

11

|

|

|

|

|

|

Item

3. Legal Proceedings.

|

|

11

|

|

|

|

|

|

Item

4. Submission of Matters to a Vote of Security Holders.

|

|

11

|

|

|

|

|

|

Part

II

|

|

12

|

|

|

|

|

|

Item

5. Market for Common Equity and Related Stockholder

Matters.

|

|

12

|

|

|

|

|

|

Item

6. Selected Financial Data

|

|

14

|

|

|

|

|

|

Item

7. Management's Discussion and Analysis or Plan of

Operation.

|

|

14

|

|

|

|

|

|

Item

7A. Quantitative and Qualitative Disclosures about Market

Risk

|

|

21

|

|

|

|

|

|

Item

8. Financial Statements and Supplementary Data

|

|

21

|

|

|

|

|

|

Item

9. Changes In and Disagreements with Accountants on Accounting and

Financial Disclosure.

|

|

21

|

|

|

|

|

|

Item

9A. Controls and Procedures.

|

|

22

|

|

|

|

|

|

Item

9A(T). Controls and Procedures.

|

|

22

|

|

|

|

|

|

Item

9B. Other Information.

|

|

22

|

|

|

|

|

|

Part

III

|

|

Page

|

|

|

|

|

|

Item

10. Directors, Executive Officers and Corporate

Governance.

|

|

23

|

|

|

|

|

|

Item

11. Executive Compensation.

|

|

24

|

|

|

|

|

|

Item

12. Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

|

26

|

|

|

|

|

|

Item

13. Certain Relationships and Related Transactions.

|

|

27

|

|

|

|

|

|

Item

14. Principal Accountant Fees and Services.

|

|

27

|

|

|

|

|

|

Item

15 Exhibits, Financial Statement Schedules

|

|

28

|

|

|

|

|

|

Signatures.

|

|

31

|

|

|

|

|

|

Financial

Statements

|

|

F-1

|

PART I

FORWARD-LOOKING

INFORMATION

This

Annual Report on Form 10-K (including the section regarding Management's

Discussion and Analysis of Financial Condition and Results of Operations)

contains forward-looking statements regarding our business, financial condition,

results of operations and prospects. Words such as "expects," "anticipates,"

"intends," "plans," "believes," "seeks," "estimates" and similar expressions or

variations of such words are intended to identify forward-looking statements,

but are not deemed to represent an all-inclusive means of identifying

forward-looking statements as denoted in this Annual Report on Form 10-K.

Additionally, statements concerning future matters are forward-looking

statements.

Although

forward-looking statements in this Annual Report on Form 10-K reflect the good

faith judgment of our management, such statements can only be based on facts and

factors currently known by us. Consequently, forward-looking statements are

inherently subject to risks and uncertainties and actual results and outcomes

may differ materially from the results and outcomes discussed in or anticipated

by the forward-looking statements. Factors that could cause or contribute to

such differences in results and outcomes include, without limitation, those

specifically addressed under the heading "Risks Factors” that may be included in

our reports from time to time, as well as those discussed elsewhere in this

Annual Report on Form 10-K. Readers are urged not to place undue reliance on

these forward-looking statements, which speak only as of the date of this Annual

Report on Form 10-K. We file reports with the Securities and Exchange Commission

("SEC"). We make available on our Web site under "Investor Relations/SEC

Filings," free of charge, our annual reports on Form 10-K, quarterly reports on

Form 10-QSB, current reports on Form 8-K and amendments to those reports as soon

as reasonably practicable after we electronically file such materials with or

furnish them to the SEC. You can also read and copy any materials we file with

the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC

20549. You can obtain additional information about the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC

maintains an Internet site (www.sec.gov) that contains reports, proxy and

information statements, and other information regarding issuers that file

electronically with the SEC, including us.

We

undertake no obligation to revise or update any forward-looking statements in

order to reflect any event or circumstance that may arise after the date of this

Annual Report on Form 10-K. Readers are urged to carefully review and consider

the various disclosures made throughout the entirety of this Annual Report,

which attempt to advise interested parties of the risks and factors that may

affect our business, financial condition, results of operations and

prospects.

|

ITEM 1.

|

DESCRIPTION

OF BUSINESS

|

Corporate

History

Wellstar

International, Inc. ("Wellstar" or the "Company") was formed in the State of

Nevada on December 5, 1997. Wellstar was a development stage company with no

operating activities. On July 12, 2005, Wellstar entered into a share exchange

agreement with Trillennium Medical Imaging, Inc. ("Trillennium" or "TMI"), a

development stage company formed in June of 2005. As a result of the share

exchange agreement, Trillennium became a subsidiary of Wellstar.

Wellstar

International, Inc., through its Trillennium subsidiary, is dedicated to

developing and licensing the use of advanced thermal imaging technology (TMI

SYSTEM) in the consumer health care markets throughout the World.

Introduction

Trillennium

Medical Imaging, Inc. (TMI) is dedicated to placing cameras for a monthly charge

in hospitals, clinical and long care facilities throughout the United States.

The company’s current competitive advantage is derived from the state of the art

technology of the camera and software it is utilizing, combined with an intimate

knowledge and relationships in the markets. It plans to grow in these markets by

expanding its imaging capabilities by the constant acquisitions of new imaging

technologies.

The TMI

Infrared Technology and software is approved by the FDA as an Adjunctive

Diagnostic screening procedure for early breast cancer detection, differential

diagnosis of pain dysfunctions, (such as Reflex Sympathetic Dystrophy,

Neuromuscular Skeletal Syndromes and Neurological disorders), detection of

pressure ulcers, deep tissue injuries, and bed sores, as well as orthopedic

applications. This screening modality provides a differential diagnosis to

justify additional screening procedures to ensure successful patient outcome

assessment. Thermal Imaging is a low cost, non-contact, non-radioactive

diagnostic screening procedure designed for clinical evaluation. In addition

thermal imaging provides an ability to track the progress of therapies being

utilized in a low cost, non-invasive manner.

The TMI

Infrared Technology fills a need that currently exists in diagnostic medicine

today. Thermal imaging provides information that is specific to the

physiological and functional activity in the body. This information becomes

invaluable in that conventional diagnostic screening utilizes tests such as

X-Ray, MRI and CT Scans. All aspects of these tests are concerned with the

anatomical and structural problems of the body. Many problems arise from not

combining both diagnostic modalities of structure and physiology, in that people

are missed diagnosed and considered healthy and well when the physiological

information provides an earlier outcome or risk assessment of future health

predictors than the structural modalities.

Major

markets such as University Research Centers, hospitals, multidisciplinary

physician practices, pain centers, long term care facilities, home health care,

and rehabilitation centers support the need for this type of screening

modality.

In

summary, Trillennium Medical Imaging has created an innovative new business

model that gives it early market advantage.

History

and Future of Medical Infrared Applications

The

detection and estimation or measurement of heat released by the body has been a

cornerstone of medicine since its beginning. The earliest physicians knew the

presence of excessive heat signaled illness. For centuries the measurement of

heat, either present in or being released by the body, required contact.

Temperature was physically felt and much later was measured with various devices

such as the thermometer.

In the

1800’s Herschel demonstrated the presence of heat energy as an invisible wave,

much like light. Heat could be reflected and refracted under the right

conditions. Understanding of this heat energy wave would require years of

investigation. Much later, as all with all scientific advances, these studies

would provide more finite measurements of heat energy.

In the

1940’s, the electronic detector of infrared energy was developed for use in

military applications. Night vision scopes were the first applications. The

science of infrared detection owes its current development and sophistication to

demands from military and industrial applications.

Medical

use of infrared detection lagged behind military application due to government

classification of the infrared detectors and technologies. Only when scientific

advances are released from such government restrictions are they open to general

use and applications. Once available, the scientific/medical application of the

heat detector was made simultaneously by the British, the Canadians and

Americans. These scientists and physicians used thermal imaging as a measurement

of human physiology; the most common applications being the evaluation of

cancerous tumors. The level of heat emitted was correlated to the presence and

type of disease, as well as a prognostic indicator. Many tumors were hot, and

the hotter the tumor the worse the outcome.

These

first infrared applications were both costly and cumbersome, therefore the

infrared detection units were found mostly in research. Like all early

electronics the infrared detection systems were physically large, costly to

produce and challenging to operate. These restrictions meant exposure to general

medicine use was limited.

Today,

through the advances in all levels of science, and driven by military funding,

infrared detection devices are state-of-the art electronics. Like all electronic

components, the infrared detector has come down in cost, size and has

significantly improved in general applicability.

The

continued refinement of infrared systems, both in image acquisition and data

collection, has brought the use of infrared energy analysis to a new level.

Together with a better understanding of human and animal physiological

thermoregulatory mechanisms, the use of infrared detection in health and illness

provides a new mechanism for early disease detection.

Trillennium

Medical Imaging recognized the medical need for cost-effective, non-contact

physiological monitoring – and embraced the use of infrared imaging. Trillennium

is dedicated to the advancement of infrared detection in medicine. Trillennium

has forged relationships with well-known manufacturers of infrared detection

systems, recognizable entities in multiple medical specialties, and highly

skilled computer analysts – and together are developing state-of the art

infrared imaging systems, as well as investigating new uses/applications in

medicine.

The focus

of medicine and health care today means technology must be “faster, better, and

more cost-effective.” Trillennium Medical Imaging and its partners are working

to make infrared detection systems the easiest to use, applicable in the

every-day clinical setting and cost-effective in its application.

The use

of infrared analysis has historically been limited in clinical application. With

improved science comes improve equipment development and with computerization –

the analytical evaluation of infrared information is moving to new levels.

Today’s computerization of infrared systems is overcoming the limitations of the

past applications. Trillennium Medical Imaging systems incorporate, not only

objective temperature data analysis, but TMI has also taken data collection to a

new level. Today, medical device development and use is based on evidence of

efficacy. Application data collected from all TMI systems is compiled into a

single database that will continue to provide the statistical analysis needed to

demonstrate the efficacy of this technology in all current and future

applications. TMI believes that it is currently the only company to incorporate

this data collection component into their systems.

The first

records of physical observation demonstrate that physiological temperature

variations have signaled the presence of disease. Today the importance of this

vital physical parameter is of no less significance. Together, scientific

advancements and technological improvements will demonstrate that temperature

shifts can signal the earliest stages of physiological change. Through

non-contact temperature analysis, Trillennium Medical Imaging and partners will

continue to demonstrate the efficacy of infrared analysis in disease detection

and to drive the use of infrared analysis in new medical

applications.

The

Future of Disease Detection

Trillennium

Medical Imaging sees the future of infrared imaging moving to critical positions

in early phase disease detection and monitoring. Although currently not a

diagnostic modality, infrared analysis still provides key information in health

monitoring. The development of objective data analysis and proof of efficacy

will catapult infrared detection to key positions and prominence. Trillennium’s

completed research project conducted at Duke University for early detection of

tissue breakdown, provides the initial data demonstrating the TMI Systems

ability to detect damage prior to visible evidence. This capability – in a

non-contact device – will save patients from potential disabling conditions, as

well as generate a sizeable cost-savings in health care.

Trillennium

believes translation of the ‘early tissue damage detection’ application to other

previously untried medical areas- such as early detection of infection – will

reduce the associated costs and potential spread of treatment-resistant super

bugs. Super drugs have created super bugs and today the spread of

treatment-resistant disease is a major concern. Both community spread and

in-hospital presence of these organisms is a detection nightmare. In spite of

improved hygiene – transmission and containment of various diseases is still of

critical importance.

Cost-effective,

non-contact detection of circulatory compromise in surgical applications will

improve the success of many tissue transplants, reducing the need for additional

surgeries. And non-contact evaluation of tissue changes may help categorize

potentially malignant conditions demanding greater intervention from those that

are currently benign. However, these arenas are all in the invention phase, and

as all research, requires large capital investments to translate the research

findings to clinical application. Trillennium believes these areas hold huge

potential in both dollars spent in health care delivery as well as corporate

return-on-investment and strives to keep these investigations

on-going.

Markets

Skin

Assessment

The early

visualization of tissue damage that can lead to development of pressure ulcers

and or deep tissue injury is paramount to the reduction of open sores and the

deadly complications that accompany them. Currently no method of detection is

used that can identify tissue breakdown prior to the visible and palpable

changes that take place.

Trillennium

Medical Imaging began investigation of this health care issue shortly after the

company was formed. The ability of infrared to detect blood flow changes is well

documented and the key benefit of the technology. Association of blood flow

changes to both pressure ulcers and deep tissue injury has been documented since

the 1970’s when early imaging units were used to image suspicious damage. One of

the original studies of pressure sores by thermal detection was conducted by

Barton and Barton in 1973. Studying existing ulcers they determined the

temperature variations present with their classification of ‘indolent’ and

normal pressure sores. The category of indolent was associated with a longer

healing time (approximately four months) and a temperature difference of 1°C or

less. A classification of normal demonstrated a higher temperature differential

of approximately 2.5ºC and healed more quickly than indolent sores and the

patients generally displayed a better outcome. This ‘normal’ classification of

ulcer was generally attributed to the ‘otherwise healthy person’ whose pressure

sore was either post operative from extended times in one position or from

incorrect use of a prosthetic device. This wound usually resolved in six weeks.

This thermal evaluation has been substantiated by Hansen et al in a 1996

study.

The size,

cost and availability of infrared was a limiting factor in its use for many

years. The most cost effective detection was contact thermography, and the

question was if the contact alone was increasing the possible artifact of

damage. Electronic imaging provided the benefit of non-contact evaluation, but

thermal artifact induced in uncontrolled environments was still a

question.

Trillennium

Medical Imaging began the process of incorporating computerized analysis of

images to eliminate the subjective influence of previous infrared analysis.

Changes introduced in the analytical phase reduced the influence of

environmental shifts. This proprietary approach has been evaluated through a

completed study at Duke University and the data / results will be released and

published in the very near future.

Market

Opportunities

Functional

or physiological evaluation conducted with infrared imaging has applications in

many areas of medicine. Initially, Trillennium Medical Imaging focused on three

key markets with our current imaging system: Breast Health Monitoring, Pain

Evaluation; and Sports Medicine applications. However recent developments

indicate significant economic gains can be realized with a revised

plan.

Trillennium

Medical has begun investigating the use of infrared detection in early stage

pressure ulcer development. Trillennium is proposing a unique approach for early

detection of tissue changes that will significantly impact the wound care

market. TMI is in the initial phase for design and application of a new imaging

device that incorporates software and data collection that is separate and apart

from its current clinical markets.

While

Trillennium Medical Imaging will continue to prove the viability of IR through

its ongoing trials in existing markets (outlined under existing market profile),

it is evident that a method of early detection of tissue changes related to

pressure ulcers is not currently available.

Pressure

ulcers have always been an area of concern for healthcare providers due to the

degradation of the patient’s condition and the increased care required when

pressure ulcers occur. Pressure ulcers are responsible for over 65,000 deaths

per year in the United States alone. Aside from the human toll, the costs

involved in treating this problem are enormous and escalating at an alarming

rate annually. Taking into consideration all direct, indirect and peripheral

costs, it is conservatively estimated that currently over $25 billion is spent

annually on wound care in the United States (Columbia Surgery, Department of

Surgery, H. Brem, M.D., 2006). The urgency of this situation is not lost on

those in the medical field, associated industries and the government as

well.

Each year

the government spends on average over $3 billion on wound treatment and care for

pressure sores and bedsores. Insurance companies pay out millions annually for

this same treatment, directly affecting premiums to increase annually for

healthcare facilities. Inflationary effects add to this escalation.

New

regulation recently imposed by the Center for Medicare and Medicaid will reshape

the approach by all health care facilities and practitioners. In October 2008,

reimbursement for the care of individuals incurring pressure ulcers during

hospitalization (secondary diagnosis) will no longer be reimbursed. This edict

from the government has been followed by third party payers. This loss of

revenue can cripple many health care facilities if a procedure or validated

system is not put in place.

Additionally,

the potential of fines incurred for the occurrence of pressure ulcers in the

long term care facilities will drive these markets with burden of

proof.

Trillennium

Medical Imaging will be ideally positioned to provide a cost-effective,

non-contact method to identify the presence of early or existing tissue damage.

The next step for TMI is to implement the system within the marketplace with a

Beta Test. TMI believes that the Beta Test will begin the early part of 2010 as

we are currently in discussions.

Breast Health

Monitoring

Current

Testing/Screening Methods

The

medically accepted tool (gold standard) for breast cancer screening is x-ray

mammography. Mammography detects structural changes present in the breast

tissue, indicating either the presence of dead cell structures (calcifications)

or a shift in tissue density. Mammography was established as the test of choice

following the Breast Cancer Detection Demonstration Project (BCDDP) study and as

a result of the Health Insurance Plan (HIP) study of 1974.

According

to the National Cancer Institute Fact Sheet on Mammography, “Several large

studies conducted around the world show that breast cancer screening with

mammograms reduces the number of deaths from breast cancer for women ages 40 to

69, especially those over age 50. Studies conducted to date have not shown a

benefit from regular screening mammograms, or from a baseline screening

mammogram (a mammogram used for comparison), in women under age 40.” Regardless,

it is the only medically accepted screening test to-date.

With the

evolution in technology, proposals have been made to implement other modalities

in the screening process. Due to associated cost, and or sensitivity and

specificity of the exams (Ultrasound/MRI/PET) recommendations for screening have

not changed. These tests are used as ‘adjunctive’ or in addition to mammography

following a positive or questionable test.

Limitations

of Current Methods

Contact,

compression, ionizing radiation, limited or no options for screening other than

mammography (physician restricted access) and cost are some of the primary

reasons women list for limited or non-participation in breast health

evaluation.

Current

statistics demonstrating the number of women who participate in mammography are

not readily available. 2002 studies estimated approx 60% of women over the age

of 40 participated in mammography within the year. Studies show that for the

uninsured it (screening mammography) is a low priority procedure, because few

programs exist to assist in the payment for or toward mammography for women less

than 50 years of age as are for those who are older (Medicare).

“Women

over the ages of 50 and 60 are not getting mammograms as frequently as women in

their 40s, yet mammograms are more effective in reducing deaths from breast

cancer as women age.”

Women

reject or delay mammography for many reasons. Fear appears to be the primary

factor. Fear of discomfort, fear of radiation and fear of finding cancer are

only a few reasons that women site.

Many

women falsely believe that if there is no known breast cancer within their

family that there is no reason to be concerned. Few women know that

approximately 75% of breast cancers found occur in women who have no known

history.

Studies

indicate that 40% or more of the population eligible for screening mammography

do not participate in testing. Reasons listed are economic, cultural and

perception of increased harm (radiation / compression) from the exam – whether

real or imagined. These factors contribute to late-stage

Importance

of Infrared Imaging for Breast Cancer

Management

defines risk as the likelihood that harm will arise coupled with consequence.

Medical assessment of ‘risk’ for developing breast cancer is linked with

time/cost and effort to arrive at the benefit of risk assessment. Risk/benefit

studies determine that screening for breast cancer should begin at 40 years of

age. The cost of screening the female population younger than 40 years of age

provides no reduction in life-years saved compared to costs

incurred.

Although

mammography screening is an effective tool for detecting the presence of breast

cancer, it has inherent and well described limitations. In addition,

mathematical models such as the Gail Model have been developed to predict

breast cancer

risk

, but such models are

better at assessing population-based risk rather than individual

risk.

Monitoring

individuals with infrared imaging provides for improved individual assessment to

determine the ‘at-risk’ person as indicated by physiology (versus mathematical),

and therefore in a screening scenario, the ‘at-risk’ population.

Infrared

imaging is a non-contact, non-invasive, non-ionizing imaging tool and poses no

physical risk. It displays information regarding breast blood flow. Temperature

assessment of breast tissue provides for a profile as it relates to homeostasis

within the breast tissue. Any alterations are attributed to imbalance. The

presence of structural changes or tissue is not visible on the infrared image.

But neither is the vascular information displayed on the mammogram. Screening

the breast with infrared provides the individual and practitioner with

information not currently available as a screening modality. Other functional

imaging is prohibited by availability and cost. (fMRI/ PET/f CT). Additionally

other functional modalities are most often incorporated into structural exams

such as computed tomography and MRI.

Infrared

study parameters have been identified as consistent repeatable and independent

markers that identify those patients at risk for breast disease. Ease of

implementation (non-ionizing), low comparative cost and appeal to the general

population (non-contact) make it an ideal test for screening in the younger

patient (not a candidate for mammography), the woman with dense breasts or

implants, those who have surgically altered breasts that add to mammography

distortion (biopsies, lumpectomies, mastectomies) and those that refuse to

participate in screening mammography.

Market

Opportunities

Breast

Health Monitoring/Screening

Today the

U.S population is roughly 300 million (projection based on 2000 Census Data) and

of this 150 million individuals are female. According to the Census Bureau,

currently the largest segments of females are 40-44 (11.35M), 35-39 (11.34M) and

45-49 (10.27M) years of age respectively. These are closely followed by the

30-34 (10.21M) and the 10-14 (10M) years of age.

These

numbers become significant when we consider the disease of breast cancer. It is

the second leading cause of cancer deaths in the female population. 1 in 8 women

will be diagnosed with cancer of the breast during their lifetime.

The

probability of breast cancer occurrence increases with age. Fifty percent of all

breast cancers will occur in women under 61 — the median age of occurrence. But

roughly 1/3 of all breast cancers will occur in women under the age of 50 (20 to

50 years of age.) In the total population of breast cancers the largest

percentage are found in women over 50 years of age. The average projected growth

rate (disease development prior to detection) for breast cancer is approximately

8 to 10 years. For this reason, mammography is recommended as a screening

procedure beginning at 40 years of age.

U.S

Government statistics in 2005, show an estimated 2 million women diagnosed with

or living with breast cancer. 2006 estimates projected 212,920 new cases of

invasive breast cancer diagnosed, along with 61,980 new cases of non-invasive

breast cancer. The current medical paradigm with breast imaging is demonstrated

in the inability of mammography to reduce the mortality statistics of those

women found with invasive breast lesions. Structural studies, and mammography in

particular, are detecting the presence of tumors and tissue changes, but missing

the functional or metabolic activity presented by the disease. Infrared has

continued to demonstrate underlying metabolic changes present in tissue years in

advance of mammography. Slow growing, metabolically inactive cancers such as

those with low IR signals can easily be detected with mammography. The issue of

early detection is key for the women with dense breasts, especially the younger

woman who would be missed by never participating in mammography until a palpable

lesion is found.

Sports

Medicine

Sports

medicine or sport medicine is an interdisciplinary subspecialty of medicine

which deals with the treatment and preventive care of athletes, both amateur and

professional. The team includes specialty physicians and surgeons, athletic

trainers, physical therapists, coaches, other personnel, and, of course, the

athlete.

There has

been a tendency for many to assume that sport-related problems are by default

musculoskeletal and that sports medicine is an orthopedic specialty. It is

commonly understood that there is much more to sports medicine than just

musculoskeletal diagnosis and treatment. Illness or injury in sport can be

caused by many factors – from environmental to physiological and psychological.

Consequently, sports medicine

can encompass an array of specialties, including cardiology, pulmonology,

orthopedic surgery, exercise physiology, biomechanics, and

traumatology.

The risk

of injury in athletic practice will never be entirely eliminated, but

modifications in training techniques, equipment, sports venues and rules, based

on outcomes of meaningful research have shown that it can be lowered. For these

reasons sports medicine will make its most significant future contributions in

the area of prevention.

Market

Opportunities

When all

the inclusive markets are considered, the total revenue projections for the

sports medicine market are vast but illusive. Costs are measured in billions of

dollars when both treatment cost and indirect costs of loss (wage and

productivity) are considered.

Differential

diagnosis related to sports injuries is complicated by the fact that soft tissue

injuries are some of the most common and clinically challenging musculoskeletal

disorders in patients presenting for treatment. Therefore, establishing

clear-cut diagnostic and therapeutic objectives for these injuries is important.

Current imaging methods of evaluation are structural. Flat plane x-ray, computed

tomography (CT), ultrasound, and MRI are the most common examinations. This

leaves the assessment of soft tissue injury to visual, palpable and indirect

visualization via the structural image.

Complication

of evaluation (structure vs. tissue) results in inappropriate or ill-timed care.

Oversight of the magnitude of soft tissue injuries may result in a failure to

expeditiously consider vascular injury or compartment syndrome and its resultant

complications, including loss of a limb. Misdiagnosis or mismanagement of damage

may lead to chronic problems with subsequent development of degenerative joint

disease and/or loss of function, including but not limited to an inability to

bear weight or ambulate.

Like all

areas of pain, the number of those afflicted by joint and connective tissue

disorders seems to be increasing rather than under control.

Statistics

taken from the U.S. government website on arthritis provides the following

numbers related to occurrence.An estimated 46 million adults in the United

States reported being told by a doctor that they have some form of arthritis,

rheumatoid arthritis, gout, lupus, or fibromyalgia. By 2030, an estimated 67

million of Americans aged 18 years or older are projected to have

doctor-diagnosed arthritis. Arthritis & Rheumatism 2006;54(1):226-229 [Data

Source: 2003 NHIS]

Importance

of TMI Infrared Monitoring System

Until

recently, sports medicine has been a little-explored market for infrared

technology as an adjunctive to diagnostics. Infrared imaging provides an

indirect measurement of skin blood flow and a temperature measurement of the

physiological response controlled by the body’s autonomic nervous system. This

information has broad application in the world of sports medicine. Infrared

evaluation can provide a new dimension to diagnostic capabilities in an

adjunctive capacity (physiology vs. anatomy). Some of these applications are:

providing a monitor for hyperthermic and hypothermic responses associated with

nerve irritation, acute injuries, swelling, inflammation, infection, and

atrophy. Provide physicians and trainers with a visual and measurable reference

for differential diagnosis, and a visual and objective reference relating to

treatment efficacy.

TMI

Solution in Sports Medicine Applications

TMI is

currently involved in a pilot study with Duke University Sports Medicine

evaluating infrared technology for spot-checking of core body temperatures of

athletes in the field. The preliminary study of this non-invasive technology has

demonstrated temperature readings that are directly correlated with the core

body temperature in a small population. A more extensive study is being planned.

The value will be an easy to use, non-invasive tool for monitoring heat

exhaustion in athletics that can be easily used in the field. All levels and

types of sports organizations (schools, teams and professionals) could all

benefit from using this technology. TMI is working to develop a portable,

cost-effective, handheld solution that will fit the need of this extensive

market.

TMI is

also exploring the use of this same assessment tool for immediate trauma

evaluation on the field or in emergency rooms for monitoring deep tissue injury

and assist with fast evaluation of potential compartment syndrome.

TMI

Market Approach

With significant relationships in the

medical industry, our initial marketing approach and main thrust will be to

hospitals and long term care facilities for the early detection of pressure

ulcers. The study at Duke Medical Center has been completed and was successful.

The data and the publishing of the data will be released in the near

future.

Rheumatology

For over

forty years infrared measurement has been used in the evaluation of

rheumatological disease. Initially identified and analyzed in the 1970’s by

Abernathy, Ring, and many others, joint and connective tissue disorders were an

undisputed area in which infrared detection provided a non-ionizing and

non-contact method of detection.

Infrared

evaluation provides both an indication of abnormal blood flow in the area of

pain, and as a monitoring device for the efficacy of various therapies.

Additionally infrared imaging is an ideal tool for evaluation of this peripheral

blood flow and vasospastic disorders of peripheral digital vessels is often an

indication of connective tissue disorders.

Research and

Development

Equipment

Development

We

continue to interface with equipment manufacturers and medical device research

and development firms to seek out state of the art thermal imaging

technology.

In

addition, we have created a Data Collection division. This will enable us in the

future to keep data and compare results of images taken from all of our cameras.

This will then lead to definitive conclusions for the medical community. Through

a HIPPA-compliant database we plan to gather a statistically-verifiable data set

from our patient population from all of our participating facilities. This

information will be compared to currently known statistics and provide

additional verification regarding the efficacy of infrared imaging in a variety

of applications. The medical community requires "evidence" to back the use or

implementation of all technologies. TMI expects that its thermal imaging

operations will yield significant data. This will supply the data needed to

support evidenced-based practice. This data can then be compared to the patient

outcome-information held by each practitioner.

Future

Market Research/Medical

Grafts

and Flaps

The use

of skin grafts and local flaps can help solve some difficult wound closure

problems. Postoperative flap failure is a devastating complication that surgeons

occasionally encounter when using plastic surgery techniques.

Intraoperative

monitoring of flap perfusion has shown to prevent flap failure. Infrared imaging

can be used to evaluate and monitor reperfusion, and is a fast, non-contact,

reliable method.

Infrared

can be used preoperatively to trace perforators in the skin to be excised for

reconstruction, as well as postoperatively to monitor the rewarming following

attachment.

Amputation

Infrared

has proven to be valuable in the area of amputation of tissue as well.

Evaluation of digits or limbs of persons undergoing amputation has improved the

success by proving or disproving the viability of tissue present. In instances

of lower limb amputation due to peripheral vascular disease, amputation can

often be preformed below the knee, improving the rehabilitation and mobility of

the patient and therefore quality of life issues. Selection of amputation level

made on the basis of laboratory criteria using skin blood flow and infrared

thermography data proves to be more successful.

Diabetic

Neuropathy

Diabetic

peripheral neuropathy (DPN) is a condition secondary to the disease and can

result in ulceration. Of the diabetic population 0.6 % eventually require lower

limb amputation. However of those with peripheral neuropathy roughly 40% require

amputation of a toe, 12% a foot, and 47% The total annual cost of DPN and its

complications in the U.S. was estimated to be between $4.6 and $13.7 billion. Up

to 27% of the direct medical cost of diabetes

Dermatology

“The skin

is the largest organ in the body, and it is therefore not surprising that cancer

of the skin is the most common of all cancers. Basal cell carcinoma and squamous

cell carcinoma make up the vast majority of cases. Melanoma is the least common

but the most deadly skin cancer, accounting for only about 4% of all cases but

79% of skin cancer deaths. For 2002, the American Cancer Society estimates there

will be 53,600 new cases of melanoma in the United States and 7,400 deaths from

the disease. The United States has experienced a dramatic increase in the number

of melanoma cases over the past few decades. According to the American Cancer

Society, the incidence rate for melanoma (number of new cases of melanoma per

100,000 people each year) has more than doubled since 1973. The mortality rate

for melanoma (number of deaths per 100,000 people each year) has increased at a

much slower pace and has remained stable over the past 10 years. During this

same time period, there has been a significant rise in overall five-year

survival in patients with melanoma. This may be due to thinner depth of tumors

at time of diagnosis and improved surgical techniques to treat the disease.

“

The study

of skin and skin lesions is an area of infrared that has waxed and waned since

the early studies of thermography conducted in the 1980’s by the French.

Evaluation of the thermal flare presented by the increased vascularity present

in melanomas was thermally mapped prior to radiotherapy. Infrared mapping

provided information that demonstrated that the underlying vascular bed related

to the visible lesion was usually significantly larger than assumed, and if not

included in the area of radiation, may remain as a pathway of

metastasis.

With the

increase in melanoma occurrence, the use of infrared imaging in screening

evaluations could add to number of cases found in the early stages.

Additionally, the use to map the underlying vascularity could again aid in

mapping the underlying angiogenic blood supply to the tumor.

Pharmaceuticals/Vaccines

The use

of infrared detection for adverse reactions resulting from administration of

drugs and vaccines is an area of potential investigation.

Trillennium

Medical Imaging anticipates that investigation of adverse reactions with

infrared imaging may provide a non-contact, cost-effective way to monitor for

adverse reactions prior to their occurrence. Through is affiliation with Duke

University, TMI plans to participate in research projects that are first

isolating these drug-reaction potentials in mice. Participation in this and

other research projects will require capital investment to provide various lens

and other adaptations to the existing infrared imaging device, as well as the

possible development of other specific IR optical imaging devices that could

revolutionize this arena.

Trillennium,

through its advisors and affiliates will continue to investigate areas of

medical concern where infrared imaging will possibly benefit the

survival-outcome, the cost-effective delivery of non-invasive diagnostic and

adjunctive imaging, as well the return-on-investment from development of such

products.

FDA

Regulations

Changes

in Approved Devices - The FD&C Act requires device manufacturers to obtain a

new FDA 510(k) clearance when there is a substantial change or modification in

the intended use of a legally marketed device or a change or modification,

including product enhancements and, in some cases, manufacturing changes, to a

legally marketed device that could significantly affect its safety or

effectiveness. Supplements for approved PMA devices are required for device

changes, including some manufacturing changes that affect safety or

effectiveness. For devices marketed pursuant to 510(k) determinations of

substantial equivalence, the manufacturer must obtain FDA clearance of a new

510(k) notification prior to marketing the modified device. For devices marketed

with PMA, the manufacturer must obtain FDA approval of a supplement to the PMA

prior to marketing the modified device.

Good

Manufacturing Practices and Reporting. TMI does not manufacture the infrared

cameras used in its thermal imaging system. Nevertheless, the FD&C Act

requires device manufacturers to comply with Good Manufacturing Practices

regulations. The regulations require that medical device manufacturers comply

with various quality control requirements pertaining to design controls,

purchasing contracts, organization and personnel, including device and

manufacturing process design, buildings, environmental control, cleaning and

sanitation; equipment and calibration of equipment; medical device components;

manufacturing specifications and processes; reprocessing of devices; labeling

and packaging; in-process and finished device inspection and acceptance; device

failure investigations; and record keeping requirements including complaint

files and device tracking. We are in compliance with the above

requirements.

Current

Regulatory Status- The FDA found that the cameras utilized in the TMI thermal

imaging system are substantially equivalent to an existing legally marketed

device, thus permitting them to be marketed as an adjunct (supplemental)

screening/diagnostic device. The cameras utilized in our system first received

510(k) clearance in September 2001 and subsequently in March 2003. Together with

our software we, are marketing the TMI thermal imaging system as an adjunct

(supplemental) method for the diagnosis of breast cancer and other diseases

affecting the perfusion or reperfusion of blood in tissue or organs in the

foreign markets, and exclusively promoting the early detection of Pressure

Ulcers in the US market.

Permits

and Inspections

The

manufacturer of the thermal imaging cameras utilized in the TMI thermal imaging

system is subject to compliance with Good Manufacturing Practices under the

FD&C Act, as described above. The manufacturer is subject to government

inspection and failure to comply with all applicable standards can result in

suspension or termination of its ability to manufacture cameras for use in our

system. In that event we would be compelled to seek thermal imaging cameras from

other manufacturers.

Users of

the TMI thermal imaging system are required to utilize protocols for accurate

thermal imaging such as the "Technical Protocols for High Resolution Infrared

Imaging" approved by the ACCII 5-15-99. Failure to comply with these

requirements can result in suspension or termination of the facilities'

authority to utilize our thermal imaging system. In that event we would

experience a disruption in revenue while we removed our equipment and sought to

install it in another location.

As a

Smaller Reporting Company, the Company is not required to include the disclosure

under this Item 1A. Risk Factors.

ITEM

1B. UNRESOLVED STAFF COMMENTS

As a

Smaller Reporting Company, the Company is not required to include the disclosure

under this Item 1B. Unresolved Staff Comments.

ITEM

2. DESCRIPTION OF PROPERTY.

We

maintain our principal office at 6911 Pilliod Road, Holland OH 43528. Our

telephone number at that office is (419) 865-0069 and our facsimile number is

(419) 867-0829. We currently occupy this facility on a month to month basis at a

no cost arrangement with the building owner. The facilities are in good

condition.

ITEM 3. LEGAL PROCEEDINGS.

From time

to time, we may become involved in various lawsuits and legal proceedings, which

arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties, and an adverse result in these or other matters may

arise from time to time that may harm our business. We are currently not aware

of any such legal proceedings or claims that we believe will have, individually

or in the aggregate, a material adverse affect on our business, financial

condition or operating results.

None of

our directors, officers or affiliates are involved in a proceeding adverse to

our business or have a material interest adverse to our business.

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

PART II

ITEM

5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

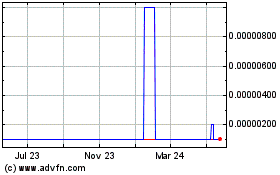

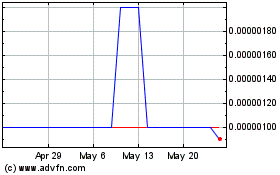

MARKET INFORMATION

Our

common stock is quoted on the OTC Bulletin Board under the symbol "WLSI".

For the

periods indicated, the following table sets forth the high and low bid prices

per share of common stock. These prices represent inter-dealer quotations

without retail markup, markdown, or commission and may not necessarily represent

actual transactions.

|

|

|

Fiscal

2008

|

|

|

Fiscal

2009

|

|

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

First

Quarter

|

|

$

|

0.02

|

|

|

$

|

0.004

|

|

|

$

|

0.004

|

|

|

$

|

0.0038

|

|

|

Second

Quarter

|

|

$

|

0.0016

|

|

|

$

|

0.001

|

|

|

$

|

0.0047

|

|

|

$

|

0.001

|

|

|

Third

Quarter

|

|

$

|

0.0009

|

|

|

$

|

0.0007

|

|

|

$

|

.002

|

|

|

$

|

.0005

|

|

|

Fourth

Quarter

|

|

$

|

0.022

|

|

|

$

|

0.016

|

|

|

$

|

.001

|

|

|

$

|

.0001

|

|

Holders

As of

November 12, 2009, there were approximately 14,346,647,175 shares of common

stock outstanding.

As of

November 12, 2009, there were approximately 99 active holders of our common

stock. The number of record holders was determined from the records of our

transfer agent and does not include beneficial owners of common stock whose

shares are held in the names of various security brokers, dealers, and

registered clearing agencies. The transfer agent of our common stock is Pacific

Stock Transfer.

Dividends

There are

no restrictions in our articles of incorporation or bylaws that prevent us from

declaring dividends. The Nevada Revised Statutes, however, do prohibit us from

declaring dividends where, after giving effect to the distribution of the

dividend:

|

·

|

we

would not be able to pay our debts as they become due in the usual course

of business; or

|

|

|

|

|

·

|

our

total assets would be less than the sum of our total liabilities plus the

amount that would be needed to satisfy the rights of shareholders who have

preferential rights superior to those receiving the

distribution.

|

We have

not declared any dividends, and we do not plan to declare any dividends in the

foreseeable future.

We have

never declared or paid any cash dividends on our common stock. We do not

anticipate paying any cash dividends to stockholders in the foreseeable future.

In addition, any future determination to pay cash dividends will be at the

discretion of the Board of Directors and will be dependent upon our financial

condition, results of operations, capital requirements, and such other factors

as the Board of Directors deem relevant.

Recent

Sales of Unregistered Securities

Convertible Debenture

Financing

On May

15, 2009, the Company entered into a Securities Purchase Agreement with AJW

Partners, LLC ("Partners"), AJW Partners II, LLC ("Partners II "), AJW Master

Fund, Ltd. ("Master"), AJW Master Fund II, Ltd. ("Master II") and New Millennium

Capital Partners, II, LLC ("Millennium" and collectively with Partners, Partners

II, Master and Maser II, the “Purchasers”) for the sale of 13% secured

convertible notes in an aggregate principal amount of up to $79,500 (the

"Notes"). The Purchasers closed on $22,000 in Notes on May 18,

2009.

The Notes

bear interest at the rate of 13% per annum. Interest is payable monthly, unless

the Company's common stock is greater than $0.045 per share for each trading day

of a month, in which event no interest is payable during such month. Any

interest not paid when due shall bear interest of 15% per annum from the date

due until the same is paid. The Notes mature three years from the date of

issuance, and are convertible into common stock, at the Purchasers' option, at

the lesser of (i) $0.12 or (ii) a 75% discount to the average of the three

lowest trading prices of the common stock during the 20 trading day period prior

to conversion. The Notes contain a call option whereby, if the Company's stock

price is below $0.045, the Company may prepay the outstanding principal amount

of the Notes, subject to the conditions set forth in the call option. The Notes

also contain a partial call option whereby, if the Company's stock price is

below $0.045, the Company may prepay a portion of the outstanding principal

amount of the Note, subject to the conditions set forth in the partial call

option.

The full

principal amount of Notes are due upon a default under the terms of the secured

convertible notes. In addition, the Company granted the Purchasers a security

interest in substantially all of the Company's assets and intellectual property.

The Company is required to file a registration statement with the Securities and

Exchange Commission upon demand, which will include the common stock underlying

the Notes.

The

conversion price of the Notes may be adjusted in certain circumstances such as

if the Company pays a stock dividend, subdivides or combines outstanding shares

of common stock into a greater or lesser number of shares, or takes such other

action as would otherwise result in dilution of the selling stockholder's

position.

The

Purchasers have agreed to restrict their ability to convert their Notes and

receive shares of common stock such that the number of shares of common stock

held by them in the aggregate and their affiliates after such conversion or

exercise does not exceed 4.99% of the then issued and outstanding shares of

common stock.

Series A Preferred

Stock

On May

20, 2009, the Company entered into a conversion agreement with John Antonio

(“Antonio”) and Kenneth McCoppen (“McCoppen”), both executive officers and

directors of the Company, pursuant to which the Company agreed to convert

$30,000 in outstanding wages owed to each McCoppen and Antonio into a total of

60,000 shares of Series A Preferred Stock.

The above

transactions were approved by the Board of Directors of the Company. The Series

A Preferred Stock does not pay dividends but each holder of Series A Preferred

Stock shall be entitled to 100 votes for each share of common stock that the

Series A Preferred Stock shall be convertible into. The Series A Preferred Stock

has a conversion price of $0.0014 (the “Conversion Price”) and a stated value of

$1.00 (the “Stated Value”). Each share of Series A Preferred Stock is

convertible, at the option of the holder, into such number of shares of common

stock of the Company as determined by dividing the Stated Value by the

Conversion Price. The Series A Preferred Stock has no liquidation

preference.

Series B Preferred

Stock

On

October 1, 2009, the Company entered into a conversion agreement with John

Antonio (“Antonio”) and Kenneth McCoppen (“McCoppen”), both executive officers

and directors of the Company, pursuant to which the Company agreed to convert

$50,000 in outstanding wages owed to each McCoppen and Antonio into a total of

100,000 shares of Series B Preferred Stock.

The above

transactions were approved by the Board of Directors of the Company. The Series

B Preferred Stock does not pay dividends but each holder of Series B Preferred

Stock shall be entitled to 100 votes for each share of common stock that the

Series B Preferred Stock shall be convertible into. The Series B Preferred Stock

has a conversion price of $0.001 (the “Conversion Price”) and a stated value of

$1.00 (the “Stated Value”). Each share of Series B Preferred Stock is

convertible, at the option of the holder, into such number of shares of common

stock of the Company as determined by dividing the Stated Value by the

Conversion Price. The Series B Preferred Stock has no liquidation

preference.

JMJ

Financing

On May

22, 2009, the Company issued a Convertible Promissory Note to JMJ Financial

(“JMJ”) in aggregate principal amounts of $575,000 (the “Initial JMJ Note”). In

consideration for Wellstar’s issuing of the Initial JMJ Note, JMJ issued

Wellstar a Secured and Collateralized Promissory Note in the principle amount of

$500,000 (the “Initial Wellstar Note”).

In

addition, on August 19, 2009 Wellstar issued a Convertible Promissory Note to

JMJ in aggregate principal amounts of $1,150,000 (the “Second JMJ Note” and

together with the Initial JMJ Note, the “JMJ Notes”). In consideration for

Wellstar’s issuing of the Second JMJ Note, JMJ issued Wellstar a Secured and

Collateralized Promissory Note in the principle amouns of $1,000,000 (the

“Second Wellstar Note” and together with the Initial Wellstar Note, the

“Wellstar Notes”).

The JMJ

Notes bear interest at 12%, mature three years from the date of issuance, and

are convertible into our common stock, at JMJ’s option, at a conversion price,

equal to 70% of the lowest trade for our common stock during the 20 trading days

prior to the conversion. Prior to the conversion of the JMJ Notes, JMJ must make

a payment to Wellstar reducing the amount owed to Wellstar under the Wellstar

Notes. As of October 7, 2009, the lowest trade for our common stock during the

20 trading days as reported on the Over-The-Counter Bulletin Board was $.0001

and, therefore, the conversion price for the JMJ Notes was $.00007. Based on

this conversion price, the JMJ Notes in the aggregate amount of $1,725,000,

excluding interest, are convertible into 24.6 billion shares of our common

stock.

JMJ has

agreed to restrict their ability to convert the JMJ Notes and receive shares of

common stock such that the number of shares of common stock held by them in the

aggregate and their affiliates after such conversion or exercise does not exceed

4.99% of the then issued and outstanding shares of common stock.

The

Wellstar Notes bear interest at the rate of 13.8% per annum and mature three

years from the date of issuance. No interest or principal payments are required

until the maturity date, but both principal and interest may be prepaid prior to

Maturity Date. The Wellstar Notes are secured by units of STIC AIM Liquidity

Portfolio Select Investment Select Investment Fund (the “JMJ Collateral”). On

each of the Wellstar Notes, JMJ has agreed to pay down the principal of the

Wellstar Notes commencing 210 days after the original issuance of the Wellstar

Notes, However, JMJ may adjust the payment schedule within its sole discretion.

In the event that JMJ defaults on the Wellstar Notes, Wellstar may take

possession of the JMJ Collateral.

* All of

the above offerings and sales were deemed to be exempt under Rule 506 of

Regulation D and/or Section 4(2) of the Securities Act of 1933, as amended. No

advertising or general solicitation was employed in offering the securities. The

offerings and sales were made to a limited number of persons, all of whom were

accredited investors, business associates of the Company or executive officers

of the Company, and transfer was restricted by the Company in accordance with

the requirements of the Securities Act of 1933. In addition to representations

by the above-referenced persons, we have made independent determinations that

all of the above-referenced persons were accredited or sophisticated investors,

and that they were capable of analyzing the merits and risks of their

investment, and that they understood the speculative nature of their investment.

Furthermore, all of the above-referenced persons were provided with access to

our Securities and Exchange Commission filings.

ITEM

6. SELECTED FINANCIAL DATA

As a

Smaller Reporting Company, the Company is not required to include the disclosure

under this Item 6. Selected Financial Data.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

The

following information should be read in conjunction with the consolidated

financial statements and the notes thereto contained elsewhere in this report.

The Private Securities Litigation Reform Act of 1995 provides a "safe harbor"

for forward-looking statements. Information in this Item 6, "Management's

Discussion and Analysis or Plan of Operation," and elsewhere in this 10-K that

does not consist of historical facts, are "forward-looking statements."

Statements accompanied or qualified by, or containing words such as "may,"

"will," "should," "believes," "expects," "intends," "plans," "projects,"

"estimates," "predicts," "potential," "outlook," "forecast," "anticipates,"

"presume," and "assume" constitute forward-looking statements, and as such, are

not a guarantee of future performance. The statements involve factors, risks and

uncertainties including those discussed in the “Risk Factors” section contained

elsewhere in this report, the impact or occurrence of which can cause actual

results to differ materially from the expected results described in such

statements. Risks and uncertainties can include, among others, fluctuations in

general business cycles and changing economic conditions; changing product

demand and industry capacity; increased competition and pricing pressures;

advances in technology that can reduce the demand for the Company's products, as

well as other factors, many or all of which may be beyond the Company's control.

Consequently, investors should not place undue reliance on forward-looking

statements as predictive of future results. The Company disclaims any obligation

to update the forward-looking statements in this report.

Plan

of Operation and Financing Needs

We are

seeking financing in different amounts and up to 12 million dollars. While we

have signed definitive agreements with JMJ Financial for up to 1.2 million

dollars, there is no guarantee that this amount will be fully funded as per the

agreements and explained in the company’s last 8K filing. As the funding is

released to the company, we will be moving forward with implementing a Beta Test

in long term care facilities and possibly a hospital as well.

Once the

Beta Test is completed, the company will have demonstrated to the market that

the system works within the environment and the company has the ability to

execute the installations and operation of the systems. The company’s goal is to

have the Beta test start in January of 2010. This test will be run for

approximately 3 months. Upon conclusion of the test, we feel confident that we

should have multiple orders for the system and should be in a position to raise

any additional capital that would be needed to retire the company debt as well

as fund the complete roll out of our system.

If We Are

Unable to Obtain Additional Funding, Our Business Operations Will be Harmed. In

Addition, Section 4e of the October 2005 Securities Purchase Agreements Contains

Certain Restrictions and Limitations on Our Ability to Seek Additional

Financing. If We Do Obtain Additional Financing, Our Then Existing Shareholders

Will Suffer Substantial Dilution.

Results

of Operations

Year

Ended July 31, 2009 compared to Year Ended July 31, 2008 (all references are to

the Year Ended July 31)

Revenue:

We did not have revenue during the years ended July 31, 2009 and 2008.

Cost of

Sales and Gross Profit: There was no Cost of Sales for the years ended July 31,

2009 and 2008 as we did not generate revenue during these periods.

Operating,

Selling, General and Administrative Expenses: Operating, selling, general and

administrative expenses decreased by $203,031, or 9% in the 2009 fiscal year to

$2,163,673 from $2,366,704 in 2008. This decrease reflects increases in

stockholder relations expenses by $377,550. In addition, salaries decreased by

$157,272 from $892,772 to $735,500, professional fees decreased by $62,379 from

$319,319 to $256,940, research and development expense decreased by 259,200 from

$259,200 to none and travel decreased by $83,107 from $141,054 to $57,947for the

same period in 2008.

Loss from

Operations: Loss from operations for the 2009 fiscal year was $2,163,673, a

decrease of $203,031 or 9% from the loss from operations in 2008 of $2,366,704

as a result of the aforementioned decrease in operating, sales and

administrative expenses.

Other

Income and Expense: Total other expenses of $39,668,848 in the 2009 fiscal year

represent an increase of $36,322,465 from the expense of $3,346,383 in 2008 as a

result of a greater expense from derivative instrument expense for the period

related to a decrease in derivative instrument liabilities caused by lower stock

prices.

Net

Income: Net loss of $41,832,521 for the 2009 fiscal year was $36,119,434 greater

than the net loss of $5,713,087 for the same period in 2008 due to the greater

amount of derivative instrument expense.

Liquidity

and Capital Resources

It is

Managements opinion that the current financial position of the company is in

dire straits and the Company will need to obtain additional funding to continue

operations. The Company expects that it will be able to continue operating

through January 2010. If the Company does not obtain financing at this time, it

will be required to cease operations.

As of

July 31, 2009, we had a working capital deficit of approximately $30,631,304,

and cash of $29,564. We do not have the funds necessary to maintain our

operations for the coming fiscal year, and will need to raise additional

funding.

The

liquidity impact of our outstanding debt is as follows:

Our

secured convertible note with Andrew W. Thompson (the "Thompson Note"), in the

principal amount of $400,000, matured on April 11, 2006 and remains outstanding.

We are in default pursuant to the terms of the Thompson Note, although we have

not received a notice of default from Mr. Thompson, nor has Mr. Thompson

indicated to the Company that he intends to place the Company in default under

the loan agreement. Interest on the Thompson Note is at the rate of 8% plus the

prevailing margin rate charged to the lender, which is currently 7.625%. In

addition to the outstanding principal, we also owe accrued interest in the

amount of $233,364. The lender has the option of converting the loan into fully

registered common stock at a discount of 40% on the day of conversion, which is

the prepayment date or the due date, whichever occurs first. Additionally, the

lender also received warrants to purchase 1,000,000 shares of the company's

fully registered common stock at an exercise price of $0.50 per share. If the

lender converts, the Company will issue the appropriate number of shares and

will not be required to use cash to liquidate the debt. Additionally, the

Company will receive the cash proceeds in the amount of $500,000 if the lender

exercises the $0.50 warrants. On November 10, 2006, the Thompson Note was

amended to include a provision stipulating that the holder may not convert the

secured convertible note if such conversion or exercise would cause him to own

more than 9.99% of our outstanding common stock. However, this restriction does

not prevent the holder from converting a portion of the note and then converting

the rest of the note. In this way, the holder could sell more than this limit

while never holding more than this limit.

Our

unsecured demand note with Michael Sweeney (the "Sweeney Note"), in the

principal amount of $150,000, matured on August 1, 2006 and remains outstanding.

In addition to the outstanding principal, we also owe accrued interest in the

amount of $36,500. We are in default pursuant to the terms of the Sweeney Note

and we have not received a notice of default from Mr. Sweeney, nor has Mr.

Sweeney indicated to the Company that he intends to place the Company in default

under the note.

Our

unsecured demand note with Micro Health Systems (the "MHS Note"), dated December

21, 2005 in the principal amount of $200,000, with interest at 8% per annum, has

two maturity dates: at the 180th day and the 365th day following issuance. A

payment of $100,000.00 is due at each maturity date. We did not make the first

or second payment. There is an acceleration provision in the MHS Note

stipulating that the entire $200,000.00 was due upon non-payment of the first

$100,000. The interest rate then goes to the highest rate allowed by Florida

law. We received a notice of default from MHS on November 28, 2006 but no

further action has been taken. The MHS Note is secured by a pledge of 1.5

million shares of the Company's treasury stock.

To obtain

funding for our ongoing operations, we entered into a Securities Purchase

Agreement with four accredited investors - AJW Partners, LLC, AJW Qualified