VESTIN REALTY MORTGAGE II, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 9, 2017.

TO THE STOCKHOLDERS OF VESTIN REALTY MORTGAGE II, INC:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Annual Meeting") of Vestin Realty Mortgage II, Inc., a Maryland corporation (the "Company"), will be held on March 9, 2017, at 10:00 a.m. Eastern Time at Venable LLP, 750 E. Pratt Street, Suite 900, Baltimore, Maryland 21202, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

|

|

1.

|

To approve an amendment to the Company's Articles of Incorporation ("Charter") effecting a 1-for-1,000 reverse stock split of the common stock, par value $0.0001 per share, of the Company (the "Common Stock") which would result in (i) holdings prior to such split of fewer than 1,000 shares of Common Stock being converted into a fractional share, which will then be immediately cancelled and converted into a right to receive cash consideration described in the attached Proxy Statement, and (ii) the Company having fewer than 300 stockholders of record, allowing the Company to deregister its Common Stock under the Securities Exchange Act of 1934, as amended, and avoid the costs associated with being a public reporting company;

|

|

|

2.

|

To elect one director to serve until the 2019 Annual Meeting of Stockholders and until a successor is duly elected and qualify; and

|

|

|

3.

|

To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

|

The proposals to be voted upon at the Annual Meeting are more fully described in the Proxy Statement accompanying this Notice. The Company's Board of Directors has fixed the close of business on January

17

,

2017, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. Only those stockholders of record of the Company as of the close of business on that date will be entitled to vote at the Annual Meeting or any postponement or adjournment thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend, please authorize your proxy by one of the methods described in the accompanying Proxy Statement. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be voted to assure that all of your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote in person at the Annual Meeting will be counted.

NEITHER THE REVERSE STOCK SPLIT NOR ANY OF THE OTHER PROPOSED ACTIONS HAVE BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION; AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE COMMISSION HAS PASSED UPON THE FAIRNESS OR MERITS OF THE REVERSE STOCK SPLIT OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

|

WE HAVE ELECTED TO PROVIDE ACCESS TO OUR PROXY MATERIALS OVER THE INTERNET UNDER THE SECURITIES AND EXCHANGE COMMISSION'S RULES. BY PROVIDING THE INFORMATION YOU NEED THROUGH THE INTERNET, WE WILL LOWER THE OVERALL COSTS OF THE DELIVERY OF PROXY MATERIALS FOR THE ANNUAL MEETING. AS A RESULT, WE ARE MAILING TO OUR STOCKHOLDERS A NOTICE INSTEAD OF A PAPER COPY OF THIS PROXY STATEMENT, PROXY CARD, OUR 2015 ANNUAL REPORT AND OUR QUARTERLY REPORT FOR SEPTEMBER 30, 2016 . THE NOTICE CONTAINS INSTRUCTIONS ABOUT HOW TO OBTAIN A PAPER COPY OF OUR ANNUAL REPORT AND PROXY MATERIALS. PLEASE READ THE PROXY STATEMENT AND PROXY CARD CAREFULLY AND DETERMINE THE METHOD YOU WILL USE TO VOTE.

|

|

|

By Order of the Board of Directors,

|

|

|

/s/Michael V. Shustek

|

|

|

Secretary, Chairman of the Board, President and Chief Executive Officer

|

|

Las Vegas, Nevada

|

|

January 27

,

2017

TABLE OF CONTENTS

PAGE

VESTIN REALTY MORTGAGE II, INC.

8880 W Sunset Road, Suite 200

Las Vegas, Nevada 89148

(702) 227-0965

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 9, 2017

The accompanying proxy is solicited on behalf of the Board of Directors (the "Board") of Vestin Realty Mortgage II, Inc., a Maryland corporation (the "Company"), for exercise at our Annual Meeting of Stockholders to be held on March 9, 2017, at 10:00 a.m. Eastern Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The 2016 Annual Meeting will be held at Venable LLP, 750 E. Pratt Street, Suite 900, Baltimore, Maryland 21202. In this Proxy Statement "we," "us," or "our" refer to the Company.

Please authorize a proxy to vote your shares of common stock by one of the methods described in this Proxy Statement. This Proxy Statement has information about the 2016 Annual Meeting and was prepared by Vestin Mortgage, LLC ("Vestin Mortgage" or our "Manager"), the sole manager of the Company, for our Board. This Proxy Statement, the accompanying proxy card and other proxy material are first being made available to you on or about January 27, 2017.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

We are furnishing our proxy materials to our stockholders over the Internet in accordance with the Securities and Exchange Commission ("SEC") rules. The proxy materials include a Notice of Annual Meeting of Stockholders, this Proxy Statement, the accompanying proxy card and the Company's Annual Report on Form 10-K for the year ended December 31, 2015 and the Company's quarterly report on form 10Q for the quarter ending September 30, 2016. The proxy materials will be available on the Internet at

www.proxyvote.com

(stockholders will need to enter their control number reflected on the notice regarding the internet availability of proxy materials that they receive). Stockholders will not receive printed copies of the proxy materials unless they request written copies of such materials. A Notice of Internet Availability of Proxy Materials (the "Notice") is being mailed to each of our stockholders of record as of the Record Date (as defined below) with instructions on how to access and review the proxy materials on the Internet, how to authorize a proxy through the Internet or through the mail as well as how to request printed copies of the proxy materials.

GENERAL INFORMATION ABOUT VOTING

Who can attend the meeting?

Attendance at the 2016 Annual Meeting is limited to the Company's stockholders. Registration will begin at 9:30 a.m. and each stockholder may be asked to present valid picture identification such as a driver's license or passport. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares at the close of business on January 17, 2017, the record date for determination of stockholders entitled to notice of and to vote at the 2016 Annual Meeting (the "Record Date"), approximately 2,337,425 shares of our common stock, par value $0.0001 per share, were issued and outstanding. Holders of our common stock are entitled to one vote for each share of stock held by them as of the close of business on the Record Date.

Holders of common stock will vote at the 2016 Annual Meeting as a single class on all matters.

What items of business are scheduled to be voted on at the 2016 Annual Meeting?

The items of business to be voted on at the 2016 Annual Meeting are:

|

|

1.

|

To approve an amendment to the Company's Articles of Incorporation ("Charter") effecting a 1-for-1,000 reverse stock split (the "Reverse Stock Split") of the common stock, par value $0.0001 per share, of the Company (the "Common Stock") which would result in (i) holdings prior to such split of fewer than 1,000 shares of Common Stock being converted into a fractional share, which will then be immediately cancelled and converted into a right to receive cash consideration described in the attached Proxy Statement, and (ii) the Company having fewer than 300 stockholders of record, allowing the Company to deregister its Common Stock under the Securities Exchange Act of 1934 (the "Exchange Act"), and avoid the costs associated with being a public reporting company ("Proposal No. 1");

|

|

|

2.

|

To elect one director to serve until the 2019 Annual Meeting of Stockholders and until a successor is duly elected and qualify ("Proposal No. 2"); and

|

|

|

3.

|

To transact such other business as may properly come before the meeting or any postponement or adjournment.

|

Each proposal is discussed in more detail in the pages that follow.

What are the purpose and reasons for the Reverse Stock Split?

The Board has decided that the costs of being a SEC reporting company outweigh the benefits and, thus, it is no longer in the best interests of the Company or of our shareholders, including our unaffiliated shareholders, for us to remain an SEC reporting company. The Reverse Stock Split will enable us to terminate the registration of our Common Stock under the Exchange Act, if, after the Reverse Stock Split, there are fewer than 300 record holders of our Stock and we make the necessary filings with the SEC. Our reasons for proposing the Reverse Stock Split include the following:

|

·

|

Annual cost savings we expect to realize as a result of the termination of the registration of our Common Stock under the Exchange Act, including accounting, legal, printing and other miscellaneous costs associated with being a public reporting company, which we estimate will be approximately $160,000 per year, which does not include estimated executive and administrative time incurred in complying with public company requirements.

|

|

·

|

The absence of many of the benefits to the Company and its shareholders that are associated with being a public reporting company, particularly as reflected by the limited public trading volume, liquidity and analyst coverage of our Common Stock.

|

|

·

|

The proposed Reverse Stock Split is expected to free management and staff time to focus on long-term business objectives as well as internal financial reporting and analytics to support those objectives.

|

|

·

|

The ability of shareholders holding fewer than 1,000 shares of our Common Stock to liquidate their shares of Common Stock and receive a price for such shares that we believe is fair (for the reasons set forth below under "Special Factors - Fairness of the Reverse Stock Split"), without incurring brokerage commissions.

|

See "Special Factors—Proposal No. 1 Reverse Stock Split."

How does the Board recommend that I vote on the proposals?

The Board has unanimously recommended that stockholders of the Company vote their shares of Common Stock to approve the Reverse Stock Split under Proposal No. 1 and to elect the Company's nominee for director under Proposal No. 2.

What votes are required to approve the proposals?

The affirmative vote from holders of a majority of the outstanding shares of Common Stock as of the Record Date is required for the approval of the Reverse Stock Split under Proposal No. 1.

The vote of a plurality of all the votes cast is required for the election of the director under Proposal No. 2. You may not cumulate votes in the election of a director under Proposal No. 2.

Assuming a quorum is present, (i) in each case where a majority of votes entitled to be cast is required to approve a proposal (including under Proposal No. 1), abstentions and broker non-votes will have the same effect as votes against the proposal, and (ii) in each case where a plurality of votes cast is required to approve a proposal (including under Proposal No. 2), abstentions and broker non-votes will not be counted as votes cast and will not influence the outcome of votes.

What if other matters come up at the 2016 Annual Meeting?

The matters described in this Proxy Statement are the only matters that we know will be voted on at the 2016 Annual Meeting. If other matters are properly presented at the 2016 Annual Meeting, the proxy holders will vote your shares in their own discretion.

How may I vote if I am a stockholder of record and hold shares in my own name as of the record date?

You may access the proxy materials at

www.proxyvote.com

with your control number.

How may I obtain a paper copy of the proxy materials?

The Notice includes instructions about how to obtain a paper or email copy of the proxy materials at no charge.

How do I authorize a proxy to vote my shares?

You may vote by proxy or in person at the Annual Meeting. To vote by proxy, you may use one of the following methods if you held your stock of record in your own name as of the Record Date:

|

|

·

|

Internet voting:

You may authorize a proxy to vote by Internet by following the instructions on the Notice that you receive. If you wish to authorize a proxy to vote your shares on the Internet, you will need your "Stockholder Control Number" (which can be found on the Notice you receive).

|

|

|

·

|

Phone Voting:

You may vote by phone by calling 1-800-690-6903 and following the instructions. You will need your control number to vote by phone

|

|

|

·

|

Mail:

You can authorize a proxy to vote by mail by requesting a paper copy of the materials, which will include a proxy card, pursuant to the instructions provided in the Notice. If you request a paper copy of the proxy materials, you may authorize a proxy to vote by completing the proxy card and returning it in the envelope that will be included with the proxy materials.

|

What do I do if my shares are held in "street name"?

If your shares are held on your behalf by a broker, bank or other nominee (that is in "street name"), you will receive instructions from such individual or entity that you must follow in order to have your shares voted at the Annual Meeting. If your shares are held in "street name" and you plan to vote your shares in person at the Annual Meeting, you should contact your broker, bank or other nominee to obtain a legal proxy or other evidence from your broker, bank or other nominee giving you the right to vote the shares and bring it to the Annual Meeting in order to vote.

May I change my vote after I return my proxy card?

Yes. You can change your vote at any time before the vote on a proposal either by authorizing a new later dated proxy on the Internet or by filing with Michael V. Shustek, our Chief Executive Officer, at our principal executive offices at 8880 W Sunset Road, Suite 200, Las Vegas, Nevada 89148, a written notice revoking your proxy or by signing, dating and returning to us a new proxy card before the meeting.

We will honor the proxy submitted with the latest date. If you hold your shares in "street name," you must follow your broker, banker or other nominee's instructions to change your vote. You may also revoke your proxy by attending the 2016 Annual Meeting and voting in person.

May I vote in person at the 2016 Annual Meeting rather than by authorizing a proxy?

We encourage you to vote by proxy, however, you are certainly welcome to attend the 2016 Annual Meeting and vote your shares in person. If you hold your shares in "street name," you must follow your broker, banker or other nominee's instructions to obtain a legal proxy or other evidence from your broker, bank or other nominee giving you the right to vote the shares.

How are votes counted?

All votes will be tabulated by the inspector of elections appointed for the 2016 Annual Meeting, who will separately tabulate affirmative votes, withheld or negative votes and abstentions. Abstentions are counted as present for purposes of determining whether there is a quorum for the transaction of business. Abstentions and withheld votes will not be counted as votes cast.

If your shares are held in the name of a broker, bank, or other nominee, and you do not direct the broker, bank, or other nominee how to vote your shares, the nominee is entitled to vote them in its discretion on "routine" matters only. None of the proposals at the 2016 Annual Meeting constitutes a "routine matter." Therefore, if your shares are held in the name of a broker, bank, or other nominee, and you do not direct the broker, bank, or other nominee how to vote your shares on any of the proposals at the 2016 Annual Meeting, the nominee cannot vote the shares on that proposal. This is called a broker non-vote and will not be counted as a vote cast, but will be counted as present for quorum purposes.

The presence, in person or by proxy, of holders of a majority of shares of Common Stock entitled to cast votes at the meeting will constitute a quorum. As of the Record Date, there were approximately 2,337,425 shares of the Common Stock outstanding. If you authorize a proxy on the Internet or sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

Who pays for this proxy solicitation?

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of the Notice, the Proxy Statement, the proxy card and any additional solicitation materials furnished to the stockholders. The Company will use the services of Broadridge Financial Solutions, Inc. ("Broadridge"), in connection with this proxy solicitation. The estimated fees paid by the Company to Broadridge will be approximately $10,000.

Copies of solicitation materials will be furnished to brokers, banks, or other nominees holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by internet may be supplemented by a solicitation by telephone, mail or other means by directors, officers or employees of the Company or of Vestin Mortgage. No additional compensation will be paid to these individuals or to Vestin Mortgage for any such services. Except as described above, the Company does not presently intend to solicit proxies other than by Internet and through the use of direct solicitation by mail and/or telephone.

Pursuant to an SEC approved procedure called "householding," multiple stockholders who share the same address will receive a single Notice of Meeting and Internet Availability of Proxy Material at that address unless they provide contrary instructions. Any such stockholder who wishes to receive a separate Notice of Meeting and Internet Availability of Proxy Material now or in the future may write or call the Company at

Vestin Realty Mortgage II, Inc., 8880 W Sunset Road, Suite 200, Las Vegas, Nevada 89148, telephone: (702) 227-0965.

The Company will promptly, upon written or oral request, deliver a separate copy of the Notice of Meeting and Internet Availability of Proxy Material to any stockholder at a shared address to which only a single copy was delivered. Similarly, stockholders sharing the same address who have received multiple copies of the Notice of Meeting and Internet Availability of Proxy Materials may contact the Company at the above address and phone number to request delivery of a single copy in the future. Stockholders who hold shares beneficially in street name may contact their broker to request information about householding.

FUTURE STOCKHOLDER PROPOSALS

Stockholder proposals that are intended to be presented at our 2017 Annual Meeting and included in our proxy materials relating to the 2017 Annual Meeting must be received by our Corporate Secretary at Vestin Realty Mortgage II, Inc., 8880 W. Sunset Road, Suite 200, Las Vegas, Nevada 89148, no later than September 19, 2017. All stockholder proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the Proxy Statement and form of proxy for the 2017 Annual Meeting.

If a stockholder wishes to present a proposal that is not intended to be included in our Proxy Statement relating to the 2017 Annual Meeting, or to nominate a candidate for election to our 2017 Annual Meeting, the stockholder must give advance notice to us prior to the deadline for proposals and nominations for the Annual Meeting determined in accordance with our Bylaws. In order to be deemed properly presented, the notice of a proposal must be delivered to our Corporate Secretary in accordance with our Bylaws as then in effect. Under our Bylaws, as currently in effect, a proposal for business or nominee for election must be submitted not earlier than the 150

th

day and not later than 5:00 P.M. Pacific Time on the 120

th

day prior to the first anniversary of the date of this Proxy Statement, or between August 20, 2017 and 5:00 P.M. Pacific Time on September 19, 2017, and must contain the information required by our Bylaws. However, in the event that the 2017 Annual Meeting is called for a date which is more than 30 days before or after the first anniversary of the date of the 2016 Annual Meeting, stockholder proposals intended for presentation at the 2017 Annual Meeting must be received by our Corporate Secretary no earlier than 150 days before the date of such annual meeting and no later than 5:00 P.M. Pacific Time on the later of 120 days before the date of the 2017 Annual Meeting or the tenth day following the day on which public announcement of the date of such meeting is first made. You may obtain a copy of our Bylaws by sending a written request addressed to the Corporate Secretary at the address set forth in the preceding paragraph.

SUMMARY OF TERMS OF REVERSE STOCK SPLIT

The following summary term sheet about Proposal No. 1 emphasizes certain material details of the proposed transaction. In addition to reviewing this Summary Term Sheet, we strongly encourage you to read the more detailed description of the proposed transaction provided in this proxy statement. The date on which the Reverse Stock Split takes effect is referred to herein as the "Effective Date."

|

Reverse Stock Split

|

The Board has unanimously approved the Reverse Stock Split in order to reduce the Company's number of stockholders of record to fewer than 300 holders. If approved at the Annual Meeting, stockholders who own fewer than 1,000 shares of Common Stock on the Effective Date will no longer be stockholders of the Company ("Cashed Out Stockholders"). Stockholders holding more than 1,000 shares on the Effective Date will remain stockholders of the Company after the Reverse Stock Split ("Continuing Stockholders"), but will receive payment for any fractional shares that would result from the Reverse Stock Split. The shares we purchase will be cancelled. The See "Special Factors—Proposal No. 1 Reverse Stock Split."

If approved at the Annual Meeting, the Company will effectuate the Reverse Stock Split by filing an amendment to the Charter in substantially the form attached hereto as Appendix A with the Maryland State Department of Assessments and Taxation of Maryland. See Appendix A.

|

|

|

|

|

Payment for Fractional Shares

|

Stockholders with fewer than 1,000 shares will receive a cash payment (without interest or deduction) for their fractional shares (such payment, the "Cash-Out Payment"). The Cash-Out Payment will be equal to the fraction to which the stockholder would otherwise be entitled multiplied by $2.70, which is the average per-share closing price of the Common Stock on NASDAQ for the ten consecutive trading days ending on the last trading day prior to September 15, 2016. September 15, 2016 is the date of the first public disclosure of the Reverse Stock Split proposal in the form of the initial filing of this proxy statement with the SEC.

Notwithstanding the foregoing, if the average per-share closing price of the Common Stock on NASDAQ for the ten (10) consecutive trading days ending on the last trading day prior to the Effective Date (such price, the "Closing Trading Price") is greater than $2.70, then the Cash-Out Payment will be equal to the fraction to which the stockholder would otherwise be entitled multiplied by the Closing Trading Price.

|

|

Stockholder Approval

|

Approval of the Reverse Stock Split will require the affirmative vote from holders of a majority of the outstanding shares of Common Stock as of the Record Date. The Company's directors and executive officers, as a group, own approximately 21.5% of the outstanding shares of Common Stock. See "Security Ownership of Certain Beneficial Owner" for more information. The transaction does not require the approval of a majority of the unaffiliated stockholders. See "Special Factors—Proposal No. 1 The Reverse Stock Split."

|

|

Purpose of Transaction

|

The Reverse Stock Split represents the first step in the Company's plan to terminate its public reporting obligations under the Exchange Act by reducing the number of its stockholders of record to fewer than 300 holders, and deregistering its class of Common Stock from under the Exchange Act. See "Purposes of the Reverse Stock Split," "Advantages of the Reverse Stock Split," "Disadvantages of the Reverse Stock Split" and "Alternatives Considered."

|

|

Reasons for Transaction

|

The Board believes that the significant costs and heightened disclosure obligations associated with being a public reporting company, and the limited trading market and analyst coverage for the Common Stock outweigh the perceived benefits of being a public reporting company. See "Purposes of the Reverse Stock Split," "Advantages of the Reverse Stock Split," "Disadvantages of the Reverse Stock Split" and "Alternatives Considered."

|

|

Effects of Reverse Stock Split on Affiliates

|

The transaction would not differentiate among stockholders on the basis of affiliate status. The sole determining factor in whether a stockholder will become a Cashed Out Stockholder or a Continuing Stockholder as a result of the Reverse Stock Split is the number of shares held by such stockholder immediately before the effective time of the Reverse Stock Split as no fractional shares will be issued.

As of September 30, 2016, approximately 513,276 shares of our Common Stock, or approximately 21.5% of the issued and outstanding shares of Common Stock on such date, were held, directly or indirectly, by Mr. Shustek, our chief executive officer and chairperson of the board. Upon the effectiveness of t

he Reverse Stock Split

, the aggregate number of shares of our Common Stock owned directly or indirectly by Mr. Shustek may increase to approximately 25.5% as a result of the reduction of the number of shares of our Common Stock outstanding. No other director or officer of the Company owns any share of our Common Stock as of the date hereof.

|

|

Fairness of Transaction

|

The Board believes that the Cash-Out Payment, which is based on the market closing price of the Common Stock on NASDAQ, is fair to the Company's stockholders, including its unaffiliated stockholders, and unanimously recommends that stockholders vote to approve the Reverse Stock Split. See "Fairness of the Reverse Stock Split."

|

|

Appraisal Rights

|

Stockholders who receive shares and/or cash in the Reverse Stock Split do not have appraisal rights under Maryland law. The Board did not consider the presence or lack of appraisal rights to be a material factor in its consideration and approval of the Reverse Stock Split. See "Appraisal Rights."

|

|

Trading Market

|

As a result of the intended delisting, the Common Stock may be traded on the over-the-counter market and may be quoted on the Pink Sheets, although no assurances in this regard can be made.

|

|

Schedule 13E-3 Filing

|

The Reverse Stock Split is considered a "going private" transaction as defined in Rule 13e-3 promulgated under the Exchange Act, because it is intended to, and, if completed, will enable us to, terminate the registration of (or "deregister") our Common Stock under Section 12(g) of the Exchange Act and suspend our duty to file periodic reports and other information with the SEC under Section 13(a) thereunder.

|

SPECIAL FACTORS – PROPOSAL NO. 1

This section provides information concerning special factors relating to Proposal No. 1 and the proposed 1-for-1,000 Reverse Stock Split and related transactions including the cashing out of fractional shares following such split and subsequent anticipated SEC deregistration.

THE REVERSE STOCK SPLIT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE COMMISSION HAS PASSED UPON THE FAIRNESS OR MERITS OF THE REVERSE STOCK SPLIT OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Overview

The Board has unanimously adopted resolutions approving and recommending to the stockholders for their approval a reverse stock split of all of the outstanding shares of Common Stock, whereby each 1,000 shares would be combined, converted and changed into one share of Common Stock. As described in greater detail below, the Reverse Stock Split is proposed to be effected to decrease the number of stockholders of record to a number less than 300 to, among other things, place the Company in a position to voluntarily delist the Common Stock from NASDAQ and voluntarily deregister from the reporting requirements of the Exchange Act.

Following the Reverse Stock Split, the number of issued and outstanding shares of Common Stock would be reduced in accordance with the Reverse Stock Split ratio. Except for adjustments that may result from the treatment of fractional shares, each stockholder will hold the same percentage of the outstanding Common Stock immediately following the Reverse Stock Split as such stockholder held immediately prior to the Reverse Stock Split. As described in greater detail below, as a result of the Reverse Stock Split, stockholders who hold less than 1,000 shares of Common Stock will no longer be stockholders of the Company on a post-split basis.

Board Deliberations

The Board, with input from senior management, regularly reviews and evaluates the Company's business, strategic plans and prospects. As part of this regular assessment, from time to time, the Board has considered and deliberated the advantages and disadvantages of a potential deregistration transaction. In connection with such assessment, the Board has considered the costs and expenses of remaining a public company, the limited trading in the Common Stock and the other considerations set forth under the sections "Advantages of the Reverse Stock Split" and "Disadvantages of the Reverse Stock Split," and has also considered other alternatives to the Reverse Stock Split, including those described under the section "Alternatives Considered."

Following such deliberations and after obtaining input from outside legal counsel with respect to the Reverse Stock Split and potential alternatives, at a meeting of the Board held on August 15, 2016, the Board unanimously approve taking all actions, including obtaining stockholder approval, to effectuate the Reverse Stock Split as soon as reasonably practicable.

After review and discussion, the Board determined that the proposed Reverse Stock Split is necessary for execution of the Company's business plan. In addition, the Board

determined that voluntarily delisting and deregistering is in the overall best interests of the Company after carefully considering several factors, including

|

·

|

the large costs of preparing and filing periodic reports with the SEC,

|

|

·

|

the increased outside accounting, audit, legal and other costs and expenses associated with being a public company,

|

|

·

|

the burdens placed on Company management to comply with reporting requirements, and

|

|

·

|

the low trading volume in the Common Stock,

|

all as further

disclosed in the sections "Advantages of the Reverse Stock Split," "Disadvantages of the Reverse Stock Split" and "Alternatives Considered."

As further disclosed under "Advantages of the Reverse Stock Split," the Board has concluded that the large costs of

preparing and filing periodic reports with the SEC and the increased outside accounting, audit, legal and other costs and expenses associated with being a public company are outweigh by the perceived benefits of remaining a public company, particularly in light of the limited trading in the Common Stock.

The Board also believes the Reverse Stock Split would free management and staff time to focus on long-term business objectives as well as internal financial reporting and analytics to support those objectives. The Board also considered the fact that the Reverse Stock Split will provide an opportunity for Cashed Out Stockholders to sell their holdings without brokerage fees or commissions or other transaction costs at market price.

As further disclosed under "Disadvantages of the Reverse Stock Split," the Board also considered the requirement that stockholders owning less than 1,000 shares of record surrender their shares and accept the Cash-Out Payment as part of the Reverse Stock Split, thereby foregoing any opportunity to participate in any possible future increases in value of the Common Stock. The Board also considered the possible significant decline in value and liquidity of the Common Stock following the Reverse Stock Split. In particular, the Board noted that the Common Stock may suffer further illiquidity following the Reverse Stock Split as a result of the reduced number of shares of Common Stock and the significant increase in the per share price of Common Stock resulting from the Reverse Stock Split. The decreased liquidity of the Common Stock, coupled with an absence of publicly available information, may further decrease the value of the shares owned by continuing stockholders.

As part of its assessment, the Board also noted that the share price of Vestin Realty Mortgage I, Inc. ("VRTA") common stock did not decrease significantly following its delisting from the NASDAQ. On December 30, 2015, the last day of trading of VRTA common stock, the closing price of VRTA stock on NASDAQ was $1.75. On January 11, 2016, the day after delisting, the closing price of VRTA stock on the Pink Sheets was $1.35. On September 8, 2016, the closing price of VRTA stock on the Pink Sheets was $3.4399. VRTA has a similar investment strategy with the Company and is managed by the same advisor. The Board recognized, however, that the historical performance of VRTA stock price cannot be used to predict the future stock performance of the Common Stock following the Reverse Stock Split, particularly given the differences in stock ownership, shares outstanding, share prices, and financial and operating performances of the Company and VRTA. The Board thus continues to consider the potential decline in value of the Common Stock resulting from the Reverse Stock Split as a potential disadvantage resulting from the Reverse Stock Split.

Neither the Board nor management believes the Reverse Stock Split itself will be a change factor for better performance of the Company, but the Board believes the Reverse Stock Split is a vehicle the Company can use to reduce costs and redirected time resources resulting from regulatory and reporting compliance cessation post Reverse Stock Split; assuming the Company's shareholders of record are reduced below 300 and the Company is able to deregister with the SEC.

As further disclosed under "Alternatives Considered," the Board also considered issuer purchases and maintaining the status quo as alternatives, but concluded ultimately that the proposed Reverse Stock Split was the best method and was in the best interests of the Company and its stockholders. As further disclosed under "Fairness of the Reverse Stock Split," the Board has further determined that the Reverse Stock Split is substantively and procedurally fair to the unaffiliated stockholders.

Purpose of the Reverse Stock Split

The Common Stock is currently listed on NASDAQ under the symbol "VRTB." Among other requirements, the listing maintenance standards established by NASDAQ require there be a minimum of 300 stockholders. In addition, the Exchange Act requires reporting requirement registration for companies with more than 300 stockholders. Through the date of filing this proxy statement, there were approximately 1,744 stockholders of the Company. The Company estimates that if the Reverse Stock Split is approved and implemented, the approximate number of record shareholders is anticipated to be approximately 291.

The primary purpose of the Reverse Stock Split is to enable us to reduce the number of our stockholders of record to fewer than 300. This reduction in the number of our stockholders will allow:

|

·

|

Substantial cost savings of time and money derived from termination of the registration of our Common Stock under the Exchange Act and suspension of our duties to file periodic reports with the SEC and comply with Sarbanes-Oxley Act and other SEC requirements

|

|

·

|

Elimination of the administrative burden and expense of maintaining many small stockholders' accounts

|

|

·

|

Liquidation by small stockholders of their shares of our Common Stock at a market price, without having to pay brokerage commissions

|

If approved at the Annual Meeting, the Company will effectuate the Reverse Stock Split by filing an amendment to the Charter in substantially the form attached hereto as Appendix A with the Maryland State Department of Assessments and Taxation of Maryland. See Appendix A.

Following the Reverse Stock Split, the

Company expects to file a Form 25, Notification of Removal from Listing and/or registration under Section 12(b) of the Exchange Act with the SEC and NASDAQ. The Form 25 will become effective 10 days after it is filed. Upon its effectiveness, the Company anticipates that its Common Stock will be quoted on the Pink Sheets, a centralized electronic quotation service for over-the-counter securities. The Company expects the Common Stock will continue to trade on the Pink Sheets, so long as market makers continue to make a market in the Common Stock. However, the Company can give no assurance that trading in its stock will continue on the Pink Sheets or on any other securities exchange or quotation medium.

Upon the effective date of the NASDAQ delisting, the Company intends to file a Form 15 to deregister its Common Stock with the SEC and become a non-reporting company under the Exchange Act. As of the date of the filing of the Form 15, the obligation of the Company to file reports under the Exchange Act, including Forms 10-K, 10-Q and 8-K, will be immediately suspended. The Company expects the deregistration of its Common Stock to become effective 90 days after filing the Form 15. The Company intends to continue to make certain information available to stockholders as required by applicable law. In addition, although no longer required after deregistration, the Company intends to release financial results and issue press releases for the benefit of its shareholders. There can be no assurance, however, that the Company will continue to provide such information in the future.

Principal Effects of the Reverse Stock Split

After the Effective Date, each stockholder will own a reduced number of shares of the Common Stock. However, the Company expects that the market price of the Common Stock immediately after the Reverse Stock Split will increase substantially above the market price of the Common Stock immediately prior to the Reverse Stock Split. The proposed Reverse Stock Split will be effected simultaneously for all of the Common Stock, and the ratio for the Reverse Stock Split will be the same for all of the Common Stock. The Reverse Stock Split will affect all stockholders uniformly and will not affect any stockholder's percentage ownership interest in the Company (except to the extent that the Reverse Stock Split would result in any of the stockholders owning a fractional share as described below). Proportionate voting rights and other rights and preferences of the holders of Common Stock will not be affected by the proposed Reverse Stock Split (except to the extent that the Reverse Stock Split would result in any stockholders owning a fractional share as described below). For example, a holder of 2% of the voting power of the outstanding shares of Common Stock immediately prior to the Reverse Stock Split would continue to hold approximately 2% of the voting power of the outstanding shares of Common Stock immediately after the Reverse Stock Split. The number of stockholders of record also will not be affected by the proposed Reverse Stock Split (except to the extent that the Reverse Stock Split would result in any stockholders owning only a fractional share as described below).

The Common Stock is currently registered under Section 12(b) of the Exchange Act, and the Company is subject to the periodic reporting and other requirements of the Exchange Act. The proposed Reverse Stock Split will affect the registration of the Common Stock under the Exchange Act. If the proposed Reverse Stock Split is implemented, the Company will voluntarily delist the Common Stock from NASDAQ and voluntarily deregister from the reporting requirements of the Exchange Act.

The respective rights, preferences or limitations of the Company's Common Stock will remain the same after the proposed Reverse Stock Split as before the split. For example, the rights of shareholders as voting, dividends, liquidation or other rights of the Company's Common Stock will remain the same and will not change as a result of the proposed Reverse Stock Split. In addition, the Company has decided not to adjust the par value of its Common Stock in connection with the Reverse Stock Split.

The Company estimates that if the Reverse Stock Split is approved and implemented, the total number of shares of outstanding Common Stock in pre-split terms would be approximately 2,089,000 (a reduction of approximately 457,771 pre-split shares or 18.0% of the pre-split total shares outstanding), and the approximate number of record shareholders is anticipated to be approximately 291.

This would represent an anticipated reduction of approximately 1,453 pre-split record shareholders out of the approximately 1,744 shareholders of record as of the Record Date. Based on the minimum Cash-Out Payment of $2.70 per share, the total anticipated cost of cashing out such estimated 457,771 shares pre-split would be approximately $1,240,000. If the 10-day average market price ending on the last trading day prior to the Effective Date is greater than $2.70, then the actual cost will be based on such Closing Trading Price. The Company plans to pay such anticipated cash-out cost from the Company's available cash resources. The Company does not anticipate any material impact on the Company's financial statements if the Reverse Stock Split is approved and implemented.

Effects of the Reverse Stock Split on our Affiliates

.

The transaction would not differentiate among stockholders on the basis of affiliate status. The sole determining factor in whether a stockholder will become a Cashed Out Stockholder or a Continuing Stockholder as a result of the Reverse Stock Split is the number of shares held by such stockholder immediately before the effective time of the Reverse Stock Split as no fractional shares will be issued. The beneficial ownership percentage of shares of our Common Stock held by our executive officers and directors and the beneficial ownership percentage of the stockholders who will continue to hold our Common Stock after the Reverse Stock Split, may, however, increase or decrease as a result of such purchases, sales and other transfer of shares of our Common Stock by our stockholders prior to the effective time of the Reverse Stock Split, and depending on the number of shares that are actually Cashed-Out in the Reverse Stock Split.

As of September 30, 2016, approximately 513,276 shares of our Common Stock, or approximately 21.5% of the issued and outstanding shares of Common Stock on such date, were held, directly or indirectly, by Mr. Shustek, our chief executive officer and chairperson of the board. Upon the effectiveness of t

he Reverse Stock Split

, the aggregate number of shares of our Common Stock owned directly or indirectly by Mr. Shustek may increase to approximately 25.5% as a result of the reduction of the number of shares of our Common Stock outstanding. No other director or officer of the Company owns any share of our Common Stock as of the date hereof. The table below reflects the pre-Reverse Stock Split and an estimate of the post-Reverse Stock Split ownership of our current executive officers and directors:

|

Name

(1)

|

|

Title

|

|

Common Stock

Pre-Reverse

Stock Split

(2)

|

|

Percentage

of Class

(3)

|

|

Common Stock

Post-Reverse

Stock Split

|

|

Percentage

of Class

(4)

|

|

Michael V. Shustek (5)

|

|

|

Chairman & CEO

|

|

|

|

513,276

|

|

|

|

21.5

|

%

|

|

|

513

|

|

|

|

25.5

|

%

|

|

Edwin H. Bentzen IV

|

|

|

CFO

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Michael J. Whiteaker

|

|

|

Vice President of Regulatory Affairs

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

Donovan Jacobs

|

|

|

Director

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

Daryl C. Idler, Jr.

|

|

|

Independent Director

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

Roland M. Sansone

|

|

|

Independent Director

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

All Directors and Executive Officers as a group (6 persons)

|

|

|

|

|

|

|

513,276

|

|

|

|

21.5

|

%

|

|

|

513

|

|

|

|

25.5

|

%

|

_____________________

|

|

(1)

|

The address of each of the beneficial owners listed above is c/o Vestin Realty Mortgage II, Inc.,

8880 W. Sunset Road, Suite 200 Las Vegas, NV 89118

|

|

|

(2)

|

The Common Stock information is calculated based on 2,384,179 shares of our total outstanding Common Stock as of September 30, 2016.

|

|

|

(3)

|

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

|

|

|

(4)

|

The percentage calculation is based the assumption that 2,013 shares of our Common Stock will remain outstanding after the Reverse Stock Split.

|

|

|

(5)

|

Mr. Shustek is the Manager of Vestin Mortgage. Mr. Shustek holds,

directly or indirectly, 513,276 shares of our Common Stock,

representing approximately 21.5% of our outstanding Common Stock (based upon 2,384,179 shares of Common Stock outstanding at September 30, 2016). Mr. Shustek directly owns 458,001 shares of our Common Stock (totaling 19.2%) and indirectly owns and has economic benefit of 23,175 shares of our Common Stock (totaling 0.97%) through his ownership of Vestin Mortgage. Mr. Shustek has economic benefit of and shares voting and dispositive power of 18,774 shares of our Common Stock (totaling 0.79%) owned by his spouse, of which 6,327 shares were acquired by her prior to their marriage.

Mr. Shustek indirectly holds 13,326

shares of our Common Stock

(totaling 0.56%)

, which represents Mr. Shustek's 9.9% proportionate interest in the shares of Vestin Realty Mortgage I, Inc., which owns 134,270 shares of the Company.

|

A

s a result of the Reverse Stock Split, Mr. Shustek's interest in the Company's net book value and net earnings (losses) will increase to the extent of the increase in his percentage ownership in the Company as a result of a reduction in the number of shares of Common Stock after the Reverse Stock Split. The Company's net book value, calculated as total assets minus total liabilities, was approximately $17,491,000 and $6,862,000 at December 31, 2015 and September 30, 2016, respectively, and the Company had net losses of approximately $18,006,000 and $3,846,000 for the year ended December 31, 2015 and nine months ended September 30, 2016.

|

·

|

Assuming Mr. Shustek owned 21.5% of the outstanding shares throughout 2015 and 2016:

|

|

o

|

Mr. Shustek's interest in the Company's net book value as of December 31, 2015 and September 30, 2016, would have been approximately $3,760,565 and $1,475,330, respectively, or 21.5% of the total net book value as of December 31, 2015 and September 30, 2016; and

|

|

o

|

Mr. Shustek's interest in the Company's net losses as of December 31, 2015 and September 30, 2016, would have been approximately $3,871,290 and $826,890, respectively, or 21.5% of the total net losses as of December 31, 2015 and September 30, 2016.

|

|

·

|

Assuming the Reverse Stock Split is consummated and Mr. Shustek's percentage ownership in the Company increases to 25.5% from 21.5% as noted above:

|

|

o

|

Mr. Shustek's interest in the Company's net book value as of December 31, 2015 and September 30, 2016, on a pro forma basis, after giving effect to the Reverse Stock Split as of such dates, would have been approximately $4,460,2055 and $1,749,810, respectively, or 25.5% of the total net book value as of December 31, 2015 and September 30, 2016; and

|

|

o

|

Mr. Shustek's interest in the Company's net losses as of December 31, 2015 and September 30, 2016, on a pro forma basis, after giving effect to the Reverse Stock Split as of such dates, would have been approximately $4,591,530 and $980,730, respectively, or 25.5% of the total net losses as of December 31, 2015 and September 30, 2016.

|

Additionally, directors, executive officers and

10% stockholders and their affiliates

will be relieved of certain SEC reporting requirements and "short-swing profit" trading provisions under Section 16 of the Exchange Act, and public disclosure of information regarding their compensation and stock ownership will no longer be required. The Company after deregistration would also no longer be prohibited, pursuant to Section 402 of the Sarbanes-Oxley Act, from making personal loans to directors or executive officers.

We do not have any agreement, arrangement or understanding, whether written or unwritten, with any of our affiliates pursuant to which we are obligated to pay to any affiliate compensation, whether present, deferred or contingent, that is based on, or otherwise relates to, the Reverse Stock Split. All of our officers and directors will continue in such capacity after the Reverse Stock Split.

To the extent known by the Company, each executive officer or director of the Company that is entitled to vote at the Annual Meeting intends to vote for the Reverse Stock Split. No executive officer or director of the Company will be entitled to the Cash-Out Payment, except for payment for any fractional shares that may result from the Reverse Stock Split.

Treatment of Fractional Shares

No scrip or fractional shares would be issued if, as a result of the Reverse Stock Split, a registered stockholder would otherwise become entitled to a fractional share. Instead, the Company would pay to the registered stockholder, in cash, the value of any fractional share interest arising from the Reverse Stock Split, for a minimum Cash-Out Payment of $2.70 per share. The minimum Cash-Out Payment is equal to the average per-share closing price of the Common Stock on NASDAQ for the ten consecutive trading days ending on the last trading day prior to September 15, 2016. September 15, 2016 is the date of the first public disclosure of the Reverse Stock Split proposal in the form of the initial filing of this proxy statement with the SEC.

Notwithstanding the foregoing, if the Closing Trading Price is greater than $2.70, then the Cash-Out Payment will be equal to the fraction to which the stockholder would otherwise be entitled multiplied by the Closing Trading Price. The Closing Trading Price is the average per-share closing price of the Common Stock on NASDAQ for the ten consecutive trading days ending on the last trading day prior to the Effective Date.

No transaction costs would be assessed to stockholders for the cash payment. Stockholders would not be entitled to receive interest for the period between the Effective Date and the date payment is made for their fractional shares. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment as described herein. This cash payment merely represents a mechanical rounding off of the fractions in the exchange.

As a result of the Reverse Stock Split, stockholders who hold less than 1,000 shares of Common Stock will no longer be stockholders of the Company on a post-split basis. In other words, any holder of 999 or fewer shares of Common Stock prior to the effectiveness of the Reverse Stock Split would only be entitled to receive cash for the fractional share of Common Stock such stockholder would hold on a post-split basis. The actual number of stockholders that will be eliminated will depend on the actual number of stockholders holding less than 1,000 shares of Common Stock on the Effective Date. Reducing the number of post-split stockholders is the purpose of the Reverse Stock Split.

If you do not hold sufficient shares of pre-split Common Stock to receive at least one post-split share of Common Stock and you want to hold Common Stock after the Reverse Stock Split, you may do so by taking either of the following actions far enough in advance so that it is completed before the Reverse Stock Split is effected:

|

•

|

purchase a sufficient number of shares of Common Stock so that you would hold at least 1,000 shares of Common Stock in your account prior to the implementation of the Reverse Stock Split that would entitle you to receive at least one share of Common Stock on a post-split basis; or

|

|

•

|

if applicable, consolidate your accounts so that you hold at least 1,000 shares of Common Stock in one account prior to the Reverse Stock Split that would entitle you to at least one share of Common Stock on a post-split basis. Common stock held in registered form (that is, shares held by you in your own name on the Company's share register maintained by its transfer agent) and Common Stock held in "street name" (that is, shares held by you through a bank, broker or other nominee) for the same investor would be considered held in separate accounts and would not be aggregated when implementing the Reverse Stock Split. In addition, shares of Common Stock held in registered form but in separate accounts by the same investor would not be aggregated when implementing the Reverse Stock Split.

|

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where the Company is domiciled and where the funds for fractional shares would be deposited, sums due to stockholders in payment for fractional shares that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Advantages of the Reverse Stock Split

Cost Savings

The costs of being a public reporting company are significant and have increased over the years, including as a result of compliance with the internal control assessment and audit requirements of Section 404 and other requirements imparted by Sarbanes-Oxley Act and the Dodd-Frank Act, and are expected to continue to increase in the near future.

Legislation such as Sarbanes-Oxley Act and the Dodd-Frank Act will continue to have the effect of increasing the compliance burdens and potential liabilities of being a public reporting company. It will increase audit fees and other costs of compliance, such as outside securities legal counsel fees, as well as outside director fees and large insurance premiums to cover potential liability faced by our officers and directors. We also incur substantial indirect costs as a result of, among other things, our management's time expended to prepare and review our public filings.

The Board believes that by deregistering our shares of Common Stock and suspending our periodic reporting obligations we will realize annual cost savings of approximately $160,000. These estimated annual cost savings reflect, among other things: (i) a reduction in audit, legal and other fees required for publicly held companies, (ii) the elimination of various internal costs associated with filing periodic reports with the SEC, and (iii) the reduction or elimination of various clerical and other expenses associated with being a public company. The cost savings figures set forth above are only estimates. The actual savings we realize from the transaction may be higher or lower than such estimates, but the savings will continue annually. Estimates of the annual savings to be realized are based upon (i) the actual costs to us of the services and disbursements in each of the categories listed above that are reflected in our financial records and (ii) the allocation to each category of management's estimates of the portion of the expenses and disbursements in such category believed to be solely or primarily attributable to our public reporting company status. In some instances, management's cost saving expectations were based on information provided or upon verifiable assumptions. The Board has reviewed an analysis prepared by management on the cost saving expectations if the Company were to cease being a reporting company. The analysis was also reviewed by independent accountants, but the independent accountants did not render any opinion or other written report in connection with its review of the cost savings analysis.

Limited Liquidity of Common Stock

The Board further believes that the perceived benefits of remaining a public company is outweighed by the costs, particularly in light of the limited public trading value, liquidity and analyst coverage of the Common Stock. The Common Stock is traded on NASDAQ under the symbol "VRTB". As of September 30, 2016, the Company has outstanding 2,384,179 shares of Common Stock. Over the last nine-month period ending September 30, 2016, the average NASDAQ daily trading volume of the Common Stock was approximately 3,393 shares, or less than 0.15% of the total outstanding shares as of September 30, 2016. The Company also is not aware of any analyst coverage of the Common Stock.

Additional Potential Management Resources Arising From Reduced Disclosure Obligations

Another main benefit is that the proposed Reverse Stock Split would free management and staff time to focus on long-term business objectives as well as internal financial reporting and analytics to support those objectives. Additional benefits and advantages would also include greater confidentiality of strategic and competitively sensitive information. Our management will also be able to focus on long-term growth without undue emphasis on short-term financial results that is often expected of SEC reporting companies.

Opportunity for Cashed Out Stockholders to Sell Their Holdings at Current Market Trading Price Without Brokerage Fees or Commissions

The Reverse Stock Split provides an opportunity for Cashed Out Stockholders to sell their holdings without brokerage fees or commissions or other transaction costs at a minimum amount equal to $2.70.

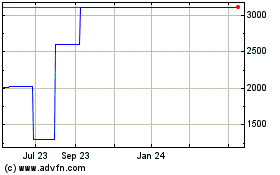

The Board believes the minimum Cash-Out Payment of $2.70 is fair to the stockholders as it is equal to the 10-day average trading price of our common stock ending on the last trading day prior to our initial public announcement of the Reverse Stock Split. The Board also considered the fact that the minimum Cash-Out Payment of $2.70 exceeds $2.53, which is the average price paid per share for our stock repurchases during the nine months ended September 30, 2016, and falls within the quarterly highest sales prices of our common stock through the end of 2016, as shown in the tables below.

Notwithstanding the foregoing, if the average per-share closing price of the Common Stock for the ten consecutive trading days ending on the last trading day prior to the Effective Date is greater than $2.70, then the Cash-Out Payment will be calculated based on the Closing Trading Price instead of $2.70. The Board is unable to predict whether the Closing Trading Price will be in excess of $2.70 per share, but if there is an increase in the stock price, the Board believes any the increase is reflective of the stock market's support of the Reverse Stock Split. The Board believes stockholders whose shares are being cashed out in the Reverse Stock Split should benefit from any such price increase. For a further discussion on the Board's determination regarding the fairness of the Cash-Out Payment, please see the section entitled "Fairness of the Reverse Stock Split" below.

In addition, stockholders with less than 1,000 pre-split shares could buy additional shares, at a relatively low cost per share, to get to 1,000 by the Record Date and thereby avoid cash-out if they prefer. Similarly, shareholders with slightly more than 1,000 pre-split shares could sell some shares to get under the 1,000 share level if they prefer.

Disadvantages of the Reverse Stock Split

Holders of less than 1,000 shares of record will be required to give up their shares and accept cash consideration.

The Reverse Stock Split of 1-for-1,000 will force stockholders who own less than 1,000 shares of record to be cashed out for the Cash-Out Payment. Other than acquiring more shares of stock before the Effective Date, stockholders may only vote against the proposed Reverse Stock Split, but if the Reverse Stock Split proposal is approved and implemented, stockholders who own less than 1,000 shares of record will be required to sell for the Cash-Out Payment.

Substantial or Complete Reduction of Public Sale Opportunities for our Stockholders

Following the transaction, we anticipate that the market for shares of our Common Stock will be even less active and may be eliminated altogether. Our stockholders may no longer have the option of selling their Common Stock in a public market. While shares may be quoted in the Pink Sheets, any such market for our Common Stock may be highly illiquid after the suspension of our periodic reporting obligations.

Loss of Certain Publicly Available Information

Upon terminating the registration of our Common Stock under the Exchange Act, our duty to file periodic reports with the SEC will be suspended. The information regarding our operations and financial results that is currently available to the general public and our investors will not be available after we have terminated our registration. Upon the suspension of our duty to file reports with the SEC, investors seeking information about us may have to contact us directly to request such information. We cannot assure you that we will provide the requested information to an investor. While the Board acknowledges the circumstances in which such termination of publicly available information may be disadvantageous to some of our stockholders, the Board believes that the overall benefit to the Company of no longer being a public reporting company substantially outweighs the disadvantages.

If the Company is no longer subject to certain liability provisions of the Exchange Act, including those associated with officer certifications required by Sarbanes-Oxley, stockholders will find that the information provided to them is more limited and that their recourse for alleged false or misleading statements is also more limited. If the shares are traded on the Pink Sheets, the Company will submit quarterly unaudited financial statements of the Company with the Pink Sheets in accordance with the Pink Sheets requirements, although such information is generally not publicly available.

Possible Significant Decline in the Value and Liquidity of the Common Stock

The market price of our Common Stock is based on our performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of our Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. In many cases, both the total market capitalization of a company and the market price of a share of such company's Common Stock following a Reverse Stock Split are lower than they were before the Reverse Stock Split.

Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split, as well as the increase in the stock price triggered by the Reverse Stock Split.

The Company estimates that if the Reverse Stock Split is approved and implemented, the total number of shares of outstanding Common Stock in pre-split terms would be approximately 2,087,000 (a reduction of approximately 457,771 pre-split shares or 18.0% of the pre-split total shares outstanding) and the approximate number of record shareholders is anticipated to be approximately 291. This would represent an anticipated reduction of approximately 1,453 pre-split record shareholders out of the approximately 1,744 shareholders of record as of the Record Date.

Based on the closing price of a share of Common Stock on the minimum Cash-Out Payment of $2.70 per share, a 1-for-1,000 Reverse Stock Split is expected to result in split-adjusted per share Common Stock price of $2,700. This high per share stock price could further limit the market for the Common Stock after the Reverse Stock Split.

The decreased liquidity of the Common Stock, coupled with an absence of publicly available information, may further decrease the value of the shares owned by continuing stockholders.

Inability to Participate in any Future Increases in Value of our Common Stock

Cashed Out Stockholders will have no further financial interest in the Company, and therefore will not have the opportunity to participate in any potential appreciation in the value of our shares, including without limitation, an increase in profitability of the Company. The Board believes that the Reverse Stock Split is nonetheless fair to our unaffiliated stockholders, because those stockholders are being cashed out at a fair price for their shares.

Alternatives Considered

The Board considered alternative transactions to reduce the number of shareholders but concluded ultimately that the proposed Reverse Stock Split was the best method and was in the best interests of the Company and its stockholders.

The Board considered issuer purchases, e.g., by tender offer, but concluded that the Company did not have sufficient resources to effectuate such purchases at the level that would reduce record shareholders to below 300. The Board also considered the possibility that an existing shareholder might undertake a possible tender offer but concluded that no shareholder had expressed interest in undertaking such a transaction.

The Board also considered doing nothing, or maintaining the status quo. The Board concluded, however, that this alternative would not allow the Company to achieve the significant potential benefits of completing the Reverse Stock Split and deregistering the Company's common shares so the Company would no longer be an SEC-reporting company. The Board concluded that maintaining the status quo would result in the Company continuing to be burden by the costs and expenses of remaining a public company without enjoying the benefits traditionally associated with public reporting company status.

The Board unanimously agreed that the significant costs of operating as a reporting company warranted deregistering the Common Stock under the Exchange Act and that the most viable method to achieve that deregistration was a reverse stock split. The Board also agreed that the historically limited trading activity of the Company's Common Stock supported the conclusion that it was in the Company's best interest to effectuate a Reverse Stock Split and deregistration.

Fairness of the Reverse Stock Split

The Board has fully reviewed and considered the terms, purpose, alternatives and effects of the Reverse Stock Split, and has unanimously determined (without the vote of Mr. Shustek, the only affiliated director on the Board) that the transaction is in our best interests and is substantively and procedurally fair to the unaffiliated stockholders.

Mr. Shustek, as President, Chief Executive Officer and a Director of the Company, and as an individual, adopted the conclusions of the Board and believes that the transaction is substantively and procedurally fair to unaffiliated security holders. Mr. Shustek also considered the purposes, alternatives and fairness of the Reverse Stock Split in determining how to vote his shares. Mr. Shustek intends to vote his shares in favor of the Reverse Stock Split.

The Reverse Stock Split does not require the approval of a majority of our unaffiliated stockholders. Despite the foregoing, the Board believes that the Reverse Stock split is substantively and procedurally fair to each differently-impacted group of stockholders – those unaffiliated stockholders who will be cashed-out and those affiliated and unaffiliated stockholders who will be Continuing Stockholders. The Board bases its opinion on:

|

·

|

the requirement that the proposal receive a majority vote of the shares represented, in person or by proxy, at the Annual Meeting,

|

|

·

|

the calculation of the Cash-Out Payment, pursuant to which stockholders are provided with the benefit of receiving the greater of (i) $2.70, which is the 10-day average market price ending on the last trading day prior to the first public disclosure of the Reverse Stock Split proposal, or (ii) the 10-day average market price ending on the last trading day prior the Effective Date, and

|

|

·

|

the possibility, although not the assurance, that the unaffiliated stockholders may be able to change their status from Cashed Out Stockholder to Continuing Stockholder (or vice versa) as they see fit.

|

In addition, Continuing Stockholders have the advantage of continuing as stockholders in a company that will not be subject to the costs associated with being a public company. These savings should decrease our ongoing expenses.

The Board believes the minimum Cash-Out Payment of $2.70 is fair to our stockholders as it is equal to the 10-day average trading price of our Common Stock ending on the last trading day prior to our initial public announcement of the Reverse Stock Split. The Board also considered the fact that the minimum Cash-Out Payment of $2.70:

|

·

|

exceeds $2.53, which is the average price paid per share for our stock repurchases during the nine months ended September 30, 2016,

|

|

·

|

exceeds $1.97, which the closing price of our Common Stock on August 15, 2015, the last full trading day prior to the Board approving the Reverse Stock Split, and

|

|

·

|

is within the range of the highest sales price for our common stock on NASDAQ during the first, second, third and fourth quarters of 2016, or $2.32, $2.97, $3.75 and $3.00, respectively.

|

The Board also notes that the Cash-Out Payment will be calculated based on the Closing Trading Price, which is the average closing price during the 10 trading days prior to the Effective Date, rather than the minimum Cash-Out Payment of $2.70 if the Closing Trading Price is in excess of $2.70 per share. The Board is unable to predict whether the Closing Trading Price prior to the Effective Time will be in excess of $2.70 per share, particularly in light of the limited trading in the Common Stock and the potential volatility in the stock price as a result of such limited trading. However, if there is an increase in the stock price, the Board believes such increase is likely reflective of the stock market's support of the Reverse Stock Split. The Board believes stockholders whose shares are being cashed out in the Reverse Stock Split therefore should benefit from any such price increase.

The Board considered the net book value per share of our common stock in relation to the minimum Cash-Out Payment of $2.70. The net book value per share of our common stock was equal to approximately $3.97 and $2.88, as of June 30, 2016 and September 30, 2016, respectively. Net book value is defined generally as total assets minus total liabilities. While the Board considered the relationship of market value to net book value in its deliberations, the Board does not view net book value alone to be a material indicator of the fair value of our common stock but rather indicative of historical costs. The Board notes that net book value does not take into account our future prospects, market conditions, trends in the industry in which we conduct our business or the business risks inherent in competing with other companies in the same industry. The Board further notes that net book value does not state all assets and liabilities at market value, nor does it take into account the other considerations that might be part of a transaction between a willing buyer and a willing seller.

The Board did not seek to establish, and did not consider, a going concern valuation because the Board

determined that

the costs associated with engaging an independent financial advisor to assist the Board in analyzin

g and providing an accurate estimate of our

going concern value exceeded the anticipated benefits of such analysis.

In addition, the Board believes that

the market value determined by the public trading market reflected any value attributable to the Company as a going concern.

The Board further views the liquidation value of the Company to be an inappropriate measure for the purpose of evaluating the fairness of the Cash-Out Payment because the Board considers the Company to be a viable going concern business. There is no present intention of liquidating the Company. Further, the Reverse Stock Split will only result in the termination of an equity interest by those stockholders who has holdings are reduced to fractional shares as a result of the Reverse Stock Split. A liquidation process would also involve additional legal fees, costs of sale and other expenses that would reduce any amounts that stockholders might receive upon liquidation. In addition, the Board believes that the value of the Company's assets that might be realized in liquidation may be substantially less than its going concern value. Given the other factors considered by the Board as described in this Proxy Statement, the Board did not pursue a liquidation value approach.

The Board considered the stock repurchases discussed in the section "

Purchases of Equity Securities by the Issuer and Affiliated Purchasers."

The Board believes the minimum Cash-Out Price of $2.70 is fair in consideration of the fact that the minimum Cash-Out Price represents a premium to the average price paid of $2.53 per share for our most recent stock repurchases during the nine months ended September 30, 2016. The Board, however,

did not consider such prices to be a significant material factor in its fairness