of 400% (based on historical volatility), 0% dividend rate and interest rate of 2.3% . In the first quarter 2009, we recorded interest expense of $11,000 to fully amortize the discount on the convertible notes payable

related to the allocation of value to the warrants. Obligations under the third promissory note are collateralized by all of our tangible and intangible assets, including intellectual property. During the three and nine months ended September 30,

2009, we recorded interest expense of approximately $23,000 and $160,000, respectively, related to our obligations under the convertible note payable to related party. As of September 30, 2009, we have recorded accrued interest payable of

approximately $61,000 related to this convertible note payable to related party.

Convertible notes payable due to certain investors

— In May and June 2008, we issued convertible promissory notes in an aggregate amount of

$1,135,000 to certain investors. The notes bore interest at 6% per annum and are repayable on or before October 31, 2008. The notes and related accrued interest were convertible into shares of our common stock at $1.00 per share at the

option of the holder. The convertible promissory notes were issued together with warrants to purchase 1,135,000 shares of our common stock at an original exercise price of $1.05 per share, exercisable for three years. Terms of the convertible

notes and warrants provide that the conversion price of the notes and the exercise price of the warrant will be reduced in the event of subsequent financings at an effective price per share less than the conversion or exercise price, subject to

certain exceptions. The convertible notes when issued included a beneficial conversion feature because they allowed the holders to acquire common shares of the company at an effective conversion price that was less than their fair value per common

share of $2.05 on May 15, 2008 and $1.51 on June 9, 2008. The discount on the convertible notes payable related to the allocation of value of the warrants and the beneficial conversion feature was valued at $635,000 and $500,000 in

May and June 2008 based on the effective conversion price of $0.328 and $0.399, respectively. The fair value of the warrants was computed using the Black-Scholes option pricing model with the following assumptions: expected term of three

years (contractual term), volatility of 400% (based on historical volatility), 0% dividend rate and interest rate of approximately 3%.

In September 2008, the conversion price of certain of the convertible notes in an aggregate amount of $235,000 was reduced from $1.00 to $0.50. In addition, the conversion price of

certain of the warrants to purchase an aggregate of 235,000 shares of our common stock was reduced from $1.05 to $0.50. On September 4, 2008, the fair value of the company’s stock was $0.50, so the beneficial conversion feature was

not reset. We recognized interest expense related to the amortization of the beneficial conversion feature of $0.7 million and $1.0 million during the three and nine months ended September 30, 2008. In addition, we have recorded accrued

interest of approximately $62,000 related to the convertible notes, which remain unpaid, as of September 30, 2009.

In December 2008, $900,000 of the convertible notes were converted into common stock at $1.00 per share.

Note 5.

Stockholders’ Equity (Deficit)

Preferred Stock

— Our board of directors has the authority, without action by the stockholders, to designate and issue up to 10,000,000 shares of

preferred stock in one or more series and to designate the rights, preferences and privileges of each series, any or all of which may be greater than the rights of our common stock. No shares of preferred stock have been designated or issued.

Common Stock

— Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the holders

of our common stock. Subject to the rights of the holders of any class of our capital stock having any preference or priority over our common stock, the holders of shares of our common stock are entitled to receive dividends that are declared by our

board of directors out of legally available funds. In the event of our liquidation, dissolution or winding-up, the holders of common stock are entitled to share ratably in our net assets remaining after payment of liabilities, subject to prior

rights of preferred stock, if any, then outstanding. Our common stock has no preemptive rights, conversion rights, redemption rights or sinking fund provisions, and there are no dividends in arrears or default. All shares of our common stock have

equal distribution, liquidation and voting rights, and have no preferences or exchange rights.

Common Stock Issuances

— In February, March and May 2008, we raised net proceeds of approximately $380,000 through the issuance of 304,000

units at $1.25 per unit, with each unit comprised of one share of common stock and one three-year warrant to purchase one share of common stock at an exercise price of $2.00 per share.

We evaluated the warrants and determined that the warrants do not contain any provisions equivalent to net-cash settlement provisions and accordingly are accounted for as equity.

In May 2009, we issued 112,500 shares of our common stock to a consultant in settlement of a disputed contract. The fair value of the shares of $7,000 was included in accrued expenses at

December 31, 2008.

In July 2009 we entered into an agreement with Seahawk Capital Partners, Inc. for investor relations and capital raising services. In connection with this agreement, 50,000 shares of our

common stock were issuable at each of July 15, 2009 and August 15, 2009 and 150,000 shares of our common stock were issuable at September 15, 2009. We valued the shares issuable to Seahawk

8

Capital Partners, Inc. under the agreement at the closing market prices of our common stock at each of those dates and recorded the expense as general and administrative expense. Under the terms of this agreement, an

additional 150,000 shares are issuable on the 15

th

of every month through January 2010 along with monthly cash fees of $10,000, unless the agreement is cancelled by us

upon 60 days notice.

During 2007, we issued 2.0 million shares of our common stock for marketing-related services to be provided during 2007 by the Custom Group under an operating agreement. In June 2009, we

cancelled 1.2 million shares previously treated as issued to the Custom Group as services were not provided. The value related to the uncancelled shares was $800,000 based on the fair value of our common stock of $1.00 per share as

determined by recent stock sales and is recorded as sales and marketing expense in 2007 in the consolidated financial statements, and no value was recorded related to the cancelled shares as no services were performed.

Stock Incentive Plans

— In May 2008, our stockholders adopted and approved our 2007 Stock Option Plan (the “2007 Plan”). In April 2009,

we terminated the 2007 Plan and adopted our 2009 Equity Incentive Plan (“2009 Plan”), which allows for awards of qualified and non-qualified stock options for up to 3,000,000 shares of our common stock. In August 2009, our board of

directors approved the adoption of our Amended and Restated 2009 Equity Incentive Plan (the “Amended 2009 Plan”). Our board of directors amended the 2009 Plan to increase the number of shares issuable under the 2009 Plan to 4,000,000

shares of our common stock.

At September 30, 2009, options to purchase up to 1,585,000 shares of our common stock were outstanding and 2,415,000 shares were available for future grants or awards under our Amended 2009

Plan.

Stock-based Compensation

— The following table summarizes stock-based compensation expense (in thousands):

|

|

Three Months ended

|

|

Nine Months ended

|

|

|

September 30,

|

|

September 30,

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

Stock-based compensation:

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

$

|

|

|

$

|

—

|

|

$

|

12

|

|

$

|

—

|

|

Sales and marketing

|

|

|

|

|

—

|

|

|

5

|

|

|

—

|

|

General and administrative

|

|

8

|

|

|

—

|

|

|

58

|

|

|

—

|

|

Total stock-based compensation

|

$

|

8

|

|

$

|

—

|

|

$

|

75

|

|

$

|

—

|

Non-cash compensation expense is recognized on a straight-line basis over the applicable vesting periods of one to three years, based on the fair value on the grant date. The vesting period is

deemed to be the requisite service period. Certain option and share awards provide for accelerated vesting if there is a change in control (as defined in the applicable plan and certain employment agreements we have with key officers).

The fair value of stock-based option awards was estimated at the date of grant using the Black-Scholes option valuation model with the following weighted average assumptions for the periods

presented as follows:

|

|

Three months ended

|

|

Nine months ended

|

|

|

September 30,

|

|

September 30,

|

|

|

2009

|

|

2008

|

|

2009

|

|

|

2008

|

|

Expected dividend yield

|

*

|

|

*

|

|

0

|

%

|

|

*

|

|

Risk free interest rate

|

*

|

|

*

|

|

2.5

|

%

|

|

*

|

|

Expected stock volatility

|

*

|

|

*

|

|

71

|

%

|

|

*

|

|

Expected option life

|

*

|

|

*

|

|

5.5 years

|

|

|

*

|

|

Fair value of options granted

|

*

|

|

*

|

|

$

|

0.09

|

|

|

*

|

* There were no option grants during the three months ended September 30, 2009 or 2008, or the nine months ended September 30, 2008.

Stock Options

— Stock options to purchase shares of our common stock are granted under our existing stock-based incentive plan to certain employees

and consultants, at prices at or above the fair market value on the date of grant.

Option activity was as follows during the nine-month period ended September 30, 2009:

9

|

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

|

Weighted

|

|

Average

|

|

|

|

|

|

|

|

|

Average

|

|

Remaining

|

|

Aggregate

|

|

|

|

|

|

Exercise

|

|

Contractual

|

|

Intrinsic

|

|

|

Options

|

|

|

Price

|

|

Life

|

|

Value

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

(in thousands)

|

|

Outstanding December 31, 2008

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

Options granted

|

2,265

|

|

|

|

0.08

|

|

|

|

|

|

|

Options exercised

|

(350

|

)

|

|

|

0.02

|

|

|

|

|

|

|

Options expired

|

—

|

|

|

|

—

|

|

|

|

|

|

|

Options forfeited

|

(330

|

)

|

|

|

0.08

|

|

|

|

|

|

|

Options cancelled

|

—

|

|

|

|

—

|

|

|

|

|

|

|

Outstanding at September 30, 2009

|

1,585

|

|

|

$

|

0.08

|

|

9.6 years

|

|

$

|

—

|

|

Exercisable at September 30, 2009

|

415

|

|

|

$

|

0.08

|

|

9.6 years

|

|

$

|

—

|

As of September 30, 2009, we had approximately $95,000 of total unrecognized compensation cost related to unvested stock options. Total unrecognized compensation cost will be adjusted for

future changes in estimated forfeitures. We expect to recognize this cost over a weighted average period of approximately two and three quarter years.

The intrinsic value of stock options outstanding and exercisable at September 30, 2009 is based on the $0.02 closing market price of our common stock on that date, and is calculated by

aggregating the difference between $0.02 and the exercise price of each of the outstanding vested and unvested stock options which have an exercise price less than $0.02. The total fair value of options that vested during the three and

nine-month periods ended September 30, 2009, net of forfeitures, was approximately $8,000 and $72,000, respectively. There were no options which vested during the three and nine-month periods ended September 30, 2008.

As further discussed in Note 9, pursuant to an employment agreement dated October 6, 2009 with our Vice President of Broadcast Operations, John Daly, we granted Mr. Daly options to purchase up

to 500,000 shares of our common stock, at an exercise price of $0.02 per share. The options vest monthly in equal installments over a 36- month period and expire 10 years after the grant date. The grant was made pursuant to the standard form of

grant agreement under our Amended 2009 Plan.

Non-Employee Grants

— In April 2009, we granted non-qualified options under our 2009 Plan to purchase 350,000 shares of our common stock at an

exercise price of $0.02 per share to a consultant engaged in providing accounting and advisory services to our company. The options were fully vested on the date of grant and have a ten year term. The options were exercised in July 2009.

Warrants

— We issued warrants in connection with our 2008 private placements and our convertible notes. In connection with warrants issued together

with the convertible notes in 2008, the financial reporting (non-cash) effect of initial adoption of the authoritative guidance related to warrants with down-round protection resulted in a cumulative effect of change in accounting principle of

approximately $0.1 million, based on a per share price of $0.09 per share at January 1, 2009, which increased accumulated deficit and recorded a fair value liability for price adjustable warrants. The fair value liability is revalued

quarterly utilizing Black-Scholes valuation model computations with the increase or decrease in fair value being reported in the condensed consolidated statement of operations as other income (expense). At September 30, 2009, the weighted average

assumptions used in our Black-Scholes calculation were: expected life of 1.65 years, volatility equal to 400%, risk-free rate of 0.4% and dividend rate of 0%. During the three months ended September 30, 2009, the fair value decreased approximately

$12,000, based on a per share price of our common stock of $0.02 at September 30, 2009, which was recorded as other income. During the nine months ended September 30, 2009, the fair value decreased by approximately $81,000, which was

recorded as other income.

As discussed in Note

6, in May 2009, we granted warrants to purchase 50,000 shares of our common stock

at an exercise price of $0.05 to our Chief Executive Officer (“CEO”).

The warrants expire in May 2014. The warrants were recorded to expense in 2009

at their fair value of $1,500, which was determined using the Black-Scholes

model using the following assumptions: stock price of $0.03, volatility of

400%, risk free rate of 2.5%, expected term of five years, dividend yield of

0.0% .

As discussed in Note 6, pursuant to the terms of his consulting agreement, in June 2009, we granted warrants to the chairman of our board of directors to purchase 540,000 shares of our common

stock at an exercise price of $0.50 per share, which warrants vest in 1/36 monthly installments beginning on the first month anniversary of the date of the consulting agreement. The warrants have a three year term. During the nine months ended

September 30, 2009, we recorded expense of approximately $2,000 related to the fair value of the warrants, which was determined using the Black-Scholes model using the following assumptions: stock price of $0.03, volatility of 400%, risk

free rate of 3.0%, expected term of three years, dividend yield of 0.0% .

10

In August 2009, we issued five-year warrants to certain consulting or service providers to purchase an aggregate of 200,000 shares of our common stock at an exercise price of $0.50 per

share. The warrants vested immediately. The warrants were recorded to expense in 2009 at their fair value of approximately $10,000, which was determined using the Black-Scholes model using the following assumptions: stock price of $0.05

(closing price on date of board approval), volatility of 400%, risk free rate of 2.3%, expected term of 5.0 years, dividend yield of 0.0% .

The following summarizes warrant activity during the nine months ended September 30, 2009 (in thousands):

|

Warrants outstanding, December 31, 2008

|

|

|

1,489

|

|

Warrants issued

|

|

|

1,940

|

|

Warrants exercised

|

|

|

—

|

|

Warrants expired

|

|

|

—

|

|

Warrants outstanding, September 30, 2009

|

|

|

3,429

|

|

Weighted average exercise price, September 30, 2009

|

|

$

|

0.77

|

Note 6. Related Party Transactions

As further described in Note 4, in 2007, we borrowed $985,000 from the chairman of our board of directors, pursuant to terms of a promissory note, subsequently replaced in 2008 by a second

promissory note in the principal amount of $961,000 and subsequently replaced in 2009 by a third promissory note in the principal amount of $1,150,000.

In February 2009, we entered into a three-year consulting agreement with the chairman of our board of directors, pursuant to which we will pay him monthly cash payments of $15,000, and in

June 2009, we granted warrants to purchase 540,000 shares of our common stock at an exercise price of $0.50 per share, which warrants vest in 1/36 monthly installments beginning on the first monthly anniversary of the date of the consulting

agreement. The warrants have a three year term. Upon a change of control of our company, all obligations under the consulting agreement become immediately due and payable. The amounts due under the consulting agreement of $135,000, along with

advances totaling $865,000, are included in due to related parties on the accompanying balance sheets at September 30, 2009.

In April 2009, we entered into an employment agreement with our CEO, pursuant to which, among other things, the officer will be entitled to annual base compensation of $240,000. To date,

amounts due under the employment agreement, which total $100,000, remain unpaid and are included in due to related parties on the accompanying condensed consolidated balance sheet at September 30, 2009. In April 2009, we also issued incentive options under the 2009

Plan to purchase 1,000,000 shares of our common stock at an exercise price of $0.09 per share to our CEO pursuant to his employment agreement. The options vest in 1/36 monthly installments beginning on the first monthly anniversary of the grant

date, over a period of three years. The options have a term of ten years.

As described in Note 5, in May 2009, we granted warrants to purchase 50,000 shares of our common stock at an exercise price of $0.05 to our CEO as additional compensation for services he

provided as a consultant before his appointment as an officer of our company. The warrants expire in May 2014.

Note 7. Income Taxes

We continue to record a valuation allowance in the full amount of deferred tax assets since realization of such tax benefits has not been determined by our management to be more likely than

not. At the end of each interim period, we make our best estimate of the effective tax rate expected to be applicable for the full fiscal year, and the rate so determined is used in providing for income taxes on a current year-to-date basis. The

difference between the expected provision or benefit computed using the statutory tax rate and the recorded provision or benefit of zero, is primarily due to the estimated change in valuation allowance more likely to result due to taxable losses

anticipated for the applicable fiscal year.

11

Note 8. Commitments and Contingencies

Consulting Agreements —

As discussed in Note 6, in February 2009, we entered into a three-year consulting agreement with the chairman of our board

of directors, pursuant to which we will pay him monthly cash payments of $15,000, and in June 2009, we granted warrants to purchase 540,000 shares of our common stock at an exercise price of $0.50 per share, which warrants vest in 1/36

monthly installments beginning on the first month anniversary of the date of the consulting agreement. The warrants have a three year term. Upon a change of control of our company, all obligations under the consulting agreement become immediately

due and payable.

Severance Agreement –

In

August 2009, we entered into a severance agreement with our former President,

pursuant to which we will pay him severance of $112,500, comprised of a

cash payment of $12,500 upon completion of a financing or series of financings

totaling at least $1.0 million, additional seven monthly cash payments of $10,000

each, and a final payment on the seventh month of $30,000, after we have

consummated a financing or series of financings of at least $2.0 million.

We believe it is reasonably possible we will pay the full $112,500, but no amounts

have been accrued as of September 30, 2009.

Contingencies

— We are subject to various legal proceedings and claims that arise in the ordinary course of business. Our management currently

believes that resolution of such legal matters will not have a material adverse impact on our consolidated financial position, results of operations or cash flows.

Note 9 — Subsequent Events through November

16, 2009 (the date these financial statements

were issued)

Effective as of October 6, 2009, our board of directors appointed Mr. John Daly as our Vice President of Broadcast Operations. We also entered into an employment agreement (the “Daly

Agreement”) with Mr. Daly, pursuant to which Mr. Daly will serve as our Vice President of Broadcast Operations for a term beginning on October 6, 2009 (the “Effective Date”) and ending at any time upon termination by either party.

Pursuant to the Daly Agreement, Mr. Daly will be entitled to annual base compensation of $180,000. Mr. Daly’s base salary shall accrue monthly, on the first business day of each calendar month, beginning on the Effective Date and payment of

all or any portion of base salary shall be deferred by the Company until consummation of our sale of 10% convertible secured promissory notes, convertible into shares of our common stock, par value $0.001 per share, for aggregate proceeds of at

least $5,000,000. Mr. Daly is also eligible to receive a target annual bonus of $50,000, with the actual amount to be determined by our board of directors. Pursuant to the Daly Agreement, we granted Mr. Daly options to purchase up to 500,000

shares of our common stock, at an exercise price of $0.02 per share. The options vest monthly in equal installments over a 36- month period, beginning the first month after the Effective Date, and expire 10 years after the grant date. The grant

was made pursuant to the standard form of grant agreement under our 2009 Equity Incentive Plan.

On October 30, 2009, we entered into a letter agreement (the “Compass Agreement”) with Compass Entertainment LLC, a diversified entertainment production company based in Las Vegas,

Nevada (“Compass”). Pursuant to the Compass Agreement, we granted to Compass an exclusive, worldwide license to produce and distribute the television content we generate from our annual World Series of Golf amateur golf tournament and from

a series of live regional or “satellite” amateur golf tournaments that Compass will organize, promote and produce on our behalf. Compass is required to secure national television broadcasting for the programming content derived from our

tournaments. Compass will pay all of the costs incurred to stage the live satellite tournaments and all costs to produce and distribute the television programming derived from each our tournaments. We also granted Compass the right to represent us

for ninety days, subject to an additional ninety day extension period, in the promotion and commercialization of previously recorded programming derived from our past annual tournaments. Under the Compass Agreement, Compass will pay us the following

amounts in consideration of the rights granted under the agreement: (i) 30% of the net aggregate player entry fees for each tournament staged by Compass, such amount to be calculated after deduction of all production costs and expenses incurred by

Compass relating to such tournament, payable once annually following our annual championship tournament and (ii) 15% of all gross advertising and sponsorship revenue received in connection with the tournaments. The Compass Agreement has a term of

five years and can be renewed annually by Compass for up to an additional five years.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Statements contained herein may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, an amended (the “Securities Act”), and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements reflect our current views with respect to future events or our financial performance, and involve certain known and unknown risks,

uncertainties and other factors, including those identified below, which may cause our or our industry’s actual or future results, levels of activity, performance or achievements to differ materially from those expressed or implied by any

forward-looking statements or from historical results. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. The following factors, among others, could cause our or our industry’s future results to differ materially from historical results or those anticipated: (1) the availability of additional funds to enable us to

successfully pursue our

12

business plan; (2) the uncertainties related to the appeal and acceptance of our proprietary method of play and our planned online products; (3) the success or failure of our development of additional products and

services; (4) our ability to maintain, attract and integrate management personnel; (5) our ability to secure suitable broadcast and sponsorship agreements; (6) our ability to effectively market and sell our services to current and new customers; (7)

changes in the rules and regulations governing our business; (8) the intensity of competition; and (9) general economic conditions. As a result of these and other factors, we may experience material fluctuations in future operating results on a

quarterly or annual basis, which could materially and adversely affect our business, financial condition, operating results and stock price. Additional factors that would cause actual results to differ materially from those projected or suggested in

any forward-looking statements are contained in our filings with the Securities and Exchange Commission, including those factors discussed under the caption “Forward-Looking Information” in our most recent Annual Report on Form 10-K, as

may be supplemented or amended from time to time, which we urge investors to consider. We have no duty to update, supplement or revise any forward-looking statements after the date of this report or to conform them to actual results, new

information, future events or otherwise. The following discussion and analysis should be read in conjunction with our condensed consolidated financial statements and notes appearing elsewhere in this Report.

On January 31, 2008, Innovative Consumer Products, Inc. (“ICP”), a public Nevada shell corporation, acquired all of the outstanding capital stock of World Series of Golf, Inc., a

privately-held Nevada corporation (“WSG-NV”) engaged in the sports entertainment industry.

The acquisition was consummated pursuant to an Agreement and Plan of Merger, dated January 31, 2008, whereby WSG-NV merged with and into WSG Acquisition, Inc. (“Acquisition Sub”), a newly formed wholly-owned

Nevada subsidiary. This transaction is commonly referred to as a “reverse acquisition” in which all of the outstanding capital stock of WSG-NV was effectively exchanged for a controlling interest in ICP. This type of transaction is

considered to be a recapitalization rather than a business combination. Accordingly, for accounting purposes, no goodwill or other intangible assets were recorded and WSG-NV was considered to be the acquirer for financial reporting purposes. Our

historical financial statements for any period prior to January 31, 2008 are those of WSG-NV. On February 1, 2008, we merged with Acquisition Sub in a short form merger under Nevada law and changed our name to “World Series of Golf,

Inc.”

We are a sports entertainment company that hosts amateur golf tournaments and events and seeks to create branded products, games, media and entertainment based on our proprietary golf

tournament method of play which we call “The World Series of Golf”. We believe our unique method of play enhances the entertainment value of the skilled game of golf by incorporating elements of strategy similar to those found in

“Texas Hold ‘Em”, a popular style of the card game poker.

We have held a three-day World Series of Golf tournament in Las Vegas, Nevada during May in each of 2007, 2008 and 2009. Through our media partners, we broadcast our tournaments on domestic and

international television and via other media outlets, as live events or as a produced series. We also sell sponsorships for our live tournaments and television coverage. Beginning in the latter part of 2009 with full deployment in the first quarter

of 2010, we plan to offer through our website,

www.worldseriesofgolf.com

, a multi-player, online video game based on our unique method of play and a social network/web

community where interested players can communicate with one another.

We generate revenue primarily through sponsorship and advertising fees, brand licensing fees and entry fees paid by the amateur players entering our tournaments. Once we fully implement our

online game strategy, management expects revenue from subscription fees for online games and sponsorship fees to become a material percentage of our total revenue.

Recent Developments

Management Changes

R. Terry Leiweke –

Effective as of September 6, 2009, Mr. R. Terry Leiweke resigned from his position as a director and as President. In connection

with his resignation, we entered into a severance agreement with Mr. Leiweke, pursuant to which we will pay him severance of $112,500, comprised of a cash payment of $12,500 upon completion of a financing or series of financings totaling at

least $1.0 million, additional seven monthly cash payments of $10,000 each, and a final payment on the seventh month of $30,000, after we have consummated a financing or series of financings of at least $2.0 million.

Joseph F. Martinez

– Effective as of September 6, 2009, our board of directors appointed Mr. Joseph F. Martinez, our current Chief Executive Officer

and a member of our board of directors, as the new President. Mr. Martinez will not receive any additional compensation for serving as President.

John Daly –

As previously reported in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (“SEC”) on October

7, 2009, effective as of October 6, 2009, our board of directors appointed Mr. John Daly as our Vice President of

13

Broadcast Operations. We also entered into an employment agreement (the “Daly Agreement”) with Mr. Daly, pursuant to which Mr. Daly will serve as our Vice President of Broadcast Operations for a term beginning on

October 6, 2009 (the “Effective Date”) and ending at any time upon termination by either party. Pursuant to the Daly Agreement, Mr. Daly will be entitled to annual base compensation of $180,000. Mr. Daly’s base salary shall accrue

monthly, on the first business day of each calendar month, beginning on the Effective Date and payment of all or any portion of base salary shall be deferred by the Company until consummation of our sale of 10% convertible secured promissory notes,

convertible into shares of our common stock, par value $0.001 per share, for aggregate proceeds of at least $5,000,000. Mr. Daly is also eligible to receive a target annual bonus of $50,000, with the actual amount to be determined by our

board of directors. Pursuant to the Daly Agreement, we granted Mr. Daly options to purchase up to 500,000 shares of our common stock, at an exercise price of $0.02 per share. The options vest monthly in equal installments over a thirty-six (36)

month period, beginning the first month after the Effective Date, and expire ten (10) years after the grant date. The grant was made pursuant to the standard form of grant agreement under our 2009 Equity Incentive Plan.

Compass Agreement

As previously reported in our Current Report on Form 8-K, filed with the SEC on November 5, 2009, on October 30, 2009, we entered into a letter agreement (the “Compass Agreement”)

with Compass Entertainment LLC, a diversified entertainment production company based in Las Vegas, Nevada (“Compass”). Pursuant to the Compass Agreement, we granted to Compass an exclusive, worldwide license to produce and distribute the

television content we generate from our annual World Series of Golf amateur golf tournament and from a series of live regional or “satellite” amateur golf tournaments that Compass will organize, promote and produce on our behalf. Compass

is required to secure national television broadcasting for the programming content derived from our tournaments. Compass will pay all of the costs incurred to stage the live satellite tournaments and all costs to produce and distribute the

television programming derived from each our tournaments. We also granted Compass the right to represent us for ninety days, subject to an additional ninety day extension period, in the promotion and commercialization of previously recorded

programming derived from our past annual tournaments. Under the Compass Agreement, Compass will pay us the following amounts in consideration of the rights granted under the agreement: (i) 30% of the net aggregate player entry fees for each

tournament staged by Compass, such amount to be calculated after deduction of all production costs and expenses incurred by Compass relating to such tournament, payable once annually following our annual championship tournament and (ii) 15% of all

gross advertising and sponsorship revenue received in connection with the tournaments. The Compass Agreement has a term of five years and can be renewed annually by Compass for up to an additional five years.

Cash Position, Going Concern and Recent Financing Activities

We have prepared our condensed consolidated financial statements assuming that we will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities

in the normal course of business. As of September 30, 2009, we had an accumulated deficit of approximately $12.9 million, negative cash flows from operations and expect to incur additional losses in the future as we continue to develop and grow

our business. We have funded our losses primarily through sales of common stock and warrants in private placements and borrowings from related parties and other investors and revenue provided by our sponsorships and advertising contracts, licensing

arrangements and tournaments. The further development of our business will require capital. At September 30, 2009, we had a working capital deficit (current assets less current liabilities) of approximately $3.9 million and approximately

$4,000 in cash. Our operating expenses will consume a material amount of our cash resources.

We are still in the early stages of executing our business strategy. Our current cash levels, together with the cash flows we generate from operating activities, are not sufficient to enable us

to execute our business strategy. We require additional financing to execute our business strategy and to satisfy our near-term working capital requirements. In the event that we cannot obtain additional funds, on a timely basis or our operations do

not generate sufficient cash flow, we may be forced to curtail or cease our activities, which would likely result in the loss to investors of all or a substantial portion of their investment. We are actively seeking to raise additional capital

through the sale of shares of our capital stock to institutional investors and through strategic investments. If management deems necessary, we might also seek additional loans from related parties. However, there can be no assurance that we will be

able to consummate any of these transactions, or that these transactions will be consummated on a timely basis or on terms favorable to us.

Discussion of Cash Flows

We used cash of approximately $0.9 million and $1.3 million in our operating activities in the nine months ended September 30, 2009 and 2008, respectively. Cash used in operating

activities relates primarily to funding net losses and the change in prepaid and other assets and accounts receivable, partially offset by the change in accounts payable and other current liabilities and share-based payments of consulting and other

expenses. We expect to use cash for operating activities in the foreseeable future as we continue our operating activities.

14

Our investing activities used cash of approximately $3,000 and $21,000 in the nine months ended September 30, 2009 and 2008, respectively. Changes in cash from investing activities are

due to purchases of equipment.

Our financing activities provided cash of approximately $0.8 million and $1.5 million in the nine months ended September 30, 2009 and 2008, respectively. Changes in cash from financing

activities are proceeds from related party advances, proceeds from issuance of common stock and warrants and proceeds from issuance of convertible notes payable and warrants.

Recent Financing Activities

In February 2009, the existing obligations under our promissory note with the chairman of our board of directors were replaced by another promissory note for $1,150,000. In connection with

the refinancing of the obligations under the promissory note,

we recorded interest expense of $78,000 in February 2009. The new note, as amended and restated in May 2009, is payable

within five days after the demand of the holder, and bears interest at 8% per annum. The principal amount of the note is convertible into shares of our common stock at a conversion price of $0.50 per share. In addition, in connection with the

promissory note, we issued the holder a six-year warrant to purchase 1,150,000 shares of our common stock at an exercise price of $0.50 per share. Obligations under the promissory note are secured by all of our tangible and intangible assets,

including intellectual property.

In May and June 2008, we issued convertible promissory notes in an aggregate amount of $1,135,000. The notes bore interest at 6% per annum and are repayable on or before October 31, 2008.

The notes and related accrued interest were convertible into shares of our common stock at $1.00 per share at the option of the holder. The convertible promissory notes were issued together with warrants with an exercise price of $1.05 per

share, exercisable for three years. Terms of the convertible notes and warrants provide that the conversion price of the notes and the exercise price of the warrant will be reduced in the event of subsequent financings at an effective price per

share less than the conversion or exercise price, subject to certain exceptions. In September 2008, the conversion price of certain of the convertible notes in an aggregate principal amount of $235,000 was reduced from $1.00 to $0.50. In

addition, the conversion price of certain of the warrants to purchase an aggregate of 235,000 shares of common stock was reduced from $1.05 to $0.50. In December 2008, $900,000 of the convertible notes were converted into common stock at

$1.00 per share. The remaining $235,000 convertible notes are currently in default and are classified as current on the accompanying condensed consolidated balance sheet.

In February, March and May 2008, we raised net proceeds of approximately $380,000 through the issuance of 304,000 units at $1.25 per unit, each unit comprised of one share of common

stock and one three-year warrant to purchase one share of common stock at an exercise price of $2.00 per share. In addition, in October 2008, we issued 120,000 shares of our common stock to a consultant in connection with the offering.

Going Concern

In our Annual Report on Form 10-K for the year ended December 31, 2008, our independent auditors included an explanatory paragraph in its report relating to our consolidated financial statements for the years ended

December 31, 2008 and 2007, which states that we have experienced recurring losses from operations and have a substantial accumulated deficit. These conditions give rise to substantial doubt about our ability to continue as a going concern. Our

ability to expand operations and generate additional revenue and our ability to obtain additional funding will determine our ability to continue as a going concern. Our condensed consolidated financial statements do not include any adjustments that

might result from the outcome of this uncertainty.

Summary

We are dependent on existing cash resources and external sources of financing to meet our working capital needs. Current sources of liquidity are insufficient to provide for budgeted and

anticipated working capital requirements. We will therefore be required to seek additional financing to satisfy our working capital requirements. No assurances can be given that such capital will be available to us on acceptable terms, if at all. In

addition to equity financing and strategic investments, we may seek additional related party loans. If we are unable to obtain any such additional financing or if such financing cannot be obtained on terms acceptable to us, we may be required to

delay or scale back our operations, including the development of our online game, which would adversely affect our ability to generate future revenues and may force us to curtail or cease our operating activities.

To attain profitable operations, management’s plan is to execute its strategy of (i) increasing the number of tournaments; (ii) leveraging the existing tournament to generate ancillary

revenue streams via Internet TV or other venues; (iii) continuing the development of the online game; and (iv) continuing to build sponsorship, advertising and related revenue, including license fees related to the sale of branded merchandise. We

will continue to be dependent on outside capital to fund our operations for the foreseeable future. Any financing we obtain may further dilute or otherwise impair the ownership interest of our current stockholders. If we fail to generate positive

cash flows or fail to obtain additional capital when required, we could modify, delay or abandon some or all of our plans. These factors, among others, raise substantial doubt about our ability to continue as a going concern.

15

Consolidated Results of Operations

Percentage comparisons have been omitted within the following table where they are not considered meaningful. All amounts, except amounts expressed as a percentage, are presented in thousands

in the following table.

|

|

Three Months Ended

|

|

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

Change

|

|

September 30,

|

|

Change

|

|

|

|

2009

|

|

|

|

2008

|

|

|

|

$

|

|

|

%

|

|

|

2009

|

|

|

|

2008

|

|

|

|

$

|

|

|

%

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sponsorship and advertising

|

$

|

195

|

|

|

$

|

100

|

|

|

$

|

95

|

|

|

95

|

%

|

|

$

|

674

|

|

|

$

|

964

|

|

|

$

|

(290

|

)

|

|

(30

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing

|

|

—

|

|

|

|

95

|

|

|

|

(95

|

)

|

|

(100

|

)%

|

|

|

—

|

|

|

|

892

|

|

|

|

(892

|

)

|

|

(100

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Player entry fees

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

%

|

|

|

790

|

|

|

|

543

|

|

|

|

247

|

|

|

45

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue

|

|

195

|

|

|

|

195

|

|

|

|

—

|

|

|

—

|

%

|

|

|

1,464

|

|

|

|

2,399

|

|

|

|

(935

|

)

|

|

(39

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

279

|

|

|

|

27

|

|

|

|

252

|

|

|

|

|

|

|

1,758

|

|

|

|

2,698

|

|

|

|

(940

|

)

|

|

(35

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

—

|

|

|

|

217

|

|

|

|

(217

|

)

|

|

(100

|

)%

|

|

|

63

|

|

|

|

1,133

|

|

|

|

(1,070

|

)

|

|

(94

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

434

|

|

|

|

383

|

|

|

|

51

|

|

|

13

|

%

|

|

|

1,532

|

|

|

|

1,428

|

|

|

|

104

|

|

|

7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

713

|

|

|

|

627

|

|

|

|

86

|

|

|

14

|

%

|

|

|

3,353

|

|

|

|

5,259

|

|

|

|

(1,906

|

)

|

|

(36

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

(518

|

)

|

|

|

(432

|

)

|

|

|

(86

|

)

|

|

(20

|

)%

|

|

|

(1,889

|

)

|

|

|

(2,860

|

)

|

|

|

971

|

|

|

34

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value liability

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for price adjustable warrants

|

|

(27

|

)

|

|

|

(728

|

)

|

|

|

701

|

|

|

96

|

%

|

|

|

(171

|

)

|

|

|

(1,077

|

)

|

|

|

906

|

|

|

84

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

12

|

|

|

|

—

|

|

|

|

12

|

|

|

|

|

|

|

81

|

|

|

|

—

|

|

|

|

81

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

(533

|

)

|

|

$

|

(1,160

|

)

|

|

$

|

627

|

|

|

54

|

%

|

|

$

|

(1,979

|

)

|

|

$

|

(3,937

|

)

|

|

$

|

1,958

|

|

|

50

|

%

|

Comparison of the Three and Nine Months Ended September 30, 2009 to the Three and Nine Months Ended September 30, 2008

Revenue

. We generate revenue primarily through a combination of (i) the sale of sponsorships and advertising in connection with our tournaments,

(ii) the license of our proprietary marks/brands, and (iii) entry fees paid by the players entering our golf tournaments. During 2009 and 2008, a significant portion of our revenue was derived from a small number of customers, as follows (as a

percentage of total revenue):

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

Custom Group, Ltd.

|

0

|

%

|

|

49

|

%

|

|

0

|

%

|

|

37

|

%

|

|

Pocket Kings, Ltd.

|

100

|

%

|

|

51

|

%

|

|

24

|

%

|

|

17

|

%

|

|

The Mirage Casino Hotel

|

0

|

%

|

|

0

|

%

|

|

17

|

%

|

|

19

|

%

|

|

Other

|

0

|

%

|

|

0

|

%

|

|

59

|

%

|

|

27

|

%

|

|

|

100

|

%

|

|

100

|

%

|

|

100

|

%

|

|

100

|

%

|

In 2009 and 2008, approximately 87% and 67% of our annual revenue was earned in the second quarter of the year due to the fact that we hold our tournament during the month of May.

16

Sponsorship and advertising revenue

. Sponsorship and advertising revenue is comprised of in-kind barter and trade revenue and advertising revenue from

our sponsors. We record barter and in-kind revenue at gross, and record the related sponsorship expenses to cost of sales when used. Revenue from our sponsorship partners remained consistent in the three months ended September 30, 2009 compared to

the three months ended September 30, 2008. Sponsorship and advertising revenue during the third quarter 2009 was comprised of revenue related to our contract with Pocket Kings, Ltd. and related to the airing of our 13-week series on WGN-America. In

the prior year period, we recognized revenue related to our Pocket Kings, Ltd. contract related to our European contract rights. In the current year period, we have not yet obtained a network sponsor to air our series in Europe. Once we obtain a

European network to air our series, we expect to recognize additional revenue related to the Pocket Kings, Ltd. contract.

Sponsorship and advertising revenue in the nine months ended September 30, 2009 primarily represented the fair value of our sponsorship and advertising package with The Mirage Casino and Hotel

(“The Mirage”), which we recorded at $243,600, $100,000 for the player positions portion of our contract with Pocket Kings, Ltd., recognition of $50,000 in amortization of a $100,000 up-front payment from Pocket Kings, Ltd.

in the first nine months of 2009, as well as $195,000 for airing the series on WGN-America, and $85,000 in additional barter revenue recorded in trade for vendor credits. During the nine months ended September 30, 2008, we recognized revenue

of approximately $454,000 related to our sponsorship and advertising package with The Mirage and $395,000 related to our contract with Pocket Kings, Ltd.

Licensing revenue

.

During the first nine months of 2008, we recorded revenue related to our licensing

contract with the Custom Group. In the second quarter 2009, we terminated this

contract due to the Custom Group’s default.

Player entry fees revenue.

Player entry fees revenue is comprised of the tournament entry fees paid by the amateur players in our live events, which were

$10,000 per player for our 2009 and 2008 events. Revenue related to player entry fees is recorded during the second quarter as the tournament takes place in May. We record player entry fees revenue on a net basis, in that we do not record gifted

or sponsored buy-ins to player entry fees revenue with an offset to expense. Revenue from player entry fees increased in the nine months ended September 30, 2009 compared to the nine months ended September 30, 2009. In 2009, we had 125 playing

positions, with 73 players paying the full entry fee and 17 sponsored players. In 2008, we had 80 playing positions, with 54 players paying the full entry fee and 23 sponsored players.

Cost of revenue

. Cost of revenue primarily consists of barter transactions, player payout (tournament prizes), media production costs and other

event costs. Cost of revenue increased in the three months ended September 30, 2009 compared to the three and nine months ended September 30, 2008 due to the timing of media and production costs incurred related to the airing of our 13-week series

on WGN-America in the current year versus the prior year, in which the series aired on NBC and Sentanta (internationally). Cost of revenue decreased in the nine months ended September 30, 2009 as compared to the nine months ended September 30, 2008

due primarily to our cost reduction efforts.

-

Barter transactions were approximately $329,000 in the nine months ended September 30, 2009 compared to

approximately $531,000 nine months ended September 30,

2008.

-

Player payouts increased to $671,000 in the current nine month period compared to $580,000 in the prior year

comparable period, due to the increase in the number of

players.

-

Media and production costs were $275,000 and $425,000 in the three and nine months ended September 30, 2009,

respectively, compared to nil and approximately

$883,000 in the prior year comparable periods, due to timing (as

discussed above) and cost reductions in the current year.

-

Other event costs, which are primarily comprised of golf course management fees and signage, were $0.3 million in

2009 compared to $0.7 million in

2008.

Sales and marketing

. Sales and marketing expense consists primarily of consulting, public relations, sales materials and advertising. Sales and

marketing decreased significantly in the three and nine months ended September 30, 2009 compared to the three and nine months ended September 30, 2008 due to cost reductions in the current year and the inclusion in the three and nine months ended

September 30, 2008 of $150,000 and $450,000, respectively, of fair value of shares of our common stock issued to a consulting group which provided public relations and promotional services.

General and administrative

. General and administrative expense consists primarily of salaries and other personnel-related expenses to support our

tournament operations, non-cash stock-based compensation for general and administrative personnel, professional fees, such as accounting and legal, corporate insurance and facilities costs. The increase in general and administrative expenses in the

three and nine months ended September 30, 2009 compared to the three and nine months ended September 30, 2008 resulted primarily from an overall increase in 2009 as compared to 2008 in consulting fees and salaries paid to administrative personnel in

support of tournament operations.

17

Interest Expense

.

In January 2008, the original promissory note due to the chairman of our board of

directors in the amount of $985,000 was replaced by a second promissory note in the principal amount of $961,000, bearing interest at a rate of 12% per annum. This new note was due on January 1, 2009. During the three and nine months ended

September 30, 2008, we recorded interest expense of approximately $28,000and $86,000, respectively, related to this note.

In February 2009, the existing obligations under our promissory note with the chairman of our board of directors were replaced by another promissory note for $1,150,000. In connection with

the refinancing of the obligations under the promissory note, we recorded interest expense of $78,000 in February 2009 as a financing fee. The new note, as amended and restated in May 2009, is payable within five days after the demand of the

holder, and bears interest at 8% per annum. During the three and nine months ended September 30, 2009, we recorded interest expense of approximately $23,000 and $160,000, respectively, related to this note.

In addition, during the nine months ended September 30, 2009 we recorded interest expense of approximately $11,000 related to the $235,000 aggregate principal amount of convertible

notes issued to certain investors.

Change in Fair Value Liability Related to Price Adjustable Warrants.

In connection with warrants issued together with the convertible notes in

2008, the financial reporting (non-cash) effect of initial adoption of the authoritative guidance related to warrants with down-round protection resulted in a cumulative effect of change in accounting principle of approximately $102,000, based

on a per share price of our common stock of $0.09 at January 1, 2009, which increased accumulated deficit and recorded a fair value liability for price adjustable warrants. The fair value liability is revalued quarterly utilizing Black-Scholes

valuation model computations with the increase or decrease in fair value being reported in the statement of operations as other income (expense). During the three months ended September 30, 2009, the fair value decreased approximately $12,000,

based on a per share price of our common stock of $0.02 at September 30, 2009, which was recorded as other income. During the nine months ended September 30, 2009, the fair value decreased by approximately $81,000, which was recorded as

other income.

Off-Balance Sheet Arrangements

As of September 30, 2009, we did not have any off-balance sheet arrangements, as defined in Item 303(a)(4)(ii) of SEC Regulation S-K.

ITEM 4T. CONTROLS AND PROCEDURES.

(a) Disclosure Controls and Procedures. As of the end of the period covered by this Quarterly Report on Form 10-Q, we carried out an evaluation, under the supervision and with the participation

of senior management, including Mr. Joseph F. Martinez, our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design and operation of our disclosure controls and procedures (as such

term is defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based upon that evaluation, our CEO/CFO concluded that our disclosure controls and procedures were not effective

in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by us in the reports that we file or submit under the Exchange Act. As previously reported under Item 9A(T) in our Annual Report on Form

10-K for the year ended December 31, 2008 (the “Annual Report”), we had numerous deficiencies in our disclosures controls as of December 31, 2008. In the Annual Report we described the remediation efforts we have begun to undertake in

order to correct such deficiencies. As of September 30, 2009, the deficiencies described in the Annual Report still existed since the remediation efforts had not yet been fully implemented as of such date.

(b) Internal Control over Financial Reporting. There have been no changes in our internal controls over financial reporting or in other factors during the third fiscal quarter ended September

30, 2009 that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting subsequent to the date we carried out our most recent evaluation. As previously reported in Item 9A(T) of the Annual

Report, we had numerous material weaknesses in our internal control over financial reporting as of December 31, 2008. In the Annual Report we described the remediation efforts we have begun to undertake in order to correct such material weaknesses.

As of September 30, 2009, the material weaknesses described in the Annual Report still existed since the remediation efforts had not yet been fully implemented as of such date.

18

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

The following sets forth certain information for all securities we sold during the quarter ended September 30, 2009 without registration under the Securities Act of 1933, as amended (the

“Securities Act”), other than those sales previously reported in a Current Report on Form 8-K:

On September 1, 2009, we issued warrants to purchase an aggregate of 200,000 shares of our common stock to professional and other service provides at an exercise price of $0.50 per share in

payment for services provided. Such issuances were exempt from registration pursuant to Section 4(2) of the Securities Act.

On October 1, 2009, we issued 250,000 shares of our common stock to a consulting firm for services rendered. Such issuance was exempt from registration pursuant to Section 4(2) of the

Securities Act.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters have been submitted to our security holders for a vote, through the solicitation of proxies or otherwise, during the period ended September 30, 2009.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

The exhibits required by this item are listed on the Exhibit Index attached hereto.

19

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Dated: November 13, 2009

|

|

WORLD SERIES OF GOLF, INC.

|

|

|

|

|

|

By:

|

/s/ Joseph F. Martinez

|

|

|

|

|

Chief Executive Officer, Chief Financial Officer,

|

|

|

|

|

and Principal Accounting Officer

|

20

EXHIBIT INDEX

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

31.1

|

|

Certification of our Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the

|

|

|

|

Sarbanes-Oxley Act of 2002.

|

|

|

|

32.1

|

|

Certification of our Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the

|

|

|

|

Sarbanes-Oxley Act of 2002.

|

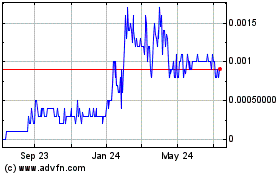

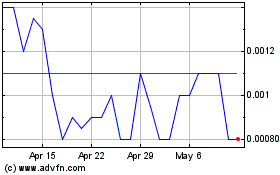

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jul 2023 to Jul 2024