EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 8-K/A (this “Amendment”) to amend our Current Report on Form 8-K dated April 8, 2009 (the “Original Filing”). The purpose of this Amendment is to supplement

our disclosure under Item 4.02 of the Original Filing in response to comments of the Securities and Exchange Commission. This Amendment hereby amends Item 4.02 of the Original Filing.

SECTION 4 – MATTERS RELATED

TO ACCOUNTANTS AND FINANCIAL STATEMENTS

|

Item 4.02.

|

Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim Review.

|

Our management, after consultation from our recently engaged consulting accounting firm, concluded that it is necessary to restate (i) our audited financial statements as of and for the year

ended December 31, 2007 which were included in our Annual Report on Form 10-KSB for the year ended December 31, 2007, and (ii) our unaudited interim financial statements as of and for the three months ended March 31, 2008, the three and six months

ended June 30, 2008, and the three and nine months ended September 30, 2008, which were included in our Quarterly Report on Form 10-QSB for the period ended March 31, 2008 and our Quarterly Reports on Form 10-Q for the periods ended June 30, 2008

and September 30, 2008.

The following is a brief description of the facts and circumstances now known to us regarding the errors cited in the Original Filing:

Error # 1

Facts and Circumstances:

The first reported error related to accounts receivable of $186,000 at December 31, 2007, which was initially thought to be

overstated with the related understatement of expense. It has been determined that $30,000 of the accounts receivable balance was subsequently offset by accounts payable with a customer and represented a reclassification between accounts

receivable and accounts payable, which in and of itself would not require restatement. It has been determined that $156,000 of accounts receivable was overstated as a result of incorrect revenue recognition as to a transaction with a former

customer. While there was evidence that an arrangement existed, evidence was not available that collectability was appropriately reviewed to support a position that collectability was reasonably assured, and thus, in the absence of sufficient

evidential matter in support of such determination, management has concluded that revenue should not have been recognized. In addition, management has concluded that there was an insufficient number of effectively designed controls and procedures to

ensure that:

-

revenue recognition criteria were properly applied in accordance with generally accepted accounting

principles (GAAP) and company policies.

-

all revenue transactions occurred, were accurately calculated in accordance with the terms of the

applicable contract, were processed properly and were accurately reflected

in the proper period in the

general ledger;

-

all sponsor-related transactions occurred, were accurately calculated in accordance with the terms of

the applicable contract, were processed properly and were accurately

reflected in the proper period in

the general ledger; and

-

all revenue transactions were properly authorized before entry into the general ledger.

The adjusting entry necessary to correct this first reported error is to decrease accounts receivable and decrease revenues by $156,000.

Error # 2

Facts and Circumstances:

The second reported error related to stock subscription receivables of $2.0 million, which was initially thought to be

overstated with the related overstatement of common stock and additional paid-in capital, for no net effect to stockholders’ equity. Management has determined that, pursuant to terms of an operating agreement, in 2007 the Company issued two

million shares of its common stock to a company for services provided to the Company, which were recorded at an estimated fair value of $1.00 per share based on recent cash transactions.

This was a significant non-routine transaction in 2007 and the Company believes the error in recording this transaction was primarily due to deficiencies pertaining to insufficiently skilled

personnel and a lack of human resources within its finance and accounting reporting functions and deficiencies relating to insufficient analysis, documentation and review of the selection and application of GAAP to significant non-routine

transactions, including the preparation of financial statement disclosures relating thereto.

The adjusting entry necessary to correct this second reported error is to increase common stock and additional paid in capital by $2 million, decrease stock subscriptions receivable by

$2 million and increase sales and marketing expense by $2 million.

Error # 3

Facts and Circumstances:

The third reported error related to fixed assets representing tournament signage, with a net book value of approximately

$183,000, which was initially thought to have been incorrectly capitalized and depreciated rather than expensed as incurred. Management has determined that the net book value of this signage, which was subsequently determined to be $175,000,

should not be reported as an asset at December 31, 2007, but rather should be reported as cost of sales. Based on its review of Company procedures regarding accounting for tournament signage, management has determined that it is appropriate to

reflect these costs as period costs as they do not represent future benefit to the Company. This error was primarily due to deficiencies pertaining to insufficiently skilled personnel and a lack of human resources within its finance and accounting

reporting functions and deficiencies relating to insufficient analysis, documentation and review of the selection and application of GAAP, as well as insufficient oversight of financially significant processes and systems, including deficiencies

relating to monitoring and oversight of the work performed by its finance and accounting personnel.

The adjusting entry necessary to correct this third reported error is to decrease fixed assets, net, by $175,000, decrease depreciation expense by $45,000 and increase cost of sales by

$220,000.

Error # 4

Facts and Circumstances:

The fourth reported error related to $1.4 million recorded as commission expense and an increase in common stock and

additional paid-in capital. Management has determined that this expense should not have been recorded at December 31, 2007. After review of stockholders’ equity transactions and activity, the entry to record this commission expense was likely

based on preliminary information, which was not later confirmed. As was the case in the second and third reported errors, the Company believes that the errors contributing to recording this transaction were primarily due to

deficiencies pertaining to insufficiently skilled personnel and a lack of human resources within its finance and accounting reporting functions and deficiencies relating to insufficient

analysis, documentation and review of the selection and application of GAAP to significant non-routine transactions, including the preparation of financial statement disclosures relating thereto.

The adjusting entry necessary to correct this fourth reported error is to decrease common stock and additional paid in capital by $1.4 million and decrease general and administrative

expense by $1.4 million.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

WORLD SERIES OF GOLF, INC.

|

|

|

Date: August 17, 2009

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Joseph F. Martinez

|

|

|

|

|

Joseph F. Martinez

|

|

|

|

|

Chief Executive Officer

|

|

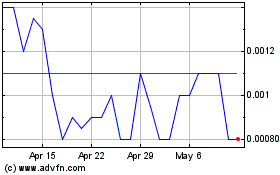

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jun 2024 to Jul 2024

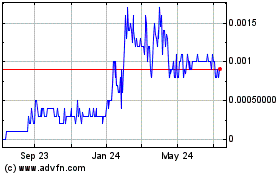

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jul 2023 to Jul 2024