UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10-Q

|

[X]

|

Quarterly

Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

|

|

|

|

|

For

the quarterly period ended

September 30,

2008

|

|

|

|

|

[ ]

|

Transition

Report pursuant to 13 or 15(d) of the Securities Exchange Act of

1934

|

|

|

|

|

|

For

the transition period

to

__________

|

|

|

|

|

|

Commission

File Number:

333-140685

|

World Series of Golf,

Inc.

(Exact

name of small business issuer as specified in its charter)

|

Nevada

|

87-0719383

|

|

(State

or other jurisdiction of incorporation or organization)

|

(IRS

Employer Identification No.)

|

|

5340 S. Procyon St.,

Las Vegas, NV 89118

|

|

(Address

of principal executive offices)

|

|

(702)

740-1740

|

|

(Issuer’s

telephone number)

|

|

_______________________________________________________________

|

|

(Former

name, former address and former fiscal year, if changed since last

report)

|

Check

whether the issuer (1) filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the issuer was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days [X]

Yes [ ] No

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company.

[ ] Large

accelerated

filer [

] Accelerated filer

[ ]

Non-accelerated

filer [X]

Smaller reporting company

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). [ ] Yes [X] No

State the

number of shares outstanding of each of the issuer’s classes of common stock, as

of the latest practicable date: 22,109,999 common shares as of

November 12, 2008

PART

I - FINANCIAL INFORMATION

Item 1. Financial Statements

|

Our

unaudited financial statements included in this Form 10-Q are as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

These

unaudited financial statements have been prepared in accordance with accounting

principles generally accepted in the United States of America for interim

financial information and the SEC instructions to Form 10-Q. In the

opinion of management, all adjustments considered necessary for a fair

presentation have been included. Operating results for the interim

period ended September 30, 2008 are not necessarily indicative of the results

that can be expected for the full year.

WORLD

SERIES OF GOLF, INC.

Balance Sheets

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

CURRENT

ASSETS

|

|

|

|

|

|

|

|

|

|

Cash

|

$

|

401,213

|

|

$

|

244,914

|

|

Accounts

receivable

|

|

881,442

|

|

|

186,960

|

|

Prepaid

expenses

|

|

3,465

|

|

|

-

|

|

|

|

|

|

|

|

|

Total

Current Assets

|

|

1,286,120

|

|

|

431,874

|

|

|

|

|

|

|

|

|

FIXED

ASSETS, net

|

|

287,179

|

|

|

190,627

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

$

|

1,573,299

|

|

$

|

622,501

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts

payable

|

$

|

460,865

|

|

$

|

59,135

|

|

Convertble

debt, net

|

|

1,728,969

|

|

|

912,653

|

|

Other

current liabilities

|

|

171,485

|

|

|

63,500

|

|

|

|

|

|

|

|

|

Total

Current Liabilities

|

|

2,361,319

|

|

|

1,035,288

|

|

|

|

|

|

|

|

|

LONG-TERM

LIABILITIES

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

Total

Liabilities

|

|

2,361,319

|

|

|

1,035,288

|

|

|

|

|

|

|

|

|

STOCKHOLDERS'

EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock; 50,000,000 shares authorized,

at $0.001 par value,

22,109,999 and 21,399,999

shares

issued

and outstanding, respectively

|

|

22,109

|

|

|

21,399

|

|

|

|

|

|

|

|

|

Additional

paid-in capital

|

|

9,932,607

|

|

|

8,109,520

|

|

Stock

subscription receivable

|

|

(2,000,000)

|

|

|

(2,000,000)

|

|

Accumulated

deficit

|

|

(8,742,736)

|

|

|

(6,543,706)

|

|

|

|

|

|

|

|

|

Total

Stockholders' Equity (Deficit)

|

|

(788,020)

|

|

|

(412,787)

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES AND STOCKHOLDERS'

EQUITY

(DEFICIT)

|

$

|

1,573,299

|

|

$

|

622,501

|

The

accompanying notes are an integral part of these financial

statements.

WORLD

SERIES OF GOLF, INC.

Statements of

Operations

(unaudited)

|

|

For

the Three

Months

Ended

September

30,

|

|

For

the Nine

Months

Ended

September

30,

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

$

|

571,876

|

|

$

|

519,670

|

|

$

|

2,634,630

|

|

$

|

1,169,544

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST

OF SALES

|

|

25,351

|

|

|

25,074

|

|

|

1,939,649

|

|

|

567,101

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS

PROFIT

|

|

546,525

|

|

|

494,596

|

|

|

694,981

|

|

|

602,443

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management

fees

|

|

174,986

|

|

|

100,000

|

|

|

485,871

|

|

|

621,543

|

|

Depreciation

and amortization

|

|

12,823

|

|

|

35,165

|

|

|

38,467

|

|

|

35,165

|

|

Advertising

and marketing

|

|

70,009

|

|

|

208,238

|

|

|

311,645

|

|

|

390,000

|

|

Professional

fees

|

|

281,001

|

|

|

268,739

|

|

|

728,921

|

|

|

320,381

|

|

General

and administrative

|

|

100,731

|

|

|

2,825,638

|

|

|

1,041,442

|

|

|

3,675,617

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Expenses

|

|

639,550

|

|

|

3,437,780

|

|

|

2,606,346

|

|

|

5,042,706

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING

LOSS

|

|

(93,025)

|

|

|

(2,943,184)

|

|

|

(1,911,365)

|

|

|

(4,440,263)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER

INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

income

|

|

79

|

|

|

-

|

|

|

655

|

|

|

-

|

|

Interest

expense

|

|

(137,323)

|

|

|

-

|

|

|

(288,320)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Other Income (Expense)

|

|

(137,244)

|

|

|

-

|

|

|

(287,665)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

LOSS

|

$

|

(230,269)

|

|

$

|

(2,943,184)

|

|

$

|

(2,199,030)

|

|

$

|

(4,440,263)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

LOSS PER COMMON SHARE

|

$

|

(0.01)

|

|

$

|

(0.41)

|

|

$

|

(0.10)

|

|

$

|

(0.76)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED

AVERAGE NUMBER OF COMMON SHARES OUTSTANDING

|

|

21,969,999

|

|

|

7,252,284

|

|

|

21,750,0999

|

|

|

5,875,000

|

The accompanying notes are an integral part of these financial

statements.

WORLD

SERIES OF GOLF, INC.

Statements of Stockholders' Equity

(Deficit)

(unaudited)

|

|

Common

Stock

|

|

|

|

|

|

Accumulated

|

|

|

|

|

Shares

|

|

Amount

|

|

Capital

|

|

Receivable

|

|

Deficit

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

December 31, 2006

|

8,629,568

|

|

$

|

8,629

|

|

$

|

1,964,371

|

|

$

|

-

|

|

$

|

(1,693,410)

|

|

$

|

279,590

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock issued for

cash at $1.05 per share

|

4,323,319

|

|

|

4,323

|

|

|

4,554,677

|

|

|

(2,000,000)

|

|

|

-

|

|

|

2,559,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock issued for

services at $1.05 per

share

|

1,447,113

|

|

|

1,447

|

|

|

1,524,553

|

|

|

-

|

|

|

-

|

|

|

1,526,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributed

capital

|

-

|

|

|

-

|

|

|

24,885

|

|

|

-

|

|

|

-

|

|

|

24,885

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial

conversion feature

of convertible debt

|

-

|

|

|

-

|

|

|

48,034

|

|

|

-

|

|

|

-

|

|

|

48,034

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recapitalization

|

6,999,999

|

|

|

7,000

|

|

|

(7,000)

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss for the year

December 31, 2007

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(4,850,296)

|

|

|

(4,850,296)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

December 31, 2007

|

21,399,999

|

|

|

21,399

|

|

|

8,109,520

|

|

|

(2,000,000)

|

|

|

(6,543,706)

|

|

|

(412,787)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock issued for

cash at $1.25 per share

|

304,000

|

|

|

304

|

|

|

379,696

|

|

|

-

|

|

|

-

|

|

|

380,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial

conversion feature

of convertible debt

|

-

|

|

|

-

|

|

|

587,404

|

|

|

-

|

|

|

-

|

|

|

587,404

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair

value of warrant attached

to common

stock

|

-

|

|

|

-

|

|

|

598,093

|

|

|

-

|

|

|

-

|

|

|

598,093

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock issued for

services at $1.25 per share

|

406,000

|

|

|

406

|

|

|

257,894

|

|

|

-

|

|

|

-

|

|

|

258,300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss for the nine months

ended September 30,

2008

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(2,199,030)

|

|

|

(2,199,030)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

September 30, 2008

|

22,109,999

|

|

$

|

22,109

|

|

$

|

9,932,607

|

|

$

|

(2,000,000)

|

|

$

|

(8,742,736)

|

|

$

|

(788,020)

|

The accompanying notes are an

integral part of these financial statements.

WORLD

SERIES OF GOLF, INC.

Statements of Cash

Flows

(unaudited)

|

|

For

the Nine

Months

Ended

September

30,

|

|

|

2008

|

|

2007

|

|

|

|

|

|

|

OPERATING

ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net

loss

|

$

|

(2,199,030)

|

|

$

|

(4,440,263)

|

Adjustments

to reconcile net loss to

net cash used by operating

activities:

|

|

|

|

|

|

|

Depreciation

|

|

38,467

|

|

|

35,165

|

|

Amortization

of discount on debt

|

|

195,801

|

|

|

|

|

Common

stock and warrants issued for services

|

|

856,394

|

|

|

1,526,000

|

|

Changes

in operating assets and liabilities

|

|

|

|

|

|

|

(Increase)

decrease in accounts receivable

|

|

(694,482)

|

|

|

(195,540)

|

|

(Increase)

decrease in prepaid expenses

|

|

(3,465)

|

|

|

-

|

|

Increase

(decrease) in accounts payable

|

|

401,730

|

|

|

285,315

|

|

Increase

(decrease) in other current liabilities

|

|

107,985

|

|

|

25,795

|

|

|

|

|

|

|

|

|

Net

Cash Used in Operating Activities

|

|

(1,296,600)

|

|

|

(2,763,528)

|

|

|

|

|

|

|

|

|

INVESTING

ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase

of fixed assets

|

|

(135,019)

|

|

|

(225,075)

|

|

|

|

|

|

|

|

|

Net

Cash Used in Investing Activities

|

|

(135,019)

|

|

|

(225,075)

|

|

|

|

|

|

|

|

|

FINANCING

ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase

in note payable - related party

|

|

72,918

|

|

|

985,572

|

|

Increase

in convertible notes payable

|

|

1,135,000

|

|

|

-

|

|

Common

stock issued for cash

|

|

380,000

|

|

|

1,774,000

|

|

|

|

|

|

|

|

|

Net

Cash Provided by Financing Activities

|

|

1,587,918

|

|

|

2,759,572

|

|

|

|

|

|

|

|

|

NET

INCREASE (DECREASE) IN CASH

|

|

156,299

|

|

|

(229,031)

|

|

|

|

|

|

|

|

|

CASH

AT BEGINNING OF PERIOD

|

|

244,914

|

|

|

298,934

|

|

|

|

|

|

|

|

|

CASH

AT END OF PERIOD

|

$

|

401,213

|

|

$

|

69,903

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL

DISCLOSURES OF

|

|

|

|

|

|

|

CASH

FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

PAID FOR:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

|

$

|

80,462

|

|

$

|

-

|

|

Income

Taxes

|

$

|

-

|

|

$

|

-

|

The accompanying notes are an

integral part of these financial statements.

WORLD

SERIES OF GOLF, INC.

(A

Development Stage Company)

Notes to the Financial Statements

September

30, 2008 and December 31, 2007

NOTE

1 - CONDENSED FINANCIAL STATEMENTS

The

accompanying financial statements have been prepared by the Company without

audit. In the opinion of management, all adjustments (which include

only normal recurring adjustments) necessary to present fairly the financial

position, results of operations and cash flows at September 30, 2008 and for all

periods presented have been made.

Certain

information and footnote disclosures normally included in financial statements

prepared in accordance with accounting principles generally accepted in the

United States of America have been condensed or omitted. It is suggested that

these condensed financial statements be read in conjunction with the financial

statements and notes thereto included in the Company's December 31, 2007 audited

financial statements. The results of operations for the periods ended

September 30, 2008 and 2007 are not necessarily indicative of the operating

results for the full years.

NOTE

2 - GOING CONCERN

The

Company’s financial statements are prepared using generally accepted accounting

principles applicable to a going concern which contemplates the realization of

assets and liquidation of liabilities in the normal course of

business. The Company has had no revenues and has generated losses

from operations.

In

order to continue as a going concern and achieve a profitable level of

operations, the Company will need, among other things, additional capital

resources and to develop a consistent source of

revenues. Management’s plans include of investing in and developing

all types of businesses related to the sports entertainment

industry.

The

ability of the Company to continue as a going concern is dependent upon its

ability to successfully accomplish the plan described in the preceding paragraph

and eventually attain profitable operations. The accompanying

financial statements do not include any adjustments that might be necessary if

the Company is unable to continue as a going concern.

Item 2. Plan of Operation

Forward-Looking

Statements

Certain

statements, other than purely historical information, including estimates,

projections, statements relating to our business plans, objectives, and expected

operating results, and the assumptions upon which those statements are based,

are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of

1934. These forward-looking statements generally are identified

by the words “believes,” “project,” “expects,” “anticipates,” “estimates,”

“intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions. We intend

such forward-looking statements to be covered by the safe-harbor provisions for

forward-looking statements contained in the Private Securities Litigation Reform

Act of 1995, and are including this statement for purposes of complying with

those safe-harbor provisions. Forward-looking statements are based on

current expectations and assumptions that are subject to risks and uncertainties

which may cause actual results to differ materially from the forward-looking

statements. Our ability to predict results or the actual effect of future plans

or strategies is inherently uncertain. Factors which could have a

material adverse affect on our operations and future prospects on a consolidated

basis include, but are not limited to: changes in economic conditions,

legislative/regulatory changes, availability of capital, interest rates,

competition, and generally accepted accounting principles. These risks and

uncertainties should also be considered in evaluating forward-looking statements

and undue reliance should not be placed on such statements. We

undertake no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or

otherwise. Further information concerning our business, including

additional factors that could materially affect our financial results, is

included herein and in our other filings with the SEC.

Overview

We are in

the sports and entertainment business. Our premiere event is a golf

tournament played under a patent pending format similar to Texas Hold ‘Em

poker. The Inaugural World Series of Golf was played May 13-16, 2007

in Las Vegas, Nevada and aired on NBC Sports. The event was hosted by the MGM

Mirage - the official casino and hotel of the World Series of Golf. The event

featured two Las Vegas style wrap-around parties - opening night and closing

night. The three day event with single day elimination was played at Primm

Valley Golf Club with 60 players participating. The event was viewed

in over 2 million households on NBC Sports and had over 96 million internet

impressions. It aired on SKY Sports in Europe and was featured in local,

national and regional coverage including the AP wire service.

The 2008

World Series of Golf was played the week of May 12-15. There were more

applicants than playing positions and the event has doubled in

size. The event aired June 28 and 29 on the CBS television

network. Our objective is to build a global brand with the finals

bringing players from all over the world to Las Vegas and creating the largest

payout of any golf tournament in the world. The World Series of Golf is also

preparing to launch the World Series of Golf Europe and The World Series of Golf

Online.

We

also own the rights to a number of other event titles, including the “World

Series of Men’s Professional Golf

ä

”,

“World Series of Women’s’ Professional Golf

ä

”,

“World Series of Amateur Golf

ä

”, and

the “World Series of Club Championship Golf™”. An application for the mark

“World Series of Golf®” was filed in Canada on December 6, 2004 and was approved

by the Canadian authority on September 27, 2005. We filed an international

application for the World Series of Golf® game format in any of the countries

which are members of the Patent Cooperation Treaty. A United States

patent application was filed for the World Series of Golf® game format with the

United States Patent Trademark Office on October 5, 2004. The application is now

patent pending.

Plan

of Operation

Our

strategic plan is based on management’s belief that it will take three

successful annual events, along with the development of an online accessible

game, to obtain acceptance of the World Series of Golf® as a method of play and

to establish it as a brand in the mind of players. The first

event was viewed by management as a means to prove that the game concept works

and to establish it as an authentic concept. The second event was

viewed by management as demonstrating that the game can be grown and that the

first event was not just a fluke. The third event is being viewed as

the means to validate the game in the mind of players and the public

generally.

Management

sees the development and acceptance of an online game as critical to getting the

game’s method of play to a significantly larger number of players than would be

possible if we only offered a land based event. The larger number of

players and greater regularity of game events potentially offered by online play

are expected to raise significantly more revenues for us over time.

We

succeeded in completing the inaugural event in Las Vegas on May 13-16,

2007. According to the statistics we received, it was viewed in over

2 million households on NBC Sports and had over 96 million internet impressions

from our online component. It aired on SKY Sports in Europe and was featured in

local, national and regional coverage in the U.S., including the AP wire

service. The 2008 annual event was played during the week of May

12-15, 2008. Our online component is in the process of development with a public

launch targeted for 2009. At this time, our third major event in Las Vegas is

expected to be planned for the following year at about the same time of year, in

May 2009.

Year One -- Proof of Concept

and Establishing Authenticity

During

the year ended December 31, 2007, our primary objective was to establish proof

of our unique concept and to create an authentic and successful event based upon

our proprietary method of tournament golf play. Our first tournament

was viewed by over 2 million households and has generated a very positive

overall response. The popularity of the inaugural 60-player event led

to more applicants than player positions available for the expanded 125-player

tournament played May 12-15, 2008.

Management

believes it has succeeded in establishing the World Series of Golf game format

as a legitimate and enjoyable method of play. Our strategy going

forward in 2008 will thus be to expand and broaden the game play and acceptance

generally.

Year Two -- Event Growth and

Online Development

Our plan

of operations for the 2008 fiscal year has been to build upon the success of our

inaugural event and will focus on two distinct but complimentary methods of

play: land based events and online play.

Growth

of Land-Based Events

Our

land-based tournament events generate revenue directly through the $10,000

buy-in paid by each tournament player. To expand the revenues created

directly by our land-based events, we must expand the number of tournaments and

players. Our flagship World Series of Golf tournament will continue

to be played in Las Vegas, Nevada for the foreseeable future as it continues to

grow in size. In this regard, we have increased the number of

players from 60 to 125 to accommodate the number of player requests, which have

already exceeded the number of spots available.

In

addition, we have opened a London office with partners in order to expand

operations and play into Europe. Our first European event was tentatively

scheduled for September or October of 2008. However, the event is now expected

to occur in 2009 instead. Our European events are expected to be varied in size,

but all played under our patent pending format. We anticipate the events to be

similar to those hosted in Las Vegas, featuring a buy-in for each player

(projected to be £10,000) and a three-to-four day elimination tournament. We are

exploring the creation of made-for-television events (i.e., USA vs. Europe)

played in a Ryder Cup style. Many of our current partners, vendors and

affiliates have a global presence. These global ties are expected to provide

valuable assistance with the expansion of our tournaments to Europe and

beyond.

Another

part of our plans for growing our land based events involves television and

broadband media. Under our current broadcast media strategy, we

retain the broadcast rights to our events and related content and air the events

through the purchase of broadcast time from a major

network. Revenues are then generated through the sale of

advertising sponsorships. In the short term, this strategy foregoes

the potentially higher net revenues which may be attainable through an outright

sale of the television rights to our events. At the current time,

however, we believe the long term interests of the company are better served by

increasing our media presence and growing and expanding the awareness, appeal,

and overall value of our events and the related telecast rights. We

thus plan to continue this strategy through the end of the 2008 fiscal

year.

Ultimately,

after we have more firmly established our game as a compelling television event,

we would like to find a permanent telecast home for flagship event in Las

Vegas. The primary contenders for a permanent relationship at this

time would be The Golf Channel in the U.S. and SKY Sports in

Europe.

Our

inaugural event was aired on NBC. It generated a .9 rating (about 2 million

households). As with any first year event, however, it was difficult to find the

proper pacing. The NBC telecast

was

therefore acceptable, but not exemplary. We believe the game is better shown on

TV as a reality show in episodic form rather than as a golf tournament. Not

completely satisfied with the results obtained in the inaugural telecast, we

have hired Echo Entertainment in Los Angeles, post production specialists, who

primarily edit poker based shows (including NBC’s Poker After Dark). We re-aired

our 2007 NBC telecast on SKY Sports in Europe.

The 2008

event aired June 28 and 29 on the CBS television

network. European-based broadcast leader Setanta Sports will air the

2008 event throughout Europe. Beginning in October, Setanta will feature four

separate one-hour segments of the event prior to live broadcasts of PGA Tour

events. The 2008 event will be aired in four separate "runs" during the twelve

months following the initial October broadcast. Through repeats, the event will

air in Europe in its entirety approximately twenty times during this

twelve-month period.

Online

Game Development

Management

believes that much of our potential for long-term growth resides with the

development of an online game and revenue base. The number of

participants in our land-based events is inherently limited by the requirements

of bringing players together in one place, by the $10,000 high-stakes buy-in,

and by the logistical challenges that will mount in any live event as more and

more participants are added. By bringing our proprietary game

to the Internet, we hope to transcend these limitations.

The

online game being developed in partnership with the World Golf Tour will contain

several valuable features: it will (1) require users to register; (2) allow

people to play and get familiar with our format and (3) encourage the

development of a social networking community related to the game and its online

play. Through the online game, the World Series of Golf, we expect to

be able to conduct events 24 hours a day, seven days a week. Players will be

able to compete varied types of play, including 3 hole, 6 hole, 9 hole, or 18

hole events. Most of these events will be buy-in events. Registered

players will acquire credits and then use these credits to participate in the

online events they choose. Management expects this to not only drive revenue,

but give the users an opportunity to learn the format. We anticipate leveraging

our land based events, media and strategic partner relations to drive traffic to

the online game site.

Once a

critical number of players have familiarized themselves with our game and have

refined their skills using our U.S.-based online game, we will explore

opportunities to incorporate online gaming into the online games. Under the

terms of our agreement with The World Golf Tour, we have the right to license

the operating system being developed to create a gambling platform to put on top

of our game and operate in those parts of the world where online gaming is

legal.

Year Three -- Validity and

Long-Term Success

Management

believes that the 2009 fiscal year, upon the completion of our third inaugural

event, will be the turning point at which we will be able to establish our

business as a viable growing concern that is well positioned for long-term

profitability and success. The successful completion of our third

flagship World Series of Golf event in the Spring of 2009 is expected to put us

over the proof of concept stage and establish the long term staying power of our

brand. Also during 2009, we expect to launch the fully-functional

version of our online game site and to begin building our online following and

community, generating the increase revenues we will need to grow the business

over time.

Expected

Changes In Number of Employees, Plant, and Equipment

We do not

have plans to purchase any physical plant or any significant equipment or to

change the number of our employees during the next twelve months.

Results

of Operations for the three and nine months ended September 30,

2008

We earned

revenues of $571,876 and incurred costs of sale totaling $25,351 during the

three months ended September 30, 2008, compared to revenues of $519,670 and

costs of sale of $25,074 during the three months ended September 30, 2007. We

incurred operating expenses in the amount of $639,550 for the three months ended

September 30, 2008 and in the amount of $3,437,780 for the three months ended

September 30, 2007. We earned revenues of $2,634,630 and incurred

costs of sale totaling $1,939,649 during the nine months ended September 30,

2008, compared to revenues of $1,169,544 and costs of sale of $567,101 during

the nine months ended September 30, 2007. We incurred operating expenses in the

amount of $2,606,346 for the nine months ended September 30, 2008 and in the

amount of $5,042,706 for the nine months ended September 30, 2007. Our operating

expenses included General and Administrative Expenses of $100,731 during the

three months ended September, 30, 2008, $2,825,638 during the three months ended

September, 30, 2007, $1,041,422 during the nine months ended September, 30,

2008, and $3,675,617 during the nine months ended September, 30,

2008.

We

incurred a net loss of $230,269 for the three months ended September 30, 2008,

compared to a net loss of $2,943,184 for the three months ended September 30,

2007. We incurred a net loss of $2,199,030 for the nine months

ended September 30, 2008, compared to a net loss of $4,440,263 for the nine

months ended September 30, 2007. Our losses are attributable to operating

expenses in excess of current revenues. The decrease in net losses from periods

ended September 30, 2007 to periods ended September 30, 2008, are primarily due

to a significant reduction in General and Administrative Expenses.

Liquidity

and Capital Resources

As of

September 30, 2008, we had current assets in the amount of $1,286,120,

consisting of $401,213 in cash, $881,442 in accounts receivable, and $3,465 in

prepaid expenses. As of September 30, 2008, we had $2,361,319 in

current liabilities, consisting of accounts payable of $460,865, convertible

debt in the amount of $1,728,969, and other current liabilities in the amount of

$171,485. We therefore had a working capital deficit of $1,075,199 as

of September 30, 2008.

Our

operating activities used $1,296,600 in cash during the nine months ended

September 30, 2008. The primary component was our Net Loss of $2,199,030. We

used $135,019 in investing activities during the nine months ended September 30,

2008. This was due exclusively to the purchase of fixed assets during the

period. Our financing activities generated 1,587,918 in cash

during

the nine months ended September 30, 2008 through the issuance of notes and

common stock.

We have

not attained profitable operations and may be dependent upon obtaining financing

to pursue our long-term business plan. For these reasons our auditors

stated in their report that they have substantial doubt we will be able to

continue as a going concern.

Thus far

in the current fiscal year, we have generated revenues from player buy-ins for

our annual Las Vegas tournament and sponsorship sales as well as payments

under the company’s stock purchase agreement with The Custom

Group.

We

believe that our financing activities, together with our revenues and

cash-on-hand, will allow us to continue to meet our budget and execute on our

strategic plan for the remainder of the 2008 fiscal year.

Off

Balance Sheet Arrangements

As of

September 30, 2008, there were no off balance sheet arrangements.

Going

Concern

Our

financial statements are prepared using generally accepted accounting principles

applicable to a going concern which contemplates the realization of assets and

liquidation of liabilities in the normal course of business. We have

had no revenues and have generated losses from operations. For these reasons our

auditors stated in their report that they have substantial doubt we will be able

to continue as a going concern.

In order

to continue as a going concern and achieve a profitable level of operations, we

will need, among other things, additional capital resources and to develop a

consistent source of revenues. Management’s plans include investing

in and developing all types of businesses related to the sports entertainment

industry.

Our

ability to continue as a going concern is dependent upon our ability to

successfully accomplish the plan described in the preceding paragraph and

eventually attain profitable operations. The accompanying financial

statements do not include any adjustments that might be necessary if we are

unable to continue as a going concern.

Item 3. Quantitative and Qualitative

Disclosures About Market Risk

A smaller

reporting company is not required to provide the information required by this

Item.

Item 4T. Controls and Procedures

We

carried out an evaluation of the effectiveness of the design and operation of

our disclosure controls and procedures (as defined in Exchange Act Rules

13a-15(e) and 15d-15(e)) as of September 30, 2008. This evaluation

was carried out under the supervision and with the participation of our Chief

Executive Officer and our Chief Financial Officer, Mr. Terry Leiweke. Based upon

that evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that, as of September 30, 2008, our disclosure controls and procedures

are effective. There have been no changes in our internal controls

over financial reporting during the quarter ended September 30,

2008.

Disclosure

controls and procedures are controls and other procedures that are designed to

ensure that information required to be disclosed in our reports filed or

submitted under the Exchange Act are recorded, processed, summarized and

reported, within the time periods specified in the SEC's rules and forms.

Disclosure controls and procedures include, without limitation, controls and

procedures designed to ensure that information required to be disclosed in our

reports filed under the Exchange Act is accumulated and communicated to

management, including our Chief Executive Officer and Chief Financial Officer,

to allow timely decisions regarding required disclosure.

Limitations on the

Effectiveness of Internal Controls

Our

management does not expect that our disclosure controls and procedures or our

internal control over financial reporting will necessarily prevent all fraud and

material error. Our disclosure controls and procedures are designed to provide

reasonable assurance of achieving our objectives and our Chief Executive Officer

and Chief Financial Officer concluded that our disclosure controls and

procedures are effective at that reasonable assurance level. Further,

the design of a control system must reflect the fact that there are resource

constraints, and the benefits of controls must be considered relative to their

costs. Because of the inherent limitations in all control systems, no evaluation

of controls can provide absolute assurance that all control issues and instances

of fraud, if any, within the Company have been detected. These inherent

limitations include the realities that judgments in decision-making can be

faulty, and that breakdowns can occur because of simple error or mistake.

Additionally, controls can be circumvented by the individual acts of some

persons, by collusion of two or more people, or by management override of the

internal control. The design of any system of controls also is based in part

upon certain assumptions about the likelihood of future events, and there can be

no assurance that any design will succeed in achieving its stated goals under

all potential future conditions. Over time, control may become inadequate

because of changes in conditions, or the degree of compliance with the policies

or procedures may deteriorate.

PART

II – OTHER INFORMATION

Item 1. Legal Proceedings

We are

not a party to any pending legal proceeding. We are not aware of any pending

legal proceeding to which any of our officers, directors, or any beneficial

holders of 5% or more of our voting securities are adverse to us or have a

material interest adverse to us.

Item 1A. Risk Factors

A smaller

reporting company is not required to provide the information required by this

Item.

Item 2. Unregistered Sales of Equity

Securities and Use of Proceeds

None

Item 3. Defaults upon Senior

Securities

None

Item 4. Submission of Matters to a Vote of

Security Holders

No

matters have been submitted to our security holders for a vote, through the

solicitation of proxies or otherwise, during the quarterly period ended

September 30, 2008.

Item 5. Other Information

None

Item 6. Exhibits

|

Exhibit

Number

|

Description

of Exhibit

|

|

3.1

|

Articles

of Incorporation

(1)

|

|

3.2

|

By-Laws

(1)

|

|

10.1

|

World

Series of Golf, Inc. Stock Option Plan

(1)

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Previously

included as an exhibit to the Current Report on Form 8-K filed with the

Securities and Exchange Commission on February 1,

2008.

|

SIGNATURES

In

accordance with the requirements of the Securities and Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

World

Series of Golf, Inc.

|

|

|

|

|

Date:

|

November

13, 2008

|

|

|

|

|

|

By: /s/

Terry

Leiweke

Terry

Leiweke

Title:

Chief

Executive Officer, Chief Financial Officer, Principal Accounting

Officer and Director

|

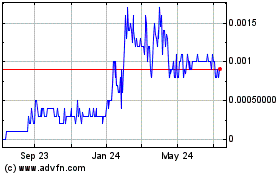

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jun 2024 to Jul 2024

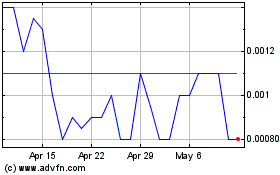

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jul 2023 to Jul 2024