Filed

Pursuant to Rule 424(B)(3)

Registration

No. 333-268839

PROSPECTUS

13,500,000

shares of common stock

SMARTCARD

MARKETING SYSTEMS, INC.

This prospectus relates to

the resale by the selling stockholders identified herein of up to 13,500,000 shares of common stock, par value $0.001 per share, of SmartCard

Marketing Systems, Inc., that may be sold by the selling stockholders identified in this prospectus from time to time at prevailing market

prices or as privately negotiated, as applicable; for an aggregate offering of 13,500,000 shares of common stock. These selling stockholders,

together with their transferees, are referred to throughout this prospectus as “selling stockholders”. Of the 13,500,000

shares being offered, 8,500,000 of such offered shares are presently issued and outstanding. The shares offered are comprised of an aggregate

of (i) 3,000,000 shares of common stock issued and sold to an accredited investor in a financing transaction (the “2022 Private

Placement”), (ii) 5,000,000 shares of common stock issuable upon exercise of common stock purchase warrants issued to the investor

in the 2022 Private Placement; and (iii) 5,500,000 shares of common stock issued to non-management holders of our common stock. We will

not receive any of the proceeds if the selling stockholders identified in this prospectus sell their shares.

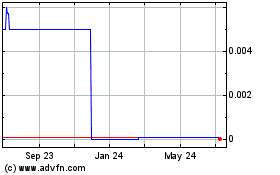

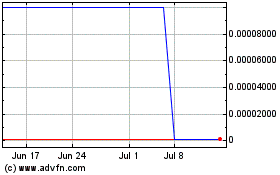

Our common stock is quoted

on OTC Market’s “OTCQB” tier under the ticker symbol “SMKG”. On December 15, 2022, the last reported sale

price of shares of our common stock on the OTCQB marketplace was $0.03 per share.

We

will pay all of the expenses incident to the registration of the shares offered under this prospectus, except for sales commissions and

other expenses of selling stockholders applicable to the sales of their shares. The shares may be offered for sale from time to time

by the selling stockholders acting as principals for their own accounts or in brokerage transactions at prevailing market prices or in

transactions at negotiated prices. No representation is made that any shares will or will not be offered for sale. It is not possible

at the present time to determine the price to the public in any sale of the shares by the selling stockholders and the selling stockholders

reserve the right to accept or reject, in whole or in part, any proposed purchase of shares. Accordingly, the public offering price and

the amount of any applicable underwriting discounts and commissions will be determined at the time of such sale by the selling stockholders.

See “Selling Stockholders” and “Plan of Distribution” in this prospectus.

Investing in our common stock

is speculative and involves a high degree of risk. Before making any investment in our common stock, you should read and carefully consider

the risks described in this prospectus under “Risk Factors” beginning on page 20 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is January 31, 2023

PROSPECTUS

SUMMARY

You

should read the following summary together with the more detailed information and the financial statements appearing elsewhere in this

Prospectus. This Prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under

“Risk Factors” and elsewhere in this Prospectus. Unless the context indicates or suggests otherwise, references to “we”,

“our”, “us”, the “Company”, “SmartCard Marketing Systems, “SMKG”, or, the “Registrant”

refer to SmartCard Marketing Systems, Inc., a Delaware corporation, together with its subsidiary.

Overview

SmartCard

Marketing Systems, Inc. (“SmartCard Marketing Systems” and the “Company”) is an innovative Fintech and Paytech

accelerator company operating as an E-Commerce, Cloud, and Mobility software solutions and applications provider to the global payments

industry. We believe in super-apps and deliver a suite of proprietary cloud-based business solutions, applications and marketplaces to

our payment industry business customers to assist with the deployment of their merchant portfolios. By providing Business Intelligence

and Digital Transformation strategies through our proprietary portfolio of specialized cloud and mobility software solutions and applications

with embedded payments technology to our customers within the Banking, Business Enterprise, Retail Point-of-Sale with e-Wallet / m-Wallet,

Cross-border Payments, Blockchain, Crypto, Non-Fungible Tokens or “NFTs”, Token, Digital ID, Video eKYC and Payments industries

with a focus on Digital Retail shops, Events Tech, Ed-tech, Tele-medicine, Digital Vault, and Transit Booking.

We

have a methodical approach to the payments acceptance industry. Our proprietary business applications are developed as a cloud-SaaS model

for web and mobility, offering flexibility, security and scalability to our customers. The Company’s proprietary cloud and mobility

applications are licensed as white-label solutions to our customers and partners. We develop business process applications for B2B, B2C,

B2B2C and P2P with integrated payment networks and embedded third party tools to expedite the go-to-market for our customers. This merchant

on-boarding strategy allows for easy adoption and ready-to-market products for our customers. Further, we seek to identify vendors with

unique technologies which we may seamlessly integrate with as part of a pay-per-use model by tier volume pricing embedded within our

applications, a process also known as “API’s”. This strategy amplifies both merchant and customer engagement while

increasing revenues. We believe that API’s are the backbone of our strategy.

The

rise in demand for cross-border payments to support international trade has become a major opportunity for SmartCard Marketing Systems

to offer both digital payment rails combined with digital card payments services as Payments as a Service (“PaaS”). The Company

uses its own payment rails as an embedded payment services strategy to accelerate its portfolio of commercial deployments for its customers.

The

Company has positioned itself to be a key services and applications provider in the Paytech, Fintech and Blockchain industries with its

unique strategy of licensing its technology with embedded payment rails, blockchain protocols, and utilities within the Company’s

portfolio of applications. This unique agnostic ecosystem provides business intelligent processes, embedded utilities and payment technology

resources in a digital strategy for faster deployments. This ecosystem and digital strategy technology is offered in markets that are

either regulated or in the process of developing and/or implementing their regulatory framework to allow for mass adoption.

SmartCard

Marketing Systems has an IP portfolio of 20+ proprietary solutions. All of the Company’s proprietary platforms are designed with

at least three tier levels via Partner, Merchant and Individual users. These users are interlinked through a permission-based structure

on each platform through a registration and approval process ensuring compliance and safety.

Our

continuing strategy is to develop a seamless portfolio of specialized industry payment technology wireframes, marketplaces and to allow

our customers to “Brand As Their Own” for e-commerce and E-POS semi-integrated solutions on the cloud and mobile infrastructures

to market and enable their portfolios of merchants and consumers. The result is a robust performing lineup of middleware’s that

integrate easily with various types of payment industry financial institutions and processors creating a powerful gateway. We target

banks and Third Party Processors for host issuing, acquiring and local payment industry businesses with an existing merchant portfolio

mix that is ready for a breadth of trending technologies which incorporate everything from payments, blockchain to social-media advantages

for their customers with an integrated price matrix to their gateways to provide seamless activations and revenues.

We currently rely on

a small number of customers for the majority of our revenue. As reflected in our accompanying consolidated financial statements,

for the nine months ended September 30, 2022, our revenue was $440,487, and for the year ended December 31, 2021, our revenue

was $405,412. We have not generated profits since inception, have sustained net losses of $988,941 for the year ended December

31, 2021 and $357,723 for the nine months ended September 30, 2022, and have incurred negative cash flows from operations for

the years ended December 31, 2021 and 2020. As of December 31, 2021, we had an accumulated deficit of $8,417,539. Accordingly,

our accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

Our ability to continue as a going concern for the next twelve months is dependent upon our ability to generate sufficient cash

flows from operations to meet our obligations, which we have not been able to accomplish to date, and/or to obtain additional

working capital from related and third-parties. Through the date our consolidated financial statements were available to be issued,

we have been financed by our primary shareholder and third-party investors. We have suffered recurring losses from operations,

have a significant accumulated deficit, continue to experience negative cash flows from operations, and our financial statements

do not include any adjustments that might result from the outcome of this uncertainty. For the foregoing reasons, our independent

auditor raised substantial doubt regarding our ability to continue as a going concern in its accompanying opinion to our financial

statements.

The Company

currently generates revenues through the white-label licensing of its cloud and mobility applications and through our processing of recurring

payments transactions. In addition, the Company also has a strategic financial model in fintech which is driven by an exchange of value

through the licensing our technologies to clients and partners in consideration for equity in their respective companies combined with

a revenue share model. The Company’s business lines which are currently generating revenue include: Remote Deposit Capture, Cross-border

Payments, Fintech Accelerator, Genorocity, Granularchain, OriginatorX, NFT Limited Series, and Qr.guru. The Company’s business

lines which are not currently generating revenues include: Menu.events, Mytravel.menu, Phaces.io, Profiler.us, Onroute.tech, ijobs.shop,

articul8te, Mtickets.events, Abotslife, and Doctor-vid.

Our

IP Portfolio Introduction Timeline

The

below timeline represents the Company’s conception and initial development of each industry application in the Company’s

intellectual property portfolio.

Principal

Products and Services

The

Company maintains an extensive IP portfolio which can be licensed within multiple industries. The below table demonstrates that the growth

in each industry creates a direct channel opportunity for the Company. The primary challenge that we currently face is our inability

to pursue multiple industries simultaneously due to our undercapitalization. We also face fierce global competition. However, in connection

with our strategic alliances with Compuage Infocom India, PWC India, and XPAY Worldwide Corporation in the Philippines, we hope to be

able to enter additional markets as each of these business relationships provides us with the ability to integrate through the local

reselling of the Company's technologies by their respective networks and partners, which could in turn enable the Company to provide

embedded payments using our technologies through local financial institutions and payments services partners. The added advantage of

this strategy may reduce market-entry friction.

Our

in-house design concept and development technology lab develops our proprietary software solutions and applications which we offer to

our customers as white-label “Brand as your Own” licensing opportunities through our own internet business marketplace, www.emphasispay.com.

Our e-commerce, cloud and mobility architecture includes: Payments with QR & Wallet, Remote Deposit Capture, Blockchain, Crypto,

NFTs, EKYC by Video, E-commerce, Cross Border FX, Events Management, Transit and Tracking, Documents Vaulting, Digital ID Key, E-Gaming,

E-Sports, Card Issuing Management & Media Publishing. These target industries combined represent more than $22.8 Trillion in opportunities

between 2022 – 2025 (as referenced herein, in “Market Opportunities”). Our proprietary software portfolio, which

we offer to our customers for white-label licensing through our Emphasispay.com marketplace, currently includes the following applications:

Intellectual

Digital Property Assets Portfolio

| Platform |

|

Description |

Life

Cycle |

Genorocity

www.genorocity.com

|

|

A

Digital Retail Platform & Wallet with a suite of features for Malls, Hotel & Entertainment Property, Theme Parks, Enterprises,

Franchisers and more. Coupons, Cards, Loyalty points, Social-media, Offer Showcase, Promoted offers, Proximity, Beacon Tech for both

Web & Mobile Applications with payment gateways. |

In

Use |

Mtickets.events

www.mtickets.events

www.mobile.events

|

|

A

digital events and mobile Ticketing management platform with an events portal for planners, associations, retailers and networking

groups. A full digital suite of features includes: creating of events, conferences, exhibitors, collaborators, partner suppliers,

ticketing and registrations. Both web and mobile applications with payment gateways embedded. |

Marketable |

Check21SaaS

www.check21saas.com

www.checkvalet.com

|

|

Remote

Deposit Capture technology. Cloud-based with multi-scanner options, seamlessly integrated, working remotely from branch or client

locations. Also with processing functionality and x9 clearing files for settlement. |

In

Use |

Articul8te

www.articul8te.com

|

|

Our

more recent release Digital Data-Room for Sales, Content & Task management application both Web & Mobile. The suite of features

includes: Private or Public mode with Group set-up, To-do Lists, Social-media & Articles publishing, Creating Tasks and Invites,

with tracking and calendar functionality. |

Marketable |

Mytravel.menu

www.mytravel.menu |

|

Designed

to capture the Consumer & Business pre-order food market and onboard or inflight menu sales. The application allows transport

operators to easily integrate and import menu options. |

Marketable |

iJobs.shop

www.ijobs.shop |

|

A

digital job seeker solution for both merchant and job seeker. This innovative solution is QR Code based and allows the job seeker

to simply upload their CV and Profile within seconds. It offers the merchant a web portal to publish job opportunities and promote

content through popular social media channels. |

Marketable |

Emphasispay

www.emphasispay.com

|

|

A

proprietary CRM & CSM solution Products and Services Portal.

• Marketing

& Communications

• Marketing

PDF’s & Onboarding PDF’s

• Partners,

ISV & Reseller Portals

• Client

Prospect forms

• Webinars,

Training, Maintenance & Support

• Portal

Banners |

In

Use |

QR.guru

http://www.qr.guru

http://myshopping.guru

http://www.prizescan.guru |

|

A

digital e-Commerce shopping platform; a lead generator and capturing solution for sales events, MLM and affiliate marketing. Generates

automated unique URL and QR codes by event or business type. Includes a user- friendly product selection list, as well as exportable

leads and data. Includes a Prize Scan solution to capture data and set prizes on products. |

In

Use |

Menu.events

http://menu.events |

|

Made

for event facilities, conference centers and catering companies. Offers a fully digital catering order application for both web and

mobile. Includes dashboards for customers, merchants, and administrators, with a customizable interface. |

Marketable |

Granularchain

http://granularchain.com |

|

A

digital ID Key with a permission-based onboarding and EKYC by Video Biometric solution with two-level authenticate solution on a

permission-based transaction architecture for Digital ID with Documents Vault |

In

Use |

Profilr.social

http://profilr.social |

|

A

search engine and booking tracking solution with eKYC that organizes public records and social network information into simple profiles

to help you safely find and learn about people. The ability to build a case file on an individual is now a simple task with Profilr.social. |

Marketable |

Onroute.Tech

http://www.onroute.tech |

|

Designed

to manage Booking Ride and Tracking solutions for individuals, limousine, courier, shuttle and bus services for the transit industry. |

Marketable |

Distributer.Email

https://distributer.email |

|

An

email campaign and analytics solution for enterprises and agencies to distribute and manage email campaigns with analytics. |

In

Use |

Atelier.Social

https://atelier.social |

|

A

publishing and managing tool for Social Media Content, Marketing and Networking. A critical tool to collect data, analytics and reporting

to improve opportunity and conversion. |

Marketable |

ABotsLife

https://abotslife.com |

|

Connects

your business with buyers through real-time conversations on your business site, social media, WhatsApp, and other platforms and

captures the data for call to action. With Features such as Machine Learning, AI ChatBot is a preferred mode of conversation with

businesses, supporting customers with queries, task walk through and management, and lead generation, sales support. Preferred by

Educational Institutions, Banks, FI’s, Insurance companies, Pharmaceuticals, Hospitals, Real Estate, Logistics, Tele-Medicine

and SME’s across industries. |

In

Use |

Eschool System

https://eschool.systems |

|

School

Management System platform enables schools to operate on a cloud environment enabling them to manage the complete array of educational

and administrative operations. |

Marketable |

Doctor Vid

http://doctor-vid.com |

|

The

Platform provides Medical Clinics and Doctors with the Tele-Medicine communications needed to facilitate both scheduling and E-Video

sessions. Enabling doctors, hospitals, and pharmacies to register on the platform and customers can access and book appointments

seamlessly and contactless, and integrated with payment gateways. |

In

Development |

Phaces.io

http://phaces.io |

|

A

SaaS solution for Organizations to enable Facial Recognition for security verification and to authenticate users for online meetings,

webinars, conferences and onsite meetings or events. |

In

Development |

OriginatorX

http://originatorx.com |

|

The platform underwrites the entire issuing,

publishing and auditing process of the Digitization of Debt, Equity or Patents into Tokens or Crypto Coins. Delivers a powerful management

and audit application to Issue ERC20 Tokens and streamlines them into the new global economy by way of SmartContract Auctions.

“Underwriting” refers to the process

of compiling all company data, (e.g. corporate, legal, and management information, etc.) required to be collected and verified, and

authorized for approval. This is the equivalent of a banking institution’s “KYC” process for a guaranteed debt

note, whereby the issuer of the note must submit the data and structure of the product to be tokenized into a digital token. The

offering of the token or digital debt / asset and valuation including the maximum supply and rules of engagement, also known as Tokenomics,

must all be included as part of the underwriting process. |

In

Use |

NFT Limited Series

http://nftlimitedseries.com |

|

NFT Limited series offers the unique ability

to curate in sequence multiple NFTs, thus creating a limited series. NFT Limited Series is a new addition to the Company’s

Ecoverse – designed to Mint your NFTs

The platform also offers a virtual tour of

the NFT marketplace allowing individuals to browse through the options, choose from the store and purchase. Artists, businesses and

individuals can mint and display their products / services and NFTs in the marketplace and place a bid option within a specified

timeframe. |

In

Use |

Axepay.com

https://axepay.com |

|

The

platform is an end-to-end fully automated cloud-based, cross-border, enterprise grade payments infrastructure that seamlessly processes

multiple transaction payment types (B2B,B2C, B2B2C, C2B,P2P) and methods (e-commerce /e-billing /e-escrow/MPOS and POS/ single or

bulk pay-in and pay-out, prepaid cards top up/send) with risk management and a global compliance ecosystem all accessible by an Axepay

API and a user interface. Axepay provides a portal for cross-border FX payments as a service by allowing access to our network of

financial services partners and specializes in offering cross-border payment rails for more than 180 countries and onboarding in

more than 42 Countries including China. |

In

Use |

Operational

History

Since

the beginning of 2015, the Company has focused on two distinct channels of business development:

| |

1) |

The development and commercialization of its proprietary software platform solutions and applications for the payments, incentives and events industries; and |

| |

2) |

Strategic partnerships to develop alterative payments solutions for payment industry businesses, including banks, telecoms, acquirers / issuers of credit cards (e.g. credit, debit and loyalty cards) as an acceptance point for emulating payment and rewarding transactions, processing and settlement. |

The

Company’s first partnership entered into with Contact Innovation in North America in late 2014 and early 2015 resulted in the technology

development for our Check21 Act software platform, servicing the need for Remote Deposit Capture (RDC), which was commercially deployed

in trial stages in late May 2015 with the Company’s first joint client, ICICI Bank of India (its Canadian subsidiary across 14

branches and select corporate clients). The platform solution as a cloud-based host was ultimately branded as Check21saas.com, and its

successful deployment is now allowing us to market the platform to customers internationally. Concurrently with the development success

of Check21Saas.com, the Company commenced the design and development of its Genorocity.com platform, and shortly thereafter, its Mtickets.events

platform.

Throughout

2016 and 2017, the Company ambitiously sought to expand its technology portfolio to meet the new changes in global markets for payment

business processing applications and the foreseeable demand in the financial, workforce and retail markets for intelligent business applications

ready to deploy.

Throughout 2017 and 2018, the Company

continued to develop its payment technology infrastructure and worked with our existing customers to commercialize software solutions,

strengthening its position in the financial services segment. We also began transitioning the Company from a direct merchant services

provider to enabling a channel of portfolio merchants for banks and telecom businesses. This transition allows us to position ourselves

as a technology host to support processors and industry consultants while further building relationships with banks and credit unions

and partnering with payment providers globally. A series of successful industry channel partners in Airlines, Events Management, and Shopping

Centers, opened up opportunities for the Company to leverage a definitive strategy to design, develop and license its technology portfolio.

The introduction of Menu.events, Mytravel.menu, Onroute.tech became part of the Company’s expanding offering.

In

2018, the Company invested in executive management in India to open a new channel of business opportunities to accelerate our technology

offerings in a new robust economy of scale. We have been strategizing avenues for working with financial institutions in India and educating

them on our technology portfolio, so that we might enter the Indian market as a vibrant technology company and leader in the Electronic

Know Your Client (“EKYC”) marketplace for digital solutions. We are actively working with the Mumbai FinTech Hub (established

by the Government of Maharashtra for implementing Maharashtra State FinTech Policy), VISA, the India Institute for Development and Research

in Banking Technology or “IDRBT” (the Certifying Authority for the Indian Banking and

Financial Sector, licensed by the Controller of Certifying Authority, Government of India, for issuing Digital Certificates), and more

recently the PWC India’s International Financial Service Centre or “IFSC” (set-up to undertake financial services transactions

that are currently carried on outside India by overseas financial institutions and overseas branches / subsidiaries of Indian financial

institutions), in connection with embedded financial services products and embedding domestic payment schemes utilizing the Company’s

technologies. In addition, the Company is in continual engagement with financial institutions and enterprises in the India region to

provide access the Company’s product portfolio, and with respect to integrations with Visa CyberSource and Visa Direct, which provides

potential significant value as it would allow us to service or license to any Visa member bank or enterprise worldwide that is enabled

with the Visa Payment Facilitator. Visa Payment Facilitator acquiring is a payment processing service licensed to member banks through

major card schemes such as Visa, MasterCard, Amex, and Discover.

The

Company’s 2018 launch of Granularchain.com created an important opportunity for the Company, as these solutions cater to larger

enterprises required to meet the EKYC requirements. Granularchain.com is a multi-link relationship management solution for Signature

capture EKYC for the financial industry, which allows financial institutions and enterprises to create, issue and manage securely a QR

engine-exchange for permission-based “invitation only” access of client profiles, documents, digital signatures, for corporate

or individual users. Granularchain.com uses a blockchain token to create tamper-resistant encryption of data within the system, but neither

Granularchain.com nor the Company logs or maintains any client data. Neither Granularchain.com nor the Company are involved in the issuance

or management of any cryptocurrency issuances or offerings. Please see our “Risk Factors” for additional information regarding

the use of blockchain elements. One of the more widely known inherent risks associated with the

blockchain relates to the 51% vulnerability, which can permit an attacker to break down the consensus mechanism and assume control over

the blockchain.

The

Company’s expansion in India has led to our establishment of various strategic alliances, including:

| ● | Mumbai

Fintech Hub - A Government of Maharashtra Initiative for implementation and promotion

of Fintech in the State, located Mumbia, in the Financial and Economic capital of India. |

| ● | Compuage

Infocomm India Ltd. - A major distributer in India with roughly 12500+ online and

offline retailers, resellers and system integrators in SAARC Region |

| ● | Wipro

Ltd. - An IT & ITES service company and integration company with a market cap

of $8B USD. Wipro caters to the EU, Middle East and Africa regions, giving the Company access

to with Banks, Financial Institutions, Organizations and Governments in the regions. |

| ● | Redington

India Ltd. - An in-principal approval to access their distribution channel of 37,500

Channel Partners and Resellers in the India and SAARC regions, Middle East, Africa, and South

East Asia. |

| ● | IDBRT

(Institute for Development and Research in Banking Technology) - Established by the

Reserve Bank of India, is a unique institution focused exclusively on Banking Technology.

The Company works closely with the organization to assist them with innovative technology

for Indian banks |

In

2020, the Company released three additional SaaS platforms to meet the needs of concerns raised by the COVID-19 Pandemic, which created

further opportunities in education technology (“Edtech”), Telemedicine, and pre-screening security technologies. Our response

to this was our release of our Eschool.systems, Phaces.io, and Doctor-Vid software platforms, which are having success with opportunities

in cloud products distribution in the India and the SARC regions. During this time, the Company began planning its expansion plan into

Blockchain, Non-Fungible Token (NFT), Digital Token issuances, and Smart Contracts as an alternative payments scheme.

Recent

Developments

In

2021, the Company focused on several business engagements for the development of its distributor sales channel, including our engagement

with ITD Cloud, a US based distribution company with over 30 resellers in technology VoIP services in the US. we also engaged a major

distributer, Compuage Infocomm India, which has over 10,000 resellers throughout India, and the SARC and EMEA regions. Compuage Infocomm

India’s primary customers are banks and telecoms. This engagement became a strategic entry point for promoting through experiences

in the field networks. This engagement provided the Company with a wider reach to approach and offer clients with the technology suite

through this partnership. In addition, throughout 2021 – 2022, the Company engaged with various payment partners worldwide, including:

| |

● |

XCoop. A company which provides services to Latin America expanding the reach of our payment rails in LATAM. |

| |

● |

Unified Signal. A company with over 44 Million Wallet Clients. |

| |

● |

FacilitaPay. This integration provides Payment and a Bank as a Service (BaaS) platforms for companies around the world that needs to connect to the LATAM financial ecosystem and infrastructure. |

| |

● |

FISERV: This offering provides PCI Compliant PoS and MPoS devices giving Card present options to our clients in North America |

| |

● |

XE: This engagement provides a comprehensive range of currency services and products, including our Currency Converter, Market Analysis, Currency Data API and quick, easy, secure Money Transfers for individuals and businesses. |

| |

● |

Cambioreal. This engagement facilitates international money remittance in Brazil and the US. |

| |

● |

AnyPay: A new way of accepting payments in the Philippines. The Anypay platform was built by the Company and is an ecommerce payment cart and wallet for merchants and individuals in the Philippines through our minority stake in XPay World. The platform is backed by the PF license that was granted to Xpay World from Paymaya, which is a subsidiary of the largest telecom companies in the Philippines. |

| |

● |

Cellulant: The engagement expands our reach in the African sub-continent in approximately 26+ countries. |

The

Company also expanded various products in connection with our intellectual property portfolio, keeping abreast of market requirements,

including.

| ● | NFT

Limited Series: A NFT minting, issuing, publishing and trading platform. |

| ● | A

Bots Life: An AI-driven chat bot for organizations to engage with clients on aspects

including sales inquiry, support, product walk through, regtech analysis and more. |

Our

continuing strategy is to develop a seamless portfolio of specialized industry payment technology wireframes, marketplaces and to allow

our customers to “Brand As Their Own” for e-commerce and E-POS semi-integrated solutions on the cloud and mobile infrastructures

to market and enable their portfolios of merchants and consumers. The result is a robust performing lineup of middleware’s that

integrate easily with various types of payment industry financial institutions and processors creating a powerful gateway. We target

banks and Third Party Processors for host issuing, acquiring and local payment industry businesses with an existing merchant portfolio

mix that is ready for a breadth of trending technologies which incorporate everything from payments, blockchain to social-media advantages

for their customers with an integrated price matrix to their gateways to provide seamless activations and revenues.

On

September 20, 2019, the Company entered into an agreement to license its technology to XPAY World Corporation (“XPay”) in

the Philippines in exchange for seven percent of XPay’s outstanding shares of common stock. Pursuant to this agreement, the Company

and XPay worked in collaboration to develop and bring to market a payments industry certification PCI in the Philippines, and to introduce

the Company’s entire technology portfolio into the India market. In addition, the Company developed the Anypay.ph platform for

Xpay to deliver to market a payment solution for onboarding micro merchant accounts through the payment facilitator and third party processors

licenses. Xpay was sponsored by PayMaya the subsidiary of Smart Telecom and KKR Group Investments.

On

June 25, 2021, the Company entered into a purchase of source code agreement with Acquisition Botberries Inc. in India to acquire a copy

of its source code with embedded artificial intelligence for the Company to fast-track the technology in its own platforms for an enhanced

virtual assistant and customer experience. The Company’s “Abotslife” technology in its IP portfolio and its Chat Bot

Ai technology source library allows the Company to advance production of virtual customer relationship management and develop a virtual

assistant solution for businesses to service customers with Artificial Intelligence and self -service automation techniques.

A

new virtual market is becoming more favorable to the concept of Metaverse and embracing Crypto, NFT and Blockchain. The Company has strategically

developed a series of platforms which enable organizations and communities to deploy faster in order to meet the expectations and preferred

engagement environments of today’s customers. Not only can an individual now launch a coin in the virtual market, but individuals

can ensure that these coins provide the user with an added value purpose which becomes the driving force to engage all the community

members at large.

In

early 2022, we began the development and deployment of three new platforms in the Blockchain sector, as follows:

| |

1. |

NFT Limited Series (http://www.nftlimitedseries.com). A platform which offers the unique ability to curate in sequence multiple NFTs, thus creating a limited series. NFT Limited Series is a new addition to the Company’s Ecoverse, designed to “Mint your NFTs”. |

This

platform also offers a virtual tour of the NFT marketplace allowing individuals to browse through their options, choose from the store

and purchase. Artists, businesses and individuals can mint & display their products / services and NFT in the marketplace and place

a bid option within a specified timeframe.

| |

2. |

OriginatorX (http://originatorx.com).

A platform which “underwrites” the entire issuing, publishing and auditing process of the Digitization of Debt, Equity

or Patents into Tokens or Crypto Coins. The platform delivers a powerful management and audit application to Issue ERC20 Tokens and

streamlines them into the new global economy by way of SmartContract Auctions. “Underwriting” refers to the process of

compiling all company data, (e.g. corporate, legal, and management information, etc.) required to be collected and verified, and

authorized for approval. This is the equivalent of a banking institution’s “KYC” process for a guaranteed debt

note, whereby the issuer of the note must submit the data and structure of the product to be tokenized into a digital token. The

offering of the token or digital debt / asset and valuation including the maximum supply and rules of engagement, also known as Tokenomics,

must all be included as part of the underwriting process. |

| 3. | MetaRealm.agency

(https://metarealm.agency). An agency platform for VR and AR viewing with an enhanced

service creator studio for virtual shops. |

The

design of these combined strategies for the coins launched by an enterprise incorporates a multi-tenant multi-industry solution, “Tokenomics”

- allowing onboarding merchants a marketplace where they upload their products, services and offers. The community members use their

coins to trade, exchange or redeem to purchase or remit. Further, the merchant engages with the customers through various methods of

engagement i.e., Loyalty Rewards programs, Retail, E-gaming and Esports.

Our

combination of platforms enable an organization or a community to create a self-sustaining eco-system to launch their own coins and marketplace,

for individuals and merchants, with an engagement tool to ensure a faster go to market strategy.

One

example of our live business use case application is our client, Shekel Coin. This coin is launched for a community creating an ecosystem

to engage individuals and merchants and ensuring that all the necessity of a given household is fulfilled with in the Metaverse of their

own making. We refer to this as, “Metaverse in Action, as unlike most Metaverses, our strategy provides all that a user may have

imagined with a hands-on life application and usage.

It

is evident that with the mass adoption of Virtual and Augmented Reality, and the popularity of Metaverses and Digital Realms, the next

phase for enterprises and financial institutions will likely represent the necessity to enter these new market segments and channels.

Our role is to provide the utilities and tooling required to deliver the customer journey for b2b, b2c, b2b2c and p2p channels. The Company

has opened its design studio for AR & VR design under the marketable domain, Metarealm.agency, to offer our customers the ability

for digital collaborations.

XPay

Worldwide Overview

XPAY

Worldwide Corporation (“XPay”) is Philippines-based and globally deployed boutique technology solutions provider that delivers

the newest Digital Transition and Financial technologies available today. The Company holds a seven percent minority stake in XPay. The

Company’s partnership with XPay provides for a payment technology known as a Terminal Management Solution (TMS), which allows for

technology applications that require Android Point of Sale terminals to accelerate services to the Company’s South East Asia clients

for their Digital Transformation and Payment initiatives. Xpay works closely with clients from inception (prototyping, planning), through

designing and building phase, to the completion of the supply chain (deploying, managing) and fills any gaps in digital operations and

payment strategy with a customized solution. XPay provides all required resources to elevate a company’s Digital Payment and Marketplace

and White-labels their certified payment infrastructure to elevate clients to a premier payment provider to their consumer and institutional

market.

Services

offered by XPay:

| |

● |

PCI Compliant Remote TMS Host, which includes a Merchant Management Platform, Payment Switch and e-Commerce gateways |

| |

● |

AWS Hosting |

| |

● |

EMV PoS Android Device Certification |

| |

● |

MPoS integrated and certified |

| |

● |

E-Commerce Cart |

| |

● |

Virtual Terminal |

| |

● |

Blockchain AI |

| |

● |

Payment Facilitation License (Philippines): VISA, MasterCard, JCB, AMEX (USD &PHP) |

| |

● |

Third Party processor License in progress: : VISA, MasterCard, JCB, AMEX (USD &PHP) |

| |

● |

Aggregator for Gcash & Maya Super wallets Philippines |

The below table demonstrates

the Personal Card Information, or, “PCI”, and methods of contact for card payment flows, utilizing the XPay Terminal Management

Host Switch for EMV POS (Euro MasterCard Visa chip and pin compliant payment terminals) devices and card acceptance for Card Present

Transactions by Xpay. “Terminal Management Host Switch” or “TMS” is a payment card acceptance platform for point-of-sale

terminals and e-commerce carts. The column on the left specifies the license or certification requirement as part of the PCI which Xpay

has completed and maintains as an industry standard. “PCI” is an industry standard requirement for “Personal Card Information”

security. The column on the right describes usage under specific licenses or certifications granted by the sponsor acquiror of record

in the respective country.

| Payment Processing |

| License/ Certification |

Description |

| PCI-DSS L3.2.1 Certified |

One of the first smart Cloud Payment Processing switches to be built and PCI certified on AWS Cloud servers across the full spectrum of the payment universe, allowing plug-and-play white-labeling at a fraction of the cost and time for Enterprises and Financial Institutions. |

| Payment Facilitator and Third-Party Processor Licenses |

The

only payment facilitator and third-party processor License issued by PayMaya to XPay in the Philippines (previously the subsidiary of

Smart Telecom and now independent through investments by KKR Group Investments).

Card types accepted: Visa, Mastercard, JCB, AMEX,

WeChatpay, Alipay, PayMaya, Gcash, GrabPay*, and BancNet*

Processing in USD and PHP and settlement of funds.

Built

specifically for infinite plug-ins of payment methods, including but not limited to: Fiat, E-Cash, Loyalty, and Cryptocurrencies |

| Online Payment System (OPS) Registration |

Regulated by the Central Bank of the Philippines​ (Bangko Sentral Ng Pilipinas) |

| AML Certified |

Regulated by Philippines Anti-Money Laundering Council |

| Visa Direct |

Interconnectivity for Card-to-Card Transfer as part of the Visa Everywhere Initiative |

Xpay

World Architecture

Philippines

Commercial Expansion

XPay

Philippines’ flagship client is Packworks Ventures, Inc., which provides enterprise resource planning (“ERP”) and other

enterprise software solutions to more than 150,000 sari-sari stores throughout the Philippines. Packworks’ solution is deployed

as a technology layer that covers the full sari-sari value chain, including inventory ordering from the Brand Principals selling to resellers,

or, “mega sari sari stores”, and the reselling activity to the smaller retailers, or, “micro sari sari stores”.

Packworks,

using software integrations with XPay’s payment platform and the Company’s proprietary technologies will deliver value added

financial services. The initial stages are underway and include payment acceptance, loyalty, and wallet issuing. Later stages will include

loan, insurance, and bank account origination, among others.

Upcoming

Licensing Opportunities

XPay

Philippines is engaged in advanced negotiations for the acquisition of a target company holding Philippine Central Bank licenses for

Electronic Money Issuing, Virtual Asset Service Provider (crypto currency), and Remittance Transfer Company.

Potential

Acquisition of Additional XPay Singapore Equity

The

Company and XPay Singapore have entered discussions for the Company’s acquisition of additional shares of XPay Singapore as a result

of XPay Philippines’ delivery of the commercial engagement with Packworks, which is due to successful collaboration and integration

of the Company and the XPay Payment Platform.

Axepay

Inc.

The

Company’s partnership with Axepay Inc., a Canadian corporation (“Axepay”), commenced in 2016 to allow for cross-border

payments including China. Axepay.com is a direct service to market platform for cross-border payments. The business model is based on

embedded partnerships with financial service providers (financial institutions, MSBs, PSPs, EMIs and other payment service and foreign

exchange providers that are regulated in the funds transfer, remittance, and foreign exchange trade desk industries. Our financial service

partners have an important role in the Axepay infrastructure as Axepay.com is a technology solution and the platform provides the digital

signature confirmation of instructions to our financial services partners on behalf of our clients and ultimate end-users. Any funds

transferred payments or payments made using the Axepay platform are transferred by one or more of our financial services partners, depending

on the type and method of payment. We currently have a large roster of financial service partners ready to deploy and we continue to

explore and finalize additional providers to expand the financial service ecosystem of Axepay.

2022

Private Placement

On March 10, 2022 (the “Issuance

Date”), the Company entered into a Securities Purchase Agreement with Leonite Fund I, LP, an accredited investor (the “March

2022 Investor”), to provide for the sale by the Company to the March 2022 Investor of a Senior Secured Promissory Note in the aggregate

principal amount of $568,181.82 (the “March 2022 Note”, and, the “Financing”), to be paid by the March 2022 Investor

to the Company in two tranches (each, a “Tranche”). The first Tranche consists of a payment by the March 2022 Investor to

the Company on the Issuance Date of $250,000, from which the March 2022 Investor retained $10,000 to cover its legal fees. A second Tranche

consisting of $250,000 will be paid by the March 2022 Investor to the Company upon the Company achieving net earnings in excess of $45,000

in two (2) consecutive calendar quarters during the 12 month period following the Issuance Date, less $5,000 which the March 2022 Investor

will retain to cover its legal fees, resulting in an aggregate amount of up to $500,000 in total proceeds to be received by the Company

in the Financing. The principal amount of the March 2022 Note includes an Original Issue Discount of $68,181.82 (the “OID”),

resulting in an aggregate of up to $500,000 in total proceeds received by the Company in the Financing. The OID will be earned upon each

Tranche on a pro-rata basis. (For example: upon the advance of the first Tranche, $34,090.91 will be added to the principal amount of

the outstanding Note in addition to the amount advanced, and the total amount owed, or the total principal amount, will be $284,090.91.)

In addition to the March 2022 Note, the March 2022 Investor also received (i) 3,000,000 shares of common stock of the Company (the “Shares”),

and (ii) a common share purchase warrant (the “Warrant”, and together with the March 2022 Note and the Shares, the “Securities”)

to acquire 5,000,000 shares of common stock of the Company. The Warrant is exercisable for five(5) years at an exercise price of $0.12

per share. The closing of the Financing in the amount of $250,000 occurred on March 10, 2022.

The

maturity date (the “Maturity Date”) for each Tranche is at the end of the period that begins on the date each Tranche is

advanced and ends twelve (12) months thereafter, and interest associated with the March 2022 Note will reset daily and accrue at a rate

equal to the greater of 14% per annum or WSJ Prime plus 6%, which is payable monthly by the Company. The March 2022 Note may be prepaid

by the Company in whole or in part at any time, at 110% of the outstanding principal and accrued interest. In the event of default by

the Company of the March 2022 Note, any amount of principal plus interest due will bear interest at the lesser of the rate of 24% per

annum or the maximum legal amount permitted by law. The March 2022 Note and the Warrant carry standard anti-dilution provisions. In addition,

pursuant to the March 2022 Note we agreed to file a Form S-1 Registration Statement to register the Securities. The March 2022 Note might

be accelerated if an event of default occurs under the terms of the March 2022 Note, including, but not limited to, the Company’s

failure to pay principal and interest when due, certain bankruptcy events or if the Company is delinquent in its SEC filings. The Warrant

may not be exercised by the March 2022 Investor into more than 4.99% of the Company’s outstanding common stock at any point in

time.

If

prior to the Maturity Date, the Company enters a subsequent financing on terms that are more favorable to the investor(s) in the subsequent

financing than the terms of the Financing, the terms of the Financing will be amended to include such better terms so long as the March

2022 Note is outstanding. In addition, the March 2022 Investor has the right of first refusal on any financing so long as the March 2022

Note is outstanding. Additionally, the March 2022 Investor has the right to be repaid 100% of the remaining balance of principal and

interest under the March 2022 Note from the net cash proceeds of any future financing or asset sale closed on by the Company, provided,

however, that the repayment obligation will only be applicable to up to 50% of the first $500,000 in the aggregate generated by the Company

from any future financing proceeds. Further, the March 2022 Investor has the right to participate in any future offering by the Company

for a period of eighteen (18) months from the Issuance Date for an amount up to the Financing amount in strict accordance with the terms

of such future offering. In addition, the Company is required to file a Registration Statement on Form S-1 with the SEC to register the

Shares, and the shares of common stock issuable upon exercise of the Warrant.

The

obligations of the Company under the March 2022 Note constitute a first priority security interest and rank senior with respect to any

and all indebtedness of the Company existing prior to or incurred as of or following the initial Issuance Date. The obligations of the

Company under the March 2022 Note are secured pursuant to the Security and Pledge Agreement entered into between the Company and the

March 2022 Investor on the Issuance Date. So long as the Company has any obligation under the March 2022 Note, the Company will not incur

or suffer to exist or guarantee any indebtedness that is senior to or pari passu with the Company’s obligations under the March

2022 Note. The March 2022 Note is secured by the assets of the Company.

The

Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”)

for the private placement of the Securities pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated

under the Securities Act. The March 2022 Investor is an accredited investor as defined in Rule 501 of Regulation D promulgated under

the Securities Act. The March 2022 Note is a debt obligation arising other than in the ordinary course of business which constitutes

a direct financial obligation of the Company.

The

foregoing information is a summary of each of the agreements involved in the transactions described above, is not complete, and is qualified

in its entirety by reference to the full text of those agreements, each of which is attached an exhibit to this prospectus. Readers should

review those agreements for a complete understanding of the terms and conditions associated with this transaction.

Corporate

History

The

Company was incorporated in the State of California on July 19, 1983, as Quality Associates, Inc., and changed its name to ComputerMarketplace,

Inc. in June 1987. In March 1993, ComputerMarketplace, Inc. (i) changed its name to Computer Marketplace(R), Inc. (“Computer Marketplace(R)”)

and (ii) changed its state of incorporation from California to Delaware. On August 27, 1999, the Company changed its trading symbol on

the OTC Bulletin Board from “MKPL” to “EMKT” in contemplation of its name change to eMarketplace Inc., which

such name change was effectuated on September 17, 1999.

On

February 10, 2006, the Company filed a Certificate of Incorporation with the State of Delaware to redomicile the Company in the State

of Delaware with 100,000,000 authorized shares of common stock $0.001 par value per share.

On

March 3, 2006, the Company filed a Certificate of Amendment of Certificate of Incorporation to (i) change the name of the Company from

eMarketplace Inc. to Smart Card Marketing Systems, Inc., and (ii) effect a reverse stock split of its issued and outstanding shares of

common stock at a ratio of 1000:1, while maintaining its number of authorized shares of common stock at 100,000,000 shares. Additionally,

on March 3, 2006, the Company changed its stock symbol from “EMKT” to “SMKG”.

On

March 15, 2006, the Company entered into a definitive share exchange agreement (the “Share Exchange Agreement”) with the

shareholders (the “Smart Card Canada Shareholders”) of Smart Card Marketing Systems Inc., a Canadian corporation (“Smart

Card Canada”), pursuant to which the Company agreed to acquire from the Smart Card Canada Shareholders all of the issued and outstanding

shares of common stock of Smart Card Canada held by the Smart Card Canada Shareholders in exchange for 53,999,999 restricted shares of

common stock of the Company (the “Share Exchange Transaction). The Share Exchange Transaction closed on March 15, 2006 (the “Closing

Date”). As a result of the consummated Share Exchange Transaction, our operations and management shifted to that of Smart Card

Canada.

On

January 8, 2008, the Company filed a Form 15 with the Securities and Exchange Commission to deregister the Company’s shares of

common stock and suspend its reporting obligations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

On

October 26, 2012, the Company filed a Certificate of Amendment of Certificate of Incorporation with the State of Delaware to increase

its number of authorized shares of common stock from 100,000,000 to 300,000,000 shares.

On

February 22, 2018, the Company filed a Certificate of Amendment of Certificate of Incorporation with the State of Delaware to increase

its number of authorized shares of common stock from 300,000,000 to 500,000,000 shares.

Corporate

Information

The

Company was incorporated in the State of California on July 19, 1983, subsequently changed its state of incorporation to Delaware in

March 1993, and redomiciled in the State of Delaware on February 10, 2006. The Company changed its name to Smartcard Marketing Systems,

Inc. on March 3, 2006.

Our

corporate headquarters is located at 20C Trolley Square, Wilmington, DE 19806. Our corporate telephone number is 844-843-7296. Our website

address is www.smartcardmarketingsystems.com. We have not incorporated by reference into this prospectus the information on our website,

and you should not consider it to be a part of this prospectus or any prospectus supplement.

Risks

Factor Summary

The

following is a summary of the more significant risks relating to our Company. A more detailed description of each of the risks can be

found below in this prospectus under the caption “Risk Factors.” Our business and ability to execute our business strategy

are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider

the following risks, which are discussed more fully in the section entitled “Risk Factors” in this prospectus, as well as

the other risks described in the section captioned “Risk Factors.”

Risks

Related to our Business

| |

● |

We have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future. |

| |

● |

We have not generated a significant amount of net income and may not be able to sustain profitability or positive cash flow. |

| |

● |

We will need substantial additional funding to continue our operations, which could result in significant dilution or restrictions on our business activities. We may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our product development programs or commercialization efforts and could cause our business to fail. |

| |

● |

We are heavily dependent on the success of our lead product candidates (which are in various stages of development), which will require significant additional efforts to develop and may prove not to be viable for commercialization. |

| |

● |

We will need to grow the size of our organization, and we may experience difficulties in managing any growth we may achieve. |

| |

● |

If our efforts to protect the proprietary nature of the intellectual property related to our technologies are not adequate, we may not be able to compete effectively in our market and our business would be harmed. |

| |

● |

If we are not able to attract and retain highly qualified personnel, we may not be able to successfully implement our business strategy. |

| |

● |

We have identified weaknesses in our internal controls and there can be no assurance that these weaknesses will be effectively remediated or that additional weaknesses will not occur in the future. |

| |

● |

Our share price is expected to be volatile and may be influenced by numerous factors, some of which are beyond our control. |

Risks

Related to our Industry

| |

● |

The market for cloud solutions and mobility applications is highly competitive and we may be unable to compete effectively. |

| |

● |

We may be unable to respond to rapid technological changes with new solutions in a timely and cost-effective manner. |

| |

● |

Any significant disruption in service on our computer systems or caused by our third-party storage and system providers could damage our reputation and result in a loss of customers. |

| |

● |

If a cyber-attack was able to breach our security protocols and disrupt our data protection platform and solutions, and any such disruption could increase our expenses, damage our reputation, harm our business and adversely affect our stock price. |

| |

● |

The extent to which the COVID-19 pandemic could disrupt or adversely impact our future business, financial condition and results of operations is highly uncertain and cannot be predicted. |

| |

● |

Our services are dependent on our customers’ continued access to high-speed internet and the continued reliability of the internet infrastructure. |

| |

● |

We may not be able to retain our existing customers. |

| |

● |

A decline in demand for our services would cause our revenue to decline. |

| |

● |

We are partially dependent on third-party distributors to generate new customers and such relationships may be terminated or may not continue to generate new customers. |

| |

● |

We may be unable to sustain market recognition or brand loyalty and we may lose customers or fail to increase the number of our customers. |

| |

● |

We are subject to governmental regulation and other legal obligations related to privacy and any actual or perceived failure to comply with such obligations would harm our business. |

| |

● |

Errors, failures, bugs in or unavailability of our solutions released by us could result in negative publicity, damage to our brand, returns, loss of or delay in market acceptance of our solutions, loss of competitive position, or claims by customers or others. |

| |

● |

We face many risks associated with our growth and expansion plans, including relating to our intended international expansion. |

| |

● |

Challenges faced by our partner banks may also have a direct impact on our business and create harm. |

| |

● |

The loss of one or more of our key personnel, or our failure to attract, integrate, and retain other highly qualified personnel, could harm our business and growth prospects. |

Risks

Related to Intellectual Property

● Assertions

by a third party that our solutions infringe its intellectual property, whether or not correct, could subject us to costly and time-consuming

litigation or expensive licenses.

Risks

Relating to our Common Stock and Securities

● Our

stock price has fluctuated in the past, has recently been volatile and may be affected by limited trading volume and price fluctuations.

● We

may be subject to the SEC’s penny stock regulations.

● Upon

exercise of our outstanding warrants we will be obligated to issue a substantial number of additional shares of common stock which

will dilute our present shareholders and may cause our stock price to decline.

● We

may issue preferred stock without approval of our shareholders and have other antitakeover defenses which may make it more difficult

for a third party to acquire us and could depress our stock price.

● We

do not intend to pay cash dividends for the foreseeable future.

Please

see “Risk Factors” beginning on page 20 of this prospectus for a more detailed

discussion of these risks. Additional risks, beyond those summarized above or discussed under the caption “Risk Factors”

or described elsewhere in this prospectus may also materially and adversely impact our business, operations or financial results.

|

SUMMARY

OF THE OFFERING

| Common Stock outstanding before the Offering |

|

491,892,061 |

| |

|

|

| Common Stock offered by selling stockholders |

|

13,500,000 |

| |

|

|

| Common Stock Outstanding after the Offering |

|

491,892,061 (1) |

| |

|

|

| Use of Proceeds |

|

We will not receive any of the proceeds from the sale of shares

by the selling stockholders |

| |

|

|

| OTC Markets Trading Symbol |

|

SMKG |

| |

|

|

| Risk Factors |

|

The Common Stock offered hereby involve a high degree of risk and

should not be purchased by investors who cannot afford the loss of their entire investment. See the section entitled “Risk

Factors” beginning on page 20 of this prospectus for a discussion of factors you should carefully consider before deciding

to invest in our common stock. |

| |

(1) |

Assumes

that none of the warrants for an aggregate of 5,000,000 shares of our common stock issued to the investor in the 2022 Private Placement

have been exercised. |

|

As

of the date of this filing, there are no additional offers for shares, nor any options, warrants, or other rights for the issuance

of additional shares except those described herein. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties we describe below. The risks

and uncertainties described below are those significant risk factors, currently known and specific to us, which we believe are relevant

to an investment in our securities. If any of these risks materialize, our business, consolidated results of operations or consolidated

financial condition could suffer, the price of our securities could decline substantially and you could lose part or all of your investment.

Additional risks and uncertainties not currently known to us or that we now deem immaterial may also harm us and adversely affect your

investment in our securities.

Risks

Related to Financial Position

We

are an early-stage technology company and have a history of significant operating losses; we expect to continue to incur operating losses,

and we may never achieve or maintain profitability.

As

a development stage company, we do not currently have revenues to generate cash flows to cover operating expenses. Since our inception,

we have incurred operating losses in each year due to costs incurred in connection with research and development activities and

general and administrative expenses associated with our operations. For the years ended December 31, 2021 and 2020, we incurred

net losses of approximately $988,941 and $1,736,037, respectively. As of September 30, 2022 and December 31, 2021, we had

an accumulated deficit of $8,770,263 and $7,428,598, respectively.

We

expect to incur losses for the foreseeable future as we continue the development of technology products. If we fail to become profitable,

or if we are unable to fund our continuing losses, our shareholders could lose all or a substantial part of their investment.

We

will need substantial additional funding to operate our business and such funding may not be available or, if it is available, such financing

is likely to substantially dilute our existing shareholders.

The

development and commercialization of new technologies entails significant costs. As we are in early stage of the engineering, electronics,

algorithm and mechanical aspects of our software solutions and applications, we still must develop, modify, refine and finalize them.

To enable us to accomplish these and other related items and continue to operate our business, we will need to raise substantial additional

capital, or enter into strategic partnerships, to enable us to:

| |

● |

build or access development and commercialization capabilities; |

| |

|

|

| |

● |

Develop and test market our products; |

| |

|

|

| |

● |

acquire or license additional internal systems and other infrastructure; and |

| |

|

|

| |

● ● |

hire and support additional management and software development personnel. test and certify with regulatory agencies in the countries where we seek to deploy our products and services. |

Until

we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never achieve, we expect to finance

our cash needs primarily through public or private equity offerings, debt financings or through the establishment of possible strategic

alliances. We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are not able to secure

additional equity funding when needed, we may have to delay, reduce the scope of, or eliminate one or more of our clinical studies, development

programs or future commercialization initiatives.

In

addition, any additional equity funding that we do obtain will dilute the ownership held by our existing security holders. The amount

of this dilution may be substantially increased if the trading price of our common stock is lower at the time of any financing. Regardless,

the economic dilution to shareholders will be significant if our stock price does not increase significantly, or if the effective price

of any sale is below the price paid by a particular shareholder. Any debt financing that we obtain in the future could involve substantial

restrictions on activities and creditors could seek a pledge of some or all of our assets. We have not identified potential sources for

such financing that we will require, and we do not have commitments from any third parties to provide any future debt financing. If we

fail to obtain funding as needed, we may be forced to cease or scale back operations, and our results, financial condition and stock

price would be adversely affected.

We

will need substantial additional funding to continue our operations, which could result in significant dilution or restrictions on our

business activities. We may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our

product development programs or commercialization efforts and could cause our business to fail.

Our

operations have consumed substantial amounts of cash since inception. We expect to need substantial additional funding to pursue the

development of our software solutions and applications and launch and commercialize such products.

We

raised gross proceeds to us of $250,000 under the 2022 Private Placement. Even after giving effect to the 2022 Private Placement, we

will require significant additional capital for the further development and commercialization of our products (which are in various stages

of design and development) and may need to raise additional funds sooner if we choose to and are able to expand more rapidly than we

currently anticipate. Further, we expect our expenses to increase in connection with our ongoing activities. In addition, we expect to

incur significant commercialization expenses related to product development, marketing, sales and distribution.

Furthermore,

we expect to incur additional costs associated with operating as a public company. We may also encounter unforeseen expenses, difficulties,

complications, delays and other unknown factors that may increase our capital needs and/or cause us to spend our cash resources faster

than we expect. Accordingly, we will need to obtain substantial additional funding in order to continue our operations.

To

date, we have financed our operations through a mix of equity investments from private investors, the incurrence of debt, and technology

licensing revenues, and we expect to continue to utilize such means of financing for the foreseeable future. Additional funding from

those or other sources may not be available when or in the amounts needed, on acceptable terms, or at all.

If

we raise capital through the sale of equity, or securities convertible into equity, it would result in dilution to our then existing

stockholders, which could be significant depending on the price at which we may be able to sell our securities. For instance, in connection

with the closing of the 2022 Private Placement, we issued an aggregate of 3,000,000 shares of our common stock to the investor in that

offering as well as warrants exercisable for an additional 5,000,000 shares.

If

we raise additional capital through the incurrence of indebtedness, we may become subject to covenants restricting our business activities,

and holders of debt instruments may have rights and privileges senior to those of our equity investors. In addition, servicing the interest

and principal repayment obligations under debt facilities could divert funds that would otherwise be available to support research and

development or commercialization activities.

If

we are unable to raise capital when needed on commercially reasonable terms, we could be forced to delay, reduce or eliminate our research

and development for our technologies or any future commercialization efforts. Any of these events could significantly harm our business,

financial condition and prospects.

We

may never achieve profitability.

Because

of the numerous risks and uncertainties associated with the development and commercialization of software solutions and applications,

we are unable to accurately predict the timing or amount of future revenue or expenses or when, or if, we will be able to achieve profitability.

We have financed our operations primarily through contributions from our founders, the issuance and sale of equity and equity linked

securities, and technology licensing sales. The size of our future net losses will depend, in part, on the rate of growth or contraction

of our expenses and the level and rate of growth, if any, of our revenues. We expect to continue to expend substantial financial and

other resources on, among other things:

| |

● |

investments to expand and enhance our platforms and technology infrastructure, make improvements to the scalability, availability and security of our platforms, and develop new products; |

| |

|

|

| |

● |

sales and marketing, including expanding our indirect sales organization and marketing programs; |

| |

|

|

| |

● |

expansion of our operations and infrastructure, both domestically and internationally; and |

| |

|

|

| |

● |

general administration, including legal, accounting and other expenses related to being a public company. |

If

we are unable to successfully commercialize our products or if revenue from any of our products that receives marketing approval is insufficient,

we will not achieve profitability. Furthermore, even if we successfully commercialize our products, our planned investments may not result

in increased revenue or growth of our business. We may not be able to generate net revenues sufficient to offset our expected cost increases

and planned investments in our business and platform. As a result, we may incur significant losses for the foreseeable future, and may

not be able to achieve and sustain profitability. If we fail to achieve and sustain profitability, then we may not be able to achieve

our business plan, fund our business or continue as a going concern.

Our

quarterly results may fluctuate significantly and period-to-period comparisons of our results may not be meaningful.

Our

quarterly results, including the levels of future revenue, if any, our operating expenses and other costs, and our operating margins,

may fluctuate significantly in the future, and period-to-period comparisons of our results may not be meaningful. This may be especially

true to the extent that we do not successfully implement our business model. Accordingly, the results of any one period should not be

relied upon as an indication of our future performance. In addition, our quarterly results may not fully reflect the underlying performance

of our business. Factors that may cause fluctuations in our quarterly results include, but are not limited to:

| |

● |

the timing of commercial sales for our products in various stages of development; |

| |

|

|

| |

● |

our ability to successfully implement our business model; |

| |

|

|

| |

● |

our ability to attract and retain distribution networks, customers and to expand our business;

|

| |

● |

changes in our pricing policies or those of our competitors; |

| |

|

|

| |

● |

the timing of our recognition of revenue and the mix of our revenues during the period; |

| |

|

|

| |

● |

the amount and timing of operating expenses and other costs related to the maintenance and expansion of our business, infrastructure and operations; |

| |

|

|

| |

● |

the amount and timing of operating expenses and other costs related to the development or acquisition of businesses, services, technologies or intellectual property rights; |

| |

|

|

| |