UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Period April 2015 File No. 0-30720

Radius Gold Inc.

(Name of Registrant)

200 Burrard Street, Suite 650, Vancouver, British Columbia, Canada V6C 3L6

(Address of principal executive offices)

1.

News Release dated April 29, 2015

2.

Investment Policy

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

FORM 20-F x

FORM 40-F ¨

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Form 6-K to be signed on its behalf by the undersigned, thereunto duly authorized.

Radius Gold Inc.

(Registrant)

| |

Dated: April 30, 2015

| By: /s/ Simon Ridgway

Simon Ridgway

President and Director

|

![[radiusnrapril292015001.jpg]](radiusnrapril292015001.jpg)

news release

April 29, 2015

Radius Gold Completes Change of Business

Vancouver, Canada: Radius Gold Inc. (“Radius” or the “Company”) (TSX-V: RDU) is pleased to announce that the Company has received final approval from the TSX Venture Exchange (the “TSXV”) for the change of its business from that of a mineral exploration issuer to an investment issuer.

Effective April 30, 2015, the Company’s shares will commence trading on the TSXV as a Tier 1 Investment Issuer. There have been no changes in the Company’s trading symbol or CUSIP number as a result of the change of business.

A copy of the Company’s Investment Policy is available for viewing on SEDAR at www.sedar.com.

About Radius

Radius has been exploring for gold in Latin America for over a decade. The Company has a strong treasury and is looking for investment and project acquisition opportunities across the globe. Please call toll free 1-888-627-9378 or visit our web site (www.radiusgold.com) for more information.

ON BEHALF OF THE BOARD

Simon Ridgway

President and CEO

Symbol: TSXV-RDU

Contact: Simon Ridgway

200 Burrard Street, Suite 650

Vancouver, BC V6C 3L6

Tel: 604-801-5432; Toll free 1-888-627-9378; Fax: 604-662-8829

Email: info@goldgroup.com

Website: www.radiusgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking statements may include, without limitation, statements about the Company’s plans for its investments and properties; the Company’s business strategy, plans and outlook; the merit of the Company’s investments and properties; timelines; the future financial performance of the Company; expenditures; approvals and other matters. Often, but not always, these forward looking statements can be identified by the use of words such as “estimate”, “estimates”, “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “upgraded”, “offset”, “limited”, “contained”, “reflecting”, “containing”, “remaining”, “to be”, “periodically”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in the Company’s quarterly and annual filings with securities regulators and available under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: that the Company’s activities will be in accordance with its public statements and stated goals; that all required approvals will be obtained; that there will be no material adverse change affecting the Company or its investments or properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

![[radiusinvestmentpolicy001.jpg]](radiusinvestmentpolicy001.jpg)

(the “Company”)

INVESTMENT POLICY

Investment Objectives

The Company’s investment objectives are to seek:

a)

a high return on investment opportunities, primarily in the natural resources sector; and

b)

to preserve capital and limit downside risk while achieving a reasonable rate of return by focusing on opportunities with attractive risk to reward profiles.

The Company does not anticipate the declaration of dividends to shareholders during its initial stages and plans to reinvest the profits of its investments to further the growth and development of the Company’s investment portfolio.

Investment Strategy

In light of the numerous investment opportunities across the entire natural resources sector, the Company aims to adopt a flexible approach to investment targets without placing unnecessary limits on potential returns on its investment. This approach is demonstrated in the Company’s proposed investment strategy set out below.

Investment Sector:

Natural resources industry. All commodities that can be classified as natural resources may be considered for investment purposes, including, but not limited to, minerals, metals, petroleum, forestry and industries that derive their value from natural resources, such as power generation, and technologies that are used in the natural resources sector such as drilling and surveillance.

Investment Types:

Equity, debt, royalties, income and commodity streams, derivatives and any other investment structures or instruments that could be acquired or created.

Commodities:

All commodities that comprise natural resources. Such commodities may include, but are not limited to, precious metals, base metals, ferrous metals, nonferrous metals, industrial metals, non-industrial metals, agricultural minerals, industrial minerals, other minerals, oil, gas, water and forestry products.

Jurisdictions:

All countries are permissible depending on the risk assessment of the Board and Management at the time the investment is made and the risk-reward relationship associated with each investment in a particular jurisdiction.

Investment Size:

Unlimited, which may result in the Company holding a control position in a target corporation or possibly requiring future equity or debt financings to raise money for specific investments.

Investment Timeline:

Not limited.

Investment Targets:

Direct property investments either through outright purchase of a property or acquiring an option to earn an interest in a property, or through a derivative interest such as a royalty, stream or other derivative facility.

Investments in public or private corporations, partnership or other legal entities which own, or propose to own, natural resource assets or derivatives of natural resource assets.

Distressed situations where a change of management or other restructuring is required to realize the value of the asset.

Investment Review:

Will seek to maintain the ability to actively review and revisit all of investments on an ongoing basis.

Liquidity:

Will evaluate the liquidity of investments and seek to realize value from same in a prudent and orderly fashion.

Composition of Investment Portfolio

The nature and timing of the Company's investments will depend, in part, on available capital at any particular time and the investment opportunities identified and available to the Company.

Subject to the availability of capital, the Company intends to create a diversified portfolio of investments. The composition of its investment portfolio will vary over time depending on its assessment of a number of factors including the performance of financial markets and credit risk.

Procedures and Implementation

The senior officers and other management of the Company (“Management”) and the Company’s Board of Directors (the “Board”) and the respective members thereof shall work jointly and severally to uncover appropriate investment opportunities. These individuals have a broad range of business experience and their own networks of business partners, financiers, venture capitalists and finders through whom potential investments may be identified.

Prospective investments will be channelled through Management. Management shall make an assessment of whether the proposal fits with the investment and corporate strategy of the Company in accordance with the investment objectives and strategy set out in this policy, and then proceed with preliminary due diligence, leading to a decision to reject or move the proposal to the next stage of detailed due diligence. This process may involve the participation of outside professional consultants.

The Company will obtain detailed knowledge of the relevant business the investment shall be made in, as well as the investee corporation, their management team, quality of asset(s) and risks associated as applicable.

Once a decision has been reached to invest in a particular situation, a summary of the rationale behind the investment decision shall be prepared by Management and submitted to the Board. This summary should include, among other things, the estimated return on investment, timeline of investment, guidelines against which future progress can be measured, and risks associated with the investment. The summary should also disclose any finder’s or agent’s fees payable.

All investments shall be submitted to the Board for final approval. Management will select all investments for submission to the Board and monitor the Company’s investment portfolio on an ongoing basis, and will be subject to the direction of the Board. Management will present an overview of the state of the investment portfolio to the Board on a quarterly basis.

Negotiation of terms of participation is a key determinant of the ultimate value of any opportunity to the Company. Negotiations may be ongoing before and after the performance of due diligence. The representative(s) of the Company involved in these negotiations will be determined in each case by the circumstances of the investment opportunity.

Compliance

All investments shall be made in compliance with applicable laws in relevant jurisdictions, and shall be made in accordance with and governed by the rules and policies of applicable regulatory authorities.

From time to time, the Board may authorize such additional investments outside of the guidelines described herein as it sees fit for the benefit of the Company and its shareholders.

Management Participation

The Company may, from time to time, seek a more active role in the corporations in which it invests, and provide such corporations with financial and personnel resources, as well as strategic counsel. The Company may also ask for board representation in cases where it makes a significant investment in the business of an investee corporation. The Company’s nominee(s) shall be determined by the Board as appropriate in such circumstances.

Fund Status

The Company will aim to structure its investments in such a way as to not be deemed either an Investment Fund or Mutual Fund, as defined by applicable securities laws, thereby avoiding the requirement to register as a fund or investment advisor.

Conflicts of Interest

The Company has no restrictions with respect to investing in corporations in which a Board member may already have an interest. Any potential investments where there is a material conflict of interest involving an employee, officer or director of the Company may only proceed after receiving approval from the disinterested directors of the Board. The Company is also subject to the “related party” transaction policies of the TSX Venture Exchange, which mandates disinterested shareholder approval and valuations to certain transactions.

Prior to making any investment commitment, the Company shall adopt procedures for checking for potential conflicts of interest, which shall include but not be limited to a circulation of the names of a potential target corporation and its affiliates to the Board and Management.

All members of the Board shall be obligated to disclose any interest in the potential investment. In the event a conflict is detected, the target corporation shall be notified of the potential conflict in writing. The members of the Board and its advisors shall be responsible for detecting a potential conflict.

Where a conflict is determined to exist within Management or the Board, the individual having a conflicting interest shall provide full disclosure of their interest in the potential investment and, if such person is a Board member, shall abstain from voting on the investment decision but may participate in discussions regarding the potential investment opportunity.

The members of the Board and Management and their respective affiliates (collectively the “Parties”) are or may be involved in other financial, investment and professional activities which may on occasion cause a conflict of interest with their duties to the Company. These include serving as directors, officers, promoters, advisers or agents of other public and private corporations, including corporations in which the Company may invest. The Parties may also engage in transactions with the Company where any one or more of the Parties is acting in their capacity as financial advisor, broker, intermediary, principal, or counterparty, provided that such transactions are carried out on terms similar to those which would apply in a similar transaction between persons not connected with the Parties or any one of them and such transactions are carried out on normal commercial terms as if negotiated at arm’s length.

Amendment

The Company’s investment objectives, strategy and restrictions and other provisions of this Investment Policy may be amended from time to time on the recommendation of Management and approval by the Board. Unless required by the TSX Venture Exchange, approval by the Company’s shareholders of any such amendments is not required.

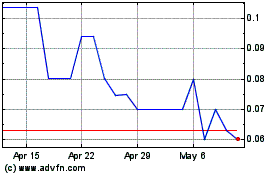

Radius Gold (PK) (USOTC:RDUFF)

Historical Stock Chart

From May 2024 to Jun 2024

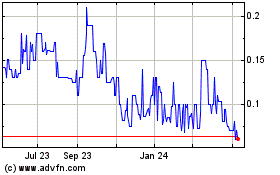

Radius Gold (PK) (USOTC:RDUFF)

Historical Stock Chart

From Jun 2023 to Jun 2024