UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Period November 2014 File No. 0-30720

Radius Gold Inc.

(Name of Registrant)

200 Burrard Street, Suite 650, Vancouver, British Columbia, Canada V6C 3L6

(Address of principal executive offices)

1.

News Release dated November 6, 2014

2.

News Release dated November 20, 2014

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

FORM 20-F x

FORM 40-F ¨

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Form 6-K to be signed on its behalf by the undersigned, thereunto duly authorized.

Radius Gold Inc.

(Registrant)

| |

Dated: November 21, 2014

| By: /s/ Simon Ridgway

Simon Ridgway

President and Director

|

![[radiusnrnov62014001.jpg]](radiusnrnov62014001.jpg)

news release

November 6, 2014

Early Warning Report

Vancouver, Canada: Radius Gold Inc. (TSX-V: RDU) announces that as a result of its exercise of previously acquired private placement warrants, it has acquired direct ownership of 3,000,000 common shares (“Shares”) in Medgold Resources Corp. (“Medgold”), such shares representing 7.2% of Medgold’s outstanding common shares. The Shares were issued at a price of $0.11 per Share, for a total purchase price of $330,000.

As a result of this transaction, Radius Gold directly owns 8,000,000 common shares of Medgold, which represents 19.1% of Medgold’s outstanding common shares. Radius also owns warrants (the “Warrants”) to purchase an additional 2,000,000 common shares of Medgold. Assuming the exercise of the Warrants in full, Radius would own a total of 10,000,000 common shares, which would represent 25.1% of the issued and outstanding common shares of Medgold on a partially diluted basis. However, the Warrants have a restriction on exercise such that Radius may only exercise at any given time the number of Warrants that will not result in Radius owning 20% or more of Medgold’s outstanding common shares

The shares were acquired by Radius for investment purposes, and it may from time to time, directly or indirectly, acquire additional securities of Medgold. The Shares were acquired by Radius in reliance on the exemption from prospectus requirements set forth in Section 2.42 of National Instrument 45-106, Prospectus and Registration Exemptions. Radius has filed on www.sedar.com a report in accordance with NI 62-103, and a copy of the report may be obtained by contacting Radius at the address noted below.

About Radius

Radius has been exploring for gold in Latin America for over a decade. The Company has a strong treasury as a result of exploration asset sales and is looking for project acquisition opportunities across the globe. Please call toll free 1-888-627-9378 or visit our web site (www.radiusgold.com) for more information.

ON BEHALF OF THE BOARD

“Simon Ridgway”

President and CEO

Symbols: TSXV-RDU; OTCQB-RDUFF

Contact: Simon Ridgway

200 Burrard Street, Suite 650

Vancouver, BC V6C 3L6

Tel: 604-801-5432; Toll free 1-888-627-9378; Fax: 604-662-8829

Email: info@goldgroup.com

Website: www.radiusgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking statements and include, without limitation, statements about the possible increase in the Company’s investment in Medgold. Often, but not always, these forward looking statements can be identified by the use of words such as “estimate”, “estimates”, “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “upgraded”, “offset”, “limited”, “contained”, “reflecting”, “containing”, “remaining”, “to be”, “periodically”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, whether the Company will acquire additional securities in Medgold; changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in the Company’s quarterly and annual filings with securities regulators and available under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: expectations regarding whether the Company will acquire additional securities in Medgold; that the Company’s stated goals and planned exploration and development activities will be achieved; that there will be no material adverse change affecting the Company or its properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

![[radiusnrnov202014001.jpg]](radiusnrnov202014001.jpg)

news release

November 20, 2014

Radius Gold provides funding to Southern Silver to complete acquisition of Cerro Las Minitas Property, Mexico

Vancouver, Canada: Radius Gold Inc. (TSX-V: RDU) announces that it has advanced CAD $800,000 to Southern Silver Exploration Corp. (“Southern Silver”) in order to fund Southern Silver’s final option payment to acquire the Cerro Las Minitas mineral claims in Mexico.

The Cerro Las Minitas property is located about 70 kilometres to the northeast of the city of Durango in Durango State, Mexico, and is accessed easily by road. The property comprises 19 concessions covering approximately 13,700 hectares, and lies within heart of the Faja de Plata (Belt of Silver) of north central Mexico. The belt is one of the most significant silver producing regions in the world.

Management of Radius, after reviewing the past three years’ historical drill results provided to the Company by Southern Silver, feels that this property has the potential to host a significant silver deposit. This secured loan grants Radius the exclusive right to conduct an in-depth review of the exploration data and to enter into a joint venture with Southern Silver contingent on positive due diligence.

Since its acquisition of an option to purchase the claims in 2010, Southern Silver and its former joint venture partner, Freeport-McMoran Exploration Corporation, have conducted 23,310 metres of diamond drilling in 75 core holes together with surface geochemical and biogeochemical sampling, airborne magnetics, and IP-resistivity and gravity geophysical surveys. Aggregate acquisition and exploration costs incurred on the property total approximately USD $9.2 million. Over the course of exploring the project, two new zones of mineralization have been discovered on the claims, the Blind zone and the El Sol zone. The mineralization has been traced at nominal 50 to 80 metre drill spacing for a cumulative 820 metres strike-length in a northwest-southeast direction and to depths of up to 550 metres in some drill holes.

A few selected examples of recent drill results from the Blind and El Sol zones are given in the following table:

| | | | | | | |

Zone

| DDH

| From

| To

| Length (m)

| Ag (g/t)

| Pb (%)

| Zn (%)

|

Blind

| 11CLM-008

| 168.4

| 171.4

| 3.0

| 895.0

| 13.8

| 11.6

|

| inc.

| 169.6

| 171.4

| 1.8

| 1400.0

| 19.7

| 14.5

|

| 13CLM-066

| 88.4

| 97.5

| 9.1

| 401.0

| 8.5

| 5.1

|

| inc.

| 92.9

| 97.5

| 4.6

| 727.0

| 13.5

| 7.0

|

| inc.

| 92.9

| 95.0

| 2.1

| 1190.0

| 21.6

| 13.0

|

El Sol

| 11CLM-006

| 215.5

| 223.3

| 7.8

| 221.0

| 6.2

| 2.1

|

| inc.

| 221.5

| 223.3

| 1.8

| 650.0

| 16.0

| 0.8

|

These drill results are quoted from Southern Silver news releases of July 9, 2013 and June 23, 2011. Radius has not independently verified these drill results but believes the work done by Southern Silver was performed to professional standards.

Agreement Terms

In consideration for the advance, Southern Silver has granted to Radius an exclusive option for 120 days to settle the terms of a business arrangement for Radius to acquire either a direct or indirect interest in the Cerro Las Minitas claims, including continued exploration and development of the property.

Details of the loan facility are:

●

The loan is repayable on demand, provided that Radius shall not demand repayment for one year.

●

Interest is payable annually at 8% per annum. At Radius’s election, interest may be paid by the issuance of common shares of Southern Silver in accordance with the policies of the TSX Venture Exchange (“TSXV”).

●

Radius shall have the right at any time during the term to convert such portion of the loan into common shares of Southern Silver to result in Radius holding no greater than 19.9% of the then issued and outstanding shares of Southern Silver. In the event of such conversion election, the balance of the loan shall remain due and payable for the remainder of the Term, provided that, upon default of payment, Radius shall have the right to convert the balance of the loan into common shares of Southern Silver based upon a market price of $.05 per share. If such conversion will result a change of control of Southern Silver, Southern Silver shall convene a shareholders meeting for the purpose of approving such change of control.

●

Security for the loan shall consist of issuance of a convertible debenture by Southern Silver in favour of Radius supported by hypothecation of all shares in Southern Silver’s subsidiary which holds the mineral claims forming the Cerro Las Minitas property.

●

The loan facility agreement is subject to acceptance by the TSXV.

Qualified Person

David Clark, M.Sc., P.Geo. (APEGBC), is the Company’s Qualified Person as defined by National Instrument 43-101, and has approved the disclosure of the technical information contained in this news release. The technical information provided in this news release was provided to Radius by Southern Silver, and has not been independently verified by Radius.

About Southern Silver

Southern Silver Exploration Corp. is a precious and base metal exploration and development company with a focus on mineral deposits in north-central Mexico and the southern USA. The company’s growth strategy is the acquisition, exploration and development either directly or through joint venture relationships in high-quality mineral properties in progressive jurisdictions and includes the Cerro Las Minitas silver-lead-zinc project located in Durango, Mexico and the Oro porphyry copper-gold project located in southern New Mexico, USA.

About Radius

Radius has been exploring for gold in Latin America for over a decade. The Company has a strong treasury as a result of exploration asset sales and is looking for project acquisition opportunities across the globe. Please call toll free 1-888-627-9378 or visit our web site (www.radiusgold.com) for more information.

ON BEHALF OF THE BOARD

“Simon Ridgway”

President and CEO

Symbols: TSXV-RDU; OTCQB-RDUFF

Contact: Simon Ridgway

200 Burrard Street, Suite 650

Vancouver, BC V6C 3L6

Tel: 604-801-5432; Toll free 1-888-627-9378; Fax: 604-662-8829

Email: info@goldgroup.com

Website: www.radiusgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking statements and include, without limitation, statements about the approval of the TSXV of the transactions, the entering into by the Company of further agreements with Southern Silver, and the repayment of the loan provided to Southern Silver. Often, but not always, these forward looking statements can be identified by the use of words such as “estimate”, “estimates”, “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “upgraded”, “offset”, “limited”, “contained”, “reflecting”, “containing”, “remaining”, “to be”, “periodically”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, obtaining the approval of the TSXV of the transactions; the entering into by the Company of further agreements with Southern Silver; the repayment of the loan provided to Southern Silver; changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in the Company’s quarterly and annual filings with securities regulators and available under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: expectations regarding whether the approval of the TSXV of the transactions will be obtained; the intention of the Company to enter into a further agreement with Southern Silver; the repayment of the loan provided to Southern Silver; that the Company’s stated goals and planned exploration and development activities will be achieved; that there will be no material adverse change affecting the Company or its properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

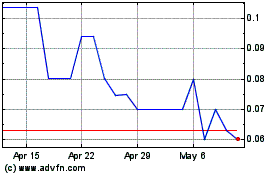

Radius Gold (PK) (USOTC:RDUFF)

Historical Stock Chart

From May 2024 to Jun 2024

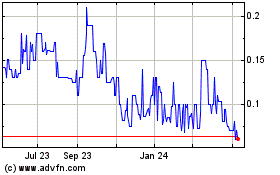

Radius Gold (PK) (USOTC:RDUFF)

Historical Stock Chart

From Jun 2023 to Jun 2024