UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): August 12, 2015

PRESSURE BIOSCIENCES, INC.

(Exact name of registrant as

specified in its charter)

| Massachusetts |

|

000-21615 |

|

04-2652826 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

14 Norfolk Avenue

South Easton, Massachusetts

02375

(Address of principal executive

offices)(Zip Code)

Registrant’s telephone

number, including area code: (508) 230-1828

N/A

(Former name or former address,

if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Cautionary Note on Forward-Looking Statements

This Current Report on Form 8-K (this “Report”)

contains, or may contain, among other things, certain “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements involve significant risks and

uncertainties. Such statements may include, without limitation, statements with respect to the Company’s plans, objectives,

projections, expectations and intentions and other statements identified by words such as “projects,” “may,”

“will,” “could,” “would,” “should,” “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “plans,” or similar expressions. These

statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant

risks and uncertainties, including those detailed in the Company’s filings with the Securities and Exchange Commission (the

“SEC”). Actual results may differ significantly from those set forth in the forward-looking statements. These

forward-looking statements involve certain risks and uncertainties that are subject to change based on various factors (many of

which are beyond the Company’s control). The Company undertakes no obligation to publicly update any forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by applicable law.

Item 1.01 Entry into a Material Definitive

Agreement.

On

July 24, 2015, Pressure BioSciences Inc., a Massachusetts corporation (the “Company”) entered into a Stock Exchange

Agreement (the “Exchange Agreement”) with Everest Investments Holdings, S.A., a Polish S.A. (“Everest”).

Pursuant to the Exchange Agreement, which calls for the Closing to occur upon delivery of the Exchange Consideration, i.e., common

shares of Pressure BioSciences, Inc. and shares of Everest Investments Holdings, on August 12, 2015 the Company transferred and

delivered to Everest 1,000,000 restricted shares of its common stock and on August 12, 2015, Everest transferred and delivered

to the Company 601,500 shares of Everest Investments Holdings, S.A. valued at $500,000 based on the last sale price on the Warsaw

Stock Exchange on the day prior to such transfer and delivery. Based upon same, the Closing Date was deemed to be August 12, 2015

when the shares were transferred and delivered to the respective parties.

Under the Exchange Agreement, the Company

and Everest are subject to mutual lock-up provisions which provide that, for the twelve month period beginning on the date of

the Exchange Agreement, each party (i) will not transfer or agree to transfer the other party’s shares, (ii) will take all

action reasonably necessary to prevent creditors in respect of any pledge of shares from exercising their rights under such pledge,

and (iii) will not take any action that would make any representations or warranties made under the Exchange Agreement untrue

or incorrect or prevent the respective party from performing any material obligations under the Exchange Agreement.

The foregoing description of the terms of

the Security Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the provisions

of such agreement which is filed as exhibit 10.1 to this Current Report on Form 8-K.

Item 3.02 Unregistered Sales of Equity

Securities.

Reference is made to the disclosure set forth

under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The issuance of the securities described above

were completed in accordance with the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit

Number |

|

Exhibit

Description |

| |

|

|

| 10.1 |

|

Stock Exchange Agreement. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

PRESSURE

BIOSCIENCES, INC. |

| |

|

|

| Dated: August

18, 2015 |

By: |

/s/ Richard

T. Schumacher |

| |

|

Richard T. Schumacher |

| |

|

President |

STOCK

EXCHANGE AGREEMENT

This

Stock Exchange Agreement, dated as of the 24th day of July, 2015 (this “Agreement”), by and between Pressure

BioSciences Inc., a Massachusetts corporation (“PBI”) and Everest Investments Holdings S.A., a Polish S.A.

(“Everest”). PBI and Everest are individually referred to herein as a “Party” and collectively,

as the “Parties.”

RECITALS

WHEREAS,

subject to the terms and conditions set forth in this Agreement and pursuant to Section 4(2) and/or Rule 506 of Regulation S of

the Securities Act of 1933, as amended (the “Securities Act”), PBI desires to issue and sell to Everest, and

Everest desires to purchase from PBI, 1,000,000 restricted shares of common stock (the “Common Stock”) of PBI

(the “PBI Common Shares”); and

WHEREAS,

in exchange for receipt of the PBI Common Shares, Everest shall deliver to PBI $500,000 worth of shares of Everest Investments

S.A. (the “Everest Shares”).The shares shall be valued at the last sale price of the stock as indicated on

the Warsaw Stock Exchange on the day prior to the Closing Date.

AGREEMENT

NOW,

THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration

the receipt and sufficiency of which are hereby acknowledged, PBI and Everest agree as follows:

1.1

The Exchange. On the terms and subject to the conditions set forth in this Agreement, on the Closing Date, PBI shall sell,

assign, transfer and deliver, free and clear of all liens, pledges, encumbrances, charges, restrictions or known claims of any

kind, nature, or description, 1,000,000 restricted common shares of PBI. In exchange for the transfer of such securities by PBI,

Everest shall deliver to PBI, 601,500 Shares of Everest (hereinafter referred to as the “Exchange Consideration”).

1.2

Closing. The closing (“Closing”) of the transactions contemplated by this Agreement shall occur upon delivery

of the Exchange Consideration as described in 1.1 herein. The Closing shall take place at a mutually agreeable time and place

and is anticipated to close by no later than July 31, 2015, (the “Closing Date”).

2.

Representations and Warranties of PBI. PBI hereby represents and warrants to Everest as of the Closing date as follows:

2.1 Organization

and Standing: Articles and Bylaws. PBI is and will be a corporation duly organized, validly existing, and in good standing

under the laws of the Commonwealth of Massachusetts and will have all requisite corporate power and authority to carry on its

business as proposed to be conducted. PBI is duly qualified to do business in each jurisdiction where the nature of its business

or its ownership or leasing of its properties makes such qualification necessary.

2.2 Corporate

Power. PBI will have at the Closing, all requisite corporate power to enter into this Agreement and to sell and issue the

PBI Common Shares. This Agreement shall constitute a valid and binding obligation of PBI enforceable in accordance with its respective

terms, except as the same may be limited by bankruptcy, insolvency, moratorium, and other laws of general application affecting

the enforcement of creditors’ rights.

2.3

Valid Issuance of PBI Common Shares. The PBI Common Shares, when issued in compliance with the provisions of this Agreement

will be duly authorized, validly issued, fully paid and non-assessable, and will be free of any liens or encumbrances caused or

created by PBI; provided, however, that all such shares may be subject to restrictions on transfer under

state and federal securities laws as set forth herein, and as may be required by future changes in such laws.

2.4

No Conflict. The execution and delivery of this Agreement by PBI and the performance by PBI of its obligations hereunder

in accordance with the terms hereof: (a) will not require the consent of any third party or governmental entity under any laws;

(b) will not violate any laws applicable to PBI and (c) will not violate or breach any contractual obligation to which PBI is

a party.

2.5 Rule

144. The PBI Common Shares are being issued pursuant to an applicable exemption from registration but may not be resold until

either they are registered or are available for resale under Rule 144. PBI will take all necessary steps to comply with all applicable

regulations, especially reporting requirements under Securities Exchange Act of 1934, to fulfill the requirements of Rule 144.

2.6 Registration.

PBI Common Shares will not be registered with the SEC but will only be eligible for resale under Rule 144 and its applicable holding

period.

3. Representations

and Warranties of Everest. Everest hereby represents and warrants to PBI as follows.

3.1 Acquisition

for Investment. Everest is acquiring the PBI Common Shares solely for their own account for the purpose of investment and

not with a view to or for sale in connection with distribution. Everest does not have a present intention to sell the PBI Common

Shares, nor a present arrangement (whether or not legally binding) or intention to effect any distribution of the PBI Common Shares

to or through any person or entity. Everest acknowledges that it is able to bear the financial risks associated with an investment

in the PBI Common Shares and that it has been given full access to such records of PBI and the subsidiaries and to the officers

of PBI and the subsidiaries and received such information as it has deemed necessary or appropriate to conduct its due diligence

investigation and has sufficient knowledge and experience in investing in companies similar to PBI in terms of PBI’s stage

of development so as to be able to evaluate the risks and merits of its investment in PBI.

3.2 Sophistication.

Everest is a sophisticated investor, as described in Rule 506(b)(2)(ii) promulgated under the Securities Act and has such experience

in business and financial matters that it is capable of evaluating the merits and risk of an investment in PBI.

3.3 Opportunities

for Additional Information. Everest acknowledges that Everest has had the opportunity to ask questions of and receive answers

from, or obtain additional information from, the executive officers of PBI concerning the financial and other affairs of PBI,

and to the extent deemed necessary in light of Everest’s personal knowledge of PBI’s affairs, Everest has asked such

questions and received answers to the full satisfaction of Everest, and Everest desires to invest in PBI.

3.4 No

General Solicitation. Everest acknowledges that the PBI Common Shares were not offered to Everest by means of any form of

general or public solicitation or general advertising, or publicly disseminated advertisements or sales literature, including

(i) any advertisement, article, notice or other communication published in any newspaper, magazine, or similar media, or broadcast

over television or radio, or (ii) any seminar or meeting to which Everest was invited by any of the foregoing means of communications.

3.5 Rule

144. Everest understands that the PBI Common Shares may not be offered for sale, sold, assigned or transferred unless such

PBI Common Shares are registered under the Securities Act or an exemption from registration is available. Everest acknowledges

that Everest is familiar with Rule 144 of the rules and regulations of the Commission, as amended, promulgated pursuant to the

Securities Act (“Rule 144”), and that such person has been advised that Rule 144 permits resales only under

certain circumstances. Everest understands that to the extent that Rule 144 is not available, Everest will be unable to sell any

Shares without either registration under the Securities Act or the existence of another exemption from such registration requirement.

3.6 Legends.

Everest hereby agrees with PBI that the PBI Common Shares will bear the following legend or one that is substantially similar

to the following legend:

THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”),

OR ANY STATE SECURITIES LAWS AND NEITHER SUCH SECURITIES NOR ANY INTEREST THEREIN MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE

TRANSFERRED EXCEPT (1) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES

LAWS OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES

LAWS, IN WHICH CASE THE HOLDER MUST, PRIOR TO SUCH TRANSFER, FURNISH TO PBI AN OPINION OF COUNSEL, WHICH COUNSEL AND OPINION ARE

REASONABLY SATISFACTORY TO PBI, THAT SUCH SECURITIES MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED IN THE MANNER

CONTEMPLATED PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE

SECURITIES LAWS.

3.7 Additional

Legend; Consent. Additionally, the PBI Common Shares will bear any legend required by the “blue sky” laws of any

state to the extent such laws are applicable to the securities represented by the certificate so legended. Everest consents to

PBI making a notation on its records or giving instructions to any transfer agent of PBI Common Shares in order to implement the

restrictions on transfer of the PBI Common Shares.

3.8 Organization

and Standing: Articles and Bylaws. Everest is and will be a corporation duly organized, validly existing, and in good standing

under the laws of Poland and will have all requisite corporate power and authority to carry on its business as proposed to be

conducted. Everest is duly qualified to do business in each jurisdiction where the nature of its business or its ownership or

leasing of its properties makes such qualification necessary.

3.9

Non U.S. Status. The undersigned is NOT a U.S. Person as defined below.

A

U.S. Person is:

(A)

Any natural person resident in the United States;

(B)

Any partnership or corporation organized or incorporated under the laws of the United States;

(C)

Any estate of which any executor or administrator is a U.S. person;

(D)

Any trust of which any trustee is a U.S. person;

(E)

Any agency or branch of a foreign entity located in the United States;

(F)

Any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the

benefit or account of U.S. person;

(G)

Any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized,

incorporated, or (if an individual) resident of the United States; and

(H)

Any partnership or corporation if (i) organized or incorporated under the laws of any foreign jurisdiction and (ii) formed

by a U.S. person principally for the purpose of investing in securities not registered under the 1933 Act, unless it is organized

or incorporated, and owned, by accredited investors (as defined in Rule 501(a) of Regulation D promulgated under the 1933 Act)

who are not natural persons, estates or trusts.

3.10 Corporate

Power. Everest will have at the Closing, all requisite corporate power to enter into this Agreement and to sell and issue

the Everest Ordinary Shares. This Agreement shall constitute a valid and binding obligation of Everest enforceable in accordance

with its respective terms, except as the same may be limited by bankruptcy, insolvency, moratorium, and other laws of general

application affecting the enforcement of creditors’ rights.

3.11

Valid Issuance of Everest Ordinary Shares. The Everest Ordinary Shares, when issued in compliance with the provisions of

this Agreement will be duly authorized, validly issued, fully paid and non-assessable, and will be free of any liens or encumbrances

caused or created by Everest; provided, however, that all such shares may be subject to restrictions on transfer

under state and federal securities laws as set forth herein, and as may be required by future changes in such laws.

3.12

No Conflict. The execution and delivery of this Agreement by Everest and the performance by Everest of its obligations

hereunder in accordance with the terms hereof: (a) will not require the consent of any third party or governmental entity under

any laws; (b) will not violate any laws applicable to Everest and (c) will not violate or breach any contractual obligation to

which Everest is a party.

4.

Miscellaneous

4.1 Everest

Lock-Up. Subject to the terms of this Agreement, Everest agrees that for a period beginning upon the date hereof and ending

twelve (12) months thereafter, Everest (i) will not transfer or agree to transfer any of the PBI Common Shares, (ii) will take

all action reasonably necessary to prevent creditors in respect of any pledge of the Shares from exercising their rights under

such pledge, and (iii) will not take any action that would make in a material respect any of his/her/its representations or warranties

contained herein untrue or incorrect or would have the effect of preventing or disabling Everest from performing any of his/her/its

material obligations hereunder.

4.2 PBI

Lock-Up. Subject to the terms of this Agreement, PBI agrees that for a period beginning upon the date hereof and ending twelve

(12) months thereafter, PBI (i) will not transfer or agree to transfer any of the Everest Ordinary Shares, (ii) will take all

action reasonably necessary to prevent creditors in respect of any pledge of the Everest Ordinary Shares from exercising their

rights under such pledge, and (iii) will not take any action that would make in a material respect any of his/her/its representations

or warranties contained herein untrue or incorrect or would have the effect of preventing or disabling such seller from performing

any of his/her/its material obligations hereunder.

4.3 Successors

and Assigns. This Agreement shall insure to the benefit of, and be binding upon, the parties hereto and their respective successors

and assigns; provided, however, that no party shall assign or delegate any of the obligations created under this Agreement without

the prior written consent of the other parties.

4.4

Notices. All notices, requests, claims, demands and other communications under this Agreement shall be in writing and shall

be deemed given upon receipt by the Parties at the following addresses (or at such other address for a Party as shall be specified

by like notice):

If

to PBI, to:

14

Norfolk Ave.

South

Easton, MA 02375, USA

(508)

230-1828

RSchumacher@pressurebiosciences.com

If

to Everest:

ul.

Grzybowska 4/207

00-131

Warszawa, Poland

0048

(601) 300 750

p.sieradzan@everestinvestments,com

4.5

Amendments; Waivers; No Additional Consideration.

No provision of this Agreement may be waived or amended except in a written instrument signed by each Party. No waiver of any

default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing waiver in

the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall

any delay or omission of any Party to exercise any right hereunder in any manner impair the exercise of any such right.

4.6 Severability.

If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule or Law, or public

policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the

economic or legal substance of the Transactions is not affected in any manner materially adverse to any Party. Upon such determination

that any term or other provision is invalid, illegal or incapable of being enforced, the Parties shall negotiate in good faith

to modify this Agreement so as to effect the original intent of the Parties as closely as possible in an acceptable manner to

the end that the transactions contemplated in this Agreement are fulfilled to the extent possible.

4.7 Counterparts;

Facsimile Execution. This Agreement may be executed in one or more counterparts, all of which shall be considered one and

the same agreement and shall become effective when one or more counterparts have been signed by each of the Parties and delivered

to the other Parties. Facsimile execution and delivery of this Agreement is legal, valid and binding for all purposes.

4.8 Entire

Agreement; Third Party Beneficiaries. This Agreement, (a) constitute the entire agreement and supersede all prior agreements

and understandings, both written and oral, among the Parties with respect to the transactions contemplated herein and (b) are

not intended to confer upon any person other than the Parties any rights or remedies.

4.9 Governing

Law. Intentionally Left Blank.

4.10 Assignment.

Neither this Agreement nor any of the rights, interests or obligations under this Agreement shall be assigned, in whole or in

part, by operation of law or otherwise by any of the Parties without the prior written consent of each of the other Parties. Any

purported assignment without such consent shall be void. Subject to the preceding sentences, this Agreement will be binding upon,

inure to the benefit of, and be enforceable by, the Parties and their respective successors and assigns.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their respective authorized officer as of

the date first above written.

| |

Pressure BioSciences Inc. |

| |

|

| |

By: |

/s/ Richard T. Schumacher |

| |

Name: |

Richard T. Schumacher |

| |

Title: |

CEO |

| |

|

|

| |

Everest Investments Holdings S.A |

| |

|

|

| |

By: |

/s/ Prezes Zarzadu |

| |

Name: |

Prezes Zarzadu |

| |

Title: |

CEO |

| |

|

Piotr Sieradzan |

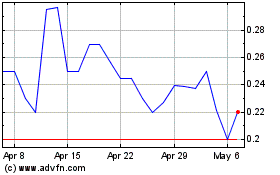

Pressure Biosciences (CE) (USOTC:PBIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pressure Biosciences (CE) (USOTC:PBIO)

Historical Stock Chart

From Nov 2023 to Nov 2024