false

0001297937

0001297937

2023-12-12

2023-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

| December

12, 2023 |

|

000-51254 |

| Date

of Report (Date of earliest event reported) |

|

Commission

File Number |

PARKS!

AMERICA, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

91-0626756 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

Number) |

1300

Oak Grove Road

Pine

Mountain, GA 31822

(Address

of Principal Executive Offices) (Zip Code)

(706)

663-8744

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PRKA |

|

OTCPink |

Item

2.02. Results of Operations and Financial Condition.

On

December 12, 2023, Parks! America, Inc. (the “Company”) issued a news release (the “News Release”) reporting

information regarding its results of operations for the fiscal year ended October 1, 2023, and its financial condition as of October

1, 2023. A copy of the News Release is attached as Exhibit 99.1 to this Report on Form 8-K.

The

information in the News Release is being furnished, not filed, pursuant to Item 2.02. Accordingly, the information in the News Release

shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(a)

Financial statements of businesses acquired:

Not

applicable

(b)

Pro forma financial information:

Not

applicable

(c)

Shell company transactions:

Not

applicable

(d)

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

December 12, 2023

| |

PARKS!

AMERICA, INC. |

| |

|

|

| |

By: |

/s/

Todd R. White |

| |

Name: |

Todd

R. White |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Parks!

America, Inc. Reports Q4 and Fiscal 2023 Results

| |

● |

Adjusted

fiscal 2023 park revenues down slightly from fiscal 2022, which remain well above fiscal 2019 pre-pandemic levels |

| |

|

|

| |

● |

Positive

EBITDA of $1.2 million for fiscal 2023 despite $1.0 million in lost revenue resulting from the March tornado event at our Georgia

Park |

| |

|

|

| |

● |

Management

remains focused on near term growth with a compelling 2024 plan while continuing to position the Company for inorganic expansion

over the long term |

PINE

MOUNTAIN, Georgia, Dec. 12, 2023 (GLOBE NEWSWIRE) — Parks! America, Inc. (OTCPink: PRKA), today announced the results for its fourth

fiscal quarter and year ended October 1, 2023.

Fourth

Quarter Fiscal 2023 Highlights

Total

revenues for the fiscal quarter ended October 1,

2023 were $2.85 million, a decrease of $212,488, compared to the fiscal quarter ended October 2, 2022. Our park revenues decreased by

$166,539 or 5.6%, and animal sales decreased by $45,949.

We

reported net income of $3,326 or $0.00 per basic share and per fully diluted share, for the fiscal quarter ended October 1, 2023, compared

to a net income of $482,409 or $0.01 per basic share and per fully diluted share, for the fiscal quarter ended October 2, 2022, resulting

in a decrease of $479,083 or $0.01 per basic and fully diluted share. Our EBITDA for the fourth quarter ending October 1, 2023

was $670,823 compared to $925,039 for the prior year, a decrease of $254,216.

The

decrease in the Company’s fourth fiscal quarter net income is partially attributable to lower park revenues, led by an 8% decline

in Georgia and more moderate declines in Texas and Missouri as well as a timing shift which resulted in lower animal sales. In addition

to lower revenues, lower fiscal fourth quarter net income was due to higher asset write-offs, higher wages and higher operational

spending, partially offset by lower advertising expense. Asset write-offs include $196,000 attributable to the mutual termination

of the general construction contract for the Georgia Park giraffe exhibit project initiated in fiscal 2022, as we reprioritized capital

in the near term to focus on rebuilding after the March 2023 severe weather and tornado event. We remain committed to a new giraffe exhibit

at our Georgia Park and expect to establish a revised timeline for this project during fiscal 2024.

Fiscal

2023 Highlights

Total

revenues for the fiscal year ended October 1, 2023

were $9.44 million, a decrease of $1.30 million, compared to the fiscal year ended October 2, 2022. Our park revenues decreased by $1.34

million or 12.6%, and animal sales increased by $34,457. Adjusting for the $1.0 million of estimated lost park revenue due to the impact

of the March 2023 severe weather and tornado event at our Georgia Park, total park revenues decreased approximately 3%.

We

reported a net loss of $483,738 or $0.01 per basic share and per fully diluted share, for the fiscal year ended October 1, 2023, compared

to a net income of $727,491 or $0.01 per basic share and per fully diluted share, for the prior fiscal year, resulting in a decrease

of $1.21 million or $0.02 per basic and fully diluted share. The decrease in the Company’s reported net income is largely

attributable to lower park revenues primarily driven by the Georgia severe weather and tornado event, higher depreciation, asset write-offs,

wages, and general operational spending, partially offset by lower advertising expense and year-over-year savings of

the Missouri Christmas lights event. Our fiscal 2023 EBITDA was $1.22 million, a decrease of approximately $950,000 from the prior year,

again largely driven by the $1.0 million in lost park revenue and the associated margin loss due to the impact of the March 2023 severe

weather and tornado event at our Georgia Park.

Balance

Sheet and Liquidity

The

Company had working capital of $3.69 million as of October 1, 2023, compared to $4.67 million as of October 2, 2022. The Company had

total debt of $4.23 million as of October 1, 2023, compared to $4.96 million at the end of the prior fiscal year. The Company’s

debt-to-equity ratio was 0.28 to 1.0 at the end of fiscal 2023, compared to 0.32 to 1.0 at the end of the prior fiscal year.

Fiscal

2023 Commentary

President

and CEO, Lisa Brady commented, “Despite challenges from the tornado impacting our Georgia Park, we swiftly rebuilt and reopened,

showcasing our resilience, while continuing to make substantial progress on initiatives setting the Company up for long-term success.”

Brady added, “We completed all major capital projects on time and on budget, including a new ring-tailed lemur exhibit and budgie

parrot feeding experience in Georgia, a marquee otter attraction in Missouri as well as numerous additional improvements in Georgia as

part of the post-tornado rebuild efforts, enriching our visitor experiences. Our commitment extended beyond infrastructure and included

improvements in employee culture, guest experience, and overall operational systemization,” Brady added.

2024

Outlook

Brady

said, “As we begin fiscal 2024, drivers of our plan include refined digital marketing efforts, dynamic pricing, systems optimization,

and comprehensive employee training, all aimed at elevating the guest experience to new heights. These initiatives reflect our commitment

to modernizing and refining our overall business model, elevating the experience we offer and creating lasting memories for every visitor.”

Brady

continued, “In tandem with these efforts, 2024 brings forth several significant capital projects. Our Georgia Park will witness

the construction of a brand-new restroom facility and a main entry plaza, which will serve as the gateway to our park and a gathering

place for our guests as we strive to improve guest experience and increase per capita revenue. Additionally, an all-new carnivore

night house continues to underscore our dedication to safety and animal welfare. Following the challenges of the tornado, strategic rebuilding

efforts will continue to reshape the landscape through additional capital projects including a capybara feeding experience, as well as

continued sidewalk, fencing and shade replacement. The major capital project at our Missouri Park features the rebuild of a dock,

allowing guests to access the water along with an all-new nature walkway surrounding the pond, adding to the overall Walkabout experience.

Our Texas Park capital is focused on the final build-out of zookeeper facilities along with covered storage and other maintenance and

safety related projects as we work to become more operationally efficient at this park.” Brady added, “In addition to the

major projects listed above, we will continue to strategically invest in the improvement of our parks, with longevity, the guest experience

and animal welfare in mind.”

Our

2024 capital plan totals approximately $1.4 million and will be funded from internally generated cash flow.

Brady

concluded, “Despite a cautious economic backdrop, our steadfast focus on near term results coupled with long-term sustainability

and growth remains unwavering and we are focused on seeding growth initiatives such as adjacent development and inorganic growth as well

as improving our corporate governance. We are optimistic for the 2024 season and expect to see our overall park revenue return to levels

at or above fiscal 2022. We are seeing early positive evidence of traction on our 2024 initiatives including our membership program and

new digital marketing efforts, albeit on small numbers in our low season. We extend heartfelt thanks to our dedicated employees for their

hard work and express gratitude to our investors for their continued support.”

About

Parks! America, Inc.

Parks!

America, Inc. (OTCPink: PRKA), through its wholly owned subsidiaries, owns and operates three regional safari parks - the Wild Animal

Safari theme park in Pine Mountain, Georgia, the Wild Animal Safari theme park located in Strafford, Missouri, as well as the Aggieland

Wild Animal Safari theme park, located near Bryan/College Station, Texas, acquired on April 27, 2020.

Additional

information, including our Form 10-K for the fiscal year ended October 1, 2023, is available on the Company’s website, http://www.animalsafari.com.

Cautionary

Note Regarding Forward-Looking Statements

Except

for historical information contained herein, this news release contains certain “forward-looking statements” within the meaning

of U.S. securities laws. Such forward-looking statements involve risks and uncertainties, including, among other things, statements concerning:

our business strategy; liquidity and capital expenditures; future sources of revenues and anticipated costs and expenses; and trends

in industry activity generally. Such forward-looking statements include, among others, those statements including the words such as “may,”

“will,” “should,” “expect,” “plan,” “could,” “anticipate,” “intend,”

“believe,” “estimate,” “predict,” “potential,” “goal,” or “continue”

or similar language or by discussions of our outlook, plans, goals, strategy or intentions.

You

are cautioned not to place undue reliance on these forward-looking statements; our actual results may differ significantly from those

projected in the forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties

and other factors, that may cause our actual results, levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors

that could cause actual results to vary materially from future results include but are not limited to: competition from other parks which

we believe is increasing, factors related to the spread of COVID-19 and its variants, difficulty engaging seasonal and full-time workers,

weather conditions during our primary tourist season, the price of animal feed and the price of gasoline. Although we believe that the

expectations reflected in these forward-looking statements are based on reasonable assumptions, we cannot guarantee future results, levels

of activity, performance or achievements.

We

believe the expectations reflected in forward-looking statements are reasonable, however we can give no assurances that such expectations

will be realized, and actual results could differ materially. We assume no obligation to update any of these forward-looking statements

to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements, except as required

by applicable law. A further description of these risks, uncertainties and other matters can be found in the Company’s annual report

and other reports filed from time to time with the Securities and Exchange Commission, including but not limited to the Company’s

Annual Report on Form 10-K for the fiscal year ended October 1, 2023.

Contact:

Lisa

Brady

President

and Chief Executive Officer

(706)

663-8744

lisa@parksamerica.com

PARKS!

AMERICA, INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS

For

the Three Months and Years Ended October 1, 2023 and October 2, 2022

| | |

For the three months ended | | |

For

the year ended | |

| | |

October 1, 2023 | | |

October 2, 2022 | | |

October 1, 2023 | | |

October 2, 2022 | |

| Park revenues | |

$ | 2,797,909 | | |

$ | 2,964,448 | | |

$ | 9,274,565 | | |

$ | 10,610,191 | |

| Sale of animals | |

| 55,363 | | |

| 101,312 | | |

| 165,683 | | |

| 131,226 | |

| Total revenues | |

| 2,853,272 | | |

| 3,065,760 | | |

| 9,440,248 | | |

| 10,741,417 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 355,245 | | |

| 359,877 | | |

| 1,284,877 | | |

| 1,446,640 | |

| Selling, general and administrative | |

| 1,842,726 | | |

| 1,803,798 | | |

| 7,015,066 | | |

| 7,217,892 | |

| Depreciation and amortization | |

| 235,702 | | |

| 204,762 | | |

| 884,459 | | |

| 782,987 | |

| Tornado expenses and write-offs, net | |

| 5,359 | | |

| - | | |

| 368,955 | | |

| - | |

| Legal settlement | |

| - | | |

| - | | |

| - | | |

| 100,000 | |

| (Gain) loss on disposal of operating assets, net | |

| 286,562 | | |

| 22,422 | | |

| 317,146 | | |

| (6,738 | ) |

| Income (loss) from operations | |

| 127,678 | | |

| 674,901 | | |

| (430,255 | ) | |

| 1,200,636 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 15,522 | | |

| 22,954 | | |

| 80,230 | | |

| 91,276 | |

| Interest expense | |

| (52,657 | ) | |

| (59,146 | ) | |

| (222,396 | ) | |

| (261,621 | ) |

| Income (loss) before income taxes | |

| 90,543 | | |

| 638,709 | | |

| (572,421 | ) | |

| 1,030,291 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense (benefit) | |

| 87,217 | | |

| 156,300 | | |

| (88,683 | ) | |

| 302,800 | |

| Net income (loss) | |

$ | 3,326 | | |

$ | 482,409 | | |

$ | (483,738 | ) | |

$ | 727,491 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) per share - basic and diluted | |

$ | 0.00 | | |

$ | 0.01 | | |

$ | (0.01 | ) | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding (in 000’s) - basic and diluted |

|

|

75,518 |

|

|

|

75,227 |

|

|

|

75,365 |

|

|

|

75,186 |

|

PARKS!

AMERICA, INC. AND SUBSIDIARIES

PARK REVENUES

REPORTED

- For the Three Months and Years Ended October 1, 2023 and October 2, 2022

PRO

FORMA - For the Year Ended October 1, 2023

| |

|

Reported | | |

Pro Forma |

| |

|

For the three months ended | | |

For the year ended | | |

For the year ended |

| |

|

October 1, 2023 | | |

October 2, 2023 | | |

October 1, 2023 | | |

October 2, 2023 | | |

October 1, 2023 |

| Georgia |

|

$ | 1,767,444 | | |

$ | 1,907,364 | | |

$ | 5,826,446 | | |

$ | 7,066,625 | | |

$6,805,446 |

| Missouri |

|

| 631,285 | | |

| 649,849 | | |

| 1,692,765 | | |

| 1,667,545 | | |

1,692,765 |

| Texas |

|

| 399,180 | | |

| 407,235 | | |

| 1,755,354 | | |

| 1,876,021 | | |

1,755,354 |

| Total park revenues |

|

$ | 2,797,909 | | |

$ | 2,964,448 | | |

$ | 9,274,565 | | |

$ | 10,610,191 | | |

$10,253,565 |

PARKS!

AMERICA, INC. AND SUBSIDIARIES

RECONCILIATION

OF NON-GAAP MEASURE - ADJUSTED NET INCOME (1)

For

the Three Months and Years Ended October 1, 2023 and October 2, 2022

| | |

For

the three months ended | | |

For

the year ended | |

| | |

October

1, 2023 | | |

October

2, 2022 | | |

October

1, 2023 | | |

October

2, 2022 | |

| Net

income (loss) | |

$ | 3,326 | | |

$ | 482,409 | | |

$ | (483,738 | ) | |

$ | 727,491 | |

| Tornado

expenses and write-offs, net | |

| - | | |

| - | | |

| 368,955 | | |

| - | |

| Tax

impact - Tornado expenses and write-offs | |

| - | | |

| - | | |

| (99,620 | ) | |

| - | |

| Legal

settlement | |

| - | | |

| - | | |

| - | | |

| 100,000 | |

| Tax

impact - legal settlement | |

| - | | |

| - | | |

| - | | |

| (27,000 | ) |

| Adjusted

net income (loss) | |

$ | 3,326 | | |

$ | 482,409 | | |

$ | (214,403 | ) | |

$ | 800,491 | |

(1)

Reconciliation of Non-GAAP Disclosure Item - Adjusted Net Income

Adjusted

net income for the year ended October 1, 2023 excludes severe weather and tornado related expenses of $780,741 and asset

write-offs of $275,297 partially offset by $687,283 of insurance proceeds. Adjusted net income for the year ended October 2, 2022 excludes

a legal settlement charge associated an employment contract dispute related to a former officer of the Company.

PARKS!

AMERICA, INC. AND SUBSIDIARIES

RECONCILIATION

OF NON-GAAP MEASURE - EBITDA (1)

For

the Three Months and Years Ended October 1, 2023 and October 2, 2022

| | |

For the three months ended | | |

For the year ended | |

| | |

October 1, 2023 | | |

October 2, 2022 | | |

October 1, 2023 | | |

October 2, 2022 | |

| Income (loss) before income taxes | |

$ | 90,543 | | |

$ | 638,709 | | |

$ | (572,421 | ) | |

$ | 1,030,291 | |

| Interest expense | |

| 52,657 | | |

| 59,146 | | |

| 222,396 | | |

| 261,621 | |

| Depreciation and amortization | |

| 235,702 | | |

| 204,762 | | |

| 884,459 | | |

| 782,987 | |

| (Gain) loss on disposal of operating assets, net | |

| 286,562 | | |

| 22,422 | | |

| 317,146 | | |

| (6,738 | ) |

| Tornado damage and expenses, net | |

| - | | |

| - | | |

| 368,955 | | |

| - | |

| Legal settlement | |

| - | | |

| - | | |

| - | | |

| 100,000 | |

| EBITDA | |

$ | 665,464 | | |

$ | 925,039 | | |

$ | 1,220,535 | | |

$ | 2,168,161 | |

(1)

Reconciliation of Non-GAAP Disclosure Item – EBITDA

EBITDA

is not a measurement of operating performance computed in accordance with generally accepted accounting principles (“GAAP”)

and should not be considered as a substitute for operating income, net income or cash flows from operating activities computed in accordance

with GAAP. We believe that EBITDA is a meaningful measure as it is widely used by analysts, investors and comparable companies in our

industry to evaluate our operating performance on a consistent basis, as well as more easily compare our results with those of other

companies in our industry. We also believe EBITDA is a meaningful measure of park-level operating profitability. EBITDA is a supplemental

measure of our operating results and is not intended to be a substitute for operating income, net income or cash flows from operating

activities as defined under GAAP.

PARKS!

AMERICA, INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

As

of October 1, 2023 and October 2, 2022

| | |

October 1, 2023 | | |

October 2, 2022 | |

| ASSETS | |

| | | |

| | |

| Cash | |

$ | 4,098,387 | | |

$ | 5,472,036 | |

| Accounts receivable | |

| 36,172 | | |

| 4,405 | |

| Inventory | |

| 419,149 | | |

| 541,986 | |

| Prepaid expenses | |

| 558,678 | | |

| 170,782 | |

| Total current assets | |

| 5,112,386 | | |

| 6,189,209 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 14,910,097 | | |

| 14,811,742 | |

| Intangible assets, net | |

| 52,331 | | |

| 79,565 | |

| Other assets | |

| 20,909 | | |

| 23,090 | |

| Total assets | |

$ | 20,095,723 | | |

$ | 21,103,606 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 79,352 | | |

$ | 267,567 | |

| Other current liabilities | |

| 571,343 | | |

| 521,872 | |

| Current portion of long-term debt, net | |

| 767,675 | | |

| 732,779 | |

| Total current liabilities | |

| 1,418,370 | | |

| 1,522,218 | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 3,459,816 | | |

| 4,227,442 | |

| Deferred tax liability, net | |

| 232,329 | | |

| - | |

| Total liabilities | |

| 5,110,515 | | |

| 5,749,660 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock | |

| 75,518 | | |

| 75,227 | |

| Capital in excess of par | |

| 5,102,471 | | |

| 4,987,762 | |

| Retained earnings | |

| 9,807,219 | | |

| 10,290,957 | |

| Total stockholders’ equity | |

| 14,985,208 | | |

| 15,353,946 | |

| Total liabilities and stockholders’ equity | |

$ | 20,095,723 | | |

$ | 21,103,606 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

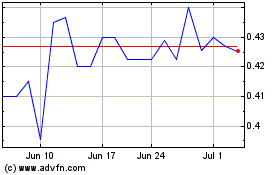

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Apr 2024 to May 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From May 2023 to May 2024