Form 8-K - Current report

June 04 2024 - 2:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

May 31, 2024

(Date of earliest event reported)

NovAccess Global Inc.

(Exact name of registrant as specified in its charter)

| Colorado | | 000-29621 | | 84-1384159 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| 8584 E. Washington Street, No. 127, Chagrin Falls, Ohio 44023 |

| (Address of principal executive offices) (Zip Code) |

213-642-9268

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 31, 2024, NovAccess Global Inc. entered into an interest free convertible loan agreement with our chairman of the board, John A. Cassarini, pursuant to which Mr. Cassarini loaned NovAccess $9,000 to address short-term cash needs. The loan does not bear interest and does not have a specified due date, but is expected to be paid in full upon completion of the pending transaction with Sumner Global or other financing of at least $1.0 million. If we default on the loan, it will bear interest at 10%. Mr. Cassarini may convert amounts outstanding under the loan into unregistered shares of NovAccess common stock at $0.11 a share.

The loan agreement with Mr. Cassarini is filed as an exhibit to this Current Report on Form 8-K. The description above is qualified in its entirety by reference to the full text of the agreement.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure included under Item 1.01 above is incorporated by reference to this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure included under Item 1.01 above is incorporated by reference to this Item 3.02. The issuance of the convertible loan to Mr. Cassarini was exempt from registration under Section 4(a)(2) of the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

Exhibit 10.1 Interest Free Convertible Loan Agreement dated May 31, 2024 between NovAccess Global Inc. and John A. Cassarini

Exhibit 104 Cover Page Interactive Data File (formatted as Inline XBRL)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

NovAccess Global Inc.

|

|

| |

|

|

|

Dated: June 4, 2024

|

/s/ Dwain K. Irvin

|

|

| |

By Dwain K. Irvin, Chief Executive Officer

|

|

false

0001039466

true

0001039466

2024-05-31

2024-05-31

Exhibit 10.1

Interest Free Convertible Loan Agreement

This Interest Free Convertible Loan Agreement (this “Agreement”) is entered into as of May 31, 2024 (the “Effective Date”) by and between NovAccess Global Inc., a Colorado corporation (“NovAccess”), and John A. Cassarini (“Cassarini”).

Whereas, NovAccess is currently seeking financing to fund its operations and repay debt, but requires a short-term loan until longer-term financing can be obtained; and

Whereas, Cassarini is a member of the NovAccess board of directors and is willing to provide to NovAccess a short-term interest-free loan for specified purposes, reflecting his faith in NovAccess.

Now, Therefore, the parties agree as follows:

1. Loan and Repayment. Cassarini loaned NovAccess $9,000 on the Effective Date. NovAccess will repay to Cassarini without interest all amounts loaned under this Agreement upon the receipt by NovAccess of debt or equity financing of at least $1.0 million (the “Due Date”).

2. Default. If NovAccess fails to repay all amounts loaned under this Agreement on the Due Date, then the balance shall bear interest at 10% per annum and NovAccess agrees to pay, in addition to the principal and interest, reasonable attorneys’ fees and collection costs incurred by Cassarini.

3. Conversion Right. Cassarini has the right from time to time, and at any time until the loan made under this Agreement is repaid in full, to convert all or any part of the outstanding and unpaid amount of the loan into fully paid and non-assessable shares of NovAccess common stock, no par value (the “Common Stock”), or any shares of capital stock or other securities of NovAccess into which such Common Stock shall hereafter be changed or reclassified (a “Conversion”). The number of shares of Common Stock to be issued upon each Conversion will be determined by dividing the Conversion Amount (as defined below) by the Conversion Price (as defined below).

“Conversion Amount” means, with respect to any Conversion, the sum of (1) the principal amount loaned under this Agreement to be converted in such Conversion, plus (2) at Cassarini’s option, accrued and unpaid default interest, if any, on such principal amount at the interest rate provided in this Agreement to the date of the Conversion.

The initial “Conversion Price” is $0.11. If NovAccess, at any time or from time to time after the Effective Date, (1) pays a dividend or makes any other distribution upon the Common Stock or any other capital stock of NovAccess payable in shares of Common Stock or in options or convertible securities, or (2) subdivides (by any stock split, recapitalization or otherwise) its outstanding shares of Common Stock into a greater number of shares, the Conversion Price in effect immediately prior to any such dividend, distribution or subdivision will be proportionately decreased. If the Corporation at any time combines (by combination, reverse stock split or otherwise) its outstanding shares of Common Stock into a smaller number of shares, the Conversion Price in effect immediately prior to such combination will be proportionately increased. Any adjustment under this paragraph will become effective at the close of business on the date the dividend, subdivision or combination becomes effective.

If Cassarini wishes to effectuate a Conversion, he must submit to NovAcess a written notice of conversion specifying the Conversion Amount. NovAccess is responsible for the costs of issuing the shares of Common Stock in the Conversion and will cause the shares to be issued to Cassarini within a reasonable amount of time.

4. Miscellaneous.

(a) Successors and Assigns. The rights and obligations of the parties are binding upon and benefit the successors, assigns, heirs, administrators and transferees of the parties.

(b) Waiver and Amendment. Any provision of this Agreement may only be amended, waived or modified upon the written consent of NovAccess and Cassarini.

(c) Governing Law. This Agreement and all actions arising out of or in connection with this Agreement shall be governed by and construed in accordance with the laws of the State of Ohio, without regard to the conflicts of law provisions of the State of Ohio, or of any other state.

(d) Waiver of Jury Trial. Each of NovAccess and Cassarini agrees to waive their respective rights to a jury trial of any claim or cause of action based upon or arising out of this Agreement.

[Signature Page Follows]

In Witness Whereof, the parties have signed this Agreement as of the Effective Date.

|

NovAccess Global Inc.

/s/ Dwain K. Irvin

|

|

/s/ John A. Cassarini

|

|

By Dwain K. Irvin

Chief Executive Officer

|

|

John A. Cassarini

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

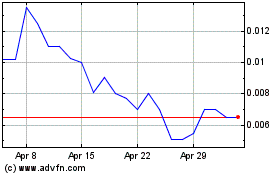

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From May 2024 to Jun 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Jun 2023 to Jun 2024