Xsunx Inc - Initial Statement of Beneficial Ownership (3)

December 21 2007 - 1:58PM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Expires:

January 31, 2008

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934, Section 17(a) of the Public Utility Holding Company Act of 1935 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Grimes Joseph

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

4/5/2006

|

3. Issuer Name

and

Ticker or Trading Symbol

XSUNX INC [XSNX]

|

|

(Last)

(First)

(Middle)

65 ENTERPRISE

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

_____ 10% Owner

___

X

___ Officer (give title below)

_____ Other (specify below)

COO /

|

|

(Street)

ALISO VIEJO, CA 92656

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Warrants

|

7/20/2006

|

4/5/2011

|

Common

|

112000

|

$1.69

|

D

|

|

|

Warrants

|

(1)

|

7/20/2011

|

Common

|

500000

|

$0.51

|

D

|

|

|

Options

|

(2)

|

1/26/2012

|

Common

|

500000

|

$0.46

|

D

|

|

|

Options

|

(3)

|

10/23/2012

|

Common

|

500000

|

$0.36

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

Employment Incentive Warrants -- Granted 7/20/06, expires 4/20/11 -- 500,000 warrants -- exercise price of $.51 per share. The warrants vest under the following provisions:

(a) The Warrant became exercisable at the rate of 28,000 shares per month up to and through the first nine months of employment of Optionee by Company commencing July 20, 2006.

(b) One Hundred Thousand (100,000) shares became exercisable upon the completion and delivery of a marketing plan by Optionee to the Board of Directors.

(c) One Hundred Forty Eight Thousand (148,000) shares shall become exercisable upon the first sale or licensure of an XSUNX, Inc. technology under the marketing plan.

|

|

(

2)

|

Employment Incentive Options -- Granted 1/26/07, expires 1/26/12 -- 500,000 options -- exercise price of $.46 per share. The options vest under the following provisions:

(a) The Option became exercisable in the amount of 50,000 shares upon the First Vesting Date of April 1, 2007. Thereafter, the Option shall vest and become exercisable at the rate of 50,000 Shares per calendar quarter up to a total of 400,000 shares.

(b) The Option shall become exercisable in the amount of 50,000 shares for each of the first two sales/licensure of an XsunX system.

|

|

(

3)

|

Employment Incentive Option -- Granted 10/23/07, expires 10/23/12 -- 500,000 options -- exercise price per share of $0.36. The options vest in conjunction with a performance milestone based vesting schedule as described below:

(a) 100,000 shares upon the assembly and commissioning of a base line production system.

(b) 100,000 shares upon the production of a commercial size working sample of the Company's planned tandem junction amorphous silicon solar module.

(c) 300,000 shares upon the assembly and commissioning of the initial 25 mega watt production system as contemplated within the Company's phased build out plan for a solar module manufacturing facility.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Grimes Joseph

65 ENTERPRISE

ALISO VIEJO, CA 92656

|

|

|

COO

|

|

Signatures

|

|

/s/ Joseph Grimes

|

|

12/21/2007

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

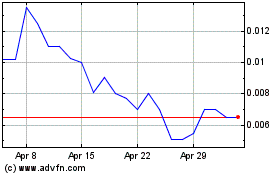

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Jun 2024 to Jul 2024

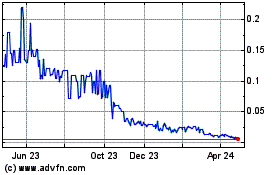

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Jul 2023 to Jul 2024