UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ___________)

Microwave Filter Company, Inc.

(Name of Issuer)

Common stock, par value $.10 per share

(Title of Class of Securities)

595176108

(CUSIP Number)

Ellyn Roberts, Esq.

Shartsis Friese LLP

One Maritime Plaza, 18th Floor

San Francisco, CA 94111

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

January 25, 2018

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of sections

240.13d-1(e), 240.13d-1(f) or 140.13d-1(g), check the following box. [ ]

Note:

Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See section 240.13d-7 for other parties to whom copies

are to be sent.

* The remainder of this cover page shall be filled out

for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

Potential persons who are to respond to the collection

of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

|

1.

|

Names of Reporting Persons.

Gerst Capital, LLC

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

X

(b) ______

|

|

|

4.

|

Source of Funds (See Instructions)

WC

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ____

|

|

|

6.

|

Citizenship or Place of Organization

Delaware

|

|

Number of

Shares

Beneficially

Owned by

Each Reporting

Person With

|

7. Sole Voting Power

0

|

|

8. Shared Voting Power

166,225

|

|

9. Sole Dispositive Power

0

|

|

10. Shared Dispositive Power

166,225

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

166,225

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions) ______

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

6.4%

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IA, OO

|

|

|

1.

|

Names of Reporting Persons.

Gregory J. Gerst

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

X

(b) ______

|

|

|

4.

|

Source of Funds (See Instructions)

WC

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ____

|

|

|

6.

|

Citizenship or Place of Organization

U.S.A.

|

|

Number of

Shares

Beneficially

Owned by

Each Reporting

Person With

|

7. Sole Voting Power

0

|

|

8. Shared Voting Power

166,225

|

|

9. Sole Dispositive Power

0

|

|

10. Shared Dispositive Power

166,225

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

166,225

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions) ______

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

6.4%

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN, HC

|

|

|

Item 1.

|

Security and Issuer

|

This statement relates to shares of Common stock, par value

$.10 per share (the “Stock”), of

Microwave Filter Company, Inc.

(the “Issuer”). The principal executive

office of the Issuer is located at

6743 Kinne Street, East Syracuse, NY 13057

.

Item 2. Identity and Background

The persons filing this statement and the persons enumerated

in Instruction C of Schedule 13D and, where applicable, their respective places of organization, general partners, directors, executive

officers and controlling persons, and the information regarding them, are as follows:

|

|

(a)

|

Gerst Capital, LLC (“Gerst Capital”)

Gregory J. Gerst

(collectively, the “Filers”).

|

|

|

(b)

|

The business address of the Filers is

also a private residence. Please contact the person authorized to receive notices and communications listed on the front page.

|

|

|

(c)

|

Present principal occupation or employment of the Filers and the name, principal business and address of any corporation or

other organization in which such employment is conducted:

Gerst Capital is an investment adviser. Mr. Gerst is the manager and control person of Gerst Capital.

|

|

|

(d)

|

During the last five years, none of the Filers has been convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors).

|

|

|

(e)

|

During the last five years, none of the Filers was a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to

such laws.

|

|

|

(f)

|

For citizenship of the Filers, see Item 6 of each Filer’s cover page.

|

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

The source and amount of funds used in purchasing the Stock

were as follows:

|

Purchaser

|

Source of Funds

|

Amount

|

|

|

|

|

|

Gerst Capital

|

Working Capital

|

$108,046

|

|

|

Item 4.

|

Purpose of Transaction

|

Gerst Capital purchased the Stock for investment purposes.

On January 29, 2018, Mr. Gerst sent a letter to the Issuer’s

board of directors informing them of his general agreement with the sentiments expressed in a letter dated January 19, 2018 to

the board from Zeff Capital, LP (“Zeff Capital”). Mr. Gerst’s letter also proposes that if the Issuer declines

to be purchased, the Issuer should invite Mr. Gerst to join the board as soon as practically possible. Although the Filers agree

with Zeff Capital, LP, they are not acting together with it or any other person or entity for the purpose of acquiring, holding,

voting or disposing of the Stock or any other securities. Accordingly, they do not believe that they are a group with any third

party within the meaning of Rule 13d-5 under the Act.

Otherwise, the Filers will routinely monitor the Issuer regarding

a wide variety of factors that affect their investment considerations, including, current and anticipated future trading prices

of the Stock and other securities, the Issuer’s operations, assets, prospects, financial position, and business development,

Issuer’s management, Issuer-related competitive and strategic matters, general economic, financial market and industry conditions,

and other investment considerations. Depending on their evaluation of various factors, including those in Mr. Gerst’s letter,

the Filers may take such actions regarding their holdings in the Issuer as they deem appropriate in light of circumstances existing

from time to time. Such actions may include purchasing additional Stock in the open market, through privately negotiated transactions

with third parties or otherwise, selling at any time, in the open market, through privately negotiated transactions with third

parties or otherwise, of all or part of the Stock now owned or hereafter acquired by either of them. The Filers also may from time

to time enter into or unwind hedging or other derivative transactions with respect to the Stock or pledge their interests in the

Stock to obtain liquidity. In addition, from time to time the Filers and their representatives and advisers may communicate with

other stockholders, industry participants and other interested parties about the Issuer. Further, the Filers may recommend action

to the Issuer’s management, board of directors and stockholders. Any of the foregoing actions could involve one or more of

the events referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D, including, potentially, one or more

mergers, consolidations, sales or acquisitions of assets, change in control, issuances, purchases, dispositions or pledges of securities

or other changes in capitalization.

|

|

Item 5.

|

Interest in Securities of the Issuer

|

The beneficial ownership of the Stock by each Filer on the

date hereof is reflected on that Filer’s cover page.

The Filers effected no transactions in the Stock in the 60

days before the date on cover page.

|

|

Item 6.

|

Contracts, Arrangement, Understandings or Relationships with Respect to Securities of the Issuer

|

None.

|

|

Item 7.

|

Material to Be Filed as Exhibits

|

Exhibit A Agreement Regarding Joint Filing of Statement

on Schedule 13D or 13G.

Exhibit B Letter dated January 29, 2018 from Gerst Capital

to the Issuer’s board of directors.

SIGNATURES

After reasonable inquiry and to the best of my knowledge, I certify

that the information set forth in this statement is true, complete and correct.

Dated: __________________

GERST CAPITAL, LLC

By:

Gregory J. Gerst, Manager

|

|

|

Gregory J. Gerst

|

|

EXHIBIT A

AGREEMENT REGARDING JOINT FILING

OF STATEMENT ON SCHEDULE 13D OR 13G

The undersigned agree to file jointly with the Securities and Exchange

Commission (the “SEC”) any and all statements on Schedule 13D, Schedule 13G or forms 3, 4 or 5 (and any amendments

or supplements thereto) required under section 13(d) or 16(a) of the Securities Exchange Act of 1934, as amended, in connection

with purchases by the undersigned of the securities of any issuer. For that purpose, the undersigned hereby constitute and appoint

Gerst Capital, LLC, a Delaware limited liability company, as their true and lawful agent and attorney-in-fact, with full power

and authority for and on behalf of the undersigned to prepare or cause to be prepared, sign, file with the SEC and furnish to any

other person all certificates, instruments, agreements and documents necessary to comply with section 13(d) and section 16(a) of

the Act, in connection with said purchases, and to do and perform every act necessary and proper to be done incident to the exercise

of the foregoing power, as fully as the undersigned might or could do if personally present.

Dated: __________________

GERST CAPITAL, LLC

By:

Gregory J. Gerst, Manager

|

|

|

Gregory J. Gerst

|

|

EXHIBIT B

January 29, 2018

Board of Directors

c/o Robert Andrews, Chairman

Microwave Filter Company, Inc.

6743 Kinne Street

East Syracuse, NY 13057

Dear Mr. Andrews,

I generally agree with the sentiments expressed in Zeff

Capital’s letter dated January 19, 2018.

If the company decides not to pursue Mr. Zeff’s

offer, then it is long past time for the board to include outsiders with material “skin in the game”. If the company

declines to be purchased, I propose that I be invited to join the board of directors as soon as practically possible.

My technical background, wireless industry experience, and financial expertise qualify me to become an effective, active and contributing

member of Microwave Filter Company’s board.

Regards,

Greg Gerst, CFA

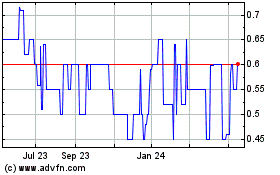

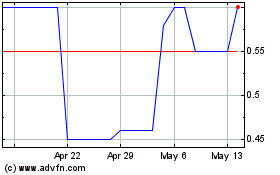

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Jul 2023 to Jul 2024