Chinese Tech Shares Tumble on Spying Concerns

October 05 2018 - 3:14AM

Dow Jones News

By Dan Strumpf

HONG KONG--The escalating trade fight between Washington and

Beijing is sending a chill through investors in Chinese tech

companies that sell to the U.S.

Hong Kong-listed shares of Lenovo Group Ltd., the Chinese maker

of PCs and servers, fell more than 20% on Friday, while shares of

ZTE Corp., which makes smartphones and telecommunications

equipment, shed more than 10%. Other Chinese hardware manufacturers

also fell, including those that sell to U.S. customers or supply

U.S. technology companies.

The selloff comes as the U.S.-China trade dispute ratchets up

and brings renewed scrutiny of the interconnectedness of the global

technology supply chain, and the potential vulnerabilities and

security risks that it entails. A report in Bloomberg Businessweek

on Thursday said Beijing used microchips inserted in computing

components built for an array of American tech companies to spy on

the U.S.

In a statement, a Lenovo spokeswoman said the chip maker linked

in the Bloomberg report to Beijing's spying efforts, called Super

Micro Computer Inc., "is not a supplier to Lenovo in any capacity.

Furthermore, as a global company we take extensive steps to protect

the ongoing integrity of our supply chain."

Super Micro Computer denied the Bloomberg report, saying it "has

never found any malicious chips, nor been informed by any customer

that such chips have been found." A ZTE spokeswoman didn't

immediately respond to a request for comment.

Tensions have been rising between the U.S. and China for months.

Vice President Mike Pence on Thursday aired a long list of

grievances with Beijing and criticized Google-parent Alphabet Inc.

for trying to develop a censored version of its search engine in

China, where internet access is restricted. A Google spokeswoman

declined to comment.

Separately, a White House report on Thursday said U.S.

industries tied to national defense faced "unprecedented set of

challenges" that have curbed their ability to quickly make crucial

military components, in part because the availability of these

components is limited to rival countries such as China.

In Chinese markets, attention was on the steep pullback in

shares of Lenovo. The company is a top seller of PCs and a major

supplier of servers world-wide, which it sells under the IBM brand

name. Lenovo bought the server business from International Business

Machines Corp. in 2014, and the business has been the key driver of

growth for the company in recent years. About a third of the

company's revenue came from the Americas region in its last fiscal

year.

"This kind of news flow has been in the market on and off the

past few years, especially concerning the national security issue,"

said Hayman Chiu, research director at Cinda International Holdings

Ltd. in Hong Kong. "We believe this market sentiment triggered the

selloff today in the tech sector, especially for Lenovo."

Shenzhen-based ZTE has long been a top seller of smartphones to

the U.S. The company has long been the subject of scrutiny by

Washington officials due to concerns its equipment could be used by

Beijing to spy on Americans, which the company has long denied.

This year, ZTE found itself at the center of the U.S.-China

trade dispute after the Commerce Department slapped the company

with an order preventing American suppliers from selling to the

Chinese firm. The U.S. Commerce Department later reversed the order

in exchange for more than $1 billion in penalties and a change of

senior leadership.

Write to Dan Strumpf at daniel.strumpf@wsj.com

(END) Dow Jones Newswires

October 05, 2018 02:59 ET (06:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

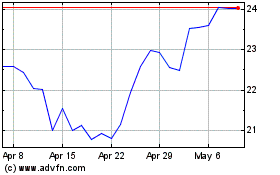

Lenovo (PK) (USOTC:LNVGY)

Historical Stock Chart

From May 2024 to Jun 2024

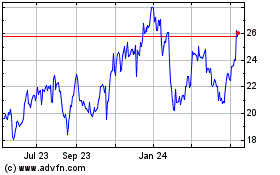

Lenovo (PK) (USOTC:LNVGY)

Historical Stock Chart

From Jun 2023 to Jun 2024