Current Report Filing (8-k)

March 25 2021 - 7:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): March

25, 2021 (March 10, 2021)

IONIX TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000- 54485

|

45-0713638

|

|

(State or Other Jurisdiction

|

(Commission File

|

(I.R.S. Employer

|

|

of Incorporation)

|

Number)

|

Identification Number)

|

Rm 608, Block B, Times Square, No. 50 People

Road, Zhongshan District,

Dalian City, Liaoning Province, China 116001

(Address of principal executive offices, including

zip code)

+86-411-88079120

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act: None

Securities registered pursuant to Section

12(g) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of the principal U.S.

market

|

|

Common Stock, par value $0.0001 per share

|

IINX

|

OTCQB marketplace of OTC Markets, Inc.

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On March 19, 2021, Ionix Technology, Inc., a Nevada

corporation (the “Company”), closed the funding transactions described below.

Securities Purchase Agreement and Self-Amortization

Promissory Note with Labrys Fund, L.P, a Delaware limited partnership (“Labrys”)

On March 19, 2021, the Company executed and closed

on the following agreements with Labrys: (i) Securities Purchase Agreement dated March 10, 2021; and (ii) Self-Amortization Promissory

Note dated March 10, 2021 (“Note”); (collectively the “Labrys Agreements”). The Company entered into the Labrys

Agreements with the intent to acquire working capital to fund current operations and grow the Company’s business.

The total amount of funding to the Company under

the Labrys Agreements is $434,000. The Notes carry an original issue discount of $50,000, a transaction expense amount of $2,500, and

a fee to J. H. Darbie & Co. of $13,500, for total debt of $500,000 (“Debt”). The Note has an amortization schedule with

monthly payments of $58,333.33 due and owing to Labrys beginning July 9, 2021 through March 10, 2022 (the “Maturity Date”).

The Company issued commitment shares related to the Labrys Agreements as follows: 417,000 shares of Common Stock (the “First Commitment

Shares”) and 1,042,000 shares of Common Stock (the “Second Commitment Shares”). The Second Commitment Shares must be

returned to the Borrower’s treasury if the Note is fully repaid and satisfied on or prior to the Maturity Date. The Company agreed

to reserve 6,562,500 shares of its common stock for issuance if any Debt is converted. The Debt is due on or before March 10, 2022. The

Debt carries an interest rate of five percent (5%). The Note is not convertible unless in Default, as defined in the Note. If the Note

is in Default, the Debt is convertible into the Company’s common stock at a conversion price of $0.12, subject to adjustment as

provided for in the Note.

The Labrys Agreements are qualified in their entirety

by reference to the Labrys Agreements, copies of which are attached to this Current Report on Form 8-K as Exhibit 10.1, and incorporated

by reference into this Item 1.01. Certain capitalized terms used herein but not otherwise defined shall have the meaning ascribed thereto

in the Transaction Documents.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in response to Item 1.01

of this report is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

See the disclosures made in Item 1.01, which are

incorporated herein by reference. All securities issued in the Labrys, Agreements were issued in a transaction exempt from registration

pursuant to Section 4(a)(2) and Rule 506(b) Securities Act of 1933. The Labrys transactions did not involve a public offering, the sale

of the securities was made without general solicitation or advertising, there was no underwriter, and no underwriting commissions were

paid.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Ionix Technology, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

Date: March 25, 2021

|

By

|

/s/ Cheng Li

|

|

|

|

Cheng Li

|

|

|

|

Duly Authorized officer, Chief Executive Officer

|

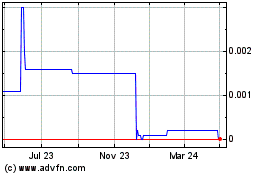

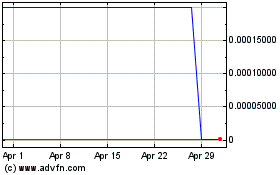

Ionix Technology (CE) (USOTC:IINX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ionix Technology (CE) (USOTC:IINX)

Historical Stock Chart

From Nov 2023 to Nov 2024