UNITED

STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

|

þ

|

Quarterly Report Pursuant to

Section 13 or 15 (d) of the Securities Exchange Act of 1934 for the

Quarterly Period ended

December

31, 2009

|

|

¨

|

Transition Report Pursuant to

Section 13 or 15 (d) of the Securities Exchange Act of 1934 for the

Transition Period from _______________ to

____________________

|

Commission

File No.

33-55254-42

M45 Mining Resources

Inc.

(Exact

name of registrant as specified in its charter)

|

NEVADA

|

|

87-0485310

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

|

1212 Redpath Crescent, Montreal (Quebec)

Canada

|

|

H3G 2K1

|

|

(Address

of principal executive offices)

|

|

(Postal

Code)

|

Registrant’s

telephone number, including area code:

(514) 812-4568

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes

þ

No

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “

accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

Large accelerated

filer

¨

Accelerated filer

¨

Non-accelerated filer

¨

Smaller reporting

company

þ

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

¨

No

þ

54,041,286

shares of Company’s common stock, par value $0.001 per share, were outstanding

as of February 15, 2010.

M45

Mining Resources Inc.

(A

Developmental Stage Company)

TABLE

OF CONTENTS FOR FORM 10-Q

|

PART

I. FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

ITEM

1.

|

FINANCIAL

STATEMENTS

|

|

|

|

|

|

|

|

|

|

Balance

Sheets as of December 31, 2009 (unaudited) and March 31,

2009

|

|

3

|

|

|

|

|

|

|

|

Statements

of Operations for the three and nine months ended December 31, 2009 and

2008, and for the period from April1, 2004 (inception) to December 31,

2009 (Unaudited)

|

|

4

|

|

|

|

|

|

|

|

Statements

of cash flows for the nine months ended December 31, 2009 and 2008, and

for the period from April 1, 2004 (inception) to December 31, 2009

(Unaudited)

|

|

5

|

|

|

|

|

|

|

|

Notes

to unaudited financial statements

|

|

6

|

|

|

|

|

|

|

ITEM

2.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

|

13

|

|

|

|

|

|

|

ITEM

3.

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

15

|

|

|

|

|

|

|

ITEM

4

|

CONTROLS

AND PROCEDURES

|

|

15

|

|

|

|

|

|

|

PART

II. OTHER INFORMATION

|

|

|

|

|

|

|

|

|

ITEM

1.

|

LEGAL

PROCEEDINGS

|

|

16

|

|

|

|

|

|

|

ITEM

1A.

|

RISK

FACTORS

|

|

16

|

|

|

|

|

|

|

ITEM

2.

|

UNREGISTERED

SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

|

16

|

|

|

|

|

|

|

ITEM

3.

|

DEFAULTS

UPON SENIOR SECURITIES

|

|

16

|

|

|

|

|

|

|

ITEM

4.

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

|

17

|

|

|

|

|

|

|

ITEM

5.

|

OTHER

INFORMATION

|

|

17

|

|

|

|

|

|

|

ITEM

6.

|

EXHIBITS

|

|

17

|

|

|

|

|

|

|

|

SIGNATURES

|

|

18

|

ITEM

I. FINANCIAL STATEMENTS

M45

MINING RESOURCES INC.

(A

Development Stage Company)

BALANCE

SHEETS

|

|

|

December 31,

|

|

|

March 31

|

|

|

|

|

2009

|

|

|

2009

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Prepaid

expense

|

|

|

-

|

|

|

|

2,336

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current

assets

|

|

|

-

|

|

|

|

2,336

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed

assets, net

|

|

|

67,162

|

|

|

|

75,274

|

|

|

Intangible

Assets bet of amortization

|

|

|

7,487

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

assets

|

|

$

|

74,649

|

|

|

$

|

77,610

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

and Stockholders' Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

liabilities

|

|

|

|

|

|

|

|

|

|

Accounts

payable and accrued liabilites

|

|

$

|

-

|

|

|

$

|

3,000

|

|

|

Payables

due to related parties

|

|

|

301,279

|

|

|

|

146,422

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

301,279

|

|

|

|

149,422

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders'

deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock, $.001 par value; 55,000,000 shares authorized, 54,008,386 shares

issued and outstanding

|

|

|

54,008

|

|

|

|

54,008

|

|

|

Additional

paid-in capital

|

|

|

6,862,985

|

|

|

|

6,862,985

|

|

|

Deficit

accumulated during the development stage

|

|

|

(7,143,623

|

)

|

|

|

(6,988,805

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders deficit

|

|

|

(226,630

|

)

|

|

|

(71,812

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

liabilities and stockholders' deficit

|

|

$

|

74,649

|

|

|

$

|

77,610

|

|

The accompanying notes are an integral part of these

financial statements.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

STATEMENTS

OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of

|

|

|

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

|

Inception to

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining

claim acquisition costs

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,156,486

|

|

|

General

and administrative

|

|

|

87,700

|

|

|

|

76,141

|

|

|

|

122,992

|

|

|

|

247,315

|

|

|

|

4,423,411

|

|

|

Marketing

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,988

|

|

|

|

48,503

|

|

|

Research

and development

|

|

|

5,000

|

|

|

|

1,414

|

|

|

|

7,336

|

|

|

|

4,242

|

|

|

|

175,775

|

|

|

Interest

on loan

|

|

|

3,633

|

|

|

|

6,232

|

|

|

|

8,667

|

|

|

|

14,790

|

|

|

|

77,279

|

|

|

Depreciation

and Amortization

|

|

|

5,698

|

|

|

|

7,726

|

|

|

|

15,823

|

|

|

|

22,938

|

|

|

|

55,120

|

|

|

Total

expenses

|

|

|

102,031

|

|

|

|

91,513

|

|

|

|

154,818

|

|

|

|

293,273

|

|

|

|

6,936,574

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss before discontinued operations and income taxes

|

|

|

(102,031

|

)

|

|

|

(91,513

|

)

|

|

|

(154,818

|

)

|

|

|

(293,273

|

)

|

|

|

(6,936,574

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

effect of recapitlization

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(124,668

|

)

|

|

Discontinued

operations - subsidiary

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(255,997

|

)

|

|

Disposal

of subsidiary

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

173,616

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss before income taxes

|

|

|

(102,031

|

)

|

|

|

(91,513

|

)

|

|

|

(154,818

|

)

|

|

|

(293,273

|

)

|

|

|

(7,143,623

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss

|

|

$

|

(102,031

|

)

|

|

$

|

(91,513

|

)

|

|

$

|

(154,818

|

)

|

|

$

|

(293,273

|

)

|

|

$

|

(7,143,623

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

and Diluted Loss Per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss per weighted average share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

operating loss

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

Discontinued

operations

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

Disposal

of subsidiary

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

Weighted

average number of common shares used to compute net loss per weighted

average share

|

|

|

54,008,386

|

|

|

|

36,699,030

|

|

|

|

54,008,386

|

|

|

|

36,699,030

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial

statements.

M45

RESOURCES INC.

(A

Development Stage Company)

(Unaudited)

|

|

|

|

|

|

|

|

|

Date of

|

|

|

|

|

Nine Months Ended

|

|

|

Inception to

|

|

|

|

|

December 31,

|

|

|

December 30,

|

|

|

December 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

Flows From Operations:

|

|

|

|

|

|

|

|

|

|

|

Net

loss

|

|

$

|

(154,818

|

)

|

|

$

|

(293,273

|

)

|

|

$

|

(7,196,409

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment

to reconcile net loss to net net cash used by operating

activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposal

of subsidiary

|

|

|

-

|

|

|

|

-

|

|

|

|

(173,616

|

)

|

|

Discontinued

operations

|

|

|

-

|

|

|

|

-

|

|

|

|

255,997

|

|

|

Depreciation

|

|

|

15,823

|

|

|

|

22,938

|

|

|

|

65,244

|

|

|

Expenses

paid with stock

|

|

|

-

|

|

|

|

-

|

|

|

|

2,899,987

|

|

|

Employee

stock option plan

|

|

|

-

|

|

|

|

-

|

|

|

|

3,319,117

|

|

|

Prior

period foreign exchange fluctuation

|

|

|

-

|

|

|

|

-

|

|

|

|

(15,548

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes

in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

Prepaid

deposits

|

|

|

2,336

|

|

|

|

4,242

|

|

|

|

2,336

|

|

|

Payables

|

|

|

(3,000

|

)

|

|

|

-

|

|

|

|

(2,914

|

)

|

|

Net

cash used for operating activities

|

|

|

(139,659

|

)

|

|

|

(266,093

|

)

|

|

|

(845,806

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition

of intangible and fixed assets

|

|

|

(15,198

|

)

|

|

|

(7,303

|

)

|

|

|

(116,441

|

)

|

|

Leasehold

Improvements

|

|

|

-

|

|

|

|

-

|

|

|

|

(13,329

|

)

|

|

Net

effect of recapitalization

|

|

|

-

|

|

|

|

-

|

|

|

|

124,668

|

|

|

Net

cash provided by (used for) investing activities

|

|

|

(15,198

|

)

|

|

|

(7,303

|

)

|

|

|

(5,102

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance

of common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

28,182

|

|

|

Net

effect of recapitalization

|

|

|

-

|

|

|

|

-

|

|

|

|

5,470

|

|

|

Variation

of advances from related parties

|

|

|

154,857

|

|

|

|

273,396

|

|

|

|

817,256

|

|

|

Net

cash provided by financing activities

|

|

|

154,857

|

|

|

|

273,396

|

|

|

|

850,908

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

incresase in cash

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Cash,

beginning of period

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash,

end of period

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

disclosures of cash flow information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

50,744

|

|

|

Income

tax

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

The

accompanying notes are an integral part of these financial

statements.

M45

Mining Resources Inc

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

NOTE 1

:

ORGANIZATION AND SIGNIFICANT

ACCOUNTING PRINCIPLES

Basis

of Presentation

The

accompanying unaudited financial statements of M45 Mining Resources Inc (“M45”

or “Company”), have been prepared in accordance with accounting principles

generally accepted in the United States of America for interim financial

information and with the instructions to Form 10-Q and Rule 10-01 of Regulation

S-X. Accordingly, they do not include all of the information and notes required

by generally accepted accounting principles for a complete presentation of the

financial statements. In the opinion of management, the unaudited interim

financial statements furnished herein include all adjustments (consisting of a

normal and recurring nature) necessary for a fair presentation of the Company’s

financial position at December 31, 2009 (unaudited) and the results of its

operations for the three and nine month periods ended December 31, 2009

(unaudited) and cash flows for the nine months ended December 31, 2009

(unaudited). Interim financial statements are prepared on a basis consistent

with the Company’s annual financial statements. Results of operations for the

three and nine month periods ended December 31, 2009 are not necessarily

indicative of the operating results that may be expected for the fiscal year

ending March 31, 2010.

These

financial statements and the notes hereto should be read in conjunction with

financial statements and notes thereto included in the Company’s Form 10-K for

the year ended March 31, 2009, which was filed October 30, 2009.

M45

Mining Resources Inc.’s, new strategy is focused on building shareholder value

through the exploration and development of mineral claims, particularly in the

Matagami Mining Camp located in Quebec, Canada. The Matagami Mining Camp is

known for its zinc-rich massive sulphide deposits. Initial exploratory work in

the Camp can be traced back to the 1930's with Noranda's activities in the

region. Ten of the eighteen deposits discovered to date have been mined and have

produced a total of 3.9 Mt zinc and 0.4 Mt copper.

The

mining titles are situated on the east side of Matagami Mining Camp adjacent to

properties owned by Xstrada plc, the world's fifth largest diversified mining

company by market capitalization. These strategic territories strengthen M45's

presence in the Matagami Camp by adding a new series of high-grade potential

mining titles to the Company's existing "West Wind" territories. The Matagami

Mining Camp is a world-class mining district, composed of 18 known volcanogenic

massive sulphide (VMS) deposits. The area is host to historical production of

8.6 billion pounds of Zinc and 853 million pounds of Copper and has established

infrastructure including a railway, paved road and a 2,350 t/day mill owned by

Falconbridge/Xstrada plc.

As of

February 22, 2010, the Company has no full-time employees. The President and

Secretary-Treasurer have agreed to allocate a portion of their time without

compensation to the activities of the Company.

The

Company had no revenues for the three and nine month periods ended December 31,

2009 and 2008. In 2008 the Company has hired an external geologist

firm to conduct geologic reports NI-43-101 on its Matagami property for an

approximate cost of $90,000. The Company also incurred operation costs related

to completing marketing material such as; Logo’s Web site, summaries and other

corporate presentation material. In accordance with an expense sharing agreement

entered into on April 1, 2007, the Company pays rent, telephone, utilities, and

other expenses for operational support at a set price of $3,500 per month. Total

expenses also include expenses incurred for legal fees, filing expenses, press

releases, traveling expenses, representation costs, mailings, research costs,

and various operational costs. For the three and nine month periods ended

December 31, 2009 and 2008, the Company reported total expenses

of $102,031 and $91,513 and $154,818 and $293,273,

respectively. Two majority control shareholders advance the Company

funds needed to pay for the expenses incurred during the three and nine month

periods ended December 31, 2009 and 2008. These shareholders have agreed to

continue to support operational costs until the Company can generate revenues

from commercial operations or funds from financing activities.

M45

Mining Resources Inc

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

Significant

Accounting Policies

Cash and cash

equivalents.

The

Company considers all highly liquid investments with a maturity of three months

or less when purchased to be cash equivalents. The Company holds cash and cash

equivalent balances in a bank and other financial institutions. Balances in

excess of FDIC limitations may not be insured. There are no cash equivalents as

of December 31, 2009.

Property

and equipment.

Property

and equipment are carried at cost less accumulated depreciation. Major additions

and improvements are capitalized, while maintenance and repairs that do not

extend the lives of assets are expensed. Gain or loss, if any, on the

disposition of fixed assets is recognized currently in operations. Depreciation

is calculated primarily on a straight-line basis over estimated useful lives of

the assets.

Research

and development.

Research

and development costs principally represent consulting fees of the Company’s

geologist and engineering professionals, material and payments to third parties

for clinical trials and additional product development and testing. All research

and development costs are charged to expense as incurred.

Exploration

Stage Company

The

Company complies with Financial Accounting Standard Board Statement No. 7 and

The Securities and Exchange Commission Exchange Act Guide 7 for its

characterization of the Company as pre-exploration stage.

Capitalization

of Mineral Claim Costs

Cost of

acquisition, exploration, carrying and retaining unproven properties are

expensed as incurred until such time as reserves are proven. Costs

incurred in proving and developing a property ready for production are

capitalized and amortized over the life of the mineral deposit or over a shorter

period if the property is shown to have an impairment in value.

Expenditures for mining equipment are capitalized and depreciated over

their useful life.

Use

of estimates.

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions, such as useful lives of property and equipment, that

affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amounts of expenses during the reporting period. Actual results

could differ from those estimates.

Stock-based

compensation.

The

Company accounts for stock-based compensation in accordance with ASC 718,

Compensation—Stock

Compensation

, which requires all share-based payments, including grants

of stock options, to be recognized in the income statement as an operating

expense, based on their fair values. Stock-based compensation is included in

general and administrative expenses for all periods presented.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

Fair

value of financial instruments.

ASC Topic

820,

Fair Value Measurements

and Disclosure

("ASC 820") establishes a new framework for measuring fair

value and expands related disclosures. Broadly, ASC 820 framework requires fair

value to be determined based on the exchange price that would be received for an

asset or paid to transfer a liability (an exit price) in the principal or most

advantageous market for the asset or liability in an orderly transaction between

market participants. ASC 820 establishes a three-level valuation hierarchy based

upon observable and non-observable inputs. These tiers include: Level 1, defined

as observable inputs such as quoted prices in active markets; Level 2, defined

as inputs other than quoted prices in active markets that are either directly or

indirectly observable; and Level 3, defined as unobservable inputs in which

little or no market data exists, therefore requiring an entity to develop its

own assumptions.

Long-lived

assets.

In

accordance with ASC Topic 360-10 (formerly SFAS No. 144,

Accounting for the Impairment or

Disposal of Long-Lived Assets),

the Company reviews the carrying values

of its long-lived assets, including long-term investments, for possible

impairment whenever events or changes in circumstances indicate that the

carrying amounts of the assets may not be recoverable. Any long-lived assets

held for disposal are reported at the lower of their carrying amounts or fair

value less costs to sell.

Income taxes.

The

Company follows the liability method of accounting for income taxes in

accordance with FASB ASC 740,

Income Taxes

, (“ASC 740”),

formerly SFAS No. 109,

Accounting for Income Taxes

.

Deferred tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax

bases and operating loss and tax credit carry forwards, if any. Deferred tax

assets and liabilities are measured using enacted tax rates expected to apply to

taxable income in the years in which those temporary differences are expected to

be recovered or settled. The effect on deferred tax assets and liabilities of a

change in tax rates is recognized in the Statements of Income in the period that

includes the enactment date.

The

Company’s policy is to record a valuation allowance against deferred tax assets,

when the deferred tax asset is not recoverable. The Company considers estimated

future taxable income or loss and other available evidence when assessing the

need for its deferred tax valuation allowance.

Comprehensive income

(loss).

FASB ASC

220-10 (formerly known as SFAS No. 130,

Reporting Comprehensive Income

(Loss),

requires companies to classify items of other comprehensive

income (loss) in a financial statement. Comprehensive income (loss) is defined

as the change in equity of a business enterprise during a period from

transactions and other events and circumstances from non-owner sources. The

Company’s comprehensive net loss is equal to its net loss for all periods

presented.

Foreign

Currency Translation.

The

Company's functional currency is the Canadian dollar. Foreign currency

transactions occasionally occur, and are primarily undertaken in Canadian

dollars. The Company translates foreign currency transactions and balances to

its reporting currency, United States Dollars, in accordance with ASC 830,

Foreign Currency Matters

(formerly SFAS No. 52,

Foreign Currency

Translation)

. Monetary balance sheet items denominated in

foreign currencies are translated into Canadian dollars at rates of exchange in

effect at the balance sheet date. Daily closing rates are used to translate

revenues and expenses into Canadian dollars at rates of exchange in effect on a

specific date. Resulting translation gains and losses are charged to operations.

The Company has not, to the date of these financial statements, entered into

derivative instruments to offset the impact of foreign currency fluctuations.

Transactions in foreign currency are translated into United States dollars as

follows: (i) Monetary items at the rate prevailing at the balance sheet date;

(ii) non-monetary items at the historical exchange rate;

and

(iii) revenue

and expenses that are monetary items are valued at the average rate in effect

during the applicable accounting period.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

Interest Rate Risk.

The

Company is exposed to fluctuating interest rates.

Basic and Diluted Net Income (Loss) Per

Share.

We

compute basic earnings per share (“basic EPS”) by dividing net income (loss) by

the weighted average number of common shares outstanding for the reporting

period; diluted earnings per share (“diluted EPS”) gives effect to all

dilutive potential shares outstanding. The Company had no potential common stock

instruments which would result in a diluted loss per share.

Development Stage

Company.

The

Company currently has no revenues and is considered to be a development stage

company under the provision of FASB ASC 915 (formerly SFAS No. 7,

Accounting and reporting by

Development Stage Enterprises

)

.

Reclassifications.

Certain

amounts reported in the previous year’s consolidated financial statements have

been reclassified to conform to the current period’s presentation.

Revenue

Recognition.

In

accordance with the ASC Topic 605,

Revenue Recognition

, the

Company recognizes revenue when persuasive evidence of an arrangement exists,

delivery has occurred, the sales price is fixed or determinable, and

collectability is reasonably assured.

Recent

Accounting Pronouncements

In April

2009, the FASB issued FASB ASC Topic 158-320-05 and 320-10-05,

Recognition and Presentation of

Other-Than-Temporary Impairments

(FASB Staff Position, or FSP, No. FAS

115-2 and FAS 124-2)

,

to amend the other-than-temporary impairment guidance in debt securities

to be based on intent to sell instead of ability to hold the security and to

improve the presentation and disclosure of other-than-temporary impairments on

debt and equity securities in the financial statements. This

pronouncement is effective for periods ending after June 15, 2009. We

adopted this standard effective July 1, 2009, and it did not have a material

impact on our financial position and results of operations.

In April

2009, the FASB issued FASB ASC Topic 820-10-05,

Determining Fair Value When the

Volume and Level of Activity for the Asset or Liability Have Significantly

Decreased and Identifying Transactions That Are Not Orderly

(FSP

157-4). FASB ASC Topic 820-10-05 provides additional authoritative

guidance to assist both issuers and users of financial statements in determining

whether a market is active or inactive, and whether a transaction is

distressed. This pronouncement is effective for periods ending after

June 15, 2009. We adopted this standard effective July 1, 2009, and

it did not have a material impact on our financial position and results of

operations.

In April

2009, the FASB issued FASB ASC Topic 270-10-05,

Interim

Disclosures about Fair Value of Financial Instruments

(FSP FAS 107-1 and

APB 28-1). FASB ASC Topic 270-10-05 enhances consistency in financial

reporting by increasing the frequency of fair value disclosures. This

guidance relates to fair value disclosures for any financial instruments that

are not currently reflected on the balance sheet of companies at fair

value. Before this guidance was adopted, fair values for these assets

and liabilities were disclosed only once a year. The guidance now

requires these disclosures to be made on a quarterly basis, providing

qualitative and quantitative information about fair value estimates for all

those financial instruments not measured on the balance sheet at fair

value. This pronouncement is effective for

periods ending

after June 15, 2009. We adopted this standard effective July 1, 2009,

and it did not have a material impact on our financial position and results of

operations.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

Recent

Accounting Pronouncements (continued)

In April

2009, the FASB issued FASB ASC Topic 805-10-10,

Accounting for Assets Acquired and

Liabilities Assumed in a Business Combination That Arise from

Contingencies

(SFAS 141(R)-1), to amend the provisions related to the

initial recognition and measurement, subsequent measurement and disclosure of

assets and liabilities arising from contingencies in a business combination

under FASB ASC Topic 805-10-10,

Business Combinations

(SFAS

141(R)). Under this guidance, assets acquired and liabilities assumed

in a business combination that arise from contingencies should be recognized at

fair value on the acquisition date if fair value can be determined during the

measurement period. If fair value cannot be determined, companies

should typically account for the acquired contingencies using existing

guidance. We do not believe adoption of FASB ASC Topic 805-10-10 will

have a material impact on our consolidated financial statements.

In May

2009, the FASB issued FASB ASC Topic 855-10-05,

Subsequent Events

(SFAS

165). This standard is intended to establish general standards of

accounting for and disclosures of events that occur after the balance sheet date

but before financial statements are issued or are available to be

issued. Specifically, this standard sets forth the period after the

balance sheet date during which management of a reporting entity should evaluate

events or transactions that may occur for potential recognition or disclosure in

the financial statements, the circumstances under which an entity should

recognize events or transactions occurring after the balance sheet date in its

financial statements, and the disclosures that an entity should make about

events or transactions that occurred after the balance sheet

date. FASB ASC Topic 855-10-05 is effective for fiscal years and

interim periods ending after June 15, 2009. We adopted this standard

effective July 1, 2009 and have evaluated any subsequent events through the date

of this filing. We do not believe there are any material subsequent

events that would require further disclosure

On

September 1, 2009, the Company adopted the accounting pronouncement on

noncontrolling interests in consolidated financial statements (ASC Topic

810). This pronouncement requires that noncontrolling (or minority)

interests in subsidiaries be reported in the equity section of a company’s

balance sheet, rather than in a mezzanine section of the balance sheet between

liabilities and equity and changes the manner in which the net income of the

subsidiary is reported and disclosed in the controlling company’s income

statement and establishes guidelines for accounting for changes in ownership

percentages and for deconsolidation. This pronouncement required

retrospective application to all prior periods presented. The adoption of

the Codification had no impact on the Company’s financial condition, results of

operations or cash flows.

On

September 1, 2009, the Company adopted the revised accounting pronouncement

relating to business combinations (ASC Topic 805), including assets acquired and

liabilities assumed arising from contingencies. This pronouncement

requires the use of the acquisition method of accounting, defines the acquirer,

establishes the acquisition date, and applies to all transactions and other

events in which one entity obtains control over one or more other

businesses. This pronouncement also amends the accounting and disclosure

requirements for assets and liabilities in a business combination that arise

from contingencies. In addition, with the adoption of this

pronouncement, changes to valuation allowances for deferred income tax assets

and adjustments to unrecognized tax benefits generally are to be recognized as

adjustments to income tax expense rather than goodwill. This adoption had

no impact on the Company’s financial condition, results of operations or cash

flows.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

Recent

Accounting Pronouncements (continued)

In

June 2009, the Financial Accounting Standards Board (“FASB”) issued

Statement of Financial Accounting Standards (“SFAS”) No. 168,

The FASB Accounting Standards

Codification

(“ASC”)

and the Hierarchy of Generally

Accepted Accounting Principles — a replacement of FASB Statement No. 162

(the “Codification”) (ASC Topic 105). The Codification reorganized

existing U.S. accounting and reporting standards issued by the FASB and other

related private sector standard setters into a single source of authoritative

accounting principles arranged by topic. The Codification supersedes all

existing U.S. accounting standards; all other accounting literature not included

in the Codification (other than SEC guidance for publicly-traded companies) is

considered non-authoritative. The Codification was effective on a

prospective basis for interim and annual reporting periods ending after

September 15, 2009. As a result of the adoption of this

pronouncement, Quarterly Reports on Form 10-Q for all quarters ending after

December 31, 2009 and all subsequent public filings will reference the

Codification as the sole source of authoritative literature. Accordingly,

all accounting references will be updated and SFAS references will be replaced

with ASC references as if the SFAS has been adopted into the

Codification. We do not expect the adoption of the adoption of

the Codification to have a material impact on the Company’s financial condition,

results of operations, or cash flows.

NOTE

2: GOING CONCERN

The

accompanying consolidated financial statements have been prepared assuming the

Company will continue as a going concern. This contemplates the realization of

assets and the liquidation of liabilities in the normal course of business. As

shown in these consolidated financial statements, the Company has an accumulated

deficit of $ 7,143,623 from inception to December 31, 2009 and does not have

significant cash or other material assets, nor does it have operations or a

source of revenue sufficient to cover its operation costs and allow it to

continue as a going concern. The future of the Company is dependent upon its

ability to obtain financing and upon future profitable operations from the

development of its new business. The Company’s continuation as a going concern

is dependent upon management to meet any costs and expenses incurred. Management

realizes that this situation may continue until the Company obtains additional

working capital through equity financing.

NOTE

3: PROPERTY AND EQUIPMENT

Machinery

and equipment consist of the following:

|

|

|

December 31,

|

|

|

March 31,

|

|

Estimated

|

|

|

|

2009

|

|

|

2009

|

|

Useful Lives

|

|

|

|

|

|

|

|

|

|

|

Furniture

and equipment

|

|

$

|

108,743

|

|

|

$

|

101,243

|

|

3 -

5 years

|

|

Leasehold

improvements

|

|

|

13,329

|

|

|

|

13,329

|

|

3

years

|

|

|

|

|

122,072

|

|

|

|

114,572

|

|

|

|

Less

accumulated depreciation

|

|

|

54,910

|

|

|

|

39,298

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property

and equipment, net

|

|

$

|

67,162

|

|

|

$

|

75,274

|

|

|

Depreciation

of fixed assets utilized in research and development activities is included in

research and development expense. All other depreciation is included in general

and administrative expense. Depreciation expense for the quarter ended December

31, 2009 and 2008 was $5,698 and $15,823, respectively.

NOTE

4: PAYABLE DUE TO RELATED PARTIES

At

December 31, 2009, the Company was indebted to multiple shareholders of the

Company for $301,279. The notes bear interest at 6 % per annum.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

NOTE 5

:

COMMON STOCK

The

Company has authorized capital stock of 55,000,000 shares of common stock with a

par value of $.001, of which 54,008,386 shares were issued and outstanding as of

February 15, 2010. The Company's common stock commenced trading on January 27,

1999 on the OTC Bulletin Board (OTCBB) operated by the National Association of

Securities Dealers, Inc., under the symbol "MRES."

NOTE

6: BASIC AND DILUTED NET LOSS PER

SHARE

Basic net

loss per common share is computed by dividing net loss by the weighted average

number of common shares outstanding during the period. Diluted net loss per

common share is computed giving effect to all dilutive potential common shares

that were outstanding during the period. Diluted potential common shares consist

of incremental shares issuable upon exercise of stock options and warrants. In

computing diluted net loss per share for the three months ended December 31,

2009 and 2008, no adjustment has been made to the weighted average outstanding

common shares as the assumed exercise of outstanding options and warrants is

anti-dilutive.

NOTE

7:

COMMITMENTS AND

CONTINGENCIES

The

Company is obligated under various operating lease agreements for office space.

Generally, the lease agreements require the payment of base rent plus

escalations for increases in building operating costs and real estate taxes.

Rental expense under operating leases totaled $9,500 and $10,500 for the three

months ended December 31, 2009 and 2008, respectively.

Income

taxes are accounted for under the asset and liability method in accordance with

FASB ASC 740,

Income

Taxes

, (“ASC 740”), formerly SFAS No. 109,

Accounting for Income Taxes.

Deferred tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax

bases and operating loss and tax credit carry forwards, if any. Deferred tax

assets and liabilities are measured using enacted tax rates expected to apply to

taxable income in the years in which those temporary differences are expected to

be recovered or settled. The effect on deferred tax assets and liabilities of a

change in tax rates is recognized in the Statements of Income in the period that

includes the enactment date. A valuation allowance related to

deferred tax assets is recorded when it is more likely than not that some

portion or all of the deferred tax assets will not be realized.

The

Company accounts for uncertainties in income taxes pursuant to ASC 740, formerly

FASB Financial Interpretation No. 48,

Accounting for Uncertainty in Income

Taxes-an interpretation of SFAS No. 109

, which clarifies the

accounting for uncertainty in income taxes recognized in the financial

statements. The Company recognizes tax liabilities for uncertain income tax

positions (“unrecognized tax benefits”) pursuant to ASC 740 , where an

evaluation has indicated that it is more likely than not that the tax positions

will not be sustained on an audit. The Company estimates the unrecognized tax

benefits as the largest amount that is more than 50% likely to be realized upon

ultimate settlement. The Company reevaluates these uncertain tax positions on a

quarterly basis or when new information becomes available to management. The

reevaluations are based on many factors, including but not limited to, changes

in facts or circumstances, changes in tax law, successfully settled issues under

audit, expirations due to statutes of limitations, and new federal or state

audit activity. The Company also recognizes accrued interest and penalties

related to these unrecognized tax benefits which are included in the provision

for income taxes in the Condensed Consolidated Statement of Income. As of

December 31, 2009, the Company has not recognized any adjustment for uncertain

tax provisions.

Included

in the Company’s net deferred tax assets are approximately $2.4 million of

potential future tax benefits from prior unused tax

losses. Realization of these tax assets depends on sufficient

future taxable income before the benefits expire. It is not certain

that the Company will have sufficient future taxable income to utilize the loss

carryforward benefits before they expire. Therefore, an allowance has been

provided for the full amount of the net deferred tax asset.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

|

ITEM 2.

|

MANAGEMENT

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS.

|

FORWARD-LOOKING

STATEMENTS

This

document contains “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements other than statements

of historical fact are “forward-looking statements” for purposes of federal and

state securities laws, including, but not limited to, any projections of

earnings, revenue or other financial items; any statements of the plans,

strategies and objections of management for future operations; any statements

concerning proposed new services or developments; any statements regarding

future economic conditions or performance; any statements or belief; and any

statements of assumptions underlying any of the foregoing.

Forward-looking

statements may include the words “may,” “could,” “estimate,” “intend,”

“continue,” “believe,” “expect,” “anticipate” or other similar words. These

forward-looking statements present our estimates and assumptions only as of the

date of this report. Except for our ongoing securities laws, we do not intend,

and undertake no obligation, to update any forward-looking

statement.

Although

we believe that the expectations reflected in any of our forward-looking

statements are reasonable, actual results could differ materially from those

projected or assumed in any of our forward-looking statements. Our future

financial condition and results of operations, as well as any forward-looking

statements, are subject to change and inherent risks and uncertainties. The

factors impacting these risks and uncertainties include, but are not limited to:

i) changes in external factors or in our internal budgeting process which might

impact trends in our results of operations; ii) unanticipated working capital or

other cash requirements; iii) changes in our business strategy or an inability

to execute our strategy due to unanticipated changes in the industries in which

we operate; and iv) various competitive market factors that may prevent us from

competing successfully in the marketplace

The

following discussion of our financial condition and results of our operations

should be read in conjunction with the Financial Statements and Notes attached

thereto. Our current fiscal year ends March 31, 2010.

RISK

FACTORS

Our

auditor has raised a concern regarding our ability to continue as a going

concern. M45 is in the development stage and we have not generated

revenues since inception. We continue to incur operating expenses,

legal and accounting expenses, consulting fees, and marketing

expenses. These factors raise substantial doubt about our ability to

continue as a going concern.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

BUSINESS

OVERVIEW

Business

of Issuer

M45

Mining Resources Inc.'s new strategy is focused on building shareholder value

through the exploration and development of mineral claims, particularly in the

Matagami Mining Camp located in Quebec, Canada. The Matagami Mining Camp is

known for its zinc-rich massive sulphide deposits. Initial exploratory work in

the Camp can be traced back to the 1930's with Noranda's activities in the

region. Ten of the eighteen deposits discovered to date have been mined and have

produced a total of 3.9 Mt zinc and 0.4 Mt copper.

M45

Management believes that there are likely one or more deposits situated within

the limits of the Claims due to the fact that the property is located near past

producers and existing deposits.

The

mining titles are situated on the east side of Matagami Mining Camp adjacent to

properties owned by Xstrata plc, the world's fifth largest diversified mining

company by market capitalization. These strategic territories strengthen M45's

presence in the Matagami Camp by adding a new series of high-grade potential

mining titles to the Company's existing "West Wind" territories. The Matagami

Mining Camp is a world-class mining district, composed of 18 known volcanogenic

massive sulphide (VMS) deposits. The area is host to historical production of

8.6 billion pounds of Zinc and 853 million pounds of Copper and has established

infrastructure including a railway, paved road and a 2,350 t/day mill owned by

Falconbridge/Xstrata plc.

The

Company expects to encounter intense competition in its efforts to become a

leader in mining exploration. Many large and small companies compete in this

intense market. The principal means of competition vary among categories and

business groups; however, the value of the territories is certainly to be taken

into consideration. The competing entities will have significantly greater

experience, financial resources, facilities, contacts and managerial expertise,

than the Company.

Results

of Operation

For the

three and nine month periods ended December 31, 2009 and 2008, the Company

reported $-0- revenue, respectively. For the quarter ended December 31, 2009,

total expenses were $102,032, a $10,519, or 11%, increase from the $91,513

reported for the same period in 2008. Approximately $24,000 of this increase is

attributable to a increase in consulting and professional fees. For the nine

months ended December 31, 2009, total expenses were $154,818, a $138,455, or

47%, decrease from the $293,273 reported for the same period in 2009.

Approximately $44,000 of this decrease is attributable to a decrease in

consulting and professional fees.

Total

expenses reported for the three and nine month periods ended December 31, 2009

and 2008 primarily represent expenses incurred for general administration,

occupancy (rent, utilities, and other related costs at $3,500 monthly),

amortization and depreciation, consulting, travel, filing fees, professional

services, and interest against a note payable to a shareholder. Significant

shareholders of the Company have been making advances to the Company for the

payment of operating expense; they have agreed to continue providing capital for

ongoing operations, until such time the Company can generate revenues from

commercial operations or increase capital through various financing

arrangements. They have also agreed to convert these advances into equity

(issuance of restricted shares).

Liquidity

and Capital Resources

M45 is a

development stage company, and through the date of this Report, it has not

generated revenue from operations. The Company does not have

sufficient cash or cash equivalents to satisfy its cash requirements for the

next twelve months.

M45

MINING RESOURCES INC.

(A

Development Stage Company)

NOTES

TO UNAUDITED FINANCIAL STATEMENTS

December

31, 2009

Liquidity

and Capital Resources (continued)

The

Company has an accumulated deficit of $7,143,623. The Company continues to

report negative stockholders’ equity and does not have sufficient assets to pay

current liabilities as they come due. These matters raise substantial doubt

about the Company’s ability to continue as a going concern. The Company’s

consolidated financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

The

Company’s continued existence is dependent upon several factors; including the

ability to attain profitable business operations and generate a positive cash

flow. Management plans to raise additional capital investment in the Company,

and it believes the necessary investment will be forthcoming within the next six

month period. There can be no assurance that equity financings will be available

to the Company in the future that will be obtained on terms satisfactory to the

Company. In the event that the Company’s efforts to obtain such financing prove

unsuccessful, the Company may be required to abandon its current business goals

and cease operations.

M45’s

current management have indicated a willingness to continue rendering services

to the Company, to advance sufficient funds to meet our operational needs, and

not to demand payment of sums owed. The Company believes, therefore, that it can

continue as a going concern in the near future.

Off-Balance

Sheet Arrangements

For the

period ending December 31, 2009, the Company had no off-balance sheet

arrangements.

ITEM 3. Quantitative and

Qualitative Disclosures about Market Risk

.

Not

required for smaller reporting companies as defined in Rule 12b-2 of the

Exchange Act .

ITEM 4.

Controls and

Procedures

Our

management, under the supervision of and with the participation of the chief

executive officer and chief financial officer performed an evaluation of the

effectiveness of our disclosure controls and procedures (as defined in Rules

13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the “Exchange

Act”)) as of December 31, 2009, the period covered by this

report. Based on this evaluation, our principal executive officer and

principal financial officer concluded that our disclosure controls were not

effective as of that date.

In our

Annual Report on Form 10-KSB/A filed for the year ended March 31, 2008, the

Company reported a material weakness in internal control over financial

reporting relating to lack of policies and procedures, lack of sufficient

accounting staff, lack of segregation of duties necessary for a good system of

internal control, over-reliance upon independent financial reporting

consultants, the adequacy of accounting systems with procedures to ensure that

financial information is secure and accurately recorded and reported. A material

weakness is defined in Public Company Accounting Oversight Board Auditing

Standard No. 5 as a deficiency, or a combination of deficiencies in internal

control over

financial

reporting such that there is a reasonable possibility that a material

misstatement would not be prevented or detected on a timely basis. In

connection with our overall assessment of internal control over financial

reporting, we have evaluated the effectiveness of our internal controls as of

December 31, 2009 and have concluded that the material weaknesses first reported

in our Annual Report on Form 10-KSB/A for the year ended March 31, 2008 and

again in our Annual Report on Form 10-K for the year ended March 31, 2009, and

further described in this paragraph, were not remediated as December 1,

2009.

Except

for the material weaknesses in internal control over financial reporting as

referenced in our Annual Report on Form 10-K for the fiscal year ended March 31,

2009 (and further described above), no other material weaknesses were identified

in our evaluation of internal controls as of December 1, 2009.

ITEM 4.

Controls and Procedures

(continued).

In light

of the foregoing, once we have the adequate funds, management plans to develop

the following additional procedures to help address these material

weaknesses:

The

Company has created and refined a structure in which critical accounting

policies and estimates are identified, and together with other complex areas, is

subject to multiple reviews by accounting personnel. In addition, we plan to

enhance and test our month-end and year-end financial close process.

Additionally, management will increase its review of our disclosure controls and

procedures. We also intend to develop and implement policies and procedures for

the financial close and reporting process, such as identifying the roles,

responsibilities, methodologies, and review/approval process.

Hire a

qualified accounting staff to manage, review, and verify the day-to-day

accounting and the financial statements.

We

believe these actions will remediate the material weaknesses by focusing

additional attention and resources in our internal accounting functions.

However, the material weaknesses will not be considered remediated until the

applicable remedial controls operate for a sufficient period of time and

management has concluded, through testing, that these controls are operating

effectively.

Changes

in Internal Control over Financial Reporting

Remediation

plans established and initiated by management during the fiscal year ended March

31, 2009 continue to be implemented. There were no other changes in

our internal controls over financial reporting during the quarter ended December

31, 2009 that have materially affected or are reasonably likely to materially

affect, our internal controls over financial reporting.

While we

have implemented or continue to implement our remediation activities, we believe

it will take multiple quarters of effective application of the control

activities, including adequate testing of such control activities, in order for

us to revise our conclusion regarding the effectiveness of our internal controls

over financial reporting.

PART

II

-

OTHER

INFORMATION

ITEM

1. Legal Proceedings.

Other

than as set forth herein, we are not aware of any pending or threatened

litigation against us that we expect will have a material adverse effect on our

business, financial condition, liquidity, or operating results. However, legal

claims are inherently uncertain and we cannot assure you that we will not be

adversely affected in the future by legal proceedings.

ITEM 1A.

Risk Factors.

Smaller

reporting companies are not required to provide the information required by this

item.

ITEM 2.

Unregistered Sales of Equity Security

and Use of Proceeds.

There

were no sales or unregistered securities during the period covered by this

report.

ITEM 3.

Defaults Upon Senior

Securities.

There

were no defaults upon senior securities during the period covered by this

report.

ITEM 4.

Submission of Matters to a Vote of

Security Holders.

There

were no matters submitted to a vote of security holders during the period

covered by this report.

ITEM 5.

Other

Information.

None

ITEM 6.

Exhibits

(a)

Exhibits.

The

following exhibits are filed with this report:

|

3.1

|

Articles of Incorporation of M45

Mining Resources Inc., as filed with the Nevada Secretary of State on July

16, 1990.

|

|

|

|

|

3.2

|

Bylaws of M45 Mining Resources

Inc. 14.1 Code of Ethics (incorporated by reference to Exhibit 14.1 of the

Company's Quarterly Report on Form 10-QSB for the period ended March 31,

2004 and filed with the Securities and Exchange Commission on May 17,

2004).

|

|

|

|

|

31.1

|

Certification of the Chief

Executive Officer pursuant to Rule

13a-14(a)/15d-14(a)

|

|

|

|

|

31.2

|

Certification of the Chief

Financial Officer pursuant to Rule

13a-14(a)/15d-14(a)

|

|

|

|

|

32.1

|

Certification of the Chief

Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of

2002

|

|

|

|

|

32.2

|

Certification of the Chief

Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of

2002

|

(b)

Reports on

Form 8-K.

There

were no Form 8-K filings made during the period covered by this

report.

SIGNATURES

In

accordance with the requirements of the Exchange Act, the registrant caused this

report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

Dated:

February, 25, 2010

|

By:

|

/s/ Barry Somervail

|

|

|

|

Barry

Somervail, CEO and Director

|

|

|

|

|

|

Dated:

February, 25, 2010

|

By:

|

/s/ Gilles Ouellette

|

|

|

|

Gilles

Ouellette, Principal Financial

Officer

|

In

accordance with the Exchange Act, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

|

|

M45

MINING RESOURCES INC.

|

|

|

|

|

|

Dated:

February, 25, 2010

|

By:

|

/s/ Barry Somervail

|

|

|

|

Barry

Somervail, CEO and Director

|

|

|

|

|

|

Dated:

February, 25, 2010

|

By:

|

/s/ Michel Yamani

|

|

|

|

Michel

Yamani,

Secretary/Treasurer

|

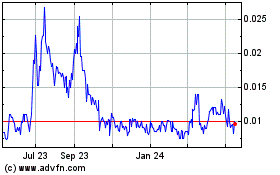

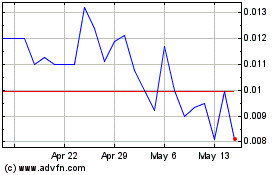

Institute of Biomedical ... (PK) (USOTC:MRES)

Historical Stock Chart

From May 2024 to Jun 2024

Institute of Biomedical ... (PK) (USOTC:MRES)

Historical Stock Chart

From Jun 2023 to Jun 2024