PART

I

ITEM

1. BUSINESS.

Overview

Healthcare

Integrated Technologies, Inc. and its subsidiaries (collectively the “Company,” “we,” “our” or “us”)

is a healthcare technology company based in Knoxville, Tennessee. We are creating a diversified spectrum of healthcare technology solutions

to integrate and automate the continuing care, home care and professional healthcare spaces.

Our

initial product, SafeSpace™ with AI Vision™, is an ambient fall detection solution designed for continuing care communities

and at home use. SafeSpace includes hardware devices utilizing RGB, radar and other sensor technology coupled with our internally developed

software to effectively monitor a person remotely. In continuing care communities, SafeSpace detects resident falls and generates alerts

to a centralized, intelligent dashboard without the use of wearable devices or any action by the resident. In the home, SafeSpace detects

falls and sends alerts directly to designated individuals.

In

addition to SafeSpace, we are creating a home concierge healthcare service application to provide a virtual assisted living experience

for seniors, recently released postoperative patients and others. The concierge application will enable the consumer to obtain home healthcare

services and health and safety monitoring equipment to improve quality of life. We are also working to develop a fully integrated solution

for the professional healthcare community that integrates electronic health records, remote patient monitoring, telehealth, and other

items where integration is beneficial.

Our

History

The

Company has had three distinct businesses. First, we were incorporated in the state of Nevada on June 25, 2013 as Tomichi Creek Outfitters,

aiming to provide professionally guided big game hunts in Sargents, Colorado which is approximately four hours southwest from Denver.

This area of the country is home to trophy size Elk and Mule Deer. Our secondary business included offering guided scenic tours on the

western slopes of the Rocky Mountains. Every season offers a diversified plethora of wildlife and stunning scenic views. Our Chief Executive

Officer (“CEO”) and sole director at that time was Jeremy Gindro. These operations were discontinued in 2015.

Second,

on March 2, 2015, the Company entered into a Business Acquisition Agreement and share exchange under which we acquired the business and

assets of Grasshopper Staffing, Inc. (“Grasshopper Colorado”), formed in the state of Colorado on January 13, 2015. The exchange

for $10,651 was represented by 250,000 shares of the Company’s common stock in exchange for all the outstanding shares of Grasshopper

Colorado. The assets purchased include the trademark and website, office supplies and office furniture. On November 2, 2015 we filed

a Certificate of Amendment to our Articles of Incorporation changing the name of our Company from Tomichi Creek Outfitters to Grasshopper

Staffing, Inc. Grasshopper Colorado was operating as a wholly owned subsidiary of the Company and was the primary operation of our business

until the acquisition of IndeLiving Holdings Inc., on March 13, 2018. Our management consisted of Melanie Osterman as CEO, and Jeremy

Gindro who was our sole director. The operations of Grasshopper Colorado were discontinued in February 2019.

Third,

we acquired IndeLiving Holdings, Inc. (“IndeLiving”) on March 13, 2018 and changed our name to Healthcare Integrated Technologies,

Inc. Our current operations are described above. With the acquisition of IndeLiving, we had another change in management, and Scott M.

Boruff became CEO and sole director of the Company.

Employees

and Human Capital

At

July 31, 2021, we had 4 employees.

At

July 31, 2020, we had 3 employees.

None

of our employees are represented by a union or covered by a collective bargaining agreement. We have not experienced any work stoppages

and we consider our relationship with our employees to be good.

Our

human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing

and new employees, advisors and consultants. The principal purposes of our equity incentive plan are to attract, retain and reward

personnel through the granting of stock-based compensation awards, in order to increase stockholder value and the success of our company

by motivating such individuals to perform to the best of their abilities and achieve our objectives.

Available

Information

We

electronically file certain documents with the Securities and Exchange Commission (the SEC). We file annual reports on Form 10-K; quarterly

reports on Form 10-Q; and current reports on Form 8-K (as appropriate); along with any related amendments and supplements thereto. From

time-to-time, we may also file registration statements and related documents in connection with equity or debt offerings. You may read

and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may

obtain information regarding the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet

website at www.sec.gov that contains reports and other information regarding registrants that file electronically with the SEC.

ITEM

1A. RISK FACTORS.

Risks

Related to Economic and Market Conditions

General

Economic and Financial Conditions

The

success of any investment activity is influenced by general economic and financial conditions, all of which are beyond the control of

the Company. These conditions, such as the recent global economic crisis and significant downturns in the financial markets, may materially

adversely affect our operating results, financial condition and ability to implement our business strategy and/or meet our return objectives.

The

recent global outbreak of COVID-19 (more commonly known as the Coronavirus) has disrupted economic markets and the prolonged economic

impact is uncertain, which could adversely affect our business operations and materially and adversely affect our results of operations,

cash flows and financial position. Some economists and major investment banks have expressed concern that the continued spread of the

virus globally could lead to a world-wide economic downturn. Many manufacturers of goods in China and other countries have seen a downturn

in production due to the suspension of business and temporary closure of factories in an attempt to curb the spread of the illness.

The

impacts of the COVID-19 pandemic may remain prevalent for a significant period of time and may continue to adversely affect our business,

results of operations and financial condition even after the COVID-19 outbreak has subsided. The extent to which the COVID-19 pandemic

impacts us will depend on numerous evolving factors and future developments that we are not able to predict. Due to the largely unprecedented

and evolving nature of the COVID-19 pandemic, it remains very difficult to predict the extent of the impact on our industry generally

and our business in particular.

Risks

Related to Our Business

The

Company’s industry is highly competitive and we have less capital and resources than many of our competitors which may give them

an advantage in developing and marketing products similar to ours or make our products obsolete.

We

are involved in a highly competitive industry where we may compete with numerous other companies who offer alternative methods or approaches,

who may have far greater resources, more experience, and personnel perhaps more qualified than we do. Such resources may give our competitors

an advantage in developing and marketing products similar to ours or products that make our products obsolete. There can be no assurance

that we will be able to successfully compete against these other entities.

The

Company may be unable to respond to the rapid technological change in its industry and such change may increase costs and competition

that may adversely affect its business

Rapidly

changing technologies, frequent new product and service introductions and evolving industry standards characterize the Company’s

market. The continued growth of the Internet and intense competition in the Company’s industry exacerbate these market characteristics.

The Company’s future success will depend on its ability to adapt to rapidly changing technologies by continually improving the

performance features and reliability of its products and services. The Company may experience difficulties that could delay or prevent

the successful development, introduction or marketing of its products and services. In addition, any new enhancements must meet the requirements

of its current and prospective users and must achieve significant market acceptance. The Company could also incur substantial costs if

it needs to modify its products and services or infrastructures to adapt to these changes.

The

Company also expects that new competitors may introduce products, systems or services that are directly or indirectly competitive with

the Company. These competitors may succeed in developing, products, systems and services that have greater functionality or are less

costly than the Company’s products, systems and services, and may be more successful in marketing such products, systems and services.

Technological changes have lowered the cost of operating communications and computer systems and purchasing software. These changes reduce

the Company’s cost of providing services but also facilitate increased competition by reducing competitors’ costs in providing

similar services. This competition could increase price competition and reduce anticipated profit margins.

The

Company’s services are new and its industry is evolving.

You

should consider the Company’s prospects considering the risks, uncertainties and difficulties frequently encountered by companies

in their early stage of development. To be successful in this industry, the Company must, among other things:

|

|

●

|

develop

and introduce functional and attractive services;

|

|

|

|

|

|

|

●

|

attract

and maintain a large base of customers;

|

|

|

|

|

|

|

●

|

increase

awareness of the Company brand and develop consumer loyalty;

|

|

|

|

|

|

|

●

|

respond

to competitive and technological developments;

|

|

|

|

|

|

|

●

|

build

an operations structure to support the Company business; and

|

|

|

|

|

|

|

●

|

attract,

retain and motivate qualified personnel.

|

The

Company cannot guarantee that it will succeed in achieving these goals, and its failure to do so would have a material adverse effect

on its business, prospects, financial condition and operating results.

The

Company’s products and services are new and are in the early stages of development. The Company is not certain that these products

and services will function as anticipated or be desirable to its intended market. Also, some of the Company’s products and services

may have limited functionalities, which may limit their appeal to consumers and put the Company at a competitive disadvantage. If the

Company’s current or future products and services fail to function properly or if the Company does not achieve or sustain market

acceptance, it could lose customers or could be subject to claims which could have a material adverse effect on the Company’s business,

financial condition and operating results.

Risks

Related to Our Company

Uncertainty

of profitability

Our

business strategy may result in increased volatility of revenues and earnings. As we will only develop a limited number of products and

services at a time, our overall success will depend on a limited number of products and services, which may cause variability and unsteady

profits and losses depending on the products and services offered.

Our

revenues and our profitability may be adversely affected by economic conditions and changes in the market. Our business is also subject

to general economic risks that could adversely impact the results of operations and financial condition.

Because

of the anticipated nature of the products and services that we will attempt to develop, it is difficult to accurately forecast revenues

and operating results and these items could fluctuate in the future due to several factors. These factors may include, among other things,

the following:

|

|

●

|

Our

ability to raise sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses.

|

|

|

|

|

|

|

●

|

Our

ability to source strong opportunities with sufficient risk adjusted returns.

|

|

|

|

|

|

|

●

|

Our

ability to manage our capital and liquidity requirements based on changing market conditions.

|

|

|

●

|

The

acceptance of the terms and conditions of our licenses and/or the acceptance of our royalties and fees.

|

|

|

|

|

|

|

●

|

The

amount and timing of operating costs and other costs and expenses.

|

|

|

|

|

|

|

●

|

The

nature and extent of competition from other companies that may reduce market share and create pressure on pricing and investment

return expectations.

|

|

|

|

|

|

|

●

|

Adverse

changes in the national and regional economies in which we will participate, including, but not limited to, changes in our performance,

capital availability, and market demand.

|

|

|

|

|

|

|

●

|

Adverse

changes in the projects in which we plan to invest which result from factors beyond our control, including, but not limited to, a

change in circumstances, capacity and economic impacts.

|

|

|

|

|

|

|

●

|

Changes

in laws, regulations, accounting, taxation, and other requirements affecting our operations and business.

|

|

|

|

|

|

|

●

|

Our

operating results may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations

may be significant.

|

Our

independent auditors’ report for the fiscal years ended July 31, 2021 and 2020 have expressed doubts about our ability to continue

as a going concern

Due

to the uncertainty of our ability to meet our current operating and capital expenses, in our audited annual financial statements as of

and for the years ended July 31, 2021 and 2020, our independent auditors included a note to our financial statements regarding concerns

about our ability to continue as a going concern. We have incurred recurring losses and have generated limited revenue since inception.

These factors and our need for additional financing to effectively execute our business plan, raise substantial doubt about our ability

to continue as a going concern. The presence of the going concern note to our financial statements may have an adverse impact on the

relationships we are developing and plan to develop with third parties as we continue the commercialization of our products and could

make it challenging and difficult for us to raise additional financing, all of which could have a material adverse impact on our business

and prospects and result in a significant or complete loss of your investment.

COVID-19

could adversely impact our business

On

January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus

originating in Wuhan, China (the “COVID-19 outbreak”) and the risks to the international community as the virus spreads globally

beyond its point of origin. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure

globally. The full impact of the COVID-19 outbreak continues to evolve as of the date of this report. As such, it is uncertain as to

the full magnitude that the pandemic will have on the Company’s future financial condition, liquidity, and results of operations.

Management is actively monitoring the impact of the global situation on its financial condition, liquidity, operations, suppliers, industry,

and workforce. Given the daily evolution of the COVID-19 outbreak and the global responses to curb its spread, the Company is not able

to estimate the effects of the COVID-19 outbreak on its results of operations, financial condition, or liquidity for fiscal year 2022.

Management

of growth will be necessary for us to be competitive

Successful

expansion of our business will depend on our ability to effectively attract and manage staff, strategic business relationships, and shareholders.

Specifically, we will need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the

general economic environment. Expansion has the potential to place significant strains on financial, management, and operational resources,

yet failure to expand will inhibit our profitability goals.

We

are entering a potentially highly competitive market

The

markets for the healthcare and senior monitoring industries are competitive and evolving. We face strong competition from larger companies

that may be in the process of offering similar products and services to ours. Many of our current and potential competitors have longer

operating histories, significantly greater financial, marketing and other resources and larger client bases than we have or expect to

have.

Given

the rapid changes affecting the global, national, and regional economies generally, and the healthcare industry specifically, we may

not be able to create and maintain a competitive advantage in the marketplace. Our success will depend on our ability to keep pace with

any market, legal and regulatory changes as well as competitive pressures. Any failure by us to anticipate or respond adequately to such

changes could have a material adverse effect on our financial condition, operating results, liquidity and cash flow.

If

we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately

or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely

impact the future trading price of our common stock.

Effective

internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial

reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed,

and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies

may adversely affect our financial condition, results of operation and access to capital.

We

currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and

accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the United States Securities and

Exchange Commission (the “SEC”) disclosure requirements. Additionally, there is a lack of formal process and timeline for

closing the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely

gather, analyze and report information relative to the financial statements.

Because

of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation of

duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting in a

situation where limitations on segregation of duties exist. In order to remedy this situation, we would need to hire additional staff.

The

Company’s failure to continue to attract, train, or retain highly qualified personnel could harm the company’s business.

The

Company’s success also depends on the Company’s ability to attract, train, and retain qualified personnel, specifically those

with management and product development skills. In particular, the Company must hire additional skilled personnel to further the Company’s

research and development efforts. Competition for such personnel is intense. If the Company fails in attracting new personnel or retaining

and motivating the Company’s current personnel, the Company’s business could be harmed.

Risks

Related to Our Common Stock

Because

we will likely issue additional shares of our common stock, investment in our Company could be subject to substantial dilution.

Investors’

interests in our company will be diluted and investors may suffer dilution in their net book value per share when we issue additional

shares. We are authorized to issue 200,000,000 shares of common stock, $0.001 par value per share. As of October 28, 2021, there

were 42,034,673 shares of our common stock issued and outstanding. We anticipate that all or at least some of our future funding,

if any, will be in the form of equity financing from the sale of our common stock. If we do sell more common stock, investors’

investment in our company will likely be diluted. Dilution is the difference between what you pay for your stock and the net tangible

book value per share immediately after the additional shares are sold by us. If dilution occurs, any investment in the Company’s

common stock could seriously decline in value.

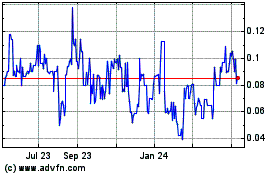

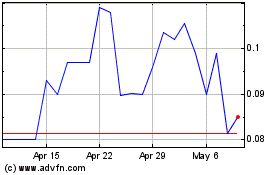

Trading

in our common stock on the OTC Pink has been subject to wide fluctuations.

Our

common stock is currently quoted for public trading on the OTC Pink. The trading price of our common stock has been subject to wide fluctuations.

Trading prices of our common stock may fluctuate in response to several factors, many of which will be beyond our control. The stock

market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating

performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios

previously experienced by our common stock will be matched or maintained. These broad market and industry factors may adversely affect

the market price of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market

price of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted,

could result in substantial costs for us and a diversion of management’s attention and resources.

Our

Certificate of Incorporation and By-Laws provides for indemnification of officers and directors at our expense and limit their liability

which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the

benefit of officers and/or directors.

Our

Certificate of Incorporation and By-Laws include provisions that fully eliminate the personal liability of our directors for monetary

damages to the fullest extent possible under the laws of the State of Nevada or other applicable law. These provisions eliminate the

liability of our directors and our shareholders for monetary damages arising out of any violation of a director of his fiduciary duty

of due care. Under Nevada law, however, such provisions do not eliminate the personal liability of a director for (i) breach of the director’s

duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment

of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction from which the director derived

an improper benefit. These provisions do not affect a director’s liabilities under the federal securities laws or the recovery

of damages by third parties.

We

do not intend to pay dividends on any investment in the shares of stock of our Company and any gain on an investment in our Company will

need to come through an increase in our stock’s price, which may never happen.

We

have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we

require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of a dividend.

Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in the

price of our common shares. This may never occur and investors may lose all their investment in our company.

Because

our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our

shares, as penny stocks, are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice

requirements on broker/dealers who sell our company’s securities including the delivery of a standardized disclosure document;

disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and furnishing monthly account

statements. These rules apply to companies whose shares are not traded on a national stock exchange, trade at less than $5.00 per share,

or who do not meet certain other financial requirements specified by the Securities and Exchange Commission.

These

rules require brokers who sell “penny stocks” to persons other than established customers and “accredited investors”

to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning

the risks of trading in such penny stocks. These rules may discourage or restrict the ability of brokers to sell our shares of common

stock and may affect the secondary market for our shares of common stock. These rules could also hamper our ability to raise funds in

the primary market for our shares of common stock.

FINRA

sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In

addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (known as “FINRA”)

has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing

that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional

customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status,

investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that

speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers

to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect

on the market for our shares.

There

could be unidentified risks involved with an investment in our securities

The

foregoing risk factors are not a complete list or explanation of the risks involved with an investment in the securities. Additional

risks will likely be experienced that are not presently foreseen by the Company. Prospective investors must not construe this information

provided herein as constituting investment, legal, tax or other professional advice. Before making any decision to invest in our securities,

you should read this entire prospectus and consult with your own investment, legal, tax and other professional advisors. An investment

in our securities is suitable only for investors who can assume the financial risks of an investment in the Company for an indefinite

period and who can afford to lose their entire investment. The Company makes no representations or warranties of any kind with respect

to the likelihood of the success or the business of the Company, the value of our securities, any financial returns that may be generated

or any tax benefits or consequences that may result from an investment in the Company.

ITEM

1B. UNRESOLVED STAFF COMMENTS.

Not

applicable.

ITEM

2. PROPERTIES.

None.

ITEM

3. LEGAL PROCEEDINGS.

The

Company is currently not involved in any litigation that the Company believes could have a materially adverse effect on the Company’s

financial condition or results of operations.

On

January 2, 2020, a sworn account lawsuit was filed against our IndeLiving Holdings, Inc. (“IndeLiving”) subsidiary and our

CEO Scott M. Boruff by our previous Certified Public Accounting Firm, RBSM LLP (“RBSM”) demanding payment of $28,007 for

services rendered. We filed our Answer with IndeLiving filing a breach of contract Counterclaim on February 24, 2020 demanding repayment

of a $7,500 retainer paid to RBSM by IndeLiving for services that we allege were not provided. On May 27, 2021, the court signed an Agreed

Order of Compromise Settlement and Dismissal with Prejudice dismissing both RBSM’s claim against us and IndeLiving’s counterclaim

against RBSM. As part of the settlement, we paid RBSM $7,500.

ITEM

4. MINE SAFETY DISCLOSURES.

Not

applicable.

PART

III

ITEM

10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The

following table sets forth information concerning our officers and directors as of the dates indicated. The directors of the Company

serve until their successors are elected and shall qualify. Executive officers are elected by the Board of Directors and serve at the

discretion of the directors.

|

Name

|

|

Age

|

|

Title

|

|

Scott

M. Boruff

|

|

58

|

|

Chief

Executive Officer, Director

|

|

Charles

B. Lobetti, III

|

|

58

|

|

Chief

Financial Officer

|

|

Kenneth

M. Greenwood

|

|

63

|

|

Chief

Technology Officer

|

|

Susan

A. Reyes

|

|

58

|

|

Chief

Medical Officer

|

Set

forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Scott

M. Boruff, Chief Executive Officer, Director, Age 58

Mr.

Boruff has served as our Chief Executive Officer and Sole Director since March 13, 2018. Since May 1, 2021, he has served in that

capacity as an outsourced, contracted Chief Executive Officer and Director. He has been the sole officer and director of IndeLiving

Holdings, Inc. since the company’s formation in 2016. He has also served as the Manager of Platinum Equity Advisors, LLC (“Platinum

Equity”) since its formation in 2016. In addition to providing consulting and advisory services, Platinum Equity has interests

in a real estate brokerage firm and a luxury real estate auction firm. Mr. Boruff is a proven executive with a diverse business background

in investment banking and real estate development. He currently serves as Manager of Own Shares, LLC, a privately held holding company

with interests in various entertainment ventures, and Managing Member of Stonewalk Companies, privately held real estate development

company. As a professional in investment banking, he specialized in consulting services and strategic planning with an emphasis on companies

in the oil and gas field. Mr. Boruff served as a member of the Board of Directors of Miller Energy Resources, Inc., a publicly traded

company, from August 2008 until March 2016, serving as Executive Chairman of the Board of Directors from September 2014 until March 2016

and Chief Executive Officer from August 2008 to September 2014. In October 2015, when it was being led by a successor management team,

Miller Energy Resources, Inc. filed a voluntary petition for reorganization under chapter 11 of title 11 of the U.S. Code in a pre-packaged

bankruptcy. It remained a debtor in possession and emerged from bankruptcy in March 2016. Mr. Boruff was a director and 49% owner of

Dimirak Securities Corporation, a broker-dealer and member of FINRA, from April 2009 until July 2012. In July 2012, Mr. Boruff sold his

interest in Dimirak. He has more than 30 years of experience in developing commercial real estate projects and from 2006 to 2007 Mr.

Boruff successfully led transactions averaging $150 to $200 million in size while serving as a director of Cresta Capital Strategies,

LLC. Mr. Boruff received a Bachelor of Science degree in Business Administration from East Tennessee State University.

Charles

B. Lobetti, III, Chief Financial Officer, Age 58

Mr.

Lobetti has served as our Chief Financial Officer since October 8, 2019. He holds both Bachelor of Science in Business Administration

(1985) and Master of Accountancy (1986) degrees from the University of Tennessee and is a licensed Certified Public Accountant (Inactive)

in the State of Tennessee. Upon graduation, Mr. Lobetti accepted a position in the tax department of the Tampa, Florida office of Ernst

& Young where he progressed to Senior Tax Consultant before he left the firm in 1989 to return to his hometown of Knoxville, Tennessee

as the Tax Manager with a progressive, local accounting firm. In 1990, Mr. Lobetti, along with two co-workers, formed the accounting

firm of Lobetti, Ideker & Reel (“LIR”) where he served as President and Director of Tax Services. LIR was a member of

the AICPA’s SEC Practice Section and served several SEC registrant clients. In 1998, Mr. Lobetti left LIR to accept a position

of Chief Financial Officer of United Petroleum Corporation (“UPET”), a small cap, SEC registrant oil and natural gas development

company and convenience store operator. Following his tenure at UPET, Mr. Lobetti served as Chief Financial Officer for a boutique investment

banking/private equity firm specializing in the placement and funding of Regulation D and Regulation S offerings. He spent the next 10-years

working in various investment banking, commercial mortgage banking and commercial banking functions before accepting the position of

Controller – Alaska Operations with Miller Energy Resources, Inc. (“Miller”), an SEC registrant oil and gas exploration

and production company. Shortly after accepting the position in 2011, Mr. Lobetti was promoted to Corporate Controller and thereafter

appointed Treasurer in 2012. Since leaving Miller in 2014, Mr. Lobetti enjoyed spending time with his family and working part-time in

commercial mortgage banking until recently accepting the position of Chief Financial Officer of Healthcare Integrated Resources, Inc.

Kenneth

M. Greenwood, Chief Technology Officer, Age 63

Kenneth

M. Greenwood has served as our Chief Technology Officer since June 15, 2020. Mr. Greenwood brings over 30-years of experience

with large-scale systems programming and implementations to our executive management team. He has provided instruction and consulting,

primarily for SAP products, in the areas of architecture, design and implementation of ABAP, big-data warehousing, business intelligence

analytics, object-orientation, cloud and systems integration, interfaces, HANA in-memory databases, data security, workflow, and archiving

to a variety of companies including Intel, World Bank, HP, Amtrak, IBM, Accenture, Wal-Mart, Home Depot, Nike and Kimberly-Clark. While

at Random House implementing a Rights Management module following two previous failed attempts by other contractors, Mr. Greenwood led

the 30-developer team to design, code and implement rights management for Random House in an SAP system using a novel approach of OO

design, which became the world’s largest SAP module at that time. Mr. Greenwood authored the best-selling Sams Teach Yourself

ABAP in 21 Days, published by Macmillan.

Susan

A. Reyes, M.D., Chief Medical Officer, Age 58

Susan

A. Reyes, M.D. has served as our Chief Medical Officer since September 1, 2020. Dr. Reyes brings extensive experience as a practicing

Internal Medicine physician in the home care environment. She earned her Doctor of Medicine degree in just six-years and was board

certified in Internal Medicine in 1994. Since then, Dr. Reyes has enjoyed expanding her skill set by working with several ground-breaking

companies. In 1997, she worked for Hospital Inpatient Management Systems, which was the first hospitalist group that transformed

the efficiencies of “length of stay” of patients in the hospital and in skilled nursing facility settings. In 2000, she was

the lead physician for MD to You in Tampa, Florida - the first organization that developed house calls for homebound geriatric patients.

In 2009, Dr. Reyes became the first physician to bring house call services to Knoxville, Tennessee and has grown her company to be the

largest mobile medical primary care practice covering East Tennessee. She has been an advisor and served as Medical Director to several

home health and hospice agencies and assisted living facilities in each community where she has resided.

Family

Relationships

There

are no family relationships among any of our directors or executive officers.

Involvement

in Certain Legal Proceedings

To

the best of the Company’s knowledge, none of the Company’s directors or executive officers has, during the past ten years,

except as set forth below:

|

|

●

|

been

convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor

offenses);

|

|

|

|

|

|

|

●

|

had

any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business

association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years

prior to that time;

|

|

|

●

|

been

the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction

or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in

any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be

associated with persons engaged in any such activity;

|

|

|

|

|

|

|

●

|

been

found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated

a federal or state securities or commodities law, and the judgment in such civil action has not been reversed, suspended, or vacated;

|

|

|

●

|

been

the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently

reversed, suspended or vacated, relating to (i) an alleged violation of any federal or state securities or commodities law or regulation,

(ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or

permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order,

or removal or prohibition order, or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business

entity; or

|

|

|

|

|

|

|

●

|

been

the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization

(as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange

Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons

associated with a member.

|

Mr.

Boruff served as a member of the Board of Directors, as Chief Executive Officer, and as Executive Chairman of Miller Energy Resources,

Inc. during the two years preceding Miller Energy Resources, Inc.’s filing of a bankruptcy petition in August 2015.

Mr.

Lobetti served as Treasurer of Miller Energy Resources, Inc. during the two-year period preceding Miller Energy Resources, Inc.’s

filing of a bankruptcy petition in August 2015.

Except

as set forth in the Company’s discussion below in “Certain Relationships and Related Transactions, and Director Independence”,

none of the Company’s directors or executive officers has been involved in any transactions with the Company or any of the Company’s

directors, executive officers, affiliates, or associates which are required to be disclosed pursuant to the rules and regulations of

the Commission.

Compliance

with Section 16(a) of the Exchange Act

Section

16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who beneficially own 10% or more of

a class of securities registered under Section 12 of the Exchange Act to file reports of beneficial ownership and changes in beneficial

ownership with the SEC. Directors, executive officers and greater than 10% stockholders are required by the rules and regulations of

the SEC to furnish the Company with copies of all reports filed by them in compliance with Section 16(a).

Based

solely on our review of certain reports filed with the Securities and Exchange Commission pursuant to Section 16(a) of the Securities

Exchange Act of 1934, as amended, the reports required to be filed with respect to transactions in our common stock during the fiscal

year ended July 31, 2021 and 2020, were not timely.

Term

of Office

The

Company’s directors are elected by the Company’s stockholders for a one-year term until the next annual general meeting of

the Company’s stockholders, or until removed by the stockholders in accordance with the Company’s bylaws. The Company’s

officers are appointed by the Board and hold office until removed by the Board.

Code

of Ethics

The

Company does not currently have a code of ethics, and because the Company has only limited business operations and only two officers

and one director, the Company believes that a code of ethics would have limited utility. The Company intends to adopt such a code of

ethics as the Company’s business operations expand and the Company has more employees.

Board

Committees

As

we only have one board member and given our limited operations, we do not have separate or independent audit or compensation committees.

Our Board of Directors has determined that it does not have an “audit committee financial expert,” as that term is defined

in Item 407(d)(5) of Regulation S-K. In addition, we have not adopted any procedures by which our shareholders may recommend nominees

to our Board of Directors.

ITEM

11. EXECUTIVE COMPENSATION.

The

following table summarizes all compensation recorded by us in the past two years for:

|

|

●

|

our

principal executive officer or other individual serving in a similar capacity,

|

|

|

|

|

|

|

●

|

our

three most highly compensated executive officers, other than our principal executive officer, who were serving as executive officers

at July 31, 2021 and 2020 as that term is defined under Rule B-7 of the Securities Exchange Act of 1934.

|

Summary

Compensation Table (in dollars)

|

Name and

Principal

|

|

Fiscal

|

|

|

|

|

|

|

|

|

Stock

|

|

|

Non-Equity

Incentive

Plan

|

|

|

Non-Qualified

Deferred

Compensation

|

|

|

All

Other

|

|

|

|

|

|

Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Awards

|

|

|

Compensation

|

|

|

Earnings

|

|

|

Compensation

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott

B. Boruff

|

|

2021

|

|

|

|

225,000

|

|

|

|

-

|

|

|

|

294,510

|

|

|

|

-

|

|

|

|

-

|

|

|

|

98,400

|

|

|

|

617,910

|

|

|

Chief

Executive Officer

|

|

2020

|

|

|

|

300,000

|

|

|

|

-

|

|

|

|

294,510

|

|

|

|

-

|

|

|

|

-

|

|

|

|

23,400

|

|

|

|

617,910

|

|

|

Director (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles

B. Lobetti, III

|

|

2021

|

|

|

|

104,000

|

|

|

|

-

|

|

|

|

86,732

|

|

|

|

-

|

|

|

|

-

|

|

|

|

4,800

|

|

|

|

195,532

|

|

|

Chief

Financial Officer (2)

|

|

2020

|

|

|

|

55,355

|

|

|

|

-

|

|

|

|

92,258

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,910

|

|

|

|

151,523

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth

M. Greenwood

|

|

2021

|

|

|

|

257,000

|

|

|

|

-

|

|

|

|

166,763

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

423,763

|

|

|

Chief

Technology Officer (3)

|

|

2020

|

|

|

|

32,125

|

|

|

|

-

|

|

|

|

20,845

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

52,970

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Susan

A. Reyes MD

|

|

2021

|

|

|

|

47,667

|

|

|

|

-

|

|

|

|

73,771

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

121,438

|

|

|

Chief

Medical Officer (4)

|

|

2020

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1)

|

Mr.

Boruff has served as our Chief Executive Officer and our sole Director since March 13, 2018.

|

|

|

(2)

|

Mr.

Lobetti has served as our Chief Financial Officer since October 8, 2019.

|

|

|

(3)

|

Mr.

Greenwood has served as our Chief Technology Officer since June 15, 2020.

|

|

|

(4)

|

Ms.

Reyes has served as our Chief Medical Officer since September 1, 2020

|

Director

Compensation

We

do not currently pay any cash fees to our directors, nor do we pay director’s expenses in attending board meetings.

Executive

Compensation Agreements

Scott

M. Boruff, CEO

Effective

May 1, 2021, we entered into a Non-Employee Chief Executive Officer Engagement Agreement (the “Contract CEO Agreement”) with

Platinum Equity Advisors, LLC (“Platinum”) to provide the services of Scott M. Boruff as Chief Executive Officer and Chairman

of the Board of Directors of the Company for a term of three (3) years. As compensation for the services, the Company shall pay Platinum

an annual base fee of $323,400 and it is entitled to discretionary bonus fee payments as may be awarded by our Board of Directors. During

the term of the Contract CEO Agreement, Mr. Boruff is entitled to participate in any employee benefit plans, programs or arrangements

of the Company in effect during the engagement period which are generally available to other senior executives of the Company.

The

Contract CEO Agreement terminates upon the death or disability of Mr. Boruff, and may be terminated by us for cause, or by Platinum without

cause or for good reason. If the Contract CEO Agreement is terminated by us for cause, upon the death or disability of Mr. Boruff, at

non-renewal or by Platinum without good cause, Platinum is only entitled to receive compensation through the date of termination. If

the Contract CEO Agreement is terminated by us without cause or by Platinum for good reason, we are obligated to pay Platinum severance

equal to one year’s base fee and any other earned but unpaid compensation. In addition, if at any time during the term of the Contract

CEO Agreement Platinum is terminated by us without cause within two years after a Change in Control of our company, or in the 90 days

prior the Change in Control at the request of the acquiror, we are obligated to pay Platinum an amount equal to 2.99 times the annual

base fee. “Change in Control” is defined in the Contract CEO Agreement to mean the acquisition by any person of beneficial

ownership of our securities representing greater than 50% of the combined voting power of our then outstanding voting securities. The

Contract CEO Agreement contains customary invention assignment, non-compete and non-solicitation provisions.

Prior

to the May 1, 2021 effective date of the Contract CEO Agreement, Scott M. Boruff served as CEO of Company pursuant to an Employment Agreement

dated March 13, 2018, which was terminated on May 1, 2021. As compensation, we paid him an annual salary of $300,000 and he was entitled

to discretionary bonuses as may be awarded from time to time by our Board of Directors. As additional compensation, we granted him an

option to purchase 2,500,000 shares of the Company’s common stock at an exercise price of $3.00 per share, which exceeded the fair

market price of our common stock on the date of grant, vesting in four equal annual installments commencing on the grant date. The vesting

date of any unvested options accelerates in the event of a Change in Control (as defined in the Employment Agreement). Mr. Boruff was

also entitled to paid vacation and sick leave, an automobile allowance and participation in any employee benefit plans or programs we

offered at the time.

Charles

B. Lobetti, III, CFO

Charles

B. Lobetti, III and the Company entered into a three-year Employment Agreement dated October 8, 2019, in which Mr. Lobetti agreed to

serve as our Chief Financial Officer. As compensation, we agreed to pay him an annual salary of $52,000 and he is entitled to discretionary

bonuses as may be awarded from time to time by our Board of Directors. Effective May 1, 2020, Mr. Lobetti’s base salary was increased

to $104,000 to reflect an increased time commitment. As additional compensation we granted him stock options to purchase 600,000 shares

of our common stock at an exercise price of $0.15 per share, which was the closing price of common stock as reported on the OTC Markets

on the date immediately preceding the date of the Employment Agreement. The options vested 25% immediately upon execution of the Employment

Agreement with the remaining vesting equally in annual installments over three (3) years. The vesting date of any unvested options accelerates

in the event of a Change in Control (as defined in the Employment Agreement). Mr. Lobetti is also entitled to paid vacation and sick

leave, an automobile allowance and participation in any employee benefit plans or programs we may offer. The initial term of the Employment

Agreement will automatically renew for an additional one-year term unless either party provides notice of non-renewal.

The

Employment Agreement terminates upon the death or disability of Mr. Lobetti, and may be terminated by us for cause, or by Mr. Lobetti

for any reason. If the Employment Agreement is terminated by us for cause, upon his death or disability, at non-renewal or by Mr. Lobetti,

he is only entitled to receive base salary accrued but not paid through the date of termination, and in the case of termination due to

death or disability, a pro rata payment of the annual incentive earned for the year of termination. If the Employment Agreement is terminated

by us without cause or by Mr. Lobetti for good reason, we are obligated to pay him severance equal to one year’s base salary and

any unpaid incentive compensation. In addition, if at any time during the term of the Employment Agreement Mr. Lobetti’s employment

is terminated by us without cause within two years after a Change in Control of our company, or in the 90 days prior the Change in Control

at the request of the acquiror, we are obligated to pay him an amount equal to 2.99 times his annualized compensation. “Change

in Control” is defined in the Employment Agreement to mean the acquisition by any person of beneficial ownership of our securities

representing greater than 50% of the combined voting power of our then outstanding voting securities. The Employment Agreement contains

customary invention assignment, non-compete and non-solicitation provisions.

Kenneth

M. Greenwood, CTO

Kenneth

M. Greenwood and the Company entered into a three-year Employment Agreement dated June 15, 2020, in which Mr. Greenwood agreed to serve

as our Chief Technology Officer. As compensation, we agreed to pay him an annual salary of $257,000 and he is entitled to discretionary

bonuses as may be awarded from time to time by our Board of Directors. As additional compensation we granted him stock options to purchase

2,000,000 shares of our common stock at an exercise price of $0.30 per share, which was the closing price of common stock as reported

on the OTC Markets on the date immediately preceding the date of the Employment Agreement. The options vested 25% immediately upon execution

of the Employment Agreement with the remaining vesting equally in annual installments over three (3) years. The vesting date of any unvested

options accelerates in the event of a Change in Control (as defined in the Employment Agreement). Mr. Greenwood is also entitled to paid

vacation and sick leave, and participation in any employee benefit plans or programs we may offer. The initial term of the Employment

Agreement will automatically renew for an additional one-year term unless either party provides notice of non-renewal.

The

Employment Agreement terminates upon the death or disability of Mr. Greenwood, and may be terminated by us for cause, or by Mr. Greenwood

for any reason. If the Employment Agreement is terminated by us for cause, upon his death or disability, at non-renewal or by Mr. Greenwood,

he is only entitled to receive base salary accrued but not paid through the date of termination, and in the case of termination due to

death or disability, a pro rata payment of the annual incentive earned for the year of termination. If the Employment Agreement is terminated

by us without cause or by Mr. Greenwood for good reason, we are obligated to pay him severance equal to one year’s base salary

and any unpaid incentive compensation. In addition, if at any time during the term of the Employment Agreement Mr. Greenwood’s

employment is terminated by us without cause within two years after a Change in Control of our company, or in the 90 days prior the Change

in Control at the request of the acquiror, we are obligated to pay him an amount equal to 2.99 times his annualized compensation. “Change

in Control” is defined in the Employment Agreement to mean the acquisition by any person of beneficial ownership of our securities

representing greater than 50% of the combined voting power of our then outstanding voting securities. The Employment Agreement contains

customary invention assignment, non-compete and non-solicitation provisions.

Susan

A. Reyes, M.D., CMO

Susan

A. Reyes, M.D. and the Company entered into a three-year Employment Agreement dated September 1, 2020, in which Dr. Reyes agreed to serve

as our Chief Medical Officer. As compensation, we agreed to pay her an annual salary of $52,000 and she is entitled to discretionary

bonuses as may be awarded from time to time by our Board of Directors. As additional compensation we granted her stock options to purchase

1,000,000 shares of our common stock at an exercise price of $0.40 per share, which was the closing price of common stock as reported

on the OTC Markets on the date immediately preceding the date of the Employment Agreement. The options vested 150,000 shares immediately

upon execution of the Employment Agreement with the remaining vesting equally in annual installments over three (3) years. The vesting

date of any unvested options accelerates in the event of a Change in Control (as defined in the Employment Agreement). Dr. Reyes is also

entitled to paid vacation and sick leave, and participation in any employee benefit plans or programs we may offer. The initial term

of the Employment Agreement will automatically renew for an additional one-year term unless either party provides notice of non-renewal.

The

Employment Agreement terminates upon the death or disability of Dr. Reyes, and may be terminated by us for cause, or by Dr. Reyes for

any reason. If the Employment Agreement is terminated by us for cause, upon her death or disability, at non-renewal or by Dr. Reyes,

she is only entitled to receive base salary accrued but not paid through the date of termination, and in the case of termination due

to death or disability, a pro rata payment of the annual incentive earned for the year of termination. If the Employment Agreement is

terminated by us without cause or by Dr. Reyes for good reason, we are obligated to pay her severance equal to one year’s base

salary and any unpaid incentive compensation. In addition, if at any time during the term of the Employment Agreement Dr. Reyes’

employment is terminated by us without cause within two years after a Change in Control of our company, or in the 90 days prior the Change

in Control at the request of the acquiror, we are obligated to pay her an amount equal to 2.99 times her annualized compensation. “Change

in Control” is defined in the Employment Agreement to mean the acquisition by any person of beneficial ownership of our securities

representing greater than 50% of the combined voting power of our then outstanding voting securities. The Employment Agreement contains

customary invention assignment, non-compete and non-solicitation provisions.

ITEM

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The

following table sets forth certain information as of October 28, 2021 regarding the number and percentage of our Common Stock

(being our only voting securities) beneficially owned by each officer, director, each person (including any “group” as that

term is used in Section 13(d)(3) of the Exchange Act) known by us to own 5% or more of our Common Stock, and all officers and directors

as a group.

|

Title

of

Class

|

|

Name,

Title and Address of

Beneficial

Owner of Shares

|

|

|

Amount

of Beneficial Ownership (6)

|

|

|

Percent

of

Class (7)

|

|

|

Common

|

|

Scott

M. Boruff, CEO, Director (1)

1462 Rudder Lane

Knoxville, TN 37919

|

|

|

|

13,539,854

|

|

|

|

29.57

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

|

|

Charles

B. Lobetti, III, CFO (2)

814 Evolve Way

Knoxville, TN 37915

|

|

|

|

750,000

|

|

|

|

1.64

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

|

|

Kenneth

M. Greenwood, CTO (3)

404 Citrus Ridge Drive

Davenport, FL 33837

|

|

|

|

1,000,000

|

|

|

|

2.18

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

|

|

Susan

A. Reyes, CMO (4)

9901 Sierra Visa Lane

Knoxville, TN 37922

|

|

|

|

433,333

|

|

|

|

<1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All

Officers and Directors as a Group

|

|

|

|

15,723,187

|

|

|

|

34.34

|

%

|

|

Principal

Shareholders:

|

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

Jeremy

Gindro (5)

310 Tanner Avenue

Florence, CO 81226

|

|

|

|

7,870,000

|

|

|

|

17.19

|

%

|

|

1)

|

The

shares owned by Mr. Boruff include 11,664,854 shares owned by Platinum Equity Advisors, LLC, of which Mr. Boruff is the Chief Manager.

Pursuant to Mr. Boruff’s March 13, 2018 employment agreement (which terminated May 1, 2021) as our Chief Executive Officer,

the shares also include options to purchase 1,875,000 shares of our common stock, which are vested and exercisable at $3.00 per share

and expire in 2023. The number of shares owned by Mr. Boruff excludes options to purchase 625,000 shares of our common stock at $3.00

per share which have not yet vested and expire in 2023.

|

|

|

|

|

2)

|

Mr.

Lobetti owned 300,000 shares at July 31, 2021 and 200,000 shares at July 31, 2020. Pursuant to Mr. Lobetti’s employment agreement

dated October 8, 2019, the shares also include options to purchase 450,000 shares of our common stock which are vested and exercisable

at $0.15 per share and expire in 2024. The number of shares owned by Mr. Lobetti excludes options to purchase 150,000 shares of our

common stock at $0.15 per share which have not yet vested and expire in 2023. Mr. Lobetti received a restricted stock grant of 500,000

shares on July 16, 2020. Under the terms of the grant, 200,000 shares vested immediately with the remaining shares vesting equally

over a three-year period.

|

|

3)

|

Mr.

Greenwood owned no shares at July 31, 2021 and 2020. Pursuant to Mr. Greenwood’s employment agreement dated June 15, 2020,

the shares include options to purchase 1,000,000 shares of our common stock which are vested and exercisable at $0.30 per share and

expire in 2025. The number of shares owned by Mr. Greenwood excludes options to purchase 1,000,000 shares of our common stock at

$0.30 per share which have not yet vested and expire in 2025.

|

|

|

|

|

4)

|

Susan

Reyes owned no shares at July 31, 2021 and 2020. Pursuant to Susan Reyes’ employment agreement dated September 1, 2020, the

shares include options to purchase 433,333 shares of our common stock which are vested and exercisable at $0.40 per share and expire

in 2025. The number of shares owned by Ms. Reyes excludes options to purchase 566,667 shares of our common stock at $0.40 per share

which have not yet vested and expire in 2025.

|

|

5)

|

The

total includes 100,000 shares owned by James Gindro, the father of Jeremy Gindro.

|

|

|

|

|

6)

|

As

used in this table, “beneficial ownership” means the sole or shared power to vote, or to direct the voting of, a security,

or the sole or share investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of

a security). The inclusion of any shares as deemed beneficially owned does not constitute an admission of beneficial ownership by

the named stockholder.

|

|

|

|

|

7)

|

Unless

otherwise indicated, we have been advised that all individuals or entities listed have the sole power to vote and dispose of the

number of shares set forth opposite their names. For purposes of computing the number and percentage of shares beneficially owned

by a security holder, any shares which such person has the right to acquire within 60 days of October 28, 2021 are deemed

to be outstanding, but those shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any

other security holder. We currently do not maintain any equity compensation plans. As of October 28, 2021, there were 45,793,006

shares beneficially owned.

|

Changes

in Control

We

are not aware of any arrangements that may result in “changes in control” as that term is defined by the provisions of Item

403(c) of Regulation S-K.

ITEM

13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Other

than compensation arrangements, the following is a description of transactions to which we were a participant or will be a participant

to, in which:

|

|

●

|

the

amounts involved exceeded or will exceed the lesser of 1% of our total assets or $120,000; and

|

|

|

|

|

|

|

●

|

any

of our directors, executive officers or holders of more than 5% of our capital stock, or any member of the immediate family of the

foregoing persons, had or will have a direct or indirect material interest.

|

To

continue operations and meet operating cash requirements, we have periodically relied on advances from related parties, primarily shareholders,

until such time as our cash flow from operations meets our cash requirements or we are able to obtain adequate financing through sales

of our equity securities and/or traditional debt financing. There is no formal written commitment for continued support by shareholders.

Amounts advanced primarily relate to amounts paid to vendors. The advances are considered temporary in nature and have not been formalized

by any written agreement. As of July 31, 2021 and 2020, related parties were owed $202,290 and $271,819, respectively. The amounts owed

are payable on demand and carry no interest. The amounts and terms of the related party advances may not necessarily be indicative of

the amounts and terms that would have been incurred had comparable transactions been entered into with independent third parties.

Effective

May 1, 2021, we entered into a Non-Employee Chief Executive Officer Engagement Agreement (the “Contract CEO Agreement”) with

Platinum Equity Advisors, LLC, a related party, to provide the services of our CEO and Chairman of the Board of Directors. Under the

terms of the Contract CEO Agreement, Platinum Equity Advisors, LLC is owed $50,150 at July 31, 2021.

Director

Independence

We

currently have no independent directors. Because our common stock is not currently listed on a national securities exchange, we have

used the definition of “independence” of The NASDAQ Stock Market to make this determination. NASDAQ Listing Rule 5605(a)(2)

provides that an “independent director” is a person other than an officer or employee of the company or any other individual

having a relationship that, in the opinion of the company’s board of directors, would interfere with the exercise of independent

judgment in carrying out the responsibilities of a director. The NASDAQ listing rules provide that a director cannot be considered independent

if:

|

|

●

|

the

director is, or at any time during the past three years was, an employee of the Company;

|

|

|

|

|

|

|

●

|

the

director or a family member of the director accepted any compensation from the Company in excess of $120,000 during any period of

12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including,

among other things, compensation for board or board committee service);

|

|

|

|

|

|

|

●

|

a

family member of the director is, or at any time during the past three years was, an executive officer of the Company;

|

|

|

|

|

|

|

●

|

the

director or a family member of the director is a partner in, controlling stockholder of, or an executive officer of an entity to

which the Company made, or from which the Company received, payments in the current or any of the past three fiscal years that exceed

5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exclusions);

|

|

|

|

|

|

|

●

|

the

director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three

years, any of the executive officers of the Company served on the compensation committee of such other entity; or

|

|

|

|

|

|

|

●

|

The

director or a family member of the director is a current partner of the Company’s outside auditor, or at any time during the

past three years was a partner or employee of the Company’s outside auditor, and who worked on the Company’s audit.

|

The

Company does not currently have a separately designated audit, nominating, or compensation committee.

ITEM

14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

The

following table sets forth the aggregate fees billed for each of the last two fiscal years for professional services rendered by the

principal accountant for the audit of the Company’s annual financial statements and review of financial statements included in

the Company’s quarterly reports or services that are normally provided by the accountant in connection with statutory and regulatory

filings or engagements for those fiscal years.

|

|

|

July

31, 2021

|

|

|

July

31, 2020

|

|

|

|

|

|

|

|

|

|

|

Audit

Fees

|

|

$

|

42,500

|

|

|

$

|

75,525

|

|

|

Audit-Related

Fees

|

|

|

-

|

|

|

|

-

|

|

|

Tax

Fees

|

|

|

370

|

|

|

|

-

|

|

|

All

Other Fees

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

$

|

42,870

|

|

|

$

|

75,525

|

|

Audit

Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

Given

the small size of our Board as well as the limited activities of our Company, our Board of Directors acts as our Audit Committee. Our

Board pre-approves all audit and permissible non-audit services. These services may include audit services, audit-related services, tax

services, and other services. Our Board approves these services on a case-by-case basis.

HEALTHCARE

INTEGRATED TECHNOLOGIES, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

|

|

|

For

the Years Ended July 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net

loss

|

|

$

|

(1,455,025

|

)

|

|

$

|

(1,058,087

|

)

|

|

Adjustments