UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): May 8, 2015

FXCM Inc.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34986 |

|

27-3268672 |

| (State or Other Jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| Incorporation) |

|

|

|

Identification No.) |

55 Water Street, FL 50 New York, NY,

10041

(Address of Principal Executive Offices)

(Zip Code)

(646) 432-2986

(Registrant’s

Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition |

On May 8, 2015, FXCM Inc. (“the Company”)

issued a press release announcing financial results for its first quarter ended March 30, 2015. The Company also released its

monthly business metrics for April 2015. A copy of this press release is furnished as Exhibit 99.1 to this Form

8-K and is hereby incorporated by reference in this Item 2.02.

The information in this Current Report on Form 8-K and the Exhibit

attached hereto is furnished pursuant to the rules and regulations of the Securities and Exchange Commission and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 7.01 | Regulation FD Disclosure |

The information set forth under Item 2.02, “Results of

Operations and Financial Condition”, is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| (a) |

Financial statements of businesses acquired: None |

| (b) |

Pro forma financial information: None |

| (c) |

Shell company transactions: None |

| (d) |

Exhibits: Press release, dated May 8, 2015 issued by FXCM Inc. |

| Exhibit No. |

Exhibit Description |

| |

|

| 99.1** |

Press Release dated May 8, 2015 |

| |

|

** Furnished herewith.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

FXCM INC. |

| |

|

| |

By: |

/s/Robert Lande |

| |

|

Name: |

Robert Lande |

| |

|

Title: |

Chief Financial Officer |

Date: May 8, 2015

Exhibit Index

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press Release dated as of May 8, 2015 |

Exhibit 99.1

FXCM Inc. Announces First Quarter 2015

Results

Releases April 2015 Customer Trading

Metrics

First Quarter 2015 Highlights:

| · | U.S. GAAP trading revenues from continuing operations of $69.2 million

|

| · | U.S. GAAP net loss attributable to FXCM Inc. from continuing operations

of $393.3 million or $8.35 per fully diluted share |

| · | U.S. GAAP revenues from discontinued operations of $28.8 million |

| · | U.S. GAAP net loss attributable to FXCM Inc. from discontinued operations

of $33.5 million or $0.71 per fully diluted share |

| · | Results from continuing and discontinued operations include $265.3

million of bad debt expense related to January 15th SNB action, a $292.4 million non-cash expense item relating to Leucadia’s

financing package, a $96.2 million non-cash impairment relating primarily to goodwill and intangibles for FXCM’s institutional

business and a net $32.7 million non-cash expense relating to the write-down of deferred tax assets |

| · | Adjusted EBITDA from continuing and discontinued operations of $14.5

million |

| · | Strong operating cash position of $328.7 million in combined operating

cash and regulatory surplus of $200.6 million at March 31, 2015 |

| · | Repaid $81.6 million of Leucadia loan to date - $12.4 million in the

quarter and $69.2 million subsequent to quarter-end |

April 2015 Customer Trading Metrics from Continuing Operations(1)

Highlights:

| · | Retail customer trading volume(2) of $306 billion, 7% lower

than March 2015 |

| · | Institutional customer trading volume(2) of $220 billion,

10% lower from March 2015 |

| · | Retail account additions of 3,045, 2% higher than March 2015 |

NEW YORK – May 8, 2015 – FXCM Inc. (NYSE:FXCM),

a leading online provider of foreign exchange, or FX, trading and related services, today announced for the quarter ended March

31, 2015, U.S. GAAP trading revenues from continuing operations of $69.2 million, compared to $82.2 million for the quarter ended

March 31, 2014, a decrease of 16%. U.S. GAAP net loss attributable to FXCM Inc. from continuing operations was $393.3 million

for the first quarter 2015 or $8.35 per fully diluted share, compared to U.S. GAAP net loss attributable to FXCM Inc. from continuing

operations of $0.8 million or $0.02 per fully diluted share for the first quarter 2014.

Results from operations for the quarter ended March 31, 2015

included a number of extraordinary items that resulted from the events of January 15, 2015 where FXCM’s customers suffered

negative equity balances due to the unprecedented move in the Swiss Franc after the Swiss National Bank (SNB) discontinued its

peg of the Swiss Franc to the Euro and the subsequent financing package provided by Leucadia National Corp. (“Leucadia”)

announced on January 16, 2015 in order for FXCM to maintain its regulatory capital requirements.

Included in the first quarter 2015 in continuing operations

were: (i) a $256.9 million bad debt expense, net of recoveries, relating to negative client equity balances, (ii) a loss on derivative

liability of $292.4 million, a non-cash item relating to the increase in value of the Leucadia Letter Agreement, a component of

the financing package provided by Leucadia, which is treated as a derivative under U.S. GAAP and valued at its estimated fair value

on each reporting date and (iii) goodwill impairment losses of $9.5 million, primarily in the institutional business, (iv) other

income of $145.2 million due to the reduction of FXCM Inc.’s estimated tax receivable agreement liability offset by a corresponding

provision for income tax of $177.9 million.

FXCM estimated the fair value of the Leucadia Letter Agreement

using a combination of valuation approaches, including using the common stock price of FXCM, a guideline public company method

as well as a discounted cash flow method, then using an option pricing model for the allocation of enterprise value among various

components. Small changes in assumptions in the models used could materially change the estimated fair value.

In the quarter, FXCM classified several non-core assets(3)

as discontinued as they are in the process of being sold. The first of these businesses, FXCM Japan, was sold on April 1, 2015

for $62.0 million.

U.S. GAAP revenues from discontinued operations were $28.8 million,

compared to $32.2 million for the quarter ended March 31, 2014, a decrease of 10%. U.S. GAAP net loss attributable to FXCM Inc.

from discontinued operations was $33.5 million for the first quarter 2015 or $0.71 per fully diluted share, compared to U.S. GAAP

net income attributable to FXCM Inc. from discontinued operations of $2.9 million or $0.07 per fully diluted share for the first

quarter 2014. Results from discontinued operations include impairment losses primarily related to goodwill and intangibles of $86.7

million.

Adjusted revenue from continuing and discontinued operations

for the first quarter 2015 was $98.8 million, compared to $111.3 million for the first quarter 2014, a decrease of 11%. Adjusted

EBITDA from continuing and discontinued operations for the first quarter 2015 was $14.5 million, compared to $24.6 million for

the first quarter 2014, a decrease of 41%.

Adjusted Revenue and Adjusted EBITDA are Non-GAAP financial

measures. These measures do not represent and should not be considered as a substitute for net income, net income attributable

to FXCM Inc. or net income per Class A share or as a substitute for cash flow from operating activities, each as determined in

accordance with U.S. GAAP, and our calculations of these measures may not be comparable to similarly entitled measures reported

by other companies. See “Non-GAAP Financial Measures” beginning on A-3 of this release for additional information regarding

these Non-GAAP financial measures and for reconciliations of such measures to the most directly comparable measures calculated

in accordance with U.S. GAAP.

FXCM Inc. today announced certain key customer trading metrics

for April 2015. Monthly activities included:

April 2015 Customer Trading Metrics from Continuing Operations

(1)

Retail Customer Trading Metrics

| · | Retail customer trading volume(2) of $306 billion in April

2015, 7% lower than March 2015 and 37% higher than April 2014. |

| · | Average retail customer trading volume(2) per day of $13.9

billion in April 2015, 7% lower than March 2015 and 36% higher than April 2014. |

| · | An average of 510,050 retail client trades per day in April 2015,

3% lower than March 2015 and 58% higher than April 2014. |

| · | Tradeable accounts(4) of 188,221 as of April 30, 2015,

an increase of 3,045, or 2%, from March 2015, and an increase of 40,888, or 28%, from April 2014. |

Institutional Customer Trading Metrics

| · | Institutional customer trading volume(2) of $220 billion

in April 2015, 10% lower than March 2015 and 25% higher than April 2014. |

| · | Average institutional trading volume(2) per day of $10.0

billion in April 2015, 10% lower than March 2015 and 25% higher than April 2014. |

| · | An average of 55,018 institutional client trades per day in April

2015, 3% higher than March 2015 and 29% higher than April 2014. |

More information, including historical results for each of

the above metrics, can be found on the investor relations page of FXCM's corporate website www.fxcm.com.

This operating data is preliminary and subject to revision

and should not be taken as an indication of the financial performance of FXCM Inc. FXCM undertakes no obligation to publicly update

or review previously reported operating data. Any updates to previously reported operating data will be reflected in the historical

operating data that can be found on the Investor Relations page of the Company’s corporate website www.fxcm.com.

(1) Customer Trading Metrics from Continuing Operations

excludes discontinued operations of FXCM Japan and FXCM Hong Kong.

(2) Volume that FXCM customers traded in period

is translated into US dollars.

(3) Non-core assets include FXCM Japan,

FXCM Hong Kong, Lucid, V3 Markets, Faros, FXCM Securities (UK) Equities Business and FXCM’s equity investment in FastMatch.

(4) A Tradeable Account is an account with sufficient

funds to place a trade in accordance with FXCM trading policies.

|

Selected Customer Trading Metrics

from Continuing Operations |

| |

Three Months Ended March 31, | |

| | |

2015 | | |

2014 | | |

% Change | |

| | |

| | |

| | |

| |

| Total retail trading volume ($ in billions) | |

$ | 935 | | |

$ | 813 | | |

| 15 | % |

| Total institutional trading volume ($ in billions) | |

$ | 648 | | |

$ | 508 | | |

| 28 | % |

| Total active accounts | |

| 170,890 | | |

| 150,285 | | |

| 14 | % |

| Trading days in period | |

| 63 | | |

| 63 | | |

| 0 | % |

| Daily average trades | |

| 521,901 | | |

| 368,852 | | |

| 41 | % |

| Daily average trades per active account | |

| 3.1 | | |

| 2.5 | | |

| 24 | % |

| Retail trading revenue per million traded | |

$ | 67 | | |

$ | 94 | | |

| -29 | % |

| Total customer equity ($ in millions) | |

$ | 666.8 | | |

$ | 765.5 | | |

| -13 | % |

Conference Call

As previously announced, FXCM will host a conference call to

discuss the results on Monday May 11, 2015 at 8:15 a.m. (EDT). This conference call will be available to domestic participants

by dialing 877.445.4603 and 443.295.9270 for international participants. The conference ID number is 34581972.

A live audio webcast, a copy of FXCM's earnings release, and

presentation slides for this conference call will be available at http://ir.fxcm.com/.

Disclosure Regarding Forward-Looking Statements

In addition to historical information, this earnings release

may contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E

of the Securities Exchange Act of 1934 and/or the Private Securities Litigation Reform Act of 1995, which reflect FXCM's current

views with respect to, among other things, its operations and financial performance in the future. These forward-looking statements

are not historical facts and are based on current expectations, estimates and projections about FXCM's industry, management's beliefs

and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly,

readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain

risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with the events

that took place in the currency markets on January 15, 2015 and the impact to FXCM's capital structure, risks associated with FXCM's

ability to recover all or a portion of any losses, risks relating to the ability of FXCM to satisfy the terms and conditions of

or make payments pursuant to the terms of its agreements with Leucadia, risks related to its dependence on FX market makers, market

conditions and those other risks described under "Risk Factors" in FXCM Inc.'s Annual Report on Form 10-K and other reports

or documents FXCM files with, or furnishes to, the SEC from time to time, which are accessible on the SEC website at sec.gov. This

information should also be read in conjunction with FXCM's Consolidated Financial Statements and the Notes thereto contained in

FXCM's Annual Report on Form 10-K, and in other reports or documents FXCM files with, or furnishes to, the SEC from time to time,

which are accessible on the SEC website at sec.gov.

These factors should not be construed as exhaustive and should

be read in conjunction with the other cautionary statements that are included in this release and in our SEC filings. FXCM Inc.

undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future

developments or otherwise, except as required by law.

Visit www.fxcm.com and follow us on Twitter @FXCM,

Facebook FXCM, Google+ FXCM or YouTube FXCM.

About FXCM Inc.

FXCM Inc. (NYSE:FXCM) is a leading provider of online

foreign exchange (forex) trading, CFD trading, spread betting and related services. Our mission is to provide global traders with

access to the world’s largest and most liquid market by offering innovative trading tools, hiring excellent trading educators,

meeting strict financial standards and striving for the best online trading experience in the market.

Clients have the advantage of mobile trading,

one-click order execution and trading from real-time charts. In addition, FXCM offers educational courses on forex trading and

provides free news and market research through DailyFX.com.

Trading foreign exchange and CFDs on margin

carries a high level of risk, which may result in losses that could exceed your deposits, therefore may not be suitable for all

investors. Read full disclaimer.

Contacts

Jaclyn Klein, 646-432-2463

Vice-President, Corporate Communications and Investor Relations

jklein@fxcm.com

ANNEX I

| Schedule |

Page Number |

| |

|

| U.S. GAAP Results |

|

| Unaudited U.S. GAAP Condensed Consolidated Statements of Operations for the Three Months Ended March 31, 2015 and 2014 |

A-1 |

| Unaudited U.S. GAAP Condensed Consolidated Statements of Financial Condition As of March 31, 2015 and December 31, 2014 |

A-2 |

| |

|

| Non-GAAP Financial Measures |

A-3 |

| Reconciliation of U.S. GAAP Reported to Adjusted EBITDA |

A-4 |

| Schedule of Cash and Cash Equivalents and Amounts Due to/from Brokers |

A-5 |

| FXCM Inc. |

| Condensed Consolidated Statements of Operations |

| (In thousands, except per share amounts) |

| (Unaudited) |

| | |

Three Months Ended March 31, | |

| | |

2015 | | |

2014 | |

| Revenues | |

| | | |

| | |

| Trading revenue | |

$ | 69,214 | | |

$ | 82,171 | |

| Interest income | |

| 322 | | |

| 455 | |

| Brokerage interest expense | |

| (204 | ) | |

| (58 | ) |

| Net interest revenue | |

| 118 | | |

| 397 | |

| Other income | |

| 145,858 | | |

| 266 | |

| Total net revenues | |

| 215,190 | | |

| 82,834 | |

| Operating Expenses | |

| | | |

| | |

| Compensation and benefits | |

| 25,039 | | |

| 24,992 | |

| Referring broker fees | |

| 16,069 | | |

| 18,806 | |

| Advertising and marketing | |

| 2,817 | | |

| 5,961 | |

| Communication and technology | |

| 9,517 | | |

| 9,333 | |

| Trading costs, prime brokerage and clearing fees | |

| 1,140 | | |

| 1,697 | |

| General and administrative | |

| 13,655 | | |

| 13,466 | |

| Bad debt expense | |

| 256,915 | | |

| - | |

| Depreciation and amortization | |

| 7,020 | | |

| 6,066 | |

| Goodwill impairment loss | |

| 9,513 | | |

| - | |

| Total operating expenses | |

| 341,685 | | |

| 80,321 | |

| Operating (loss) income | |

| (126,495 | ) | |

| 2,513 | |

| Other Expense | |

| | | |

| | |

| Loss on derivative liability — Letter Agreement | |

| 292,429 | | |

| - | |

| Loss on equity method investments, net | |

| 151 | | |

| 86 | |

| Interest on borrowings | |

| 30,559 | | |

| 2,997 | |

| Loss from continuing operations before income taxes | |

| (449,634 | ) | |

| (570 | ) |

| Income tax provision | |

| 179,762 | | |

| 751 | |

| Loss from continuing operations | |

| (629,396 | ) | |

| (1,321 | ) |

| (Loss) income from discontinued operations, net of tax | |

| (98,598 | ) | |

| 4,166 | |

| Net (loss) income | |

| (727,994 | ) | |

| 2,845 | |

| Net (loss) income attributable to non-controlling interest in FXCM Holdings, LLC | |

| (257,375 | ) | |

| 2,427 | |

| Net loss attributable to other non-controlling interests | |

| (43,802 | ) | |

| (1,659 | ) |

| Net (loss) income attributable to FXCM Inc. | |

$ | (426,817 | ) | |

$ | 2,077 | |

| | |

| | | |

| | |

| Loss from continuing operations attributable to FXCM Inc. | |

$ | (393,325 | ) | |

$ | (792 | ) |

| (Loss) income from discontinued operations attributable to FXCM Inc. | |

| (33,492 | ) | |

| 2,869 | |

| Net (loss) income attributable to FXCM Inc. | |

$ | (426,817 | ) | |

$ | 2,077 | |

| | |

| | | |

| | |

| Weighted average shares of Class A common stock outstanding - Basic and Diluted | |

| 47,131 | | |

| 39,077 | |

| | |

| | | |

| | |

Net (loss) income per share attributable to stockholders of Class A common stock of

FXCM Inc. - Basic and Diluted: | |

| | | |

| | |

| Continuing operations | |

$ | (8.35 | ) | |

$ | (0.02 | ) |

| Discontinued operations | |

| (0.71 | ) | |

| 0.07 | |

| Net (loss) income attributable to FXCM Inc. | |

$ | (9.06 | ) | |

$ | 0.05 | |

| | |

| | | |

| | |

| Dividends declared per common share | |

$ | - | | |

$ | 0.06 | |

| FXCM Inc. |

| Condensed Consolidated Statements of Financial Condition |

| As of March 31, 2015 and December 31, 2014 |

| (Amounts in thousands except share data) |

| | |

(Unaudited) | | |

| |

| | |

March 31,

2015 | | |

December 31, 2014 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 215,727 | | |

$ | 256,887 | |

| Cash and cash equivalents, held for customers | |

| 666,825 | | |

| 901,227 | |

| Due from brokers | |

| 17,802 | | |

| 9,772 | |

| Accounts receivable, net | |

| 5,802 | | |

| 7,209 | |

| Deferred tax asset | |

| 1 | | |

| 9,065 | |

| Tax receivable | |

| 1,298 | | |

| 1,381 | |

| Current assets held for sale | |

| 728,490 | | |

| 548,506 | |

| Total current assets | |

| 1,635,945 | | |

| 1,734,047 | |

| Deferred tax asset | |

| 1,816 | | |

| 172,619 | |

| Office, communication and computer equipment, net | |

| 38,734 | | |

| 39,028 | |

| Goodwill | |

| 27,879 | | |

| 37,774 | |

| Other intangible assets, net | |

| 13,320 | | |

| 15,338 | |

| Notes receivable | |

| 7,881 | | |

| 9,381 | |

| Other assets | |

| 12,488 | | |

| 14,829 | |

| Noncurrent assets held for sale | |

| - | | |

| 364,411 | |

| Total assets | |

$ | 1,738,063 | | |

$ | 2,387,427 | |

| Liabilities and Stockholders' (Deficit) Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Customer account liabilities | |

$ | 666,825 | | |

$ | 901,227 | |

| Accounts payable and accrued expenses | |

| 38,377 | | |

| 35,189 | |

| Revolving credit agreement | |

| - | | |

| 25,000 | |

| Due to brokers | |

| 722 | | |

| 15,983 | |

| Due to related parties pursuant to tax receivable agreement | |

| - | | |

| 5,352 | |

| Current liabilities held for sale | |

| 383,296 | | |

| 455,915 | |

| Total current liabilities | |

| 1,089,220 | | |

| 1,438,666 | |

| Deferred tax liability | |

| 1,272 | | |

| 1,698 | |

| Senior convertible notes | |

| 152,955 | | |

| 151,578 | |

| Credit agreement | |

| 189,520 | | |

| - | |

| Due to related parties pursuant to tax receivable agreement | |

| - | | |

| 145,224 | |

| Derivative liability — Letter Agreement | |

| 386,230 | | |

| - | |

| Other liabilities | |

| 6,045 | | |

| 5,957 | |

| Noncurrent liabilities held for sale | |

| - | | |

| 1,288 | |

| Total liabilities | |

| 1,825,242 | | |

| 1,744,411 | |

| Commitments and Contingencies | |

| | | |

| | |

| Stockholders’ (Deficit) Equity | |

| | | |

| | |

| Class A common stock, par value $0.01 per share; 3,000,000,000 shares authorized, 50,709,113 and 47,889,964 shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively | |

| 507 | | |

| 479 | |

| Class B common stock, par value $0.01 per share; 1,000,000 shares authorized, 31 and 34 shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 281,868 | | |

| 273,708 | |

| (Accumulated deficit) retained earnings | |

| (404,438 | ) | |

| 22,379 | |

| Accumulated other comprehensive loss | |

| (14,237 | ) | |

| (11,879 | ) |

| Total stockholders’ (deficit) equity, FXCM Inc. | |

| (136,299 | ) | |

| 284,688 | |

| Non-controlling interests | |

| 49,120 | | |

| 358,328 | |

| Total stockholders’ (deficit) equity | |

| (87,179 | ) | |

| 643,016 | |

| Total liabilities and stockholders’ (deficit) equity | |

$ | 1,738,063 | | |

$ | 2,387,427 | |

Non-GAAP

Financial Measures

We use Non-GAAP financial measures to evaluate our operating

performance, as well as the performance of individual employees. Management believes that the disclosed Non-GAAP measures when

presented in conjunction with comparable U.S. GAAP measures are useful to investors to compare FXCM's results across several periods

and facilitate an understanding of FXCM's operating results. These measures do not represent and should not be considered as a

substitute for, or superior to, net income, net income attributable to FXCM Inc. or net income per Class A share or as a substitute

for, or superior to, cash flow from operating activities, each as determined in accordance with U.S. GAAP, and our calculations

of these measures may not be comparable to similarly entitled measures reported by other companies.

| 1. | Compensation Expense. Adjustments have been made to eliminate expense relating to stock based compensation relating

to the Company’s IPO as well as costs associated with the acquisition of V3 Markets, LLC. Given the nature of these expenses,

they are not viewed by management as expenses incurred in the ordinary course of business and management believes it is useful

to provide the effects of eliminating these expenses. |

| 2. | Compensation Expense/ Lucid Minority Interest. Our reported U.S. GAAP results reflect the portion of the 49.9% of Lucid

earnings allocated among the non-controlling members of Lucid based on services provided as a component of compensation expense

under Allocation of income to Lucid members for services provided. Adjustments have been made to reclassify this allocation

of Lucid's earnings attributable to non-controlling members to “Net (loss) income attributable to other non-controlling interests”.

The Company's management believes that this reclassification provides a more meaningful view of the Company's operating expenses

and the Company's economic arrangement with Lucid's non-controlling members. This adjustment has no impact on net income as reported

by the Company. |

| 3. | Acquisition Costs/Income. Adjustments have been made to eliminate certain acquisition related costs/income.

Given the nature of these items, they are not viewed by management as expenses/income incurred in the ordinary course of business

and management believes it is useful to provide the effects of eliminating these items. |

| 4. | Regulatory Costs. Adjustments have been made to eliminate certain costs (including client reimbursements)

associated with ongoing discussions and settling certain regulatory matters. Given the nature of these expenses, they are not viewed

by management as expenses incurred in the ordinary course of business and management believes it is useful to provide the effects

of eliminating these expenses. |

| 5. | SNB

Costs. Adjustments have been made to eliminate certain costs/income (including costs related to the implementation

of a Stockholder Rights Plan and adjustments to the Company’s tax receivable agreement contingent liability) associated

with the January 15, 2015 SNB event. Given the nature of these expenses, they are not viewed by management as expenses incurred

in the ordinary course of business and management believes it is useful to provide the effects of eliminating these expenses. |

| | |

Reconciliation of U.S. GAAP Reported to Non-GAAP Adjusted Measures(1) | |

| | |

Three Months Ended March 31, | |

| | |

2015 | | |

2014 | |

| | |

Continuing Ops | | |

Disc Ops | | |

Combined | | |

Continuing Ops | | |

Disc Ops | | |

Combined | |

| Net (loss) income | |

$ | (629,396 | ) | |

$ | (98,598 | ) | |

$ | (727,994 | ) | |

$ | (1,321 | ) | |

$ | 4,166 | | |

$ | 2,845 | |

| EBIDTA Adjustments | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | |

| Depreciation and amortization | |

| 7,020 | | |

| 12,359 | | |

| 19,379 | | |

| 6,066 | | |

| 6,564 | | |

| 12,630 | |

| Interest on borrowings | |

| 30,559 | | |

| - | | |

| 30,559 | | |

| 2,997 | | |

| - | | |

| 2,997 | |

| MTM loss on derivatives | |

| 292,429 | | |

| - | | |

| 292,429 | | |

| - | | |

| - | | |

| - | |

| Goodwill and held for sale impairment | |

| 9,513 | | |

| 81,364 | | |

| 90,877 | | |

| - | | |

| - | | |

| - | |

| Income tax provision | |

| 179,762 | | |

| 4,900 | | |

| 184,662 | | |

| 751 | | |

| 500 | | |

| 1,251 | |

| EBITDA | |

| (110,113 | ) | |

| 25 | | |

| (110,088 | ) | |

| 8,493 | | |

| 11,230 | | |

| 19,723 | |

| Adjustments | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Revenues(2) | |

| (145,224 | ) | |

| - | | |

| (145,224 | ) | |

| - | | |

| (3,672 | ) | |

| (3,672 | ) |

| Compensation and benefits(3) | |

| - | | |

| - | | |

| - | | |

| 1,902 | | |

| 272 | | |

| 2,174 | |

| Allocation of net income to lucid members for services provided(4) | |

| - | | |

| 2,686 | | |

| 2,686 | | |

| - | | |

| 2,973 | | |

| 2,973 | |

| Communication and technology(5) | |

| - | | |

| - | | |

| - | | |

| - | | |

| 206 | | |

| 206 | |

| General and administrative(6) | |

| 1,837 | | |

| - | | |

| 1,837 | | |

| 3,037 | | |

| 163 | | |

| 3,200 | |

| Bad debt expense(7) | |

| 256,915 | | |

| 8,408 | | |

| 265,323 | | |

| - | | |

| - | | |

| - | |

| Adjusted EBITDA | |

$ | 3,415 | | |

$ | 11,119 | | |

$ | 14,534 | | |

$ | 13,432 | | |

$ | 11,172 | | |

$ | 24,604 | |

(1) The presentation includes Non-GAAP financial measures. These

Non-GAAP financial measures are not prepared under any comprehensive set of accounting rules or principles, and do not reflect

all of the amounts associated with the Company's results of operations as determined in accordance with U.S. GAAP.

(2) Represents the elimination of a $145.2 million benefit in

Q1 2015 attributable to the reduction of our tax receivable agreement contingent liability to zero and the elimination of a $3.7

million benefit recorded to reduce the contingent consideration related to the Faros acquisition in Q1 2014.

(3) Represents the elimination of stock-based compensation associated

with the IPO of $1.9 million in Q1 2014 and the elimination of V3 acquisition costs of $0.3 million in Q1 2014.

(4) Represents the elimination of the 49.9% of Lucid’s

earnings allocated among the non-controlling interests recorded as compensation for U.S. GAAP purposes.

(5) Represents the elimination of V3 acquisition costs in Q1

2014.

(6) Represents the expense related to the Stockholders Rights

Plan and the legal fees resulting from the SNB event of $1.8 million in Q1 2015, the net expense relating to pre-August 2010 trade

execution practices and other regulatory fees and fines of $2.5 million in Q1 2014 and the elimination of V3 acquisition costs

of $0.5 million in continuing ops and $0.2 million in discontinued ops in Q1 2014.

(7) Represents the net bad debt expense related to client debit

balances associated with the January 15, 2015 SNB event.

Schedule of Cash and Cash Equivalents and Due to/from Brokers

| | |

March 31, 2015 | | |

December 31, 2014 | |

| | |

Continuing Ops | | |

Disc Ops | | |

Combined | | |

Continuing Ops | | |

Disc Ops | | |

Combined | |

| Cash & Cash Equivalents | |

| 215,727 | | |

| 71,748 | | |

| 287,475 | | |

| 256,887 | | |

| 85,263 | | |

| 342,150 | |

| Due From Brokers | |

| 17,802 | | |

| 24,945 | | |

| 42,747 | | |

| 9,772 | | |

| 27,552 | | |

| 37,324 | |

| Due to Brokers | |

| (722 | ) | |

| (790 | ) | |

| (1,512 | ) | |

| (15,983 | ) | |

| (330 | ) | |

| (16,313 | ) |

| Operating Cash | |

| 232,807 | | |

| 95,903 | | |

| 328,710 | | |

| 250,676 | | |

| 112,485 | | |

| 363,161 | |

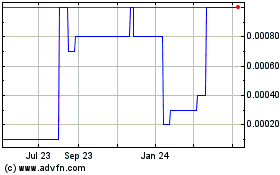

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

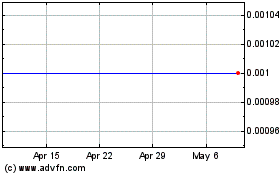

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Nov 2023 to Nov 2024