UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): March 20, 2015

FXCM Inc.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34986 |

|

27-3268672 |

| (State or Other Jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| Incorporation) |

|

|

|

Identification No.) |

55 Water Street, FL 50, New York, NY,

10041

(Address of Principal Executive Offices)

(Zip Code)

(646) 432-2986

(Registrant’s

Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

On March 20, 2015, FXCM Holdings,

LLC and FXCM Newco, LLC (collectively, the “Seller”), both wholly-owned subsidiaries of FXCM Inc. (the “Company”),

entered into a share purchase agreement (the "Share Purchase Agreement"), pursuant to which they agreed to sell all of

the issued and outstanding equity interests of FXCM Japan Securities Co., Ltd (“FXCM Japan”) to Rakuten Securities,

Inc. (“Rakuten Sec”), for a purchase price of approximately $62 million (the “Transaction”), subject to

final adjustment based on FXCM Japan’s balance sheet as of March 31, 2015.

The Share Purchase Agreement contains customary representations, warranties and covenants by Rakuten

Sec and the Seller, including representations, warranties and covenants made by the Seller with respect to FXCM Japan. The

Seller has agreed that FXCM Japan will conduct its operations in the ordinary course of business until the closing of the Transaction,

which is currently expected to close April 1, 2015, subject to the satisfaction of customary closing conditions.

The Share Purchase Agreement provides that the Seller and/or its affiliates will enter into a

transition services agreement, to be effective as of the closing of the Transaction, pursuant to which the Seller and/or its

affiliates will provide transition services to FXCM Japan. The transition services will consist of ongoing operational

and technical support for FXCM Japan during the transition of FXCM Japan to Rakuten Sec, which is expected to be

completed within eighteen months (subject to extension) after the closing of the Transaction.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. |

Exhibit Description |

| 99.1 |

Press Release dated March 25, 2015, issued by FXCM Inc. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

FXCM INC. |

| |

|

| |

By: |

/s/ David. S. Sassoon |

| |

|

Name: |

David S. Sassoon |

| |

|

Title: |

General Counsel |

Date: March 25, 2015

Exhibit 99.1

FXCM to Sell FXCM Japan

to Rakuten Sec for $62 Million

New York -- March 25, 2015 -- FXCM

Inc. (NYSE:FXCM) a leading online provider of foreign exchange (FX) trading and related services, today announced that

FXCM Holdings, LLC and FXCM Newco, LLC (“FXCM”) have signed a definitive agreement to sell FXCM Japan Securities Co.,

Ltd (“FXCM Japan”) to Rakuten Securities, Inc. (“Rakuten Sec”), a top 5 FX broker in Japan, and a subsidiary

of Rakuten, Inc. (“Rakuten”) (TOKYO:4755), one of the world’s largest Internet services companies, for a purchase

price of approximately $62 million.

Rakuten Sec will continue to use the FXCM

trading system for legacy FXCM Japan clients and will be notifying clients once the deal is finalized.

The transaction is expected to close

on April 1, 2015, subject to customary closing conditions and the final purchase price will be based on FXCM Japan’s

March 31, 2015 balance sheet.

“We are pleased to announce this

transaction with Rakuten Sec, as they are an innovative and strong firm,” said Drew Niv, CEO of FXCM. “We are confident

that they will provide the same level of excellent service and trading environment that our account holders have experienced at

FXCM.”

“We are delighted to invite FXCM

Japan to Rakuten group,” said Yuji Kusunoki, President of Rakuten Sec. “We believe that our combined capability will

enhance our strategy to be the top FX service provider in Japan.”

Pinnacle Inc. served FXCM as financial

advisor on the deal.

About FXCM Inc.

FXCM

Inc. (NYSE:FXCM) is a leading provider of online foreign exchange (forex) trading, CFD trading, spread betting and

related services. Our mission is to provide global traders with access to the world’s largest and most liquid market by

offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for

the best online trading experience in the market.

Clients have the advantage of mobile trading,

one-click order execution and trading from real-time charts. In addition, FXCM offers educational courses on forex trading and

provides free news and market research through DailyFX.com.

Trading foreign exchange and CFDs on margin

carries a high level of risk, which may result in losses that could exceed your deposits, therefore may not be suitable for all

investors. Read full disclaimer.

Visit www.fxcm.com

and follow us on Twitter @FXCM, Facebook FXCM,

Google+ FXCM or YouTube FXCM.

About Rakuten Sec

Rakuten Securities, Inc., a subsidiary

of Rakuten, Inc., is one of the major online brokers in Japan, founded in 1999. Rakuten Sec is ranked 3rd in terms of equities

trading value and 5th in terms of FX trading value in the Japanese securities market.

About Rakuten

Rakuten, Inc. (TOKYO:4755) is one of the

world's leading Internet services companies. Rakuten provides a variety of products and services for consumers and businesses,

with a focus on e-commerce, finance, and digital content. Since 2012, Rakuten has been ranked among the world’s ‘Top

20 Most Innovative Companies’ in Forbes magazine’s annual list. Rakuten is expanding worldwide and currently operates

throughout Asia, Europe, the Americas and Oceania. Founded in 1997, Rakuten is headquartered in Tokyo, with over 14,000 employees

and partner staff worldwide.

For more information: http://global.rakuten.com/corp/.

CONTACT: FXCM Inc.

Jaclyn Klein, 646-432-2463

Vice-President, Corporate

Communications

jklein@fxcm.com

investorrelations@fxcm.com

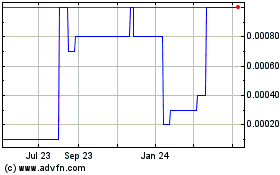

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Sep 2024 to Oct 2024

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Oct 2023 to Oct 2024