Current Report Filing (8-k)

May 03 2023 - 5:16PM

Edgar (US Regulatory)

0001829966

false

0001829966

2023-04-27

2023-04-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 27, 2023

___________________________

EBET, Inc.

(Exact name of registrant as specified in its

charter)

___________________________

| Nevada |

001-40334 |

85-3201309 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

3960

Howard Hughes Parkway, Las Vegas,

NV 89169

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (888) 411-2726

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

___________________________

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading

Symbols(s) |

Name

of each exchange on which registered |

| Common stock, par value $0.001 per share |

EBET |

The NASDAQ Stock Market LLC |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On November 29, 2021, EBET,

Inc. (the “Company”) entered a credit agreement (the “Credit Agreement”) with CP BF Lending, LLC (“Lender”),

pursuant to which the Lender agreed to make a single loan to the Company of $30,000,000 (the “Loan”). The Loan required the

Company to maintain certain minimum liquidity and other financial and other covenants. On April 28, 2023, the Lender provided the Company

with a limited waiver of certain of these covenants until May 12, 2023. The Company does not expect to satisfy certain of these covenants

prior to May 12, 2023 and is currently in discussions with the Lender on modifying the financial covenants, although there is no assurance

that the Company will be successful in making such modifications to the Loan.

On April 27, 2023, the Company

was notified by its gaming platform operator services provider Aspire Global plc (“Aspire”) that the gaming regulatory authority

in Germany had sent a letter received by Aspire on April 25, 2023 stating that Aspire would be required to shut down activity of its gaming

operations in Germany effective as of 10 days from receipt of said letter until such time as Aspire was otherwise granted a license to

operate in Germany. Aspire has informed the Company that it has sought an extension of the requested shutdown deadline and has also sought

appropriate legal relief from this request to the fullest extent of the law in Germany including a request for immediate injunctive relief.

There is no certainty that Aspire will be successful in receiving an extension of time and/or any form of other relief from this request

by the German regulator. If an extension or other form of relief is not granted to Aspire, then in order to meet the pending demand from

the German regulator, Aspire will have to shut down its for-cash gaming offerings in Germany by midnight GMT time on May 8, 2023 and as

a result the games included on websites owned by the Company that operate in Germany would also be shut down at that time. The Company

is evaluating the impact from such shutdown of activities, but believes it would materially impact the Company’s revenues.

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

EBET, INC. |

| |

|

| |

|

| Date: May 3, 2023 |

|

| |

By: /s/

Matthew

Lourie |

| |

Matthew Lourie |

| |

Chief Financial Officer |

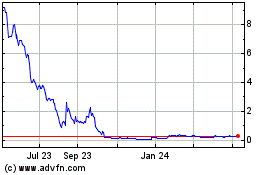

EBET (CE) (USOTC:EBET)

Historical Stock Chart

From Oct 2024 to Nov 2024

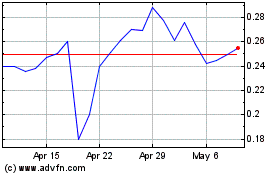

EBET (CE) (USOTC:EBET)

Historical Stock Chart

From Nov 2023 to Nov 2024