Current Report Filing (8-k)

December 11 2015 - 9:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 9, 2015

CLEAN DIESEL TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

|

001-33710 |

|

06-1393453 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

1621 Fiske Place

Oxnard, California, 93033

(Address of Principal Executive Offices) (Zip Code)

(805) 639-9458

(Registrants telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.05 Costs Associated with Exit or Disposal Activities.

On December 9, 2015, the board of directors (the “Board”) of Clean Diesel Technologies, Inc. (the “Company”), in furtherance of the Company’s transformation from serving as a manufacturer of emissions solutions to a developer and supplier of proprietary powders, committed to a plan to wind down and close its manufacturing facility in Markham, Ontario Canada. The decision to close this facility, within its Heavy Duty Diesel Systems division, and to outsource manufacturing operations and consolidate sales and support staffing for the DuraFit™ product line into the Company’s Oxnard, California facility was driven by the financial performance of this facility and to reduce the overall cost structure of the Company. It is anticipated that manufacturing operations at this facility will cease by the end of February 2016.

The Company estimates that the closing of this facility will result in a pre-tax charge to earnings of approximately $1.8 million for severance and employee benefits for approximately 23 employees and other shutdown costs. These pre-tax charges are expected to be recorded during fiscal 2015, with the majority of these expenses to be paid out during fiscal 2016.

On December 11, 2015, the Company issued a press release relating to the closure of its manufacturing facility. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 2.05 by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 10, 2015, Christopher J. Harris, the Company’s President and Chief Operating Officer, and Pedro J. Lopez-Baldrich, the Company’s General Counsel, Corporate Secretary and Vice President, Administration (together, the “Executives”) resigned from their respective positions, effective as of December 11, 2015 (the “Separation Date”). The Company and each of the Executives agreed to enter into a Separation Agreement and Release setting forth the terms and conditions of the Executives’ separation from service with the Company (for each, the “Separation Agreement”).

The Separation Agreements will provide that each Executive will release the Company and certain other parties from all claims, causes of action and demands arising on or prior to December 11, 2015 (the “Effective Date”). In addition, each Executive will be entitled to the following payments in accordance with their respective Separation Agreements:

· A cash payment equal to thirteen (13) months of Executive’s base salary payable in installments in accordance with the Company’s normal payroll schedule and payroll practices, less applicable tax withholdings.

· A lump sum cash payment in the amount of (i) with respect to Mr. Harris, $11,936.07, and (ii) with respect to Mr. Lopez-Baldrich, $10,756.86, less all applicable withholdings and deductions, to help defray costs incurred for medical insurance whether the Executive elects coverage under COBRA or obtains coverage through the State or Federal Health Insurance Marketplaces.

· Accelerated vesting and exercisability of (i) with respect to Mr. Harris, 15,595 outstanding restricted stock units and outstanding unvested stock option awards to purchase 46,763 share of common stock and (ii) with respect to Mr. Lopez-Baldrich, 16,667 outstanding restricted stock units, to be automatically accelerated on December 18, 2015.

· All of Executive’s vested stock option awards shall remain exercisable by Executive for a period of 90 days following the Separation Date.

In addition, the Company agreed to provide Mr. Harris with a bonus payment equal to $87,970 and Mr. Lopez-Baldrich with a bonus payment equal to $53,315, such amounts being equal to a prorated portion of Executive’s respective proposed annual target bonus for 2015, less all tax withholdings. The bonus payment will be payable to Executive in lump sum on the first payroll date after the following January 7, 2016. The Company also agreed to provide outplacement services and support for a maximum period of six (6) months.

2

The Executives will affirm in the Separation Agreements that they will abide by confidentiality and non-disparagement covenants entered into with the Company, and that they will continue to cooperate with the Company in any litigation or similar proceedings relating to their service with the Company.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description of Exhibits |

|

|

|

|

|

99.1 |

|

Clean Diesel Technologies Press Release dated December 11, 2015. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CLEAN DIESEL TECHNOLOGIES, INC. |

|

|

|

|

|

December 11, 2015 |

By: |

/s/ David E. Shea |

|

|

|

Name: |

David E. Shea |

|

|

|

Title: |

Chief Financial Officer |

4

EXHIBIT INDEX

|

Exhibit Number |

|

Description of Exhibits |

|

|

|

|

|

99.1 |

|

Clean Diesel Technologies Press Release dated December 11, 2015. |

5

Exhibit 99.1

CDTi Streamlines Operations with Closure of Canadian Manufacturing Facility

— Repositions operating footprint around advanced materials strategy —

— Expects to save approximately $3 million in annual costs —

— Reduces overhead to drive profitable growth and increase shareholder value —

Oxnard, California — Dec. 11, 2015 — Clean Diesel Technologies, Inc. (Nasdaq: CDTI) (“CDTi” or “the Company”) announced it is closing its manufacturing facility located in Markham, Ontario to align its operating footprint in support of its advanced materials strategy. Combined with other concurrent actions to reduce overhead, the closing of the Markham facility is expected to eliminate approximately $3 million from the company’s annual cost base. The shutdown is expected to be completed during the first quarter of 2016.

Matthew Beale, CDTi’s CEO, said: “As we stated on our third quarter 2015 conference call, we have been focused on initiatives to align our operating structure with our powder-to-coat business model. These initiatives included exiting non-core businesses and externalizing operating activities not integral to delivering value to our customers. By closing our Markham facility, we are doing just that. Our streamlined cost structure and operating footprint better supports CDTi’s positioning as an advanced materials provider for the global emissions control market. In addition, this initiative enables us to more quickly and cost effectively ramp the DuraFitTM business by simplifying our supply chain and putting manufacturing in a US location closer to our customer base, which we expect will benefit our customers by improving lead times, capacity and manufacturing flexibility.”

Following the facility closure, CDTi intends to consolidate certain commercial and supply chain activities to its Oxnard, CA facility and work with vendor partners to cost-effectively outsource other activities. The Company anticipates recording approximately $1.8 million in expenses during the fourth quarter of 2015 to complete these actions.

For additional information on these cost reduction initiatives, CDTi refers you to the Form 8-K filed today with the Securities and Exchange Commission, available at the company’s website at www.cdti.com or at www.sec.gov.

About CDTi

CDTi manufactures and distributes vehicle emissions control products that leverage its advanced materials technology. CDTi’s proprietary technologies provide high-value sustainable solutions to reduce hazardous emissions, increase energy efficiency and lower the carbon intensity of on- and off-road combustion engine systems. With a continuing focus on innovation-driven commercialization and global expansion, CDTi’s breakthrough Powder-to-Coat (P2C™) technology exploits its high-performance, advanced low-platinum group metal (PGM) emission reduction catalysts. Key technology platforms include Mixed Phase Catalyst (MPC®), Base Metal Activated Rhodium Support (BMARS™), Synergized PGM (SPGM™), Zero PGM (ZPGM™) and Spinel™. Headquartered in Oxnard, California, CDTi has operations in Canada, Japan, the United Kingdom and Sweden. For more information, please visit www.cdti.com.

Forward-Looking Statements

Certain information contained in this press release constitutes forward-looking statements, including any statements contained herein that are not statements of historical fact. You can identify these forward-looking statements by the use of the words “believes”, “expects”, “anticipates”, “plans”, “may”,

1

“will”, “would”, “intends”, “estimates”, “promises”, and other similar expressions, whether in the negative or affirmative. Forward-looking statements are based on a series of expectations, assumptions, estimates and projections which involve substantial uncertainty and risk. In this press release, the Company includes forward looking statements regarding CDTi’s ability to achieve certain cost savings and strategic initiatives. In general, actual results may differ materially from those indicated by such forward-looking statements as a result of risks and uncertainties, including, but not limited, to (i) any inability by CDTi to (1) realize the benefits of investments and planned cost saving measures; (2) successfully transition into an advanced materials supplier; (3) execute its strategic priorities; (4) commercialize its technology due to agreements with third parties; (5) protect its intellectual property; (6) obtain verifications, approvals or market acceptance of its products or technology; or (7) achieve anticipated results; (ii) changes in or lack of enforcement of or funding for emissions programs, regulations or standards; (iii) competitive conditions; (iv) prices of PGM and rare earth metals; (v) intellectual property infringement allegations; (vi) inability to meet emissions control standards; and (vii) other risks and uncertainties discussed or referenced in the Company’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K. In addition, any forward-looking statements represent the Company’s estimates only as of the date of such statements and should not be relied upon as representing the Company’s estimates as of any subsequent date. The Company specifically disclaims any obligation to update forward-looking statements. All forward-looking statements in this press release are qualified in their entirety by this cautionary statement.

###

Contact Information:

Becky Herrick or Cathy Mattison

LHA (IR Agency)

+1 415 433 3777

bherrick@lhai.com

cmattison@lhai.com

2

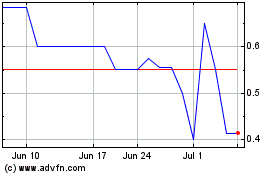

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

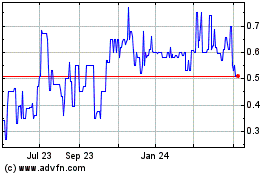

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Jul 2023 to Jul 2024