CDTI: Fourth quarter results disappointing but outlook improving - Analyst Blog

March 18 2013 - 5:55AM

Zacks

CDTI: Fourth quarter results disappointing but outlook

improving.

By Ian Gilson, CFA

On March 15, 2013 Clean Diesel (Nasdaq-small:CDTI)

announced its fourth quarter and full year 2012 results. Although

we had forecast a decline from year ago levels due to the end of

the London Emission Zone initiative the rest of the diesel business

was a disappointment. New Jersey was down and California flat at

best. Since the Diesel market uses catalysts made internally this

had an impact on the catalyst division. Lack of enforcement of the

existing regulations by CARB is still having an impact, although

citations are increasing. Some of the operators may opt to buy new

vehicles (making that a OEM sale) and others may scrap the older

vehicles.

CDTI has about 17% of the diesel pollution retrofit market in

California, as compared to about 34% in the other contiguous

states. One of its largest competitors (Cleaire Advanced Emissions

Control) has gone out of business, leaving about 40% of the

California market up for grabs. This includes a significant portion

of the school bus fleets state wide. However, there is a major

program to retrofit school buses with alternative fuel engines and

a large number of school buses run on natural gas. We estimate

that, over time, CDTI could move its market share up to 30% and

possibly higher.

The catalyst division was impacted by two major factors. The

decline in revenue from the diesel division reduced revenue from

$1.8 million in 2012 fourth quarter to $1.1 million in 4Q13 (the

eliminations line on the reported income statement is all internal

catalyst sales). The rest of the catalyst revenue was unchanged.

The second problem was that both rare earth and Platinum Metal

Group (PMG) metal prices were very volatile and not all of cost

were covered under the Honda contract. Honda is a significant

customer for catalytic convertors on both the 6 and 4 cylinder

Accords.

The Honda contract has been renegotiated to address the metal

pricing problem. This will impact both revenue and costs since the

active metal prices are a component of the selling prices as well

as part of the cost structure. This should have an immediate

positive impact although there may be a lag as inventory pricing

moves through the system.

The company also discussed several strategic initiatives. The

Pirelli initiative mentioned below may be followed by other

agreements that would provide Clean Diesel with a stronger position

in the OEM market. The company's low PMG catalyst systems may have

applications for fuel cell cost reductions and Clean Diesel has a

significant patent portfolio that has not, so far, been licensed to

third parties.

We have adjusted our estimates using the 4Q12 as a base and there

is the possibility of significant upside if the California market

improves.

Please visit SCR.Zacks.com for additional information on our

research and coverage universe, and Subscribe to receive our

articles and reports emailed directly to you each morning.

CLEAN DIESEL (CDTI): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

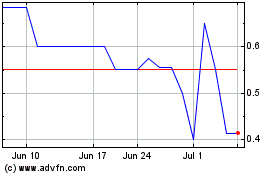

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

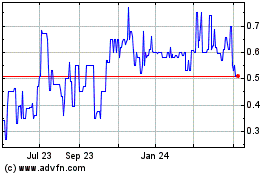

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Jul 2023 to Jul 2024