falseQ20000202947--12-312027-03-310000202947cptp:LamarLeaseMember2023-01-012023-06-300000202947cptp:LamarLeaseMember2024-06-3000002029472023-04-012023-06-300000202947cptp:SaleOfPetroleumSegmentMembercptp:SpragueLitigationMembercptp:TerminalMember2021-07-310000202947cptp:SaleOfPetroleumSegmentMember2017-02-102017-02-1000002029472023-01-012023-06-300000202947cptp:BAnkRIMemberus-gaap:LineOfCreditMember2024-01-012024-06-300000202947cptp:LamarLeaseMember2024-01-012024-06-3000002029472022-12-3100002029472024-01-252024-01-250000202947cptp:BAnkRIMembersrt:MaximumMemberus-gaap:LineOfCreditMember2024-01-012024-06-300000202947cptp:BAnkRIMemberus-gaap:LineOfCreditMember2024-06-300000202947cptp:SaleOfPetroleumSegmentMembercptp:SpragueLitigationMember2023-01-012023-06-300000202947cptp:MetroparkLtdMember2024-01-012024-06-3000002029472024-01-012024-06-300000202947cptp:MetroparkLtdMember2024-01-010000202947cptp:MetroparkLtdMember2023-12-3100002029472024-04-012024-06-3000002029472023-03-310000202947cptp:LamarLeaseMember2024-04-012024-06-300000202947cptp:SaleOfPetroleumSegmentMembercptp:SpragueLitigationMember2024-01-012024-06-300000202947cptp:MetroparkLtdMember2024-01-012024-01-010000202947cptp:PropertiesOnLeaseOrHeldForLeaseLandAndLandImprovementsMember2023-12-310000202947cptp:SaleOfPetroleumSegmentMembercptp:SpragueLitigationMember2024-04-012024-06-300000202947us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembercptp:BAnkRIMemberus-gaap:LineOfCreditMember2024-01-012024-06-300000202947cptp:BAnkRIMembersrt:MinimumMemberus-gaap:LineOfCreditMember2024-01-012024-06-300000202947us-gaap:USTreasurySecuritiesMember2024-01-012024-06-300000202947cptp:SaleOfPetroleumSegmentMembercptp:SpragueLitigationMember2023-04-012023-06-3000002029472024-01-2500002029472024-03-310000202947cptp:PropertiesOnLeaseOrHeldForLeaseSteepleStreetMember2023-12-310000202947us-gaap:USTreasurySecuritiesMember2024-06-300000202947us-gaap:BuildingAndBuildingImprovementsMember2024-06-300000202947cptp:SaleOfPetroleumStorageFacilityAndRelatedAssetsMembercptp:TerminalMember2017-01-312017-01-310000202947cptp:LamarLeaseMember2023-04-012023-06-300000202947cptp:LandImprovementsOnLeaseOrHeldForLeaseMember2023-12-310000202947cptp:PropertiesOnLeaseOrHeldForLeaseSteepleStreetMember2024-06-300000202947cptp:BAnkRIMemberus-gaap:FirstMortgageMembersrt:MaximumMemberus-gaap:LineOfCreditMember2024-01-012024-06-300000202947cptp:MetroparkLtdMember2023-06-300000202947cptp:MetroparkLtdMember2024-04-012024-06-3000002029472024-06-3000002029472023-12-310000202947srt:MinimumMembercptp:TripleNetLeaseMember2024-06-300000202947us-gaap:SubsequentEventMember2024-07-312024-07-310000202947cptp:BAnkRIMemberus-gaap:FirstMortgageMembersrt:MinimumMemberus-gaap:LineOfCreditMember2024-01-012024-06-300000202947cptp:MetroparkLtdMember2024-06-300000202947us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000202947cptp:LandImprovementsOnLeaseOrHeldForLeaseMember2024-06-3000002029472023-06-300000202947cptp:MetroparkLtdMember2023-01-012023-06-300000202947cptp:SaleOfPetroleumSegmentMember2019-11-012019-11-300000202947cptp:MetroparkLtdMember2023-04-012023-06-300000202947cptp:PropertiesOnLeaseOrHeldForLeaseLandAndLandImprovementsMember2024-06-30cptp:Locationxbrli:pureutr:sqftxbrli:sharescptp:LandLeasecptp:Billboard_Facecptp:Installmentiso4217:USDcptp:Subsidiary

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-08499

CAPITAL PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Rhode Island |

|

05-0386287 |

(State or other jurisdiction of |

|

(IRS Employer |

incorporation or organization) |

|

identification No.) |

|

|

|

|

5 Steeple Street, Unit 303 |

|

|

Providence, Rhode Island |

02903 |

|

(Address of principal executive offices) |

(Zip Code) |

(401) 435-7171

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12 (g) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

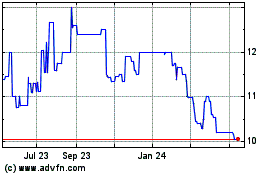

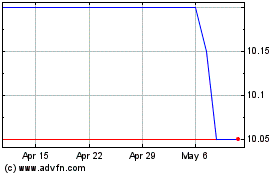

Class A Common Stock, $.01 par value |

CPTP |

OTCQX |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of the "large accelerated filer," "accelerated filer," "non-accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

Non-Accelerated Filer |

☐ |

Smaller reporting company |

☒ |

|

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2024, the Company had 6,599,912 shares of Class A Common Stock outstanding.

CAPITAL PROPERTIES, INC.

FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2024

TABLE OF CONTENTS

PART I

Item 1. Financial Statements

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 (Unaudited) |

|

|

December 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Properties and equipment (net of accumulated depreciation) (Note 4) |

|

$ |

6,455,000 |

|

|

$ |

6,498,000 |

|

Cash and cash equivalents |

|

|

847,000 |

|

|

|

652,000 |

|

Investments |

|

|

1,265,000 |

|

|

|

1,244,000 |

|

Prepaid and other |

|

|

315,000 |

|

|

|

387,000 |

|

Prepaid income taxes |

|

|

- |

|

|

|

57,000 |

|

Deferred income taxes, discontinued operations |

|

|

103,000 |

|

|

|

109,000 |

|

|

|

$ |

8,985,000 |

|

|

$ |

8,947,000 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

Property taxes |

|

$ |

340,000 |

|

|

$ |

340,000 |

|

Other |

|

|

420,000 |

|

|

|

330,000 |

|

Income tax payable |

|

|

21,000 |

|

|

|

- |

|

Deferred income taxes, net |

|

|

242,000 |

|

|

|

284,000 |

|

Environmental remediation accrual, discontinued operations (Note 9) |

|

|

379,000 |

|

|

|

402,000 |

|

|

|

|

1,402,000 |

|

|

|

1,356,000 |

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Class A common stock, $.01 par; authorized 10,000,000 shares; issued and

outstanding 6,599,912 shares |

|

|

66,000 |

|

|

|

66,000 |

|

Capital in excess of par |

|

|

782,000 |

|

|

|

782,000 |

|

Retained earnings |

|

|

6,735,000 |

|

|

|

6,743,000 |

|

|

|

|

7,583,000 |

|

|

|

7,591,000 |

|

|

|

|

|

|

|

|

|

|

$ |

8,985,000 |

|

|

$ |

8,947,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See notes to condensed consolidated financial statements. |

|

|

|

|

|

|

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND SHAREHOLDERS’ EQUITY

THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

1,494,000 |

|

|

$ |

1,492,000 |

|

|

$ |

2,836,000 |

|

|

$ |

2,743,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

227,000 |

|

|

|

207,000 |

|

|

|

486,000 |

|

|

|

432,000 |

|

General and administrative |

|

325,000 |

|

|

|

323,000 |

|

|

|

693,000 |

|

|

|

675,000 |

|

|

|

552,000 |

|

|

|

530,000 |

|

|

|

1,179,000 |

|

|

|

1,107,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income taxes |

|

942,000 |

|

|

|

962,000 |

|

|

|

1,657,000 |

|

|

|

1,636,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense: |

|

|

|

|

|

|

|

|

|

|

|

Current |

|

305,000 |

|

|

|

302,000 |

|

|

|

493,000 |

|

|

|

514,000 |

|

Deferred |

|

(26,000 |

) |

|

|

(47,000 |

) |

|

|

(42,000 |

) |

|

|

(70,000 |

) |

|

|

279,000 |

|

|

|

255,000 |

|

|

|

451,000 |

|

|

|

444,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

663,000 |

|

|

|

707,000 |

|

|

|

1,206,000 |

|

|

|

1,192,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on sale of discontinued operations, net of tax (Note 9) |

|

(235,000 |

) |

|

|

(20,000 |

) |

|

|

(290,000 |

) |

|

|

(20,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

428,000 |

|

|

|

687,000 |

|

|

|

916,000 |

|

|

|

1,172,000 |

|

Retained earnings, beginning |

|

6,769,000 |

|

|

|

6,287,000 |

|

|

|

6,743,000 |

|

|

|

6,264,000 |

|

Dividends on common stock based on 6,599,912 shares outstanding |

|

(462,000 |

) |

|

|

(462,000 |

) |

|

|

(924,000 |

) |

|

|

(924,000 |

) |

Retained earnings, ending |

$ |

6,735,000 |

|

|

$ |

6,512,000 |

|

|

$ |

6,735,000 |

|

|

$ |

6,512,000 |

|

Class A common stock |

|

66,000 |

|

|

|

66,000 |

|

|

|

66,000 |

|

|

|

66,000 |

|

Capital in excess of par |

|

782,000 |

|

|

|

782,000 |

|

|

|

782,000 |

|

|

|

782,000 |

|

Shareholders' equity, ending |

$ |

7,583,000 |

|

|

$ |

7,360,000 |

|

|

$ |

7,583,000 |

|

|

$ |

7,360,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income (loss) per common share based upon 6,599,912 shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

$ |

0.11 |

|

|

$ |

0.10 |

|

|

$ |

0.18 |

|

|

$ |

0.18 |

|

Discontinued operations |

|

(0.04 |

) |

|

|

(0.00 |

) |

|

|

(0.04 |

) |

|

|

(0.00 |

) |

Total basic income per common share |

$ |

0.07 |

|

|

$ |

0.10 |

|

|

$ |

0.14 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See notes to condensed consolidated financial statements. |

|

|

|

|

|

|

|

|

|

|

|

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Continuing operations: |

|

|

|

|

|

|

Income from continuing operations |

|

$ |

1,206,000 |

|

|

$ |

1,192,000 |

|

Adjustments to reconcile income from continuing operations to net

cash provided by operating activities, continuing operations: |

|

|

|

|

|

|

Depreciation |

|

|

43,000 |

|

|

|

43,000 |

|

Deferred income taxes |

|

|

(42,000 |

) |

|

|

(70,000 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Income taxes |

|

|

78,000 |

|

|

|

136,000 |

|

Other, net changes in prepaids, property tax payable and other |

|

|

162,000 |

|

|

|

215,000 |

|

Net cash provided by operating activities, continuing operations |

|

|

1,447,000 |

|

|

|

1,516,000 |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of investments |

|

|

(21,000 |

) |

|

|

(1,000,000 |

) |

Discontinued operations, cash used to settle obligations |

|

|

(307,000 |

) |

|

|

(20,000 |

) |

Net cash used in investing activities |

|

|

(328,000 |

) |

|

|

(1,020,000 |

) |

|

|

|

|

|

|

|

Cash flows used in financing activities, payment of dividends |

|

|

(924,000 |

) |

|

|

(924,000 |

) |

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

|

195,000 |

|

|

|

(428,000 |

) |

Cash and cash equivalents, beginning |

|

|

652,000 |

|

|

|

1,476,000 |

|

Cash and cash equivalents, ending |

|

$ |

847,000 |

|

|

$ |

1,048,000 |

|

|

|

|

|

|

|

|

Supplemental disclosures: |

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

323,000 |

|

|

$ |

372,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See notes to condensed consolidated financial statements. |

|

|

|

|

|

|

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

1.Description of business:

The operations of Capital Properties, Inc. and its wholly-owned subsidiary, Tri-State Displays, Inc. (collectively “the Company”) consist of the long-term leasing of certain of its real estate interests in the Capital Center area in downtown Providence, Rhode Island (upon the commencement of which the tenants have been required to construct buildings thereon, with the exception of the parking garage), and the leasing of locations along interstate and primary highways in Rhode Island and Massachusetts to Lamar Outdoor Advertising, LLC (“Lamar”) which has constructed outdoor advertising boards thereon. The Company anticipates that the future development of its remaining properties in the Capital Center area will consist primarily of long-term ground leases. Pending this development, the Company leases these undeveloped parcels (other than Parcel 6C) for public parking to Metropark, Ltd.

2.Basis of presentation and summary of significant accounting policies:

Principles of consolidation:

The accompanying condensed consolidated financial statements include the accounts and transactions of the Company. All significant intercompany accounts and transactions have been eliminated in consolidation.

The accompanying condensed consolidated balance sheet as of December 31, 2023 has been derived from audited financial statements. The unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading. It is suggested that these condensed consolidated financial statements be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s latest Form 10-K for the year ended December 31, 2023.

In the opinion of management, the accompanying condensed consolidated financial statements contain all adjustments (consisting solely of normal recurring adjustments) necessary to present fairly the financial position as of June 30, 2024 and the results of operations for the three and six months ended June 30, 2024 and 2023, and cash flows for the six months ended June 30, 2024 and 2023.

The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year.

Use of estimates:

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Estimates also affect the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Environmental incidents:

The Company accrues a liability when an environmental incident has occurred and the costs are estimable. The Company does not record a receivable for recoveries from third parties for environmental matters until it has determined that the amount of the collection is reasonably assured. The accrued liability is relieved when the Company pays the liability or a third party assumes the liability. Upon determination that collection is reasonably assured or a third party assumes the liability, the Company records the amount as a reduction of expense.

Fair value of financial instruments:

The Company believes that the fair values of its financial instruments, including cash and cash equivalents, receivables and payables, approximate their respective book values because of their short-term nature. The fair values described herein were determined using quoted prices in an active market (Level 1) and significant other observable inputs (Level 2) as defined by GAAP.

Investments consist of U.S. Treasury securities that yield 5.08% and mature in September 2024. The Company classifies its U. S. Treasury securities as held-to-maturity in accordance with ASC 320 "Investments - Debt and Equity Securities". Held-to-maturity securities are those securities which the Company has the ability and intent to hold until maturity. Held-to-maturity treasury securities are recorded at amortized cost on the accompanying consolidated balance sheet and adjusted for the amortization or accretion of premiums or discounts.

4.Properties and equipment:

Properties and equipment consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

Land and land improvements on lease or held for lease |

|

|

$ |

4,439,000 |

|

|

$ |

4,439,000 |

|

Building and improvements, Steeple Street (Note 7) |

|

|

|

2,582,000 |

|

|

|

2,582,000 |

|

|

|

|

|

7,021,000 |

|

|

|

7,021,000 |

|

Less accumulated depreciation: |

|

|

|

|

|

|

|

Land improvements on lease or held for lease |

|

|

|

93,000 |

|

|

|

93,000 |

|

Steeple Street (Note 7) |

|

|

|

473,000 |

|

|

|

430,000 |

|

|

|

|

|

566,000 |

|

|

|

523,000 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

6,455,000 |

|

|

$ |

6,498,000 |

|

Liabilities, other consist of the following:

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

Accrued professional fees |

|

$ |

177,000 |

|

|

$ |

157,000 |

|

Deposits and prepaid rent |

|

|

192,000 |

|

|

|

146,000 |

|

Other |

|

|

51,000 |

|

|

|

27,000 |

|

|

|

$ |

420,000 |

|

|

$ |

330,000 |

|

6.Note Payable - Revolving Credit Line:

The Company's financing agreement (“Agreement”) with BankRI provides for a revolving line-of-credit (“Line”) with a maximum borrowing capacity of $2,000,000 through March 2027. Amounts outstanding under the Agreement bear interest at the Secured Overnight Financing Rate ("SOFR") plus 200 basis points. Borrowings under the Line are secured by a First Mortgage on Parcel 5 in the Capital Center District in Providence, Rhode Island (the “Property”). The Line requires the maintenance of a debt service coverage ratio of not less than 1.25 to 1.0 on the Property and 1.20 to 1.0 for the Company. The Agreement contains other restrictive covenants, including, among others, a $250,000 limitation on the purchase of its outstanding capital stock in any twelve-month period. No advances have been made under the Line.

7.Description of leasing arrangements:

Long-term land leases:

Through June 30, 2024 the Company had entered into nine long-term land leases, eight of which have completed construction of improvements thereon. The Company’s leases generally have a term of 99 years or more, are triple net and provide for periodic rent adjustments of various types depending on the particular lease, and otherwise contain terms and conditions normal for such instruments.

Under the eight land leases, the tenants may negotiate tax stabilization treaties or other arrangements, appeal any changes in real property assessments, and must pay real property taxes assessed on land and improvements. Accordingly, real property taxes payable by the tenants are excluded from both leasing revenues and leasing expenses on the accompanying condensed consolidated statements of income and shareholders’ equity. For the three and six months ended June 30, 2024 and 2023, real property taxes attributable to the Company’s land under lease totaled $236,000 and $472,000, respectively.

On January 25, 2024, the Company entered into a long-term ground lease of Parcel 20. Under the terms of the lease, tenant's possession will not occur until such time as the tenant has received all necessary approvals for construction of not less than 100,000 square feet of mixed use improvements. Prior to transfer of possession, no rent is being paid by the tenant and the Company receives all rents from existing tenants and parking lease revenue and remains responsible for all expenses, including real estate taxes, related to Parcel 20. Following tenant's possession, tenant is obligated to pay ground rent for the parcel and to purchase the historic building presently located on the premises for an additional amount payable monthly over twenty years.

Under two of the long-term land leases, the Company receives contingent rentals (based on a fixed percentage of gross revenue received by the tenants) which totaled $34,000 and $60,000 for the three and six months ended June 30, 2024 and 2023, respectively.

Tri-State Displays Inc. leases 23 outdoor advertising locations containing 44 billboard faces along interstate and primary highways in Rhode Island and Massachusetts to Lamar under a lease which expires in 2053. The Lamar lease provides, among other things, for the following: (1) the base rent will increase annually at the rate of 2.75% for each leased billboard location on June 1 of each year, and (2) in addition to base rent, for each 12-month period commencing each June 1 (each 12-month period a “Lease Year”), Lamar must pay to the Company within thirty days after the close of the Lease Year, 30% of the gross revenues from each standard billboard and 20% of the gross revenues from each electronic billboard for such Lease Year, reduced by the sum of (a) commissions paid to unrelated third parties and (b) base rent paid to the Company for each leased billboard location. Leasing revenue includes $147,000 and $189,000 for both the three and six months ended June 30, 2024 and 2023, respectively, related to this agreement.

Parking lease:

The Company leases the undeveloped parcels of land in the Capital Center area (other than Parcel 6C) and Parcel 20 for public parking purposes to Metropark under a ten-year lease (the “Parking Lease”). The Parking Lease is cancellable as to all or any portion of the leased premises at any time on thirty days’ written notice in order for the Company or any new tenant of the Company to develop all or any portion of the leased premises. The Parking Lease provides for contingent rentals (based on a fixed percentage of gross revenue in excess of the base rent). There was no contingent rent for the three and six months ended June 30, 2024 and 2023.

The COVID-19 pandemic had an adverse impact on Metropark’s parking operations as the move by many companies to a hybrid workplace model (one that mixes in-office and remote work) resulted in lower demand for parking spaces. From June 2020 through December 31, 2023 revenue was recognized on a cash basis with the difference between the regularly scheduled rental payments and amounts paid ("deferred rent") recorded as an accounts receivable and was fully reserved. At June 30, 2023 the receivable from Metropark was $1,090,000 and was fully reserved.

Effective January 1, 2024, the Company entered into a Second Amendment to its Lease Agreement whereby Metropark agreed to return to a fixed monthly rental payment of $57,000 per month subject to adjustment in accordance with the Lease Agreement. Additionally, the Company and Metropark settled the Company’s claim for deferred rent for all prior periods which amounted to $1,127,000 (fully reserved by the Company) for $150,000 payable by Metropark in twenty (20) equal quarterly installments commencing on April 1, 2024 together with interest on the unpaid balance in the amount of 4.73% per annum. At June 30, 2024 and December 31, 2023, Prepaid and other includes $142,500 and $150,000, respectively, related to this settlement.

For the three and six months ended June 30, 2024 , revenue from Metropark was $171,000 and $342,000, respectively, and $151,000 and $283,000 for the same periods in 2023 and is included in revenue on the accompanying consolidated statement of income.

Historically, the Company has made financial statement disclosure of the excess of straight-line rentals over contractual payments and its determination of collectability of such excess. To the extent the Company determines that, with respect to any of its leases, the excess of straight-line rentals over contractual payments is not collectible, such excess is not recognized as revenue. Consistent with prior conclusions, the Company has determined that, at this time, the excess of straight-line rentals over contractual payments is not probable of collection. Accordingly, the Company has not included any part of that amount in revenue. As a matter of information only, as of June 30, 2024 the excess of straight-line rentals (calculated by excluding variable payments) over contractual payments was $94,395,000.

8.Income taxes, continuing operations:

Deferred income taxes are recorded based upon differences between financial statement and tax basis amounts of assets and liabilities. The tax effects of temporary differences for continuing operations which give rise to deferred tax assets and liabilities are as follows:

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

Gross deferred tax liabilities: |

|

|

|

|

|

|

Property having a financial statement basis in excess of

tax basis |

|

$ |

364,000 |

|

|

$ |

364,000 |

|

Accounts receivable |

|

|

55,000 |

|

|

|

52,000 |

|

Insurance premiums and accrued leasing revenues |

|

|

29,000 |

|

|

|

49,000 |

|

|

|

|

448,000 |

|

|

|

465,000 |

|

Gross deferred tax assets: |

|

|

|

|

|

|

Prepaid rent |

|

|

(52,000 |

) |

|

|

(40,000 |

) |

Accounts payable and accrued expenses |

|

|

(62,000 |

) |

|

|

(49,000 |

) |

Accrued property taxes |

|

|

(92,000 |

) |

|

|

(92,000 |

) |

|

|

|

(206,000 |

) |

|

|

(181,000 |

) |

|

|

$ |

242,000 |

|

|

$ |

284,000 |

|

9.Discontinued operations:

Prior to February 2017, the Company operated a petroleum storage facility (“Terminal”) through two wholly owned subsidiaries. On February 10, 2017, the Terminal was sold to Sprague Operating Resources, LLC (“Sprague”). In accordance with ASC 205-20, Presentation of Financial Statements – Discontinued Operations, the sale of the Terminal was accounted for as a discontinued operation.

As part of the Terminal Sale Agreement, the Company agreed to retain and pay for the environmental remediation costs associated with a 1994 storage tank leak which allowed the escape of a small amount of fuel oil. The Company continues the remediation activities set forth in the Remediation Action Work Plan (“RAWP”) filed with the Rhode Island Department of Environmental Management (“RIDEM”). The estimated future cost associated with the remediation is $379,000 and is reported separately on the consolidated balance sheets as liability associated with discontinued operations. Any subsequent increases or decreases to the expected cost of remediation will be recorded in the Company’s condensed consolidated statements of income as gain or loss from sale of discontinued operations.

The Terminal Sale Agreement also contained a cost sharing provision for the breasting dolphin whereby any construction costs incurred more than the contract cost of construction would be borne equally by Sprague and the Company subject to certain limitations, including, in the Company’s opinion, a 20% cap on the increase from the initial estimate, subject to a sharing arrangement. In November 2019, Sprague asserted that it was owed $427,000 and the Company asserted that its obligation under the Agreement cannot exceed $104,000. Mediation efforts were unsuccessful and in July 2021, Sprague commenced an action against the Company in the Rhode Island Superior Court (Superior Court) seeking monetary damages of $427,000, interest and attorney’s fees ("Sprague Litigation"). In December 2022, the Superior Court denied Sprague’s Motion for Summary Judgment filed in September 2022 and granted in part and denied in part the Company’s Cross Motion for Summary Judgment also filed in September 2022. The matter went to trial before a Superior Court judge in May 2024. Post-trial briefs were due July 25, 2024. A decision is expected to be rendered before the end of 2024.

Loss on sale of discontinued operations on the condensed consolidated statements of income and shareholders’equity includes legal and professional fees related to the Sprague Litigation of $281,000 and $351,000 for the three and six months ended June 30, 2024, respectively and $25,000 in each of the same periods for 2023.

At its July 31, 2024 regularly scheduled quarterly Board meeting, the Board of Directors voted to declare a quarterly dividend of $.07 per share for shareholders of record on August 16, 2024, payable August 30, 2024.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD LOOKING STATEMENTS

Certain portions of this report, and particularly the Management’s Discussion and Analysis of Financial Condition and Results of Operations, contain forward-looking statements within the meaning of Sections 27A of the Securities Act of 1933, as amended, and Sections 21E of the Securities Exchange Act of 1934, as amended, which represent the Company’s expectations or beliefs concerning future events. The Company cautions that these statements are further qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements, including, without limitation, the following: the ability of the Company to generate adequate amounts of cash; the collectability of the excess of straight-line over contractual rents when due over the terms of the long-term leases; tenant default under one or more of the leases; the commencement of additional long-term land leases; changes in economic conditions that may affect either the current or future development on the Company’s parcels; cyber penetrations; the long-term impact of the hybrid workplace model on future development, existing tenants and parking operations, and the Company's financial performance; and exposure to remediation and other costs associated with its former operation of the petroleum storage facility. The Company does not undertake the obligation to update forward-looking statements in response to new information, future events or otherwise.

Critical accounting policies:

The Company believes that its revenue recognition policy for long-term leases with scheduled rent increases meets the definition of a critical accounting policy which is discussed in the Company’s Form 10-K for the year ended December 31, 2023. There have been no changes to the application of this accounting policy since December 31, 2023.

2.Liquidity and capital resources:

Historically, the Company has had adequate liquidity to fund its operations.

Cash and cash commitments:

At June 30, 2024, the Company had cash and cash equivalents of $847,000. In addition to these funds, the Company has $1,265,000 invested in U.S. Treasury securities that yield 5.08% and mature in September 2024. The Company and its subsidiary each maintain checking accounts and a money market account in one bank, all of which are insured by the Federal Deposit Insurance Corporation to a maximum of $250,000. The Company periodically evaluates the financial stability of the financial institutions at which the Company’s funds are held.

To date, all tenants have paid their monthly rent in accordance with their lease agreements.

The Terminal Sale Agreement and related documentation provides that the Company is required to secure an approved remediation plan and to remediate contamination caused by a leak in 1994 from a storage tank at the Terminal. At June 30, 2024, the Company’s accrual for the remaining cost of remediation was $387,000 of which $36,000 is expected to be incurred during the balance of 2024. Any subsequent increases or decreases to the expected cost of remediation will be recorded in gain (loss) on sale of discontinued operations, net of taxes.

The Terminal Sale Agreement also contained a cost sharing provision for a breasting dolphin whereby any construction costs in excess of the contract cost of construction would be borne equally by Sprague and the Company subject to certain limitations, including, in the Company’s opinion, a 20% cap on the increase from the initial estimate subject to the sharing arrangement. In November 2019, Sprague asserted that it was owed $427,000 and the Company asserted that its obligation under the Agreement could not exceed $104,000. Mediation efforts were unsuccessful and in July 2021, Sprague commenced an action against the Company in the Rhode Island Superior Court (Superior Court) seeking monetary damages of $427,000, plus interest and attorney’s fees. In December 2022, the Superior Court denied Sprague’s Motion for Summary Judgment filed in September 2022 and granted in part and denied in part the Company’s Cross Motion for Summary Judgment also filed in September 2022. The matter went to trial before a Superior Court judge in May 2024. Post-trial briefs have been filed and the Company anticipates that a decision will be rendered before the end of 2024.

Loss on sale of discontinued operations on the condensed consolidated statements of income and shareholders’equity includes legal and professional fees related to the Sprague Litigation of $281,000 and $351,000 for the three and six months ended June 30, 2024, respectively and $25,000 in each of the same periods for 2023 related to the Sprague litigation.

The declaration of future dividends will depend on future earnings and financial performance.

Three months ended June 30, 2024 compared to three months ended June 30, 2023:

Revenue increased $2,000 from 2023 and consists of increased revenue from Metropark ($20,000), scheduled rent increases ($8,000) and other sources of revenue ($11,000) offset by a net decline in rent from Lamar caused by decreased contingent rent ($37,000).

Operating expenses increased $20,000 due principally to repair and maintenance costs, professional fees related to the Company's billboard operations and increased insurance costs.

General and administrative expense increased $2,000 due principally to an increase in payroll and payroll related costs.

Six months ended June 30, 2024 compared to six months ended June 30, 2023:

Leasing revenue increased $93,000 from 2023, due principally to Metropark ($59,000), scheduled rent increases and contingent rent associated with our land leases ($37,000) along with an increase in other revenue ($29,000) offset by a decline in contingent rent from Lamar ($32,000).

Operating expenses increased $54,000 due to professional fees associated with billboard operations ($34,000), increased insurance costs ($10,000) and repairs and maintenance ($12,000) offset by a decline in other operating expenses ($2,000).

General and administrative expense increased $18,000 due principally to increased payroll and payroll related costs.

For the six months ended June 30, 2024 and 2023, the Company’s effective income tax rate is approximately 27% of income before income taxes.

Item 4. Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the Company carried out an evaluation of the effectiveness of the design and operation of the Company's disclosure controls and procedures as of the end of the period covered by this report. This evaluation was carried out under the supervision and with the participation of the Company's management, including the Company's principal executive officer and the Company's principal financial officer. Based upon that evaluation, the principal executive officer and the principal financial officer concluded that the Company's disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms.

There was no significant change in the Company's internal control over financial reporting that occurred during the Company's most recent fiscal quarter that has materially affected, or is reasonably likely to affect, the Company's internal control over financial reporting.

PART II – OTHER INFORMATION

Item 6. Exhibits

(b) Exhibits:

|

|

|

3.1 |

Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the registrant’s report on Form 8-K filed on April 24, 2013) |

|

|

3.2 |

By-laws, as amended, October 25, 2017 (incorporated by reference to Exhibit 3.2 to the registrant’s report on Form 8-K filed October 25, 2017) |

|

|

10 |

Material contracts: |

|

|

|

|

(a) |

Lease between Metropark, Ltd. and the Company: |

|

|

(i) Dated January 1, 2017 (incorporated by reference to Exhibit 10 to the registrant’s annual report on Form 10-K for the year ended December 31, 2017) |

|

|

(ii) First Amendment dated January 1, 2018 (incorporated by reference to Exhibit 10(a)(ii) to the registrant's report on Form 10Q for the quarter ended March 31, 2024) |

|

|

(iii) Letter agreement dated July 31, 2020 between the Company and Metropark, LTD modifying the rental obligations of Metropark (incorporated by reference to Exhibit 10(a)(ii) to the registrant's report on Form 10Q for the quarter ended June 30, 2022). |

|

|

(iv) Second Amendment dated January 9, 2024 (incorporated by reference to Form 8-K filed January 10, 2024) |

|

|

|

|

(b) |

Loan Agreement between Bank Rhode Island and the Company: |

|

|

(i) Loan Agreement dated March 30, 2021 (incorporated by reference to the registrant's Form 8K dated March 31, 2021). |

|

|

(ii) Loan Agreement dated February 29, 2024 (incorporated by reference to Exhibit 10(b)(ii) to the registrant's report on Form 10Q for the quarter ended March 31, 2024) |

|

|

|

31.1 |

Rule 13a-14(a) Certification of Chairman and Principal Executive Officer |

|

|

31.2 |

Rule 13a-14(a) Certification of Treasurer and Principal Financial Officer |

|

|

32.1 |

Certification of Chairman and Principal Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

32.2 |

Certification of Treasurer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

101 |

The following financial information from the Company’s Quarterly Report on Form 10-Q for the Quarter ended June 30, 2024, filed with the Securities and Exchange Commission on August 2, 2024 formatted in iXBRL(“Inline eXtensible Business Reporting Language”): |

|

|

|

|

(i) |

Condensed Consolidated Balance Sheets as of June 30, 2024 and December 31, 2023 |

|

(ii) |

Condensed Consolidated Statements of Income and Shareholders’ Equity for the Three and Six Months ended June 30, 2024 and 2023 |

|

(iii) |

Condensed Consolidated Statements of Cash Flows for the Six Months ended June 30, 2024 and 2023 |

|

(iv) |

Notes to Condensed Consolidated Financial Statements. |

|

|

|

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

|

|

|

SIGNATURES

In accordance with the requirements of the Exchange Act, the Issuer caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

CAPITAL PROPERTIES, INC. |

|

|

|

|

By |

/s/ Robert H. Eder |

|

|

Robert H. Eder |

|

|

Chairman and Principal Executive Officer |

|

|

|

|

By |

/s/ Susan R. Johnson |

|

|

Susan R. Johnson |

|

|

Treasurer and Principal Financial Officer |

DATED: August 2, 2024

Exhibit 31.1

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

Certification Pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002

I, Robert H. Eder, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Capital Properties, Inc. and Subsidiary;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and we have:

(a)designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that was materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

(a)all significant deficiencies and material weaknesses in the design or operation of internal controls over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

Date: August 2, 2024 |

|

/s/ Robert H. Eder |

Robert H. Eder |

Chairman and Principal Executive Officer |

Exhibit 31.2

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

Certification Pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002

I, Susan R. Johnson, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Capital Properties, Inc. and Subsidiary;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and we have:

(a)designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that was materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

(a)all significant deficiencies and material weaknesses in the design or operation of internal controls over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

Date: August 2, 2024 |

|

/s/ Susan R. Johnson |

Susan R. Johnson |

Treasurer and Principal Financial Officer |

Exhibit 32.1

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

Certification Pursuant to

18 U.S.C. Section 1350,

as Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Quarterly Report of Capital Properties, Inc. (the Company) on Form 10-Q for the quarterly period ended June 30, 2024, as filed with the Securities and Exchange Commission on the date hereof (the Report), I, Robert H. Eder, Chairman and Principal Executive Officer of the Company, certify, pursuant to 18 U.S.C. ss. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

1)The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2)The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

/s/ Robert H. Eder |

Robert H. Eder |

Chairman and Principal Executive Officer |

August 2, 2024 |

Exhibit 32.2

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

Certification Pursuant to

18 U.S.C. Section 1350,

as Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Quarterly Report of Capital Properties, Inc. (the Company) on Form 10-Q for the quarterly period ended June 30, 2024, as filed with the Securities and Exchange Commission on the date hereof (the Report), I, Susan R. Johnson, Treasurer and Principal Financial Officer of the Company, certify, pursuant to 18 U.S.C. ss. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

1)The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2)The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

/s/ Susan R. Johnson |

Susan R. Johnson, Treasurer |

and Principal Financial Officer |

August 2, 2024 |

Document and Entity Information

|

6 Months Ended |

|

Jun. 30, 2024

shares

|

|---|

| Cover [Abstract] |

|

| Document Type |

10-Q

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 30, 2024

|

| Document Fiscal Year Focus |

2024

|

| Document Fiscal Period Focus |

Q2

|

| Trading Symbol |

CPTP

|

| Entity Registrant Name |

CAPITAL PROPERTIES, INC.

|

| Entity Central Index Key |

0000202947

|

| Current Fiscal Year End Date |

--12-31

|

| Entity Filer Category |

Non-accelerated Filer

|

| Entity Small Business |

true

|

| Entity Shell Company |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Current Reporting Status |

Yes

|

| Entity File Number |

001-08499

|

| Entity Tax Identification Number |

05-0386287

|

| Entity Address, Address Line One |

5 Steeple Street, Unit 303

|

| Entity Address, City or Town |

Providence

|

| Entity Address, State or Province |

RI

|

| Entity Address, Postal Zip Code |

02903

|

| City Area Code |

401

|

| Local Phone Number |

435-7171

|

| Entity Interactive Data Current |

Yes

|

| Title of 12(g) Security |

Class A Common Stock, $.01 par value

|

| Document Quarterly Report |

true

|

| Document Transition Report |

false

|

| Entity Common Stock, Shares Outstanding |

6,599,912

|

| Entity Incorporation, State or Country Code |

RI

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Condensed Consolidated Balance Sheets - USD ($)

|

Jun. 30, 2024 |

Dec. 31, 2023 |

| ASSETS |

|

|

| Properties and equipment (net of accumulated depreciation) (Note 4) |

$ 6,455,000

|

$ 6,498,000

|

| Cash and cash equivalents |

847,000

|

652,000

|

| Investments |

1,265,000

|

1,244,000

|

| Prepaid and other |

315,000

|

387,000

|

| Prepaid income taxes |

|

57,000

|

| Deferred income taxes, discontinued operations |

103,000

|

109,000

|

| Total assets |

8,985,000

|

8,947,000

|

| Liabilities: |

|

|

| Property taxes |

340,000

|

340,000

|

| Other |

420,000

|

330,000

|

| Income tax payable |

21,000

|

|

| Deferred income taxes, net |

242,000

|

284,000

|

| Environmental remediation accrual, discontinued operations (Note 9) |

379,000

|

402,000

|

| Total liabilities |

1,402,000

|

1,356,000

|

| Shareholders’ equity: |

|

|

| Class A common stock, $.01 par; authorized 10,000,000 shares; issued and outstanding 6,599,912 shares |

66,000

|

66,000

|

| Capital in excess of par |

782,000

|

782,000

|

| Retained earnings |

6,735,000

|

6,743,000

|

| Total shareholders' equity |

7,583,000

|

7,591,000

|

| Total liabilities and shareholders' equity |

$ 8,985,000

|

$ 8,947,000

|

| X |