UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

☐

|

Preliminary

Proxy Statement

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive

Proxy Statement

|

|

☒

|

Definitive

Additional Materials

|

|

☐

|

Soliciting

Material Pursuant to §240.14a-12

|

ADVAXIS,

INC.

(Name

of Registrant as Specified in Its Charter)

Not

Applicable

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required.

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

EXPLANATORY

NOTE

On October 21, 2021, Advaxis Inc. (the “Company”)

filed with the Securities and Exchange Commission its Definitive Proxy Statement (the “Definitive Proxy Statement”) for the

Company’s Special Meeting of Stockholders to be held on November 16, 2021, at 10:00 a.m. Eastern Time. The Definitive Proxy Statement

inadvertently omitted, in the section “Biosight’s Business -- Certain Projected Revenue Information” beginning

on page 166, a chart reflecting U.S. Based Aspa Forecasted Revenues. A complete version of such section, including the chart, is set

forth below.

Certain

Projected Revenue Information

Set

forth below are projected peak revenues for use of BST-236 in the treatment of AML and MDL prepared by Cello Health BioConsulting and

certain information upon which the projections are based. The full text of the Opportunity Assessment for BST-236, dated September 23,

2021 (the “Report”), which sets forth, among other things, the various qualifications, assumptions and limitations on the

scope of the review undertaken, is attached as Exhibit 99.1 to this Registration Statement. Any summaries of the Report set forth herein

are qualified in their entirety by reference to the full text of the Report. Holders of Biosight shares and Advaxis common stock are

urged to read the Report in its entirety. The Report speaks only as of its date and does not reflect any developments that may occur

or may have occurred after the date of the Report and prior to the completion of the Business Combination. The preparation of revenue

projections is a complex process and is not susceptible to a partial analysis or summary description. Cello Health BioConsulting believes

that its Report must be considered as a whole and that selecting portions of its Report, without considering the Report taken as a whole,

may create an incomplete view of the revenue projections.

The

revenue projections were not available to the boards of Biosight or Advaxis in connection with their respective reviews of the Business

Combination because the first draft of the revenue projections had not been provided by Cello Health BioConsulting to Biosight until

July 7, 2021 which was after Biosight and Advaxis entered into the Merger Agreement. In addition, because they had not yet been prepared,

the revenue projections were not available the LifeSci Capital in connection with their preparation of their opinion to the Advaxis Board

regarding the Business Combination.

Biosight

has not warranted the accuracy, reliability, appropriateness or completeness of the cash spending projections to anyone, including us.

Neither the management of Biosight nor any of its representatives, advisors or affiliates has made or makes any representation to any

person regarding the ultimate revenue of Biosight compared to the information contained in the revenue projections, and none of them

intends to or undertakes any obligation to update or otherwise revise the revenue projections to reflect circumstances existing after

the date when made or to reflect the occurrence of future events in the event that any or all of the assumptions underlying the cash

spending projections are shown to be in error. The revenue projections are subjective in many respects. As a result, there can be no

assurance that the revenue projections will be realized or that actual results will not be significantly higher or lower than estimated.

Since the revenue projections cover multiple years, that information by its nature becomes less predictive with each successive year.

Accordingly, they should not be looked upon as “guidance” of any sort. You are cautioned not to rely on the revenue projections

in making a decision regarding the transaction, as actual results may be materially different from the revenue projections.

While

presented in this proxy statement/prospectus/information statement with numeric specificity, the revenue projections of Biosight are

forward-looking statements that are based on assumptions that are inherently subject to significant risks, uncertainties and contingencies,

many of which are beyond Biosight’s control. These include the risks described in the section entitled “Forward-Looking Statements”

and “Risk Factors.” The revenue projections also reflect assumptions as to certain business decisions that are subject to

change. There may be differences between actual and projected revenue, and actual revenue may be materially less or materially greater

than those contained in the revenue projections. The inclusion of the revenue projections in this proxy statement/prospectus/information

statement should not be regarded as an indication that Biosight or its representatives considered or currently consider the revenue projections

to be a reliable prediction of future events, and reliance should not be placed on the revenue projections.

The

projections were prepared by Cello Health BioConsulting. The projections were not prepared with a view towards compliance with GAAP,

the published guidelines of the SEC, or the guidelines established by the American Institute of Certified Public Accountants for preparation

of prospective financial information. The prospective financial information included in this document has been prepared by, and is the

responsibility of, Biosight’s management. Kesselman & Kesselman, a member firm of PricewaterhouseCoopers International Limited,

has not audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to the accompanying prospective financial

information and, accordingly, Kesselman & Kesselman, a member firm of PricewaterhouseCoopers International Limited, does not express

an opinion or any other form of assurance with respect thereto. The Kesselman & Kesselman, a member firm of PricewaterhouseCoopers

International Limited, report included in this document relates to Bio sight’s previously issued financial statements. It does

not extend to the prospective financial information and should not be read to do so.

The

key elements of the revenue projections of Biosight are as follows (in millions of dollars, unaudited):

The

revenue projections was prepared using a number of assumptions, including the following assumptions that are believed to be material:

●

The revenue projections assume that (i) FDA approval for use of BST-236 for relapsed/refractory AML is received on an accelerated

basis in 2024, (2) FDA approval for use of BST-236 in high-risk relapsed/refractory MDS is received on an accelerated basis in 2024,

(3) FDA approval for use of BST-236 as a first-line, venetoclax combination treatment for AML is received in 2025 and (4) FDA

approval for use of BST-236 as a first-line, single-agent treatment for AML for adults unfit for intensive chemotherapy is received

in 2025. While Biosight and Cello Health are inherently unable to predict the behavior of the FDA as an independent agency, and what

the FDA, in its sole discretion may decide, the assumed timing of these approvals represents Biosight’s and Cello

Health’s best estimate of when these approvals might occur. These estimates are based on Biosight’s and Cello

Health’s own estimates of the remaining time and activities necessary to complete clinical trials that might be required by

the FDA in the future, and Biosight’s ability to meet these requirements. Biosight and Cello Health based these assumptions on

the current status of ongoing and planned clinical trials, their general knowledge of other oncology companies past submissions and

the requirements imposed on new drug applications for similar pharmaceuticals. Actual results may vary significantly from these

estimates. Further, there is no guarantee Biosight will successfully receive timely FDA approval for BST-236 any of these

applications according to its projected timelines, or at all, and if Biosight fails to achieve approval or incurs significant delays

in its approval for any of these applications, this could have a material adverse impact on its ability to achieve the projected

revenues set forth above.

●

Assuming FDA approval is obtained, projected revenues assume that BST-236 continues to demonstrate tolerability and efficacy similar

to that demonstrated in completed and ongoing clinical trials. The outcome of preclinical studies and early clinical trials are not

always predictive of the success of later clinical trials, and interim results of clinical trials do not necessarily predict success

in the results of completed clinical trials. For example, even though Biosight’s Phase 1/2a and Phase 2 clinical trials

provided promising data that BST-236, has safe and effective qualities in the treatment of AML, these results may not be indicative

of any results Biosight achieves in future randomized Phase 3 clinical trials that may be conducted with a different patient

pool.

●

Projected revenues assume that (i) total value of U.S. sales for all AML pharmaceutical treatments rise rapidly from approximately

$1 billion now to approximately $6 billion by 2026 and (ii) total value of U.S. sales for all MDS pharmaceutical treatments rise

rapidly from approximately $500 million now to approximately $2.4 billion by 2026. Projected revenues also assume a projected target

patient population penetration of 35% for each application.

●

Assuming FDA approval is obtained, projected revenues assume a price for BST-236 in the treatment of AML as a first-line treatment

of $125,000 annually, $75,000 annually for treatment of relapsed/recurring AML and $125,000 annually for treatment of high-risk

relapsed/recurring MDS. Biosight’s ability to commercialize BST-236, or any other product candidates, will depend

substantially on the extent to which the costs of its product candidates will be paid by health maintenance, managed care, pharmacy

benefit and similar healthcare management organizations, or reimbursed by government health administration authorities (such as, in

the United States, Medicare and Medicaid), private health coverage insurers and other third-party payors. The healthcare industry is

acutely focused on cost containment, both in the United States and elsewhere. Government authorities and third-party payors have

attempted to control costs by limiting coverage and the amount of reimbursement for particular medications, and could view our

products as not being cost-effective.

●

Assuming FDA approval is obtained, projected revenues assume that no competing product is safer, more effective, has fewer or less

severe side effects or is less expensive than BST-236. Biosight’s commercial opportunity could be reduced or eliminated if

competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects or are less

expensive than BST-236. Biosight’s competitors could also obtain FDA or other regulatory approval for their products more

quickly than Biosight is able, which could impact the success of marketing or commercializing BST-236. In addition, insurers and

other third-party payers could impact Biosight’s ability to compete if they seek to encourage the use of more cost-effective

products.

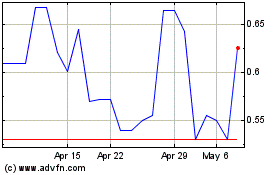

Ayala Pharmaceuticals (CE) (USOTC:ADXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ayala Pharmaceuticals (CE) (USOTC:ADXS)

Historical Stock Chart

From Nov 2023 to Nov 2024