Current Report Filing (8-k)

August 31 2015 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 31, 2015

AMERITYRE CORPORATION

(Exact name of registrant as specified in its charter)

|

NEVADA

|

000-50053

|

87-0535207

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer ID No.)

|

|

of incorporation)

|

|

|

1501 Industrial Road, Boulder City, Nevada 89005

(Address of principal executive office)

Registrant's telephone number, including area code: (702) 293-1930

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 – RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On August 31, 2015, Amerityre Corporation (the “Company”) issued a press release reporting its financial results for the fourth quarter and the year ending June 30, 2015. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-k.

ITEM 9.01 – FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunder duly authorized.

Dated: August 31, 2015

AMERITYRE CORPORATION

/s/ Lynda R. Keeton-Cardno

Lynda R. Keeton-Cardno

Chief Financial Officer

(Principal Financial and Accounting Officer)

Exhibit 99.1

SOURCE: Amerityre Corporation

Amerityre Reports FY 2015 Q4 Profit

BOULDER CITY, NV--(Marketwired - Aug 31, 2015) - Amerityre Corporation (OTCQB: AMTY) today reported its first profitable quarter, recording earnings of approximately $39,000, before preferred share dividends, for the fiscal fourth quarter of 2015.

"Our fourth quarter results validate the strategic changes implemented by our management team and the execution of this strategy by our entire organization over the last year," said Michael F. Sullivan, Chief Executive Officer. "We have focused our efforts on the development and sale of higher margin products, as well as the realignment of our cost structure. The profitable 4th quarter is a historical milestone for Amerityre Corporation as it continues its evolution into a manufacturer of premium closed cell foam and elastomer tire solutions."

Amerityre's fourth quarter 2015 sales were approximately $1.2 million, up from $0.9 million a year ago. Net income of approximately $39,000 for the quarter was up from a quarterly net loss of $633,000 a year ago.

Summarized results for the quarter and fiscal year ended June 30, 2015 are:

| |

|

|

|

|

Percent

|

|

| |

|

Three Mos. Ended June 30,

|

|

|

Change

|

|

| |

|

(in 000's)

|

|

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015 vs. 2014

|

|

|

Net revenues

|

|

$ |

1,222 |

|

|

$ |

849 |

|

|

|

43.9 |

% |

|

Cost of revenues

|

|

|

(826 |

) |

|

|

(717 |

) |

|

|

15.2 |

% |

|

Gross profit

|

|

|

396 |

|

|

|

132 |

|

|

|

200.0 |

% |

|

Research and development expenses

|

|

|

(45 |

) |

|

|

(41 |

) |

|

|

9.8 |

% |

|

Sales and marketing expense

|

|

|

(130 |

) |

|

|

(119 |

) |

|

|

9.2 |

% |

|

General and administrative expense (1)

|

|

|

(182 |

) |

|

|

(360 |

) |

|

|

(49.2 |

)% |

|

Gain on extinguishment of long term payable

|

|

|

63 |

|

|

|

- |

|

|

|

100.0 |

% |

|

Loss on sales of assets

|

|

|

(63 |

) |

|

|

(249 |

) |

|

|

(74.7 |

)% |

|

Other income

|

|

|

- |

|

|

|

4 |

|

|

|

(100.0 |

)% |

|

Net income (loss)

|

|

|

39 |

|

|

|

(633 |

) |

|

|

(106.2 |

)% |

|

Preferred stock dividend

|

|

|

(25 |

) |

|

|

(25 |

) |

|

|

0.0 |

% |

|

Net income (loss) attributable to common shareholders

|

|

$ |

14 |

|

|

$ |

(658 |

) |

|

|

(102.2 |

)% |

|

(1)

|

|

Includes stock-based compensation expense of $5,068 and $56,207 for the three months ended June 30, 2015 and 2014, respectively.

|

| |

|

|

|

|

Percent

|

|

| |

|

Fiscal Year Ended June 30,

|

|

|

Change

|

|

| |

|

(in 000's)

|

|

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015 vs. 2014

|

|

|

Net revenues

|

|

$ |

4,794 |

|

|

$ |

4,316 |

|

|

|

11.1 |

% |

|

Cost of revenues

|

|

|

(3,515 |

) |

|

|

(3,557 |

) |

|

|

(1.2 |

)% |

|

Gross profit

|

|

|

1,279 |

|

|

|

759 |

|

|

|

68.5 |

% |

|

Research and development expenses

|

|

|

(201 |

) |

|

|

(167 |

) |

|

|

20.4 |

% |

|

Sales and marketing expense

|

|

|

(557 |

) |

|

|

(471 |

) |

|

|

18.3 |

% |

|

General and administrative expense (1)

|

|

|

(819 |

) |

|

|

(1,020 |

) |

|

|

(19.7 |

)% |

|

Gain on extinguishment of long term payable

|

|

|

63 |

|

|

|

- |

|

|

|

100.0 |

% |

|

Loss on sales of assets

|

|

|

(63 |

) |

|

|

(251 |

) |

|

|

(74.9 |

)% |

|

Other expense

|

|

|

(1 |

) |

|

|

(120 |

) |

|

|

(99.2 |

)% |

|

Net loss

|

|

|

(299 |

) |

|

|

(1,270 |

) |

|

|

(76.5 |

)% |

|

Preferred stock dividend

|

|

|

(100 |

) |

|

|

(25 |

) |

|

|

300.0 |

% |

|

Net loss attributable to common shareholders

|

|

$ |

(399 |

) |

|

$ |

(1,295 |

) |

|

|

(69.2 |

)% |

|

(1)

|

|

Includes stock-based compensation expense of $23,706 and $111,973 for the fiscal years ended June 30, 2015 and 2014, respectively.

|

| |

|

|

The following table summarizes our balance sheet for the fiscal years ended June 30, 2015 and 2014.

| |

|

Fiscal Year Ended June 30,

|

|

| |

|

(in 000's)

|

|

| |

|

2015

|

|

|

2014

|

|

|

Cash

|

|

$ |

456 |

|

|

$ |

729 |

|

|

Total current assets

|

|

|

1,465 |

|

|

|

1,940 |

|

|

Total assets

|

|

|

2,175 |

|

|

|

2,695 |

|

|

Total current liabilities

|

|

|

452 |

|

|

|

634 |

|

|

Total liabilities

|

|

|

506 |

|

|

|

687 |

|

|

Preferred stock

|

|

|

2,000 |

|

|

|

2,000 |

|

|

Common stock

|

|

|

42 |

|

|

|

42 |

|

|

Total stockholders' equity

|

|

|

1,669 |

|

|

|

2,008 |

|

|

Total liabilities and stockholders' equity

|

|

|

2,175 |

|

|

|

2,695 |

|

| |

|

|

|

|

|

|

|

|

The following table summarizes our cash flows for the fiscal years ended June 30, 2015 and 2014.

| |

|

Years ended June 30,

|

|

| |

|

(in 000's)

|

|

| |

|

2015

|

|

|

2014

|

|

|

Net cash used in operating activities

|

|

$

|

(143

|

)

|

|

$

|

(781

|

)

|

|

Net cash used in investing activities

|

|

|

(52

|

)

|

|

|

(46

|

)

|

|

Net cash (used in)/provided by financing activities

|

|

|

(78

|

)

|

|

|

1,447

|

|

|

Net (decrease) increase in cash and cash equivalents during period

|

|

$

|

(273

|

)

|

|

$

|

620

|

|

Overview

Amerityre engages in the research and development, manufacturing and sale of polyurethane tires. We believe that we have developed unique polyurethane formulations that allow us to make products with superior performance characteristics, including abrasion resistance, energy efficiency and load-bearing capabilities, when compared to conventional rubber tires. We also believe that our manufacturing processes are more energy efficient than the traditional rubber tires manufacturing processes, in part because our polyurethane compounds do not require the multiple processing steps, extreme heat, and high pressure that are necessary to cure rubber. Using our polyurethane technologies, we believe tires can be produced which last longer, are less susceptible to failure and are friendly to the environment.

We are concentrating on three segments of the tire market: closed-cell polyurethane foam tires, polyurethane elastomer forklift tires and agricultural tires. Our most recent activities in these areas are summarized below:

Closed-Cell Polyurethane Tires - The sale of polyurethane foam tires to original equipment manufacturers, distributors and dealers accounts for the majority of our revenue. We have the ability to produce a broad range of products for the light duty tire market. During 2014, we introduced a new low cost formulation positioned to compete within the commodity segment of this market, and we continue to develop new products for this market segment. Marketing efforts continue to build customer relationships with original equipment manufacturers and further develop distribution networks to expand business and product sales.

Polyurethane Elastomer Forklift Tires - During 2014 the forklift product line was reintroduced into the marketplace. Sales have been below expectations, and during FY 2015 a project has been ongoing to source suitable formulation components to replace those that are unavailable. This new formulation is expected to be completed and introduced to the market during the second half of FY 2016, at which time a new marketing campaign will be launched for this product.

Agricultural Tires - The pivot tire product continues to demonstrate revenue growth. With market acceptance and growing revenues for this new product, we focused on developing product improvement for the pivot tire, including advances in manufacturing. We continue to work to establish distribution relationships to increase our market penetration in this segment. Our market knowledge continues to grow as evidenced by several new product designs we have implemented during the period and a new design patent we hold. This patent will protect the Company's interest going forward and we anticipate we can bolster future revenues by providing application-specific solutions for customers.

For more complete business and financial information than provided in this summary release, please see our Annual Report on Form 10-K for the year ended June 30, 2015 as filed with the Securities and Exchange Commission. Additional information is also available on our website at www.amerityre.com.

Forward-looking Statements

This report contains "forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions and other information that is not historical information. In some cases, forward-looking statements can be identified by terminology such as "believes," "expects," "may," "will," "should," "anticipates," or "intends" or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

All forward-looking statements, including without limitation, management's examination of historical operating trends, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but, there can be no assurance that management's expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. We undertake no obligation to publicly update or revise forward-looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events. This report may include information with respect to market share, industry conditions and forecasts that we obtained from internal industry research, publicly available information (including industry publications and surveys), and surveys and market research provided by consultants. The publicly available information and the reports, forecasts and other research provided by consultants generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy and completeness of such information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, our internal research and forecasts are based upon our management's understanding of industry conditions, and such information has not been verified by any independent sources.

Contact:

Amerityre Corporation

702-293-1930

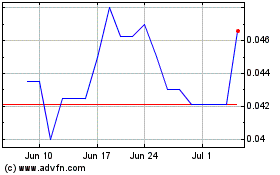

Amerityre (PK) (USOTC:AMTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

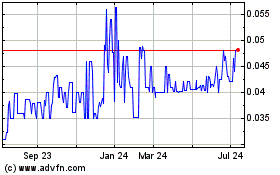

Amerityre (PK) (USOTC:AMTY)

Historical Stock Chart

From Jul 2023 to Jul 2024