As filed with the U.S. Securities and Exchange Commission

on October 31, 2019.

Registration No. 333-234299

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

American Cannabis Company, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

8742

(Primary Standard Industrial Classification Code Number)

90-1116625

(I.R.S. Employer Identification Number)

5690 Logan Street, Unit A

Denver CO. 80216

Telephone: (303) 974-4770

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Terry L. Buffalo

American Cannabis Company, Inc.

5690 Logan Street, Unit A

Denver CO. 80216

Telephone: (303) 974-4770

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Mailander Law Office, Inc.

Tad Mailander

945 4th Avenue, Ste. 311

San Diego, CA 92101

(619) 239-9034

From time to time after the effective date of this

registration statement.

(Approximate date of commencement of proposed sale to the public)

If any of

the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If this Form

is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. ☐

If this Form

is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form

is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☒

|

|

(Do not check if a smaller reporting

company)

|

Emerging growth company

|

☒

|

Calculation of Registration Fee

Title

of Each Class

of Securities to be

Registered

|

|

Amount

to be

Registered(1)

|

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

|

Proposed

Maximum

Aggregate Offering

Price

|

|

|

Amount

of

Registration Fee

|

|

|

Common

stock to be offered for resale by selling stockholders

|

|

|

34,090,909

|

|

|

$

|

0.22

|

(2)

|

|

$

|

$7,499,999,98

|

|

|

$

|

973.50

|

(3)

|

|

|

|

|

|

|

|

(1)

|

Consists of up to

34,090,909 shares of common stock to be sold to White Lion Capital, LLC under the investment agreement dated October 11,

2019.

|

|

|

|

|

(2)

|

Estimated solely

for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act

of 1933.

|

|

|

|

|

(3)

|

Based on the closing

price per share of $0.22 for American Cannabis Company, Inc.’s common stock on October 22, 2019 as reported by the OTC

Markets Group.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

|

The

information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until

the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is

not permitted.

|

Subject to Completion, Dated October 31, 2019

Preliminary Prospectus

American Cannabis Company, Inc.

34,090,909 Shares of Common Stock

This prospectus relates to the resale of 34,090,909 shares

of our common stock, par value $0.00001 per share, (the “Common Shares”), shares issuable to White Lion Capital, LLC

(defined below).

This prospectus relates to the resale of up to 34,090,909

shares of the Common Shares, issuable to White Lion Capital, LLC (“White Lion”), a selling stockholder pursuant to

a “Purchase Notice right” under an investment agreement (the “Investment Agreement”), dated October 11,

2019, that we entered into with White Lion. The Investment Agreement permits us to issue Purchase Notices to White Lion for

up to seven million, five hundred thousand dollars ($7,500,000) in shares of our common stock over a period of up to thirty-six

(36) months or until $7,500,000 of such shares have been subject of a Purchase Notice.

The selling stockholders may sell all or a portion of

the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying

prices or at negotiated prices.

White Lion Capital, LLC is an underwriter within the meaning

of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such

broker-dealers or agents, and any profit on the resale of the shares purchased by them, may be deemed to be underwriting commissions

or discounts under the Securities Act of 1933.

Our common stock is quoted by the OTC Markets Group OTCQB

tier under the symbol “AMMJ”. On October 22, 2019, the closing price of our common stock was $0.22 per share.

We will not receive any proceeds from the sale of shares

of our common stock by the selling stockholder. However, we will receive proceeds from the sale of shares of our common stock

pursuant to our exercise of the Purchase Notice right offered by White Lion Capital, LLC. We will pay for expenses of this offering,

except that the selling stockholder will pay any broker discounts or commissions or equivalent expenses and expenses of its legal

counsel applicable to the sale of its shares.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK

FACTORS” CONTAINED ON PAGE 5 HEREIN

AND IN OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2018, AS WELL AS OUR SUBSEQUENTLY FILED PERIODIC AND

CURRENT REPORTS, WHICH WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION AND ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

YOU SHOULD READ THE ENTIRE PROSPECTUS CAREFULLY BEFORE YOU MAKE YOUR INVESTMENT DECISION.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR

ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS

PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

,

The date of this prospectus is October 31, 2019

Table of

Contents

|

|

|

Page

Number

|

|

About This

Prospectus

|

|

1

|

|

Prospectus Summary

|

|

1

|

|

Risk Factors

|

|

5

|

|

Risks

Related to Our Business

|

|

5

|

|

Risks

Related to Our Company

|

|

5

|

|

Risks

Related to Our Common Stock

|

|

12

|

|

Forward-Looking Statements

|

|

15

|

|

Use of Proceeds

|

|

16

|

|

Dilution

|

|

16

|

|

The Offering

|

|

17

|

|

Selling Stockholders

|

|

18

|

|

Plan of Distribution

|

|

20

|

|

Description of Securities

|

|

22

|

|

Experts and Counsel

|

|

22

|

|

Interest of Named Experts and

Counsel

|

|

23

|

|

Information With Respect to

Our Company

|

|

23

|

|

Description of Business

|

|

23

|

|

Description of Property

|

|

28

|

|

Legal Proceedings

|

|

29

|

|

Market Price of and Dividends

on Our Common Equity and Related Stockholder Matters

|

|

29

|

|

Financial Statements

|

|

32

|

|

Management’s Discussion

and Analysis of Financial Condition and Results of Operations

|

|

67

|

|

Changes in and Disagreements

with Accountants on Accounting and Financial Disclosure

|

|

74

|

|

Directors and Executive Officers

|

|

74

|

|

Executive Compensation

|

|

78

|

|

Security Ownership of Certain

Beneficial Owners and Management

|

|

80

|

|

Transactions with Related Persons,

Promoters and Certain Control Persons and Corporate Governance

|

|

82

|

|

Where You Can Find More Information

|

|

82

|

ABOUT THIS PROSPECTUS

You should rely only on the information that we have provided

in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different information.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus

and any applicable prospectus supplement. You must not rely on any unauthorized information or representation. This prospectus

is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to

do so. You should assume that the information in this prospectus, and any applicable prospectus supplement, is accurate only as

of the date on the front of the document, regardless of the time of delivery of this prospectus, any applicable prospectus supplement,

or any sale of a security. Our business, financial conditions, results of operations and prospects may have changed since that

date.

References to “Management” in this Prospectus

mean the senior officers of the Company; See “Directors and Executive Officers.” Any statements in this Prospectus

made by or on behalf of Management are made in such persons’ capacities as officers of the Company, and not in their personal

capacities.

As used in this prospectus, the terms “we”,

“us”, the “Company”, “American Cannabis”, and our subsidiary “Hollister & Blacksmith,

Inc.” mean American Cannabis Company, Inc., unless otherwise indicated. All dollar amounts refer to U.S. dollars unless

otherwise indicated.

CAUTIONARY NOTE TO INVESTORS

This Prospectus qualifies the distribution of securities

of an entity that derives substantially all of its revenues from the cannabis industry in certain of the states in the United

States. Cannabis is classified as an illegal Schedule 1 drug and illegal under the Controlled Substances Act, 21 U.S.C. §

811 (hereafter referred to as the “CSA”). On December 20, 2018, President Donald J. Trump signed into law the Agriculture

Improvement Act of 2018, otherwise known as the “Farm Bill.” Prior to its passage, hemp, a member of the cannabis

family, was classified as a Schedule 1 controlled substance, and also illegal under the CSA.

With the passage of the Farm Bill, hemp cultivation is

broadly permitted. The Farm Bill explicitly allows the transfer of hemp-derived products across state lines for commercial or

other purposes. It also puts no restrictions on the sale, transport, or possession of hemp-derived products, so long as those

items are produced in a manner consistent with the law. Despite the passage of the Farm Bill, certain aspects of the cannabis

industry, particularly those not defined as hemp within the Farm Bill, remain illegal under U.S. federal Law. At this time, we

are not engaged in businesses that fall outside of what is permissible under the Farm Bill.

In the future, we could become involved in business activities

that would fall outside of the Farm Bill, such as the research and development, growth, cultivation and/or processing of cannabis

that are not covered under the Farm Bill. Currently, 33 states plus the District of Columbia and Guam, have laws and/or regulations

that recognize, in one form or another, legitimate medical and adult uses for cannabis and consumer use of cannabis in connection

with medical treatment or for recreational use. Many other states are considering similar legislation. Conversely, under the CSA,

the policies and regulations of the federal government and its agencies are that cannabis has no medical benefit and a range of

activities including cultivation and the personal use of cannabis is prohibited. Unless and until Congress amends the CSA with

respect to cannabis, as to the timing or scope of any such potential amendments there can be no assurance, there is a risk that

federal authorities may enforce current federal law, and we may be deemed to be producing, cultivating, dispensing and/or aiding

or abetting the possession and distribution of cannabis in violation of federal law. Active enforcement of the current CSA on

cannabis may thus directly and adversely affect our revenues and profits. The risk of strict enforcement of the CSA in light of

Congressional activity, judicial holdings, and stated federal policy remains uncertain; See sections entitled “Risk Factors”

and “Government Regulation of Cannabis.”

PROSPECTUS SUMMARY

The following summary highlights material information

contained in this Prospectus. This summary does not contain all of the information you should consider before investing in the

securities. Before making an investment decision, you should read the entire Prospectus carefully, including the risk factors

section, the financial statements and the notes to the financial statements. You should also review the other available information

referred to in the section entitled “Where You Can Find More Information” in this Prospectus and any amendment or

supplement hereto.

The Offering

This prospectus relates to the resale of 34,090,909

shares of our common stock, par value $0.00001 per share, issuable to White Lion Capital, LLC (defined below).

This prospectus relates to the resale of up to 34,090,909

shares of the Common Shares, issuable to White Lion Capital, LLC (“White Lion”), a selling stockholder pursuant to

a Purchase Notice right under an investment agreement (the “Investment Agreement”), dated October 11, 2019, that

we entered into with White Lion. The Investment Agreement permits us to elect to issue Purchase Notices to White Lion for the

sale of up to seven million, five hundred thousand dollars ($7,500,000) in shares of our common stock over a period of up to thirty-six

(36) months or until $7,500,000 of such shares have been sold.

Our Business

American Cannabis Company, Inc. and subsidiary company,

Hollister & Blacksmith, Inc., doing business as American Cannabis Consulting (“American Cannabis Consulting”),

(collectively “the “Company”, “we”, “us”, or “our”) are based in Denver,

Colorado and operate a fully-integrated business model that features end-to-end solutions for businesses operating in the regulated

cannabis industry in states and countries where cannabis is regulated and/or has been de-criminalized for medical use and/or legalized

for recreational use. We provide advisory and consulting services specific to this industry, design industry-specific products

and facilities, manage a strategic group partnership that offers both exclusive and non-exclusive customer products commonly used

in the industry. We do not directly sell, cultivate, manufacture, or transact cannabis. However,

we may choose to take advantage of Colorado Bill HB-19-1090, which was recently passed into Colorado law, effective November 1,

2019. This law allows publicly traded corporations to apply for and qualify for the ownership of Colorado cannabis licenses.

We recently began a new business consulting division called

“American Hemp Services,” which offers hemp producers with consulting and professional services including business

plan creation, greenhouse and farm design, license acquisition, seed sales, hemp processing, operational deployment, and crop

improvement. Furthermore, the Company seeks to partner with accredited universities nationwide to further the advancement of hemp

related research.

We are a publicly listed company quoted on the OTCQB under

the symbol “AMMJ”.

We were incorporated in the State of Delaware on September

24, 2001 under the name Naturewell, Inc. to develop and market clinical diagnostic products using immunology and molecular biologic

technologies.

On March 13, 2013, Naturewell, Inc. completed a merger

transaction whereby it acquired 100% of the issued and outstanding share capital of Brazil Interactive Media, Inc. (“BIMI”),

which operated as a Brazilian interactive television company and television production company through its wholly owned Brazilian

subsidiary company, EsoTV Brasil Promoção Publicidade Licenciamento e Comércio Ltda. (“EsoTV”).

Naturewell’s Certificate of Incorporation were amended to reflect a new name: Brazil Interactive Media, Inc.

On May 15, 2014, BIMI entered into a merger agreement

(“the Merger Agreement”) to acquire 100% of the issued and outstanding American Cannabis Consulting while simultaneously

disposing of 100% of the issued share capital EsoTV (“the Separation Agreement”). Both the merger with American Cannabis

Consulting and disposal of EsoTV were completed on September 29, 2014. BIMI subsequently amended its Certificate of Incorporation

to change its name to American Cannabis Company, Inc. On October 10, 2014, American Cannabis Company, Inc. changed its stock symbol

from BIMI to AMMJ.

Immediately following the completion of the Merger Agreement,

former shareholders of American Cannabis Consulting owned 31,710,628 shares of American Cannabis Company, Inc.’s common

stock, representing 78.4% of American Cannabis Company, Inc.’s issued and outstanding share capital. Accordingly, American

Cannabis Consulting was deemed to have been the accounting acquirer in a Reverse Merger which resulted in a recapitalization of

the Company. Consequently, the Company’s consolidated financial statements reflect the results of American Cannabis

Consulting since Inception (March 5, 2013) and of American Cannabis Company, Inc. (formerly BIMI) since September 29, 2014.

Government Regulation of Cannabis

The United States federal government regulates drugs through

the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances, including cannabis, in a schedule. Cannabis

is classified as a Schedule I drug, which is viewed as highly addictive and having no medical value. The United States Federal

Drug Administration has not approved the sale of cannabis for any medical application.

Doctors may not prescribe cannabis for medical use under federal law; however, they can recommend its use under the First Amendment.

In 2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis will not be denied services

or other medications that are denied to those using illegal drugs.

As of October 31, 2019, 33 states, the District

of Columbia and Guam have laws legalized cannabis in some form for either medicinal or recreational use governed by state specific

laws and regulations.

These state laws are in conflict with the federal Controlled

Substances Act, which makes cannabis use and possession illegal on a national level. However, on August 29, 2013, the U.S. Department

of Justice issued a memorandum providing that where states and local governments enact laws authorizing cannabis-related use,

and implement strong and effective regulatory and enforcement systems, the federal government will rely upon states and local

enforcement agencies to address cannabis activity through the enforcement of their own state and local narcotics laws. The memorandum

further stated that the U.S Justice Department’s limited investigative and prosecutorial resources will be focused on eight

priorities to prevent unintended consequences of the state laws, including distribution of cannabis to minors, preventing the

distribution of cannabis from states where it is legal to states where it is not, and preventing money laundering, violence and

drugged driving.

On December 11, 2014, the U.S. Department of Justice issued

another memorandum with regard to its position and enforcement protocol with regard to Indian Country, stating that the eight

priorities in the previous federal memo would guide the United States Attorneys' cannabis enforcement efforts in Indian Country.

On December 16, 2014, as a component of the federal spending bill, the Obama administration enacted regulations that prohibits

the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

On January 4, 2018, Attorney General Jeff Sessions issued

a memorandum for all United States Attorneys concerning cannabis enforcement. Mr. Sessions rescinded all previous prosecutorial

guidance issued by the Department of Justice regarding cannabis , including the August 29, 2013 memorandum. Mr. Sessions stated

that U.S. Attorneys must decide whether or not to pursue prosecution of cannabis activity based upon factors including: the seriousness

of the crime, the deterrent effect of criminal prosecution, and the cumulative impact of particular crimes on the community. Mr.

Sessions reiterated that the cultivation, distribution and possession of cannabis continues to be a crime under the U.S. Controlled

Substances Act.

Government Regulation of Hemp

On December 20, 2018, President Donald J. Trump signed

into law the Agriculture Improvement Act of 2018, otherwise known as the “Farm Bill”. Prior to its passage, hemp,

a member of the cannabis family, was classified as a Schedule 1 controlled substance, and so illegal under the Controlled Substances

Act.

With the passage of the Farm Bill, hemp cultivation is

broadly permitted. The Farm Bill explicitly allows the transfer of hemp-derived products across state lines for commercial or

other purposes. It also puts no restrictions on the sale, transport, or possession of hemp-derived products, so long as those

items are produced in a manner consistent with the law.

Additionally, there will be significant, shared state-federal

regulatory power over hemp cultivation and production. Under Section 10113 of the Farm Bill, state departments of agriculture

must consult with the state’s governor and chief law enforcement officer to devise a plan that must be submitted to the

United States Department of Agriculture (“USDA”). A state’s plan to license and regulate hemp can only commence

once the USDA approves that state’s plan. In states opting not to devise a hemp regulatory program, USDA will construct

a regulatory program under which hemp cultivators in those states must apply for licenses and comply with a federally-run program.

This system of shared regulatory programming is similar to options states had in other policy areas such as health insurance marketplaces

under Affordable Care Act, or workplace safety plans under Occupational Health and Safety Act—both of which had federally-run

systems for states opting not to set up their own systems.

The Farm Bill outlines actions that are considered violations

of federal hemp law (including such activities as cultivating without a license or producing hemp with more than 0.3 percent THC,

the psychoactive agent in cannabis).

The 2018 Farm Bill extends the protections for hemp research

and the conditions under which such research can and should be conducted. Further, Section 7501 of the Farm Bill extends hemp

research by including hemp under the Critical Agricultural Materials Act. This provision recognizes the importance, diversity,

and opportunity of the plant and the products that can be derived from it, but also recognizes that there is a still a lot to

learn about hemp and its products from commercial and market perspectives.

Where You Can Find Us

The principal offices of our company are located at 5690 Logan St., Unit A,

Denver, CO 80216. Our telephone number is (303) 974-4770.

The Offering

|

Common Stock Offered by

the Selling Security Holders

|

|

34,090,909

shares of common stock that may be subject of a Purchase Notice to White Lion.

|

|

|

|

|

|

Common Stock Outstanding Before the Offering

|

|

52,978,605 shares

of common stock as of October 31, 2019.

|

|

|

|

|

|

Common Stock Outstanding After the Offering

|

|

87,069,514 shares

of common stock. (1)

|

|

|

|

|

|

Terms of the Offering

|

|

The selling security

holder will determine when and how they will sell the common stock offered in this prospectus.

|

|

|

|

|

|

Termination of the Offering

|

|

The offering will

conclude upon such time as all of the common stock has been sold pursuant to the registration statement.

|

|

Use of Proceeds

|

|

We are

not selling any shares of common stock in this offering and, as a result, will not receive any proceeds from this offering. See

“Use of Proceeds.”

|

|

|

|

|

|

Risk Factors

|

|

The common stock

offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire

investment. See “Risk Factors” beginning on page 5.

|

|

|

|

|

|

OTCQB Symbol

|

|

AMMJ

|

|

|

|

|

|

|

(1)

|

This total shows

how many shares of common stock will be outstanding assuming 34,090,909 shares of common stock are sold to White Lion.

|

Summary of Financial Data

The

following information represents selected audited financial information for our company for the years ended December 31, 2018

and 2017 and selected unaudited financial information for our company for the six month period ended June 30, 2019. The

summarized financial information presented below is derived from and should be read in conjunction with our audited and

unaudited financial statements, as applicable, including the notes to those financial statements which are included elsewhere

in this prospectus along with the section entitled Management’s Discussion and Analysis of Financial Condition and

Results of Operations beginning on page 67 of

this prospectus.

|

Statements

of Operations Data

|

|

Six

Month Period Ended June 30, 2019

|

|

|

Six

Month Period Ended June 30, 2018

|

|

|

Year

Ended December 31, 2018

|

|

|

Year

Ended December 31, 2017

|

|

|

Revenue

|

|

$

|

1,141,281

|

|

|

$

|

454,205

|

|

|

$

|

982,349

|

|

|

$

|

2,443,055

|

|

|

Cost of Revenue

|

|

$

|

456,414

|

|

|

$

|

222,611

|

|

|

$

|

523,847

|

|

|

$

|

805,820

|

|

|

Net Operating Expenses

|

|

$

|

636,130

|

|

|

$

|

569,532

|

|

|

$

|

1,183,109

|

|

|

$

|

1,358,388

|

|

|

Net Income (Loss)

|

|

$

|

(21,264)

|

|

|

$

|

(375,942)

|

|

|

$

|

(950,691)

|

|

|

$

|

(1,488,474

|

)

|

|

Basic and Diluted Net Income (Loss) per Share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.01)

|

|

|

$

|

(0.02)

|

|

|

$

|

(0.03

|

)

|

|

Balance

Sheets Data

|

|

As

of June 30, 2019

|

|

|

As

of June 30, 2018

|

|

|

As

of December 31, 2018

|

|

|

Cash and Cash Equivalents

|

|

$

|

918,127

|

|

|

$

|

1,299,452

|

|

|

$

|

1,086,565

|

|

|

Total Current Assets

|

|

$

|

1,261,280

|

|

|

$

|

1,522,015

|

|

|

$

|

1,267,331

|

|

|

Total Current Liabilities

|

|

$

|

242,925

|

|

|

$

|

195,400

|

|

|

$

|

270,048

|

|

|

Working Capital (deficit)

|

|

$

|

1,018,355

|

|

|

$

|

1,326,615

|

|

|

$

|

997,283

|

|

|

Total Stockholders’ Equity

|

|

$

|

1,027,801

|

|

|

$

|

1,326,615

|

|

|

$

|

1,005,321

|

|

|

Accumulated Deficit

|

|

$

|

(7,195,377

|

)

|

|

$

|

(6,599,364

|

)

|

|

$

|

(7,174,113

|

)

|

RICK FACTORS

An investment in our common stock involves a number of

very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in

this prospectus in evaluating our company and our business before purchasing our securities. Our business, operating results and

financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all

or part of your investment due to any of these risks. You should invest in our common stock only if you can afford to lose your

entire investment.

There could be unidentified risks involved with

an investment in our securities.

The following risk factors are not a complete list or

explanation of the risks involved with an investment in the securities. Additional risks will likely be experienced that are not

presently foreseen by the Company. Prospective investors must not construe the information provided herein as constituting investment,

legal, tax or other professional advice. Before making any decision to invest in our securities, you should read this entire prospectus

and consult with your own investment, legal, tax and other professional advisors. An investment in our securities is suitable

only for investors who can assume the financial risks of an investment in the Company for an indefinite period of time and who

can afford to lose their entire investment. The Company makes no representations or warranties of any kind with respect to the

likelihood our business will succeed, or regarding the value of our securities, any financial returns that may be generated or

any tax benefits or consequences that may result from an investment in the Company.

Risks Related to Our Business

Cannabis remains illegal under federal law.

Cannabis is a Schedule I controlled

substance and is illegal under the CSA. Even in states that have legalized the use of cannabis, its sale and use remain violations

of federal law. The illegality of cannabis under federal law preempts state laws that legalize its use. Therefore, strict enforcement

of federal law regarding cannabis would likely result in our inability to proceed with our business plan.

Our business is dependent on laws pertaining to

the cannabis industry.

The United States federal government regulates drugs through

the CSA, which places controlled substances, including cannabis, in a schedule. Cannabis is classified as an illegal Schedule

I drug, which is viewed as highly addictive and having no medical value. The United States Federal Drug Administration has not

approved the sale of cannabis for any medical application. Doctors may not prescribe cannabis for medical use under federal law;

however, doctors can recommend its use under the First Amendment. In 2010,

the United States Veterans Affairs Department clarified that veterans using medicinal cannabis will not be denied services or

other medications that are denied to those using illegal drugs.

As of October 31, 2019, 33 states, the District

of Columbia and Guam allow their citizens to use cannabis for medicinal and/or recreational purposes through de-criminalization.

These noted state laws conflict with the CSA, which makes

cannabis use and possession illegal on a national level. However, on August 29, 2013, the U.S. Department of Justice issued a

memorandum providing that where states and local governments enact laws authorizing cannabis-related use, and implement strong

and effective regulatory and enforcement systems, the federal government will rely upon states and local enforcement agencies

to address cannabis activity through the enforcement of their own state and local narcotics laws. The memorandum further stated

that the U.S Justice Department’s limited investigative and prosecutorial resources will be focused on eight priorities

to prevent unintended consequences of the state laws, including distribution of cannabis to minors, preventing the distribution

of cannabis from states where it is legal to states where it is not, and preventing money laundering, violence and drugged driving.

On December 11, 2014, the U.S. Department of Justice issued

another memorandum with regard to its position and enforcement protocol with regard to Indian Country, stating that the eight

priorities in the August 29, 2013 federal memo would guide the United States Attorneys' cannabis enforcement efforts in Indian

Country. On December 16, 2014, as a component of the federal spending bill, the Obama administration enacted regulations that

prohibit the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

On January 4, 2018, Attorney General Jeff Sessions issued

a memorandum for all United States Attorneys concerning cannabis enforcement. Mr. Sessions rescinded all previous prosecutorial

guidance issued by the Department of Justice regarding cannabis , including the August 29, 2013 memorandum. Mr. Sessions stated

that U.S. Attorneys must decide whether or not to pursue prosecution of cannabis activity based upon factors including: the seriousness

of the crime, the deterrent effect of criminal prosecution, and the cumulative impact of particular crimes on the community. Mr.

Sessions reiterated that the cultivation, distribution and possession of cannabis continues to be a crime under the U.S. Controlled

Substances Act.

The Farm Bill recently passed, and undeveloped shared

state-federal regulations over hemp cultivation and production may impact our business.

The Farm Bill was signed into law on December 20, 2018.

Under Section 10113 of the Farm Bill, state departments of agriculture must consult with the state’s governor and chief

law enforcement officer to devise a plan that must be submitted to the United States Department of Agriculture (“USDA”).

A state’s plan to license and regulate hemp can only commence once the USDA approves that state’s plan. In states

opting not to devise a hemp regulatory program, USDA will construct a regulatory program under which hemp cultivators in those

states must apply for licenses in order to comply with the USDA-run program. The details and scopes of each state’s plans

are not known at this time and may contain varying regulations that may impact our business. Even if a state creates a plan in

conjunction with its governor and chief law enforcement officer, the USDA must approve it. There can be no guarantee that any

state plan will be approved. Review times may be extensive. There may be amendments and the ultimate plans, if approved by states

and the USDA, may materially limit our business depending upon the scope of the regulations.

Laws and regulations affecting our industry to be

developed under the Farm Bill are in development.

As a result of the Farm Bill’s recent passage, there

will be a constant evolution of laws and regulations affecting the hemp industry could detrimentally affect our operations. Local,

state and federal hemp laws and regulations may be broad in scope and subject to changing interpretations. These changes may require

us to incur substantial costs associated with legal and compliance fees and ultimately require us to alter our business plan.

Furthermore, violations of these laws, or alleged violations, could disrupt our business and result in a material adverse effect

on our operations. In addition, we cannot predict the nature of any future laws, regulations, interpretations or applications,

and it is possible that regulations may be enacted in the future that will be directly applicable to our business.

Laws and regulations affecting our industry

are constantly changing.

The constant evolution of laws

and regulations affecting the cannabis and hemp industries could detrimentally affect our operations. Local, state and federal

cannabis and hemp laws and regulations are respectively broad in scope and subject to changing interpretations. These changes

may require us to incur substantial costs associated with legal and compliance fees and ultimately require us to alter our business

plan. Furthermore, violations of these laws, or alleged violations, could disrupt our business and result in a material adverse

effect on our operations. In addition, we cannot predict the nature of any future laws, regulations, interpretations or applications,

and it is possible that regulations may be enacted in the future that will be directly applicable to our business.

Risk of government action.

While we will use our best efforts to comply with all

laws, including federal, state and local laws and regulations, there is a possibility that governmental action to enforce any

alleged violations may result in legal fees and damage awards that would adversely affect us.

Because our business is dependent upon continued

market acceptance by consumers, any negative trends will adversely affect our business operations.

We are substantially dependent on continued market acceptance

and proliferation of consumers of cannabis used for medicinal and recreational uses. We believe that as cannabis becomes more

accepted the stigma associated with cannabis use will diminish and as a result consumer demand will continue to grow. While we

believe that the market and opportunity in the cannabis space continues to grow, we cannot predict the future growth rate and

size of the market. Any negative outlook on the cannabis industry will adversely affect our business operations.

In addition, it is believed by many that large well-funded

businesses may have a strong economic opposition to the cannabis industry. We believe that the pharmaceutical industry clearly

does not want to cede control of any product that could generate significant revenue. For example, medical cannabis will likely

adversely impact the existing market for the current “marijuana pill” Marinol, sold by the mainstream pharmaceutical

industry, should cannabis displace other drugs or encroach upon the pharmaceutical industry's products. The pharmaceutical industry

is well funded with a strong and experienced lobby that eclipses the funding of the medical cannabis movement. Any inroads the

pharmaceutical could make in halting the impending cannabis industry could have a detrimental impact on our business.

FDA Regulation of cannabis and the possible registration

of facilities where medical cannabis is grown could negatively affect the cannabis industry which would directly affect our financial

condition.

Should the federal government legalize cannabis for medical

use, it is possible that the U.S. Food and Drug Administration ("FDA") would seek to regulate it under the Food, Drug

and Cosmetics Act of 1938. Additionally, the FDA may issue rules and regulations including cGMPs (certified good manufacturing

practices) related to the growth, cultivation, harvesting and processing of medical cannabis. Clinical trials may be needed to

verify efficacy and safety. It is also possible that the FDA would require that facilities where medical cannabis is grown be

registered with the FDA and comply with certain federally prescribed regulations. In the event that some or all of these regulations

are imposed, we do not know what the impact would be on the cannabis industry and what costs, requirements and possible prohibitions

may be enforced. If we are unable to comply with the regulations and/or registration as prescribed by the FDA, we may be unable

to continue to operate our business.

Our clients may have difficulty accessing the service

of banks.

On February 14, 2014, the U.S. government issued rules

allowing banks to legally provide financial services to state-licensed cannabis businesses. A memorandum issued by the Justice

Department to federal prosecutors re-iterated guidance previously given, this time to the financial industry that banks can do

business with legal cannabis businesses and "may not" be prosecuted. The Treasury Department's Financial Crimes Enforcement

Network (FinCEN) issued guidelines to banks that "it is possible to provide financial services"" to state-licensed

cannabis businesses and still be in compliance with federal anti-money laundering laws. The guidance falls short of the explicit

legal authorization that banking industry officials had pushed the government to provide and to date, it is not clear if any banks

have relied on the guidance and taken on legal cannabis companies as clients. The aforementioned policy may be administration dependent, and a change in presidential

administrations may cause a policy reversal and retraction of current policies, wherein legal cannabis businesses may not have

access to the banking industry. Also, the inability of potential clients in our target markets to open accounts and otherwise

use the service of banks may make it difficult for them to contract with us.

Due to our involvement in the cannabis industry,

we may have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to

additional risk and financial liability.

Insurance that is otherwise readily available, such as

general liability, and directors and officer’s insurance, is more difficult for us to find, and more expensive, because

we are service providers to companies in the cannabis industry. There are no guarantees that we will be able to find such insurances

in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, it may prevent us from

entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

The Company’s industry is highly competitive

and we have less capital and resources than many of our competitors which may give them and advantage in developing and marketing

products similar to ours or make our products obsolete.

We are involved in a highly competitive

industry where we may compete with numerous other companies who offer alternative methods or approaches, who may have far greater

resources, more experience, and personnel perhaps more qualified than we do. Such resources may give our competitors an advantage

in developing and marketing products similar to ours or products that make our products obsolete. There can be no assurance that

we will be able to successfully compete against these other entities.

There could be unidentified

risks involved with an investment in our securities.

The foregoing risk factors are not a complete list or

explanation of the risks involved with an investment in our securities. Additional risks will likely be experienced that are not

presently foreseen by the Company. Prospective investors must not construe this the information provided herein as constituting

investment, legal, tax or other professional advice. Before making any decision to invest in our securities, you should read this

entire prospectus and consult with your own investment, legal, tax and other professional advisors. An investment in our securities

is suitable only for investors who can assume the financial risks of an investment in the Company for an indefinite period of

time and who can afford to lose their entire investment. The Company makes no representations or warranties of any kind with respect

to the likelihood of the success or the business of the Company, the value of our securities, any financial returns that may be

generated or any tax benefits or consequences that may result from an investment in the Company.

The Company may be unable to respond to the rapid

technological change in its industry and such change may increase costs and competition that may adversely affect its business.

Rapidly changing technologies, frequent

new product and service introductions and evolving industry standards characterize

the Company’s market. The continued

growth of the Internet and intense competition in the Company’s

industry exacerbate these market characteristics. The Company’s future

success will depend on its ability to adapt to rapidly changing technologies

by continually improving the performance features and reliability of its products

and services. The Company may experience difficulties that could delay or prevent

the successful development, introduction or marketing of its products and

services. In addition, any new enhancements must meet the requirements of

its current and prospective users and must

achieve significant market acceptance. The Company could

also incur substantial costs if it needs

to modify its products and services

or infrastructures to adapt to these

changes.

The Company also expects that new competitors may introduce

products, systems or services that are

directly or indirectly competitive with the Company.

These competitors may succeed in developing, products, systems

and services that have greater

functionality or are less costly than the Company’s products, systems and services,

and may be more successful in marketing

such products, systems and services. Technological changes

have lowered the cost of operating communications and computer systems

and purchasing software. These changes reduce the Company’s

cost of providing services but also facilitate

increased competition by reducing competitors’ costs in providing similar

services. This competition could increase

price competition and reduce anticipated

profit margins.

The Company’s industry

is highly competitive and we have less capital and resources than many of our competitors, which may give them an advantage in

developing and marketing products similar to ours or make our products obsolete.

We are involved in a highly competitive

industry where we may compete with numerous other companies who offer alternative methods or approaches, who may have far greater

resources, more experience, and personnel perhaps more qualified than we do. Such resources may give our competitors an advantage

in developing and marketing products similar to ours or products that make our products obsolete. There can be no assurance that

we will be able to successfully compete against these other entities.

The Company’s services

are new and its industry is evolving.

You should

consider the Company’s prospects in light of the risks, uncertainties and

difficulties frequently encountered by companies in

their early stage of

development, particularly companies in the rapidly evolving legal cannabis

industry. To be successful

in this industry, the Company

must, among other things:

|

|

●

|

develop

and introduce functional and attractive

service offerings;

|

|

|

●

|

attract

and maintain a large base of clients;

|

|

|

●

|

increase

awareness of the Company brand and

develop consumer loyalty;

|

|

|

●

|

establish

and maintain strategic relationships with

distribution partners and service providers;

|

|

|

●

|

respond

to competitive

and technological developments;

|

|

|

●

|

build

an operations structure

to support the Company business;

and

|

|

|

●

|

attract,

retain and motivate qualified personnel.

|

The Company cannot guarantee that

it will succeed in achieving these goals,

and its failure to do so would have

a material adverse effect on its business,

prospects, financial condition and

operating results.

Some of the Company’s

products and services are new and are only in early stages

of commercialization, such as its hemp consulting services division. The Company is

not certain that its products and

services will function as anticipated

or be desirable to its intended market. Also, some of

the Company’s products and services may have

limited functionalities, which may limit

their appeal to consumers and put the

Company at a competitive disadvantage. If the Company’s

current or future products and

services fail to function properly or if the Company does not

achieve or sustain market acceptance, it could

lose customers or could be subject to claims which could have a material

adverse effect on the Company business,

financial condition and operating results.

As is typical in

a new and rapidly evolving industry,

demand and market acceptance for

recently introduced products and services

are subject to a high level of uncertainty

and risk. Because the market for the

Company is new and evolving, it is

difficult to predict with any certainty the

size of this market and its growth

rate, if any. The Company cannot guarantee

that a market for the Company will

develop or that demand for Company services will

emerge or be sustainable. If the market

fails to develop, develops more slowly than expected or becomes

saturated with competitors, the Company’s business, financial condition

and operating results would be materially

adversely affected.

Our Business Can be Affected by Unusual Weather

Patterns

Hemp cultivation can be impacted by weather patterns and

these unpredictable weather patterns may impact our ability to consult, and our client’s corresponding ability to grow,

cultivate and harvest hemp. In addition, severe weather, including drought and hail, can destroy a hemp crop, which would have

a material impact on our hemp consulting division.

Our business and financial performance may be adversely

affected by downturns in the target markets that we serve or reduced demand for the types of products we sell.

Demand for the products we sell is often affected by general

economic conditions as well as product-use trends in our target markets. These changes may result in decreased demand for our

products. The occurrence of these conditions is beyond our ability to control and, when they occur, they may have a significant

impact on our sales and results of operations. The inability or unwillingness of our customers to pay a premium for our products

due to general economic conditions or a downturn in the economy may have a significant adverse impact on our sales and results

of operations.

The Company’s failure to continue to attract,

train, or retain highly qualified personnel could harm the Company’s business.

The Company’s

success also depends on the Company’s ability to attract, train, and

retain qualified personnel, specifically those with management and product development

skills. In particular, the Company must

hire additional skilled personnel to further

the Company’s research and development efforts. Competition for

such personnel is intense. If the Company does not

succeed in attracting new personnel or retaining and motivating the Company’s

current personnel, the Company’s

business could be harmed.

Risks Related to the Company

Uncertainty of profitability.

Our business strategy may result in increased volatility

of revenues and earnings. As we will only develop a limited number of products and services at a time, our overall success will

depend on a limited number of products and services, which may cause variability and unsteady profits and losses depending on

the products and services offered.

Our revenues and our profitability may be adversely affected

by economic conditions and changes in the market for medical and recreational marijuana. Our business is also subject to general

economic risks that could adversely impact the results of operations and financial condition.

Because of the anticipated nature of the products and

services that we will attempt to develop, it is difficult to accurately forecast revenues and operating results and these items

could fluctuate in the future due to a number of factors. These factors may include, among other things, the following:

|

|

|

|

·

|

Our ability to raise

sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses.

|

|

·

|

Our ability to source

strong opportunities with sufficient risk adjusted returns.

|

|

·

|

Our ability to manage

our capital and liquidity requirements based on changing market conditions generally and changes in the developing legal medical

cannabis and recreational cannabis industries.

|

|

·

|

The acceptance of

the terms and conditions of our licenses and/or the acceptance of our royalties and fees.

|

|

·

|

The amount and timing

of operating and other costs and expenses.

|

|

·

|

The nature and extent

of competition from other companies that may reduce market share and create pressure on pricing and investment return expectations.

|

|

·

|

Adverse changes

in the national and regional economies in which we will participate, including, but not limited to, changes in our performance,

capital availability, and market demand.

|

|

·

|

Adverse changes

in the projects in which we plan to invest which result from factors beyond our control, including, but not limited to, a

change in circumstances, capacity and economic impacts.

|

|

·

|

Adverse developments

in the efforts to legalize cannabis or increased federal enforcement.

|

|

·

|

Changes in laws,

regulations, accounting, taxation, and other requirements affecting our operations and business.

|

|

·

|

Our operating results

may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations may be

significant.

|

Management of growth will be necessary for us to

be competitive.

Successful expansion of our business will depend on our

ability to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically, we will need

to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic environment.

Expansion has the potential to place significant strains on financial, management, and operational resources, yet failure to expand

will inhibit our profitability goals.

We are entering a potentially highly competitive

market.

The markets for ancillary businesses in the medical cannabis

and recreational cannabis industries are competitive and evolving. In particular, we face strong competition from larger companies

that may be in the process of offering similar products and services to ours. Many of our current and potential competitors have

longer operating histories, significantly greater financial, marketing and other resources and larger client bases than we have

(or may be expected to have).

Given the rapid changes affecting the global, national,

and regional economies generally and the medical cannabis and recreational cannabis industries, in particular, we may not be able

to create and maintain a competitive advantage in the marketplace. Our success will depend on our ability to keep pace with any

changes in its markets, especially with legal and regulatory changes. Our success will depend on our ability to respond to, among

other things, changes in the economy, market conditions, and competitive pressures. Any failure by us to anticipate or respond

adequately to such changes could have a material adverse effect on our financial condition, operating results, liquidity, cash

flow and our operational performance.

If we

fail to protect our intellectual property, our business could be adversely affected.

Our viability will depend, in

part, on our ability to develop and maintain the proprietary aspects of our technology and brands to distinguish our products

and services from our competitors' products and services. We rely on patents, copyrights, trademarks, trade secrets, and confidentiality

provisions to establish and protect our intellectual property.

Any infringement or misappropriation

of our intellectual property could damage its value and limit our ability to compete. We may have to engage in litigation to protect

the rights to our intellectual property, which could result in significant litigation costs and require a significant amount of

our time. In addition, our ability to enforce and protect our intellectual property rights may be limited in certain countries

outside the U.S., which could make it easier for competitors to capture market position in such countries by utilizing technologies

that are similar to those developed or licensed by us.

Competitors may also harm our

sales by designing products that mirror the capabilities of our products or technology without infringing on our intellectual

property rights. If we do not obtain sufficient protection for our intellectual property, or if we are unable to effectively enforce

our intellectual property rights, our competitiveness could be impaired, which would limit our growth and future revenue.

We may also find it necessary

to bring infringement or other actions against third parties to seek to protect our intellectual property rights. Litigation of

this nature, even if successful, is often expensive and time-consuming to prosecute and there can be no assurance that we will

have the financial or other resources to enforce our rights or be able to enforce our rights or prevent other parties from developing

similar technology or designing around our intellectual property.

Our trade secrets may be

difficult to protect.

Our success depends upon

the skills, knowledge and experience of our scientific and technical personnel, our consultants and advisors, as well as our

licensors and contractors. Because we operate in a highly competitive industry, we rely in part on trade secrets to protect

our proprietary technology and processes. However, trade secrets are difficult to protect. We enter into confidentiality or

non-disclosure agreements with our corporate partners, employees, consultants, outside scientific collaborators, developers

and other advisors. These agreements generally require that the receiving party keep confidential and not disclose to third

parties confidential information developed by the receiving party or made known to the receiving party by us during the

course of the receiving party's relationship with us. These agreements also generally provide that inventions

conceived by the receiving party in the course of rendering services to us will be our exclusive property, and we enter into assignment

agreements to perfect our rights.

These confidentiality, inventions

and assignment agreements may be breached and may not effectively assign intellectual property rights to us. Our trade secrets

also could be independently discovered by competitors, in which case we would not be able to prevent the use of such trade secrets

by our competitors. The enforcement of a claim alleging that a party illegally obtained and was using our trade secrets could

be difficult, expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the U.S. may be

less willing to protect trade secrets. The failure to obtain or maintain meaningful trade secret protection could adversely affect

our competitive position.

Our lack of patent and/or copyright protection and

any unauthorized use of our proprietary information and technology may affect our business.

We currently rely on a combination of protections by contracts,

including confidentiality and nondisclosure agreements, and common law rights, such as trade secrets, to protect our intellectual

property. However, we cannot assure you that we will be able to adequately protect our technology or other intellectual property

from misappropriation in the U.S. and abroad. This risk may be increased due to the lack of any patent and/or copyright protection.

Any patent issued to us could be challenged, invalidated or circumvented or rights granted thereunder may not provide a competitive

advantage to us. Furthermore, patent applications that we file may not result in issuance of a patent, or, if a patent is issued,

the patent may not be issued in a form that is advantageous to us. Despite our efforts to protect our intellectual property rights,

others may independently develop similar products, duplicate our products or design around our patents and other rights. In addition,

it is difficult to monitor compliance with, and enforce, our intellectual property rights on a worldwide basis in a cost-effective

manner. In jurisdictions where foreign laws provide less intellectual property protection than afforded in the U.S., our technology

or other intellectual property may be compromised, and our business could be materially adversely affected. If any of our proprietary

rights are misappropriated or we are forced to defend our intellectual property rights, we will have to incur substantial costs.

Such litigation could result in substantial costs and diversion of our resources, including diverting the time and effort of our

senior management, and could disrupt our business, as well as have a material adverse effect on our business, prospects, financial

condition and results of operations. We can provide no assurance that we will have the financial resources to oppose any actual

or threatened infringement by any third party. Furthermore, any patent or copyrights that we may be granted may be held by a court

to infringe on the intellectual property rights of others and subject us to the payment of damage awards.

Risks Related to Our Common Stock

Because we will likely issue additional shares of

our common stock, investment in our company could be subject to substantial dilution.

Investors’ interests in our Company will be diluted

and investors may suffer dilution in their net book value per share when we issue additional shares. We are authorized to issue

100,000,000 shares of common stock, $0.00001 par value per share. As of October 31, 2019, there were 52,978,605 shares of

our common stock issued and outstanding. We anticipate that all or at least some of our future funding, if any, will be in the

form of equity financing from the sale of our common stock. If we do sell more common stock, investors’ investment in our

company will likely be diluted. Dilution is the difference between what you pay for your stock and the net tangible book value

per share immediately after the additional shares are sold by us. If dilution occurs, any investment in our company’s common

stock could seriously decline in value.

The sale of our stock could encourage short sales

by third parties, which could contribute to the future decline of our stock price.

In many circumstances, the provision of financing based

on the distribution of equity for companies that are traded on the OTCQB has the potential to cause a significant downward pressure

on the price of common stock. This is especially the case if the shares being placed into the market exceed the market’s

ability to take up the increased stock or if we have not performed in such a manner to show that the equity funds raised will

be used to grow our business. Such an event could place further downward pressure on the price of our common stock. Regardless

of our activities, the opportunity exists for short sellers and others to

contribute to the future decline of our stock price. If there are significant short sales of our common stock, the price decline

that would result from this activity will cause the share price to decline more, which may cause other stockholders of the stock

to sell their shares, thereby contributing to sales of common stock in the market. If there are many more shares of our common

stock on the market for sale than the market will absorb, the price of our common shares will likely decline.

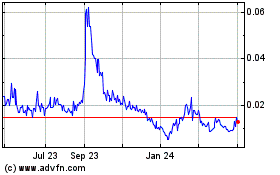

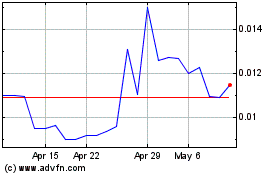

Trading in our common stock on the OTCQB has been

subject to wide fluctuations.

Our common stock is currently quoted for public trading

on the OTCQB. The trading price of our common stock has been subject to wide fluctuations. Trading prices of our common stock

may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced

extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies

with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced

by our common stock will be matched or maintained. These broad market and industry factors may adversely affect the market price

of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market price

of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted,

could result in substantial costs for us and a diversion of management’s attention and resources.

Our Certificate of Incorporation and by-laws provides

for indemnification of officers and directors at our expense and limit their liability which may result in a major cost to us

and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our Certificate of Incorporation and By-Laws include provisions

that eliminate the personal liability of our directors for monetary damages to the fullest extent possible under the laws of the

State of Delaware or other applicable law. These provisions eliminate the liability of our directors and our shareholders for

monetary damages arising out of any violation of a director of his fiduciary duty of due care. Under Delaware law, however, such

provisions do not eliminate the personal liability of a director for (i) breach of the director's duty of loyalty, (ii) acts or

omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment of dividends or repurchases

of stock other than from lawfully available funds, or (iv) any transaction from which the director derived an improper benefit.

These provisions do not affect a director's liabilities under the federal securities laws or the recovery of damages by third

parties.

We do not intend to pay dividends on any investment

in the shares of stock of our Company and any gain on an investment in our Company will need to come through an increase in our

stock’s price, which may never happen.

We have never paid any cash dividends and currently do

not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided

for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends,

any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen

and investors may lose all of their investment in our company.

Because our securities are subject to penny stock

rules, you may have difficulty reselling your shares.

Our shares of Common Stock are deemed to be "penny

stock" as that term is defined in Regulation Section 240.3a51-1 of the Securities and Exchange Commission. Penny stocks are

stocks: (a) with a price of less than $5.00 per share; (b) that are not traded on a "recognized" national exchange;

(c) whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ - where listed stocks must still meet requirement

(a) above); or (d) in issuers with net tangible assets of less than $2,000,000 (if the issuer has been in continuous operation

for at least three years) or $5,000,000 (if in continuous operation for less than three years), or with average revenues of less

than $6,000,000 for the last three years.

Section 15(g) of the Securities Exchange Act of 1934 and

Regulation 240.15g(c)2 of the Securities and Exchange Commission require broker dealers dealing in penny stocks to provide potential

investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the

document before effecting any transaction in a penny stock for the investor's account. Potential investors in our shares of Common

Stock are urged to obtain and read such disclosure carefully before

purchasing any shares of Common Stock that are deemed to be "penny stock".

Moreover, Regulation 240.15g-9 of the SEC requires broker

dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock

to that investor. This procedure requires the broker dealer to: (a) obtain from the investor information concerning his or her

financial situation, investment experience and investment objectives; (b) reasonably determine, based on that information, that

transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to

be reasonably capable of evaluating the risks of penny stock transactions; (c) provide the investor with a written statement setting

forth the basis on which the broker dealer made the determination in (ii) above; and (d) receive a signed and dated copy of such

statement from the investor confirming that it accurately reflects the investor's financial situation, investment experience and

investment objectives. Compliance with these requirements may make it more difficult for investors in our shares of Common Stock

to resell their shares to third parties or to otherwise dispose of them. Holders should be aware that, according to SEC Release

No. 34-29093, dated April 17, 1991, the market for penny stocks suffers from patterns of fraud and abuse.

Our Management is aware of the abuses that have occurred

historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or

of broker-dealers who participate in the market, Management will strive within the confines of practical limitations to prevent

the described patterns from being established with respect to our securities.

FINRA sales practice requirements may also limit

a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described

above, the Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require that in recommending

an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other

information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced

securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend

that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect

on the market for our shares.

Since our shares of Common Stock are thinly traded

it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the price

paid.