ILI Technologies (2002) Corp.: Intent to Complete Convertible Debenture

June 02 2011 - 9:00AM

Marketwired Canada

ILI Technologies (2002) Corp. or (the Company") (TSX VENTURE:ILI) announces its

intention to complete a private placement of convertible debentures with the

following terms:

Convertible Debenture - 2 year term

Amount - CDN $5,000,000 - $10,000,000

Interest 10% per annum - paid semi-annually

Option to convert into common shares the first 6 months - $0.30

Option to convert into common shares 6 months to 1 year - $0.50

Option to convert into common shares second year - $0.75

Subject to adjustment.

The net proceeds from the private placement will be used to finance the MOU

project announced on April 18, 2011 and to fund the purchase of future pipe

projects under consideration in Mexico.

The Project (MOU)

ILI's wholly owned subsidiary CDN Oilfield Technologies & Solutions Mexico

(COTS) has entered into a Memorandum of Understanding Agreement (MOU) after

receiving a proposal from a well known Mexican construction company with over 30

years of proven experience, who has been contracted by Schlumberger for the

construction of infrastructure for onshore platforms and right-of-way access

roads for Pemex, the state owned oil and gas producer.

The master contract between Schlumberger and the construction company is for

$812 million pesos (approximately CDN $65 million) and expires in the year 2013.

Under the terms of the agreement with the construction company, COTS will

provide initial funding up to Pesos $40 million per project (approximately USD

$3.3) for a period of 120 days in return for 50 percent of the gross revenue

anticipated at Pesos $80 million (approximately CDN$ 6.5 million). There are

approximately 10 projects with each project having the same costs and generating

the same revenue. Suppliers for each of these projects have been pre-approved by

Pemex with contract pricing in place. Some of the work has already been

completed leaving approximately USD $53 million in new projects which COTS will

be a full 50% partner. To earn this revenue COTS has only to fund an initial USD

$4 million to participate in all the remaining projects throughout the 2 year

term. Each project is fully secured by a performance bond and has liability

insurance coverage. Payment will be completed by way of direct assignment from

the originating source of the contract to a joint bank account equally

controlled by COTS and the construction company. Over the two year period the

total share of revenue to COTS amounts to approximately CDN $33 million and $CDN

1.1 million in earnings for each completed project.

Phil D'Angelo states "This is a great opportunity for the Company. The Company

will invest USD $4 million to earn potentially USD $33 million throughout the

life of the 2 year contract. Extensive due diligence has been completed by the

Company and management feels that every precaution has been taken to protect the

investment. Through a series of short term projects the Company can monitor the

progress thus limiting our overall risk and exposure. COTS is already under a

short term contract for USD $500,000 to the Mexican construction company to

provide funding for a Pemex project in return for an additional $80,000 in net

revenue. This project is already near completion ahead of schedule and it is

anticipated that a similar project will follow as a result of the success of

this project".

Upcoming Projects

The Company is negotiating new pipeline contracts that will require new sources

of capital to fund these projects through 2012. These are not small projects and

every effort is being made to assess these opportunities to determine the best

method of funding in order that we may secure these contracts. The Company is in

talks with the Export Development Corporation (EDC) and other sources of finance

providers to pursue a cost effective source of funding. As well, the Company

continues discussions with other service providers who have expressed a serious

interest to do business with the Company.

Summary

The Company is in a transition period moving from a small revenue company to

potentially a much larger revenue company. Every effort is being made to source

funding for these upcoming projects. The project for which we are now seeking

funding is only the beginning. COTS have positioned themselves to secure

projects that would not normally be made available to a junior company. Through

the efforts of COTS new relationships have been established, a new business in

Mexico is gaining traction beyond our expectations, and COTS has exclusively

represented themselves as the only approved supplier for flexible pipe products

in Mexico replacing conventional steel pipelines. The Company is actively

involved in several projects which could ultimately change the dynamics of ILI.

Each project that is being considered for funding is accretive to shareholders

with a good ROI. The Company has had tremendous success with current pipe

installation projects all completed ahead of schedule and exceeding the

expectations of Pemex. The Company intends to take every advantage of this

unique opportunity and ultimately expand its relationships to increase

alternative sources of revenue, rewarding shareholders who have been patiently

waiting to see this company succeed for over 15 years.

Reader Advisory

Except for statements of historical fact, this news release contains certain

"forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate" and other

similar words, or statements that certain events or conditions "may" or "will"

occur. In particular, forward-looking information in this press release

includes, but is not limited to, anticipated sales of the company and completion

of installation projects . Although we believe that the expectations reflected

in the forward-looking information are reasonable, there can be no assurance

that such expectations will prove to be correct. We cannot guarantee future

results, performance or achievements. Consequently, there is no representation

that the actual results achieved will be the same, in whole or in part, as those

set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management

at the date the statements are made, and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or results to

differ materially from those anticipated in the forward-looking information.

Some of the risks and other factors that could cause the results to differ

materially from those expressed in the forward-looking information include, but

are not limited to: general economic conditions in Canada and Mexico and

globally; industry conditions, governmental regulation, including environmental

regulation; unanticipated operating events or performance; failure to obtain

industry partner and other third party consents and approvals, if and when

required; the availability of capital on acceptable terms; the need to obtain

required approvals from regulatory authorities; stock market volatility;

competition for, among other things, capital, skilled personnel and supplies;

changes in tax laws; and the other industry and geographic specific risk

factors. Investors are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking information contained in this news release is expressly

qualified by this cautionary statement. We undertake no duty to update any of

the forward-looking information to conform such information to actual results or

to changes in our expectations except as otherwise required by applicable

securities legislation. Investors are cautioned not to place undue reliance on

forward-looking information.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of the securities in any state of

the United States or any other jurisdiction outside of Canada in which such

offer, solicitation or sale would be unlawful. The securities have not been

registered under the U.S. Securities Act of 1933, as amended, or any state

securities laws and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration requirements of

the U.S. Securities Act of 1933 and applicable state securities laws.

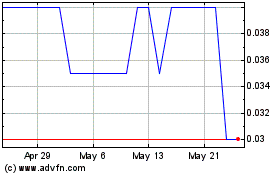

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From Apr 2024 to May 2024

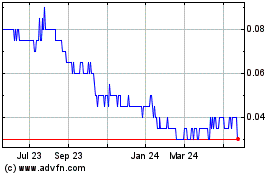

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From May 2023 to May 2024