Intermap Technologies (TSX: IMP; OTCQB: ITMSF) (“Intermap” or the

“Company”), a global leader in 3D geospatial products and

intelligence solutions, announces a new financing. The Company is

offering up to a maximum of 4,300,000 Class “A” common shares of

the Company (“Common Shares”), which upon issuance, will rank pari

passu in all respects with the Company’s existing issued Common

Shares, at a price of C$0.45 per Share for maximum gross proceeds

of C$1,935,000.00 (the “Offering”).

In connection with this Offering, Intermap has

engaged a third-party finder (the “Finder”) to conduct a

best-efforts private placement of the Common Shares. The Finder

will receive a fee of: (i) an aggregate cash fee equal to 1% of the

gross proceeds of the Offering; and (ii) an issuance of Common

Shares equal to 6% of the Common Shares placed by the Finder under

the Offering.

The Company intends to use the aggregate net

proceeds of the Offering for the execution of contracts and for

working capital. Primarily, the capital will be used to execute on

its contract with the Indonesian government to map the island of

Sulawesi as well as on a renewed and expanded contract with the

U.S. Air Force. The net proceeds of the Offering may also be used

in connection with other Southeast Asian contract awards as well as

a major renewal and expansion of a global insurance client

agreement. Further details on the use of proceeds are set forth in

the Offering Document.

Intermap has received its special area permit

from Indonesia. The Company has completed upgrades to its aircraft

platform and IFSAR systems. Intermap has also met the first

pre-deployment milestones and completed all associated contracting.

As part of its preparation for deployment, Intermap acquired

best-in-class, new hardware from VeriDaaS at attractive pricing.

The upgraded technology infrastructure ensures speed, stability,

security and flexibility as the Company executes its strategic

repositioning.

The Offering is expected to close in one or more

tranches between the date hereof and August 16, 2024 and is subject

to certain conditions including, but not limited to, the receipt of

all necessary regulatory and other approvals.

Subject to compliance with applicable regulatory

requirements, the Common Shares will be offered for sale to

purchasers resident in Canada (except Quebec) pursuant to the

listed issuer financing exemption under Part 5A of National

Instrument 45-106 – Prospectus Exemptions (the “Listed Issuer

Financing Exemption”) and to purchasers resident in the United

States by way of private placement pursuant to an exemption from

the registration requirements under the United States Securities

Act of 1933, as amended (the “1933 Act”). Because the Offering is

being completed pursuant to the Listed Issuer Financing Exemption,

the securities issued in Canada under the Offering will not be

subject to a hold period in Canada pursuant to applicable Canadian

securities laws.

The offering document related to this Offering

(the “Offering Document”) that can be accessed under the Company’s

profile at www.sedarplus.ca and on Intermap’s website at

www.intermap.com. Prospective investors should read this Offering

Document before making an investment decision.

The securities described herein have not been,

and will not be, registered under the 1933 Act, or any state

securities laws, and accordingly, may not be offered or sold within

the United States except in compliance with the registration

requirements of the 1933 Act and applicable state securities

requirements or pursuant to exemptions therefrom. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in the

United States or in any other jurisdiction in which such offer,

solicitation or sale would be unlawful.

The Company also entered into a capital markets

advisory agreement (the “Sophic Capital Agreement”) with Sophic

Capital for the provision of investor relations services to the

Company. Pursuant to the terms of the Sophic Capital Agreement,

Sophic Capital will assist the Company in the preparation of an

investor communications plan, investor materials, news releases,

road shows and conference calls. The Sophic Capital Agreement is

for a term of 12 months. The Sophic Capital Agreement will

automatically renew for successive periods of six months. Either

party may terminate the Sophic Capital Agreement with 30 days prior

written notice.

Intermap Reader

Advisory Certain information provided in this news

release, including reference to the availability of proceeds from

the Offering, the Company’s ability to raise up to the maximum

proceeds of the Offering, the use of proceeds of the Offering, the

expectation that the Offering will close and the anticipated timing

thereof and the award of new contracts and contract renewals and

the use of proceeds in the Offering in connection therewith,

constitutes forward-looking statements. The words “will”,

“intends”, “expected to”, “subject to” and similar expressions are

intended to identify such forward-looking statements. Although

Intermap believes that these statements are based on information

and assumptions which are current, reasonable and complete, these

statements are necessarily subject to a variety of known and

unknown risks and uncertainties. Intermap’s forward-looking

statements are subject to risks and uncertainties pertaining to,

among other things, cash available to fund operations, availability

of capital, revenue fluctuations, the nature of government

contracts, including changing political circumstances in the

relevant jurisdictions, economic conditions, loss of key customers,

retention and availability of executive talent, competing

technologies, common share price volatility, loss of proprietary

information, software functionality, internet and system

infrastructure functionality, information technology security,

breakdown of strategic alliances, and international and political

considerations, as well as those risks and uncertainties discussed

Intermap’s Annual Information Form for the year ended December 31,

2023 and other securities filings. While the Company makes these

forward-looking statements in good faith, should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary significantly

from those expected. Accordingly, no assurances can be given that

any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do so, what benefits

that the Company will derive therefrom. All subsequent

forward-looking statements, whether written or oral, attributable

to Intermap or persons acting on its behalf are expressly qualified

in their entirety by these cautionary statements. The

forward-looking statements contained in this news release are made

as at the date of this news release and the Company does not

undertake any obligation to update publicly or to revise any of the

forward-looking statements made herein, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

About Intermap Technologies

Founded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP; OTCQB: ITMSF) is a global leader in

geospatial intelligence solutions, focusing on the creation and

analysis of 3D terrain data to produce high-resolution thematic

models. Through scientific analysis of geospatial information and

patented sensors and processing technology, the Company provisions

diverse, complementary, multi-source datasets to enable customers

to seamlessly integrate geospatial intelligence into their

workflows. Intermap’s 3D elevation data and software analytic

capabilities enable global geospatial analysis through artificial

intelligence and machine learning, providing customers with

critical information to understand their terrain environment. By

leveraging its proprietary archive of the world’s largest

collection of multi-sensor global elevation data, the Company’s

collection and processing capabilities provide multi-source 3D

datasets and analytics at mission speed, enabling governments and

companies to build and integrate geospatial foundation data with

actionable insights. Applications for Intermap’s products and

solutions include defense, aviation and UAV flight planning, flood

and wildfire insurance, disaster mitigation, base mapping,

environmental and renewable energy planning, telecommunications,

engineering, critical infrastructure monitoring, hydrology, land

management, oil and gas and transportation.

For more information, please

visit www.intermap.com or

contact:Patrick A. BlottChairman and CEOCEO@intermap.com

+1 (303) 708-0955

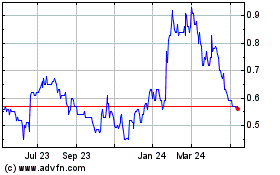

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

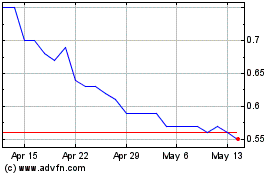

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Nov 2023 to Nov 2024