Canoe EIT Income Fund Confirms $0.10 Monthly Distribution to 2016; Launches Plan to Enhance Long-Term Unitholder Value

June 10 2014 - 9:00AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OF AMERICA.

Canoe EIT Income Fund ("EIT" or the "Fund") (TSX:EIT.UN) is pleased to confirm

its current $0.10 per unit monthly distribution through the first quarter of

2016. The Fund also announces new initiatives intended to increase long-term,

sustainable value for unitholders of the Fund.

The Canoe EIT value plan includes managing the Fund to ensure longer-term

sustainability of the monthly distribution, enhancing disclosure and

communication to unitholders and their advisors, and implementing a marketing

and media campaign designed to increase awareness of the Fund's value

proposition and the Fund's excellent performance under award-winning portfolio

manager, Robert Taylor.

"After extensive discussions with investment advisors and EIT unitholders, we

believe that the current market valuation of EIT does not reflect the strong

investment returns and attractive features of the Fund," stated Nevin G.

Markwart, president and CEO of the Fund's Manager, Canoe Financial LP.

The Fund is one of Canada's largest, most liquid, low-cost, income-producing

investment funds. Since the change in portfolio manager to Mr. Taylor in August

2013, the Fund has produced a 22.4% return to May 31, 2014 outperforming the

S&P/TSX Composite's return of 19.8% for the same period. The Fund's net asset

value (NAV) has also outperformed its S&P/TSX Composite benchmark over each of

1-, 3-, 5- and 10-year time periods as at May 31, 2014, net of fees. This strong

performance has given the Manager of the Fund sufficient confidence to confirm

the long-term sustainability of the monthly distribution. The Fund is actively

managed to provide regular and sustainable distributions to investors, while

minimizing costs.

Fund Performance(i)

(NAV performance, net of fees)

YTD 1 yr. 3 yr. 5 yr. 10 yr.

----------------------------------------------------------------------------

EIT.UN 10.4% 22.0% 5.5% 14.5% 9.5%

----------------------------------------------------------------------------

S&P/TSX Composite 8.5% 19.0% 5.0% 10.2% 8.5%

(i)As at May 31, 2014

Key initiatives include:

Implementing a Long-term Distribution Plan

The Fund intends to pay a $0.10 per unit monthly distribution through the first

quarter of 2016. Record, payment and ex-distribution dates for each distribution

will continue to be provided via news release on a monthly basis.

The Fund's objective is to maximize monthly distributions and maximize net asset

value, while maintaining and expanding a diversified investment portfolio. Since

inception, the distribution has been funded from a variety of investment

sources, including portfolio dividends, interest, capital gains and return of

capital. Since taking over management of the Fund in August 2013, Robert Taylor

has employed a total return investment strategy that generally seeks to generate

return from dividend growth securities. Taylor's approach is to create a

focused, high conviction portfolio of 40 to 60 securities - investments in solid

companies with sustainable business models that typically generate in the range

of 6% to 10% earnings growth and a 2% to 3% dividend yield, for a total return

of 10% to 12% for these securities over time. The Manager believes that Robert

Taylor's investment approach positions the portfolio to continue to deliver the

current monthly distribution level.

Enhancing Disclosure and Investor Information

The Manager is committed to enhanced disclosure and transparency to ensure

investors and their advisors are informed on Fund activities and direction,

while at the same time maintaining the portfolio manager's competitive position.

For example, we recently redesigned Canoe EIT Income Fund's online presence

including improved website content, functionality and ease of navigation, making

it easier and faster for investors to find relevant information. The Fund also

has a dedicated investor relations team which is directly responsible for

managing the Fund's relationships with unitholders and the investment community.

Raising Awareness

The Manager also intends to increase portfolio manager marketing activities to

highlight the key features and benefits of the Fund, such as its liquidity, low

fees, diversification, growth potential and annual redemption privilege which

allows unitholders to redeem units at a price substantially above the Fund's

current market price.

Current initiatives include implementing conference calls where the portfolio

manager will provide investors and the market with an update on Fund activities,

targeted cross-country roadshows/meetings with investment advisors and an active

media campaign to raise the profile of the Fund within the investment community.

"We know that investors and their advisors have a wide range of investment

choices. Each element of the value plan is designed with the long-term

sustainability of the Fund in mind," said Mr. Markwart. "We believe these

initiatives will inform investors and their advisors of the Fund's key features

and benefits, leading to greater awareness of the Fund. We will continue to keep

unitholders and their advisors updated on our progress with these value

enhancing initiatives."

June 2014 Distribution

The June distribution will be $0.10 per unit to be paid on July 15, 2014 to

unitholders of record on June 20, 2014. The ex-distribution date for this

payment is June 18, 2014.

About the Fund

The Fund is one of Canada's largest, diversified closed-end investment funds and

is listed on the TSX under the symbol EIT.UN. The Fund is actively managed and

invests in a diversified portfolio of income-generating and capital

growth-oriented securities listed primarily on the TSX. The Fund is designed to

maximize distributions and net asset value for the benefit of its unitholders.

The Fund is managed by Robert Taylor, Senior Vice President and Portfolio

Manager of Canoe Financial.

About the Manager, Canoe Financial LP

Canoe Financial is an investment management firm focused on building financial

wealth for Canadians through investing in Canada. Its 'GO CANADA!(R)' investment

thesis reflects Canoe's strategic confidence in Canada as a place to invest.

With continued global urbanization, increasing worldwide demand for resources,

and Canada's sound fiscal structure, Canoe believes this country provides

long-term growth potential for investors.

Canoe is one of Canada's fastest-growing mutual fund companies and as at May 31,

2014, manages approximately $2.5 billion in assets through its investment

products. To learn more about Canoe Financial, visit www.canoefinancial.com.

(R) 'GO CANADA!' is a registered trade-mark of Canoe Financial LP.

Forward Looking Statement: Certain statements included in this news release

constitute forward looking statements which reflect Canoe Financial's current

expectations regarding future results or events. Words such as "may," "will,"

"should," "could," "anticipate," "believe," "expect," "intend," "plan,"

"potential," "continue" and similar expressions have been used to identify these

forward-looking statements. Forward-looking statements involve significant risks

and uncertainties and a number of factors could cause actual results to

materially differ from expectations discussed in the forward looking statements

including, but not limited to, changes in general economic and market conditions

and other risk factors. Although the forward-looking statements are based on

what Canoe Financial believes to be reasonable assumptions, we cannot assure

that actual results will be consistent with these forward-looking statements.

Investors should not place undue reliance on forward-looking statements. These

forward-looking statements are made as of the current date and we assume no

obligation to update or revise them to reflect new events or circumstances.

The Fund makes monthly distributions of an amount comprised in whole or in part

of Return of Capital (ROC) of the net asset value per unit. A ROC reduces the

amount of your original investment and may result in the return to you of the

entire amount of your original investment. ROC that is not reinvested will

reduce the net asset value of the fund, which could reduce the fund's ability to

generate future income. You should not draw any conclusions about the fund's

investment performance from the amount of this distribution.

This communication is not to be construed as a public offering to sell, or a

solicitation of an offer to buy securities. Such an offer can only be made by

way of a prospectus or other applicable offering document and should be read

carefully before making any investment. This release is for information purposes

only. Investors should consult their Investment Advisor for details and risk

factors regarding specific strategies and various investment products.

FOR FURTHER INFORMATION PLEASE CONTACT:

Canoe Financial LP

Investor Relations

1-877-434-2796

info@canoefinancial.com

www.canoefinancial.com

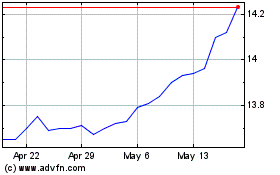

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From May 2024 to Jun 2024

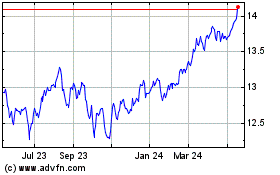

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Jun 2023 to Jun 2024