YEARS Financial Trust Proposes Fund Merger Into Dividend Growth Split Corp.

September 15 2008 - 5:54PM

Marketwired

Brompton Funds Management Limited (the "Manager") is proposing a

meeting of YEARS Financial Trust ("YTU") (TSX: YTU.UN) to consider

the merger of YTU into Dividend Growth Split Corp. ("DGS") (TSX:

DGS)(TSX: DGS.PR.A). The merger is being proposed to address the

economic inefficiencies of operating a small investment fund like

YTU and to provide investors with a high quality portfolio at a low

cost. Due to its smaller size, YTU's annual general and

administration costs currently represent 0.66% of its net asset

value and YTU is becoming too small to operate on its own.

DGS invests on an equally weighted basis in a portfolio of 20

large capitalization Canadian equities that have among the highest

dividend growth rates on the TSX and utilizes a split share

structure. Over 60% of DGS's portfolio is invested in Canadian

financial equities and it includes nine of the eleven equities

currently held in YTU. In addition, Highstreet Asset Management,

which acts as portfolio manager of YTU, invests DGS's assets,

rebalances its portfolio and selectively writes covered options to

generate additional income for DGS. As such, the Manager considers

DGS to be a similar investment to YTU. The proposed merger is

expected to provide unitholders of YEARS Financial Trust with the

following benefits:

- Lower General and Administration Costs per Unit: DGS currently

offers lower general and administration costs per unit than YTU and

these costs are expected to decrease further if the merger is

completed due to the larger combined fund size.

- Lower Management Fee: DGS offers a lower management fee of

0.60% per annum as compared to the current YTU management fee of

0.85% per annum.

- Enhanced Liquidity: Following the merger, DGS will have a

significantly larger market capitalization and a greater number of

securities and securityholders than YTU, which is expected to

provide enhanced liquidity. In addition, DGS offers quarterly

redemptions at net asset value less costs, whereas YTU only offers

redemptions at net asset value less costs on an annual basis.

- Diversified Portfolio: DGS's portfolio includes 20 blue-chip

Canadian equities and is invested in equities of financial, mining,

energy, telecommunication and energy issuers, providing greater

diversification by number of securities and by industry

sectors.

In addition, since its inception in December 2007, DGS Preferred

Shares and Class A Shares have traded at an average six percent

premium to net asset value on a combined basis, while YTU units

have typically traded at a discount to net asset value.

Details regarding the proposed merger will be contained in an

information circular which is expected to be mailed to YTU

unitholders in October. The circular will also be available on

www.sedar.com and posted on Brompton's website. In addition to the

approval of YTU unitholders, the merger is subject to applicable

regulatory approvals. Under the merger proposal, unitholders of YTU

will receive units of DGS (each unit consisting of one DGS

Preferred Share and one DGS Class A Share) and the number of DGS

units to be received will be based on the relative net asset values

per unit of each fund. The proposed merger is expected to be a

taxable transaction for YTU unitholders and they are encouraged to

read the circular in its entirety and consult with their advisors

regarding the proposed merger. The meeting date is expected to be

in early December with an effective merger date of December 31,

2008.

For additional information, please visit our website at

www.bromptongroup.com.

Forward-Looking Statements

Certain statements contained in this news release constitute

forward-looking information within the meaning of Canadian

securities laws. Forward-looking information may relate to matters

disclosed in this press release and to other matters identified in

public filings relating to the funds, to the future outlook of the

funds and anticipated events or results and may include statements

regarding the future financial performance of the funds. In some

cases, forward-looking information can be identified by terms such

as "may", "will", "should", "expect", "plan", "anticipate",

"believe", "intend", "estimate", "predict", "potential", "continue"

or other similar expressions concerning matters that are not

historical facts. Actual results may vary from such forward-looking

information for a variety of reasons, including those set forth

below.

Forward-looking statements in this press release include among

other things, the proposed timing of the merger and the expected

completion thereof; the expected benefits of the merger; and the

funds that are proposed to be merged. These statements are based on

certain factors and assumptions. In arriving at our conclusions

regarding the proposed timing of the reorganization, we have

assumed that unitholder approval will be obtained at the meeting or

adjournment thereof, and that any regulatory approvals and third

party consents and actions are given or carried out (as the case

may be) in a timely manner. Our expectations regarding the merger

are based on a single fund being more cost effective to operate and

a larger fund having greater trading volume and liquidity. While we

consider these assumptions to be reasonable based on information

currently available to us, they may prove to be incorrect. There

are no assurances that the actual outcomes will match the

forward-looking statements as a result of a number of risks and

uncertainties that could cause actual results to differ materially

from what we currently expect. These factors include changes in

market and competition, governmental or regulatory developments and

general economic conditions. Other than as required under

securities laws, we do not undertake to update this information at

any particular time.

Contacts: Brompton Funds Management Limited David E. Roode

Senior Vice President (416) 642-6008 Website:

www.bromptongroup.com

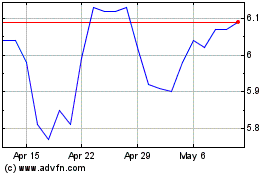

Dividend Growth Split (TSX:DGS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dividend Growth Split (TSX:DGS)

Historical Stock Chart

From Jul 2023 to Jul 2024