Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 26 2024 - 8:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16

of the Securities Exchange Act of 1934

For the month of February 2024

Commission File Number: 001-32945

WNS (Holdings) Limited

(Translation of Registrant’s name into English)

Gate 4,

Godrej & Boyce Complex

Pirojshanagar, Vikhroli (W)

Mumbai 400 079, India

+91-22-6826-2100

Malta House, 36-38 Piccadilly, London W1J 0DP

515 Madison Avenue, 8th Floor, New York, NY 10022

(Addresses of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

WNS (Holdings) Limited is incorporating by reference the information and exhibits set forth in this Form 6-K into its registration statements on Form S-8 filed on July 31, 2006 (File No: 333-136168), Form

S-8 filed on February 17, 2009 (File No. 333-157356), Form S-8 filed on September 15, 2011 (File No. 333-176849), Form S-8 filed on September 27, 2013 (File No. 333-191416), Form

S-8 filed on October 11, 2016 (File No. 333-214042), Form S-8 filed on October 31, 2018 (File No. 333-228070) and Form S-8 filed on October 21, 2020 (File No. 333-249577).

Other Events

Termination of Deposit Agreement

As previously announced, upon the direction of WNS (Holdings) Limited (the “Company”), Deutsche Bank Trust Company Americas

(the “Depositary”) today gave holders of ADSs (as defined below) notice of termination of the Deposit Agreement, dated as of July 18, 2006 (as amended, the “Deposit Agreement”), among the Company, the Depositary and the

holders and beneficial owners of American Depositary Shares (“ADSs”) evidenced by American Depositary Receipts (“ADRs”) issued thereunder. The Deposit Agreement will terminate at 5:00 p.m. (Eastern Time) on March 27, 2024,

being 30 days after the date of such notice of termination. The Company intends to arrange for holders to exchange outstanding ADSs for the underlying ordinary shares, par value 10 pence per share (the “Shares”), of the Company, and to

cause the Shares to be listed and traded on the New York Stock Exchange (the “NYSE”) in lieu of ADSs (the “Exchange”). The Company anticipates the Shares will be listed on the NYSE on March 28, 2024. WNS will continue to

trade under the symbol “WNS.”

The Company has appointed Computershare Trust Company, N.A. as the exchange agent. Upon

termination of the Deposit Agreement, the Company anticipates an immediate cancellation of ADSs held in “street name” through The Depository Trust Company (“DTC”) and the delivery of the corresponding Shares to DTC (or its

nominee).

A list of frequently asked questions regarding the Exchange can be found on the Company’s website

https://ir.wns.com/events-and-presentations/upcoming-events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

WNS (Holdings) Limited |

|

|

|

|

(Registrant) |

| Date: February 26, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Gopi Krishnan |

|

|

|

|

Name: |

|

Gopi Krishnan |

|

|

|

|

Title: |

|

General Counsel |

Exhibit 99.1

February 26, 2024

WNS (Holdings) Limited - Termination

Deutsche Bank Trust Company Americas

(the “Depositary”) today announced that it will terminate the Deposit Agreement dated July 18, 2006, as amended on January 26, 2024, by and among WNS (Holdings) Limited, the Depositary and the beneficial owners and holders of

Depositary Shares (“DSs”) evidenced by Depositary Receipts issued thereunder (the “Deposit Agreement”). Pursuant to the provisions of the Deposit Agreement, such termination will take effect at 5:00PM (Eastern Time) on

March 27, 2024 (the “Termination Date”).

Under the terms of the Receipt, you have until September 27, 2024 to

surrender your DSs for cancellation and to take delivery of the underlying shares. Holders are reminded that any time after September 30, 2024, the Depositary may sell the securities represented by then outstanding DSs and may thereafter hold

uninvested the net proceeds of any such sale, without liability for interest. If you surrender DSs for delivery of the underlying shares, you must pay a cancellation fee of up to $0.05 per DS surrendered (unless WNS (Holdings) Limited has otherwise

agreed with the Depositary to bear such cancellation fees) and any applicable U.S. or local taxes or governmental charges.

Please refer

to page 2 of this announcement for the termination provision of the Deposit Agreement and contact adr@db. com for official instructions on how to surrender DSs .

Holders are strongly urged to cancel their DRs prior to the Termination Date.

|

|

|

|

|

| Depositary Receipt Information: |

|

|

|

|

|

| Issue: |

|

WNS (Holdings) Limited |

|

Contacts |

|

|

|

| CUSIP: |

|

92932M101 |

|

Equiniti Trust Company, LLC |

|

|

|

| ISIN: |

|

US92932M1018 |

|

Tel: +1 (800) 749-1873 |

|

|

|

| Symbol: |

|

WNS |

|

Email: adr@equiniti.com |

|

|

|

| Country: |

|

India |

|

Corporate Actions |

|

|

|

| Ratio: |

|

1 DS : 1 ORD |

|

Web: www.adr.db.com |

|

|

|

| Termination Date: |

|

March 27, 2024 |

|

Duewa Brooks +1-212-250-1305 |

|

|

|

| Cancellation Expiration: |

|

September 27, 2024 |

|

|

|

|

|

| Event: |

|

Termination |

|

|

Depositary Receipts

Trust and Agency Services

Certain of these securities may not have been registered under the US Securities Act of 1933 (the “Act”) and may not be

offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Act. The investment or investment service that is the subject of this announcement is not available to retail clients as

defined by the UK Financial Conduct Authority. This announcement has been approved and/or communicated by Deutsche Bank AG London. The services described in this notice are provided by Deutsche Bank Trust Company Americas (Deutsche Bank) or by its

subsidiaries and/or affiliates in accordance with appropriate local registration and regulation. Deutsche Bank as the Depositary may use brokers, dealers or other service providers that are affiliates or other Deutsche Bank and that may earn fees

and commissions. Deutsche Bank as the Depositary may pay a rebate to brokers in connection with the issuance of unsponsored depositary receipts. Deutsche Bank disclaims all responsibility regarding whether such broker discloses or passes all or a

portion of such rebate to holders or beneficial owners of such depositary receipts. The above information is being provided solely for informational purposes by Deutsche Bank. Deutsche Bank does not warrant or guarantee the accuracy or completeness

of, and does not undertake an obligation to update or amend, this announcement. Neither this announcement nor the information contained herein constitutes an offer or solicitation by Deutsche Bank or any other issuer or entity for the purchase or

sale of any securities nor does it constitute a solicitation to any person in any jurisdiction where solicitation would be unlawful. This material shall not be construed as investment or legal advice or a recommendation, reference or endorsement by

Deutsche Bank. Deutsche Bank as the Depositary provides no advice, recommendation or endorsement with respect to any company or security. No part of this announcement may be copied or reproduced in any way without the prior written consent of

Deutsche Bank. Past results are not an indication of future performance. Copyright © February 2024 Deutsche Bank AG. All rights reserved.

Deutsche Bank

Corporate Bank

The Depositary shall, at

any time at the written direction of the Company, terminate this Deposit Agreement by mailing notice of such termination to the Holders of all Receipts then outstanding at least 30 days prior to the date fixed in such notice for such termination,

provided that the Depositary shall be reimbursed for any amounts, fees, costs or expenses owed to it in accordance with the terms of this Deposit Agreement and in accordance with any other agreements as otherwise agreed in writing between the

Company and the Depositary from time to time, prior to such termination shall take effect. If 90 days shall have expired after (i) the Depositary shall have delivered to the Company a written notice of its election to resign, or (ii) the

Company shall have delivered to the Depositary a written notice of the removal of the Depositary, and in either case a successor depositary shall not have been appointed and accepted its appointment as provided in Section 5.4, the Depositary

may terminate this Deposit Agreement by mailing notice of such termination to the Holders of all Receipts then outstanding at least 30 days prior to the date fixed for such termination. On and after the date of termination of this Deposit Agreement,

the Holder will, upon surrender of such Receipt at the Principal Office of the Depositary, upon the payment of the charges of the Depositary for the surrender of Receipts referred to in Section 2.6 and subject to the conditions and restrictions

therein set forth, and upon payment of any applicable taxes or governmental charges, be entitled to delivery, to him or upon his order, of the amount of Deposited Securities represented by such Receipt. If any Receipts shall remain outstanding after

the date of termination of this Deposit Agreement, the Registrar thereafter shall discontinue the registration of transfers of Receipts, and the Depositary shall suspend the distribution of dividends to the Holders thereof, and shall not give any

further notices or perform any further acts under this Deposit Agreement, except that the Depositary shall continue to collect dividends and other distributions pertaining to Deposited Securities, shall sell rights or other property as provided in

this Deposit Agreement, and shall continue to deliver Deposited Securities, subject to the conditions and restrictions set forth in Section 2.6, together with any dividends or other distributions received with respect thereto and the net

proceeds of the sale of any rights or other property, in exchange for Receipts surrendered to the Depositary (after deducting, or charging, as the case may be, in each case, the charges of the Depositary for the surrender of a Receipt, any expenses

for the account of the Holder in accordance with the terms and conditions of this Deposit Agreement and any applicable taxes or governmental charges or assessments). At any time after the expiration of six months from the date of termination of this

Deposit Agreement, the Depositary may sell the Deposited Securities then held hereunder and may thereafter hold uninvested the net proceeds of any such sale, together with any other cash then held by it hereunder, in an unsegregated account, without

liability for interest for the pro rata benefit of the Holders of Receipts whose Receipts have not theretofore been surrendered. After making such sale, the Depositary shall be discharged from all obligations under this Deposit Agreement with

respect to the Receipts and the Shares, Deposited Securities and American Depositary Shares, except to account for such net proceeds and other cash (after deducting, or charging, as the case may be, in each case, the charges of the Depositary for

the surrender of a Receipt, any expenses for the account of the Holder in accordance with the terms and conditions of this Deposit Agreement and any applicable taxes or governmental charges or assessments). Upon the termination of this Deposit

Agreement, the Company shall be discharged from all obligations under this Deposit Agreement except for its obligations to the Depositary hereunder.

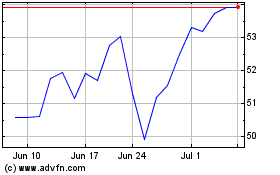

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024