Indian BPOs Likely To Gain From U.S. Health Care System Overhaul

March 23 2010 - 12:07PM

Dow Jones News

India's outsourcing firms will gain new orders after the U.S.,

one their largest markets, is overhauling their healthcare system,

which could call for insurers and healthcare providers to cut

expenses.

The U.S. House Sunday gave final approval to a far-reaching

health-care overhaul bill promising to bring health insurance to 32

million Americans while subjecting U.S. industries to a

dramatically redrawn and newly regulated marketplace.

BPO companies such as Firstsource Solutions Ltd. (532809.BY),

WNS Holdings Ltd. (WNS), Patni Computer Systems Ltd. (532517.BY),

Cognizant Technology Solutions Corp. (CTSH), the BPO units of

Infosys Technologies Ltd. (500209.BY) and Wipro Ltd. (507685.BY)

may benefit, say analysts.

"This reform is at the intersection of two of Wipro's strategic

business units--health care and government--and we are geared up to

address the technology requirements in these sectors," said Rajiv

Shah, senior vice president, healthcare vertical, at Wipro

Technologies.

Wipro Ltd. is India's third-largest software exporter by

revenue.

Analysts expect the U.S. government to spend about $15 billion

to $20 billion on healthcare technology services, a major share of

which is expected to come to the Indian business process

outsourcing companies.

"We will see an increased need for outsourcing at healthcare

insurance companies and hospitals to reorganise their operation to

accommodate the reform mandates which are coming," Firstsource

Chief Executive Ananda Mukerji.

The new regulation requires insurers to restructure their

administrative costs to ensure that about 90% of the money is spent

on actual wellness of the individual, Mukerji said.

Firstsource is looking at opportunities to support insurers to

reduce administrative costs. Studies indicate that insurance

companies spend around 9%-41% of their money on administrative

services, he added.

The company derives about 40% of its total revenue from

healthcare provider services and insurance.

It already has centres in the U.S. that offer services for

insurance claims processing and assessing eligibility for various

health programmes run by the government.

"We expect administrative requirements (for insurance companies)

to increase by early 2011 and reach its full potential by 2014,"

said Sanjiv Kapur, senior vice president and head Patni BPO.

Meanwhile, business process outsourcer WNS is also looking to

expand its healthcare offerings in the U.S. and is opening more

centers in the U.S. and Europe to build relationships with local

governments, Chief Executive Keshav Murugesh said.

The focus will be on setting up centers for "healthcare and

government (businesses) in the first phase," he added.

Insurance accounts for almost a third of WNS's revenue, while

healthcare forms a small part of this, Murugesh said.

Also, there is a proposal to spend around $20 billion on

digitization of medical records, Rohit Anand, an IT analyst with

PINC Securities.

Firstsource expects bulk of the business from the proposed

overhaul of the system to come in 2013-2014, Mukerji said, adding

that the company is already ramping up its operations in the U.S to

address this market.

Cognizant Technology, another major player in the healthcare

services segment, wasn't available for comment immediately, while

Infosys BPO, the unit of Infosys Technologies, declined to comment,

citing to a silent period ahead of quarterly results due in

April.

-By Dhanya Ann Thoppil, Dow Jones Newswires; +91-9886929464;

dhanya.thoppil@dowjones.com (Shikhar Balwani also contributed to

this article)

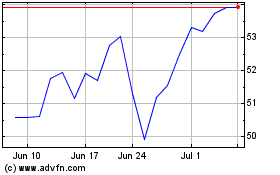

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024