WNS (Holdings) Limited (NYSE: WNS), a leading provider of global

business process outsourcing (BPO) services, today announced

results for the fiscal third quarter 2009 ended December 31, 2008

and reaffirmed its guidance on revenue less repair payments and

adjusted net income (or net income excluding amortization of

intangible assets, share-based compensation, related fringe benefit

taxes and minority interest share of loss) guidance for fiscal

2009.

Revenue for the fiscal third quarter 2009 of $134.0 million

represented an increase of 15.9% over the corresponding quarter in

the prior fiscal year, while revenue less repair payments at $99.6

million increased 34.5% over the same quarter in corresponding

period. Aviva Global Services (AGS) and Call 24/7 Limited, which

WNS acquired in July and April 2008, respectively, contributed to

the growth in this quarter.

�We had another strong quarter in terms of bottom line growth

and margin expansion, which resulted in the highest adjusted net

income quarterly results we have ever achieved. While the impact of

exchange rates continues to affect our top line, we experienced

increased volumes and organic growth on a constant currency basis,�

said Neeraj Bhargava, Group Chief Executive Officer. �I am pleased

that our focus on operational efficiencies, which includes a

decrease in attrition, has resulted in improved margins this

quarter.�

Net income including minority interest for the fiscal third

quarter 2009 was $2.1 million compared to $5.5 million during the

corresponding quarter in the prior fiscal year. The net income in

the current quarter was impacted by amortization charges from the

acquisition of AGS and higher foreign exchange losses due to the

re-valuation of British Pound-denominated assets.

Adjusted net income was $12.9 million, an increase of 59.8% over

the corresponding quarter in the prior year. The primary drivers of

this increase were revenue growth, tighter cost management and

increased income from WNS�s acquisitions. This increase was

partially offset by losses associated with the re-valuation of

British Pound-denominated assets.

WNS recorded a basic income per ADS of $0.05 for fiscal third

quarter 2009. Adjusted income per ADS (or income per ADS excluding

amortization of intangible assets, share-based compensation,

related fringe benefit taxes and minority interest share of loss)

was $0.30 for the quarter.

�Despite the base business being on track this quarter, the

continued decline of the British Pound significantly impacted our

reported revenues. However, our adjusted net income was strong and

we see additional opportunities to improve profitability by

achieving greater synergies through integration of our recent

acquisitions,� said Alok Misra, Group Chief Financial Officer. �Our

DSOs decreased substantially to what we believe is now an

industry-leading metric. In this economic environment, this

demonstrates our focus on improving collection of our receivables

and close management of our cash flows.�

Financial Highlights: Fiscal

Third Quarter Ended December 31, 2008

- Quarterly revenue of $134.0

million, up 15.9% from the corresponding quarter last year.

- Quarterly revenue less repair

payments of $99.6 million, up 34.5% from the corresponding quarter

last year.

- Quarterly net income including

minority interest of $2.1 million compared to $5.5 million from the

corresponding quarter last year.

- Quarterly adjusted net income

(or net income excluding amortization of intangible assets,

share-based compensation, related fringe benefit taxes and minority

interest share of loss) of $12.9 million, up 59.8% from the

corresponding quarter last year.

- Quarterly basic income per ADS

of $0.05, compared with $0.13 for the corresponding quarter last

year.

- Quarterly adjusted basic income

per ADS (or income per share excluding amortization of intangible

assets, share-based compensation, related fringe benefit taxes and

minority interest share of loss) of $0.30, up from $0.19 for the

corresponding quarter last year.

Reconciliations of non-GAAP financial measures to GAAP operating

results are included at the end of this release.

Key Business and Organizational

Developments

In the past quarter, WNS announced the following key

developments:

- Contract renewal for three years

with extension options with Centrica, WNS�s third largest client,

to provide support for customer service for its subsidiaries,

British Gas and Direct Energy.

- Contract renewal for six years

with SAS Airlines, the largest airline company in Scandinavia, to

deliver passenger revenue accounting processes.

- Contract renewal for five years

with SITA, a global specialist in air transport communication and

information technology solutions, to enhance supply chain

management and customer service.

- On January 27, 2009, WNS

announced that Neeraj Bhargava will transition into the role of

Strategic Advisor. Mr. Bhargava will remain in his current role as

CEO and Board member until a successor transitions into the CEO

position.

Fiscal 2009 Guidance

WNS reiterated the following guidance for the fiscal year ending

March 31, 2009:

- Revenue less repair payments is

expected to be between $385 million and $400 million. This

assumes an average USD to GBP range of 1.45 to 1.60 for the

remainder of the year.

- Adjusted net income (or net

income excluding amortization of intangible assets, share-based

compensation, related fringe benefit taxes and minority interest

share of loss) is expected to range between $46 million and $49

million.

�The value of the British Pound has further declined since we

last updated our revenue guidance. While we are confident of

meeting our guidance, our top line performance will likely fall to

the lower end of the range for the fiscal year 2009 given where the

Pound is today,� continued Misra. �Cash generation remains strong

and our cash balance has grown. We are well-positioned to meet our

debt obligations in July 2009, when the first payment on our term

loan is due.�

Conference Call

WNS will host a conference call on February 5, 2009 at 8 am (ET)

to discuss the company's quarterly results. To participate, callers

can dial: +1-800-295-3991; international dial-in +1-617-614-3924;

participant passcode 1352836. A replay will also be made available

for one week following the call at +1-888-286-8010; international

dial-in +1-617-801-6888; passcode 10750661, for a period of three

months beginning two hours after the end of the call. A webcast

will be available online at www.wns.com.

About WNS

WNS Holdings Ltd. [NYSE: WNS] is a leading global business

process outsourcing company. Deep industry and business process

knowledge, a partnership approach, comprehensive service offering

and a proven track record enables WNS to deliver business value to

some of the leading companies in the world. WNS is passionate about

building a market-leading company valued by our clients, employees,

business partners, investors and communities. For more information,

visit www.wnsgs.com.

About Non-GAAP Financial

Measures

For financial statement reporting purposes, the company has two

reportable segments: WNS Global BPO and WNS Auto Claims BPO. In the

auto claims segment, which includes WNS Assistance and Chang

Limited, WNS provides claims-handling and accident-management

services, in which it arranges for automobile repairs through a

network of third-party repair centers. In its accident-management

services, WNS acts as the principal in dealings with the

third-party repair centers and clients.

In order to provide accident-management services, the Company

arranges for the repair through a network of repair centers. Repair

costs are invoiced to customers. Amounts invoiced to customers for

repair costs paid to the automobile repair centers are recognized

as revenue. The Company uses revenue less repair payments for

�fault� repairs as a primary measure to allocate resources and

measure segment performance. Revenue less repair payments is a

non-GAAP measure which is calculated as revenue less payments to

repair centers. For �Non fault repairs,� revenue including repair

payments is used as a primary measure. As the Company provides a

consolidated suite of accident management services including credit

hire and credit repair for its �Non fault� repairs business, the

Company believes that measurement of that line of business has to

be on a basis that includes repair payments in revenue.

The Company believes that the presentation of this non-GAAP

measure in the segmental information provides useful information

for investors regarding the segment�s financial performance. The

presentation of this non-GAAP information is not meant to be

considered in isolation or as a substitute for the Company�s

financial results prepared in accordance with US GAAP.

Safe Harbor Statement under the

provisions of the United States Private Securities Litigation

Reform Act of 1995

This news release contains forward-looking statements, as

defined in the safe harbor provisions of the US Private Securities

Litigation Reform Act of 1995. These forward-looking statements

include statements regarding expected future financial results.

These statements involve a number of risks, uncertainties and other

factors that could cause actual results to differ materially

from�those that may be projected by these forward looking

statements. These risks and uncertainties include but are not

limited to technological innovation; telecommunications or

technology disruptions; future regulatory actions and conditions in

our operating areas; our dependence on a limited number of clients

in a limited number of industries; our ability to attract and

retain clients; our ability to expand our business or effectively

manage growth; our ability to hire and retain enough sufficiently

trained employees to support our operations; negative public

reaction in the US or the UK to offshore outsourcing; regulatory,

legislative and judicial developments; increasing competition in

the business process outsourcing industry; political or economic

instability in India, Sri Lanka and Jersey; worldwide economic and

business conditions, including a slowdown in the US and Indian

economies and in the sectors in which our clients are based and a

slowdown in the BPO and IT sectors world-wide; our ability to

successfully grow our revenues, expand our service offerings and

market share and achieve accretive benefits from our acquisition of

Aviva Global Services Singapore Private Limited and our master

services agreement with Aviva Global Services (Management Services)

Private Limited; our ability to successfully consummate strategic

acquisitions, as well as other risks detailed in our reports filed

with the US Securities and Exchange Commission. These filings are

available at www.sec.gov. We may, from time to time, make

additional written and oral forward-looking statements, including

statements contained in our filings with the Securities and

Exchange Commission and our reports to shareholders. You are

cautioned not to place undue reliance on these forward-looking

statements, which reflect management�s current analysis of future

events. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Reconciliation of revenue less repair payments (non-GAAP) to

revenue (GAAP) � �

�

Three months ended

Nine months ended

December 31, �

December 31, �

2008 � �

2007 � �

2008 � �

2007 (Amount in

thousands) Revenue less repair payments (Non-GAAP) $ 99,607 � $

74,056 $ 290,831 � $ 215,564 Add: Payments to repair centers �

34,403 � � 41,589 � � 115,920 � � 128,182 Revenue (GAAP) $ 134,010

� $ 115,645 � $ 406,751 � $ 343,746 �

Reconciliation of cost of

revenue (non-GAAP to GAAP) �

Three months ended Nine

months ended December 31, �

December 31, �

2008 � �

2007 � �

2008 � �

2007

(Amount in thousands) Cost of revenue (Non-GAAP) $ 62,627 $

50,272 $ 194,509 $ 146,354 Add: Payments to repair centers � 34,403

� � 41,589 � � 115,920 � � 128,182 Cost of revenue (GAAP) $ 97,030

� $ 91,862 � $ 310,429 � $ 274,536 �

Reconciliation of selling,

general and administrative expense (non-GAAP to GAAP) �

Three months ended Nine months ended December

31, �

December 31, �

2008 � �

2007 � �

2008 � �

2007 (Amount in thousands) Selling,

general and administrative expenses (excluding share-based

compensation expense and FBT(1)) (Non-GAAP) $ 16,206 $ 16,653 $

50,439 $ 47,367 Add: Share-based compensation expense 2,612 892

7,349 3,056 Add: FBT1 � 84 � � 232 � � 615 � � 859 Selling, general

and administrative expenses (GAAP) $ 18,902 � $ 17,777 � $ 58,403 �

$ 51,282

1

�

FBT means the fringe benefit taxes

on options and restricted share units granted to employees under

the WNS 2002 Stock Incentive Plan and the WNS 2006 Incentive Award

Plan (as applicable) payable by WNS to the government of India.

Three months ended �

Nine months ended December

31, �

December 31, �

2008 � �

2007 � �

2008 � �

2007 (Amount in thousands) Operating

income (excluding amortization and � � impairment of goodwill and

intangible assets, share-based compensation and FBT(1)) (Non-GAAP)

$ 21,667 $ 7,724 $ 48,564 $ 23,696 Less: Amortization of intangible

assets 7,419 897 16,900 2,205 Less: Impairment of goodwill and

intangible assets � � � 15,464 Less: Share-based compensation

expense 3,505 1,486 10,030 4,909 Less: FBT1 � 84 � � 232 � � 615 �

� 859 Operating (loss) income (GAAP) $ 10,659 � $ 5,109 � $ 21,019

� $ 259 �

Reconciliation of net income (non-GAAP to GAAP) �

Three months ended Nine months ended December

31, �

December 31, �

2008 � �

2007 � �

2008 � �

2007 (Amount in thousands) Net income

(excluding amortization and impairment of goodwill and intangible

assets, share-based compensation, FBT(1) and minority interest

share of loss) (Non-GAAP) $ 12,894 $ 8,069 $ 32,997 $ 26,877 Less:

Amortization of intangible assets 7,419 897 16,900 2,205 Less:

Impairment of goodwill and intangible assets � � � 15,464 Less:

Share-based compensation expense 3,505 1,486 10,030 4,909 Less:

FBT1 84 232 615 859 Add: Minority interest share of loss � 180 � �

� � � 180 � � � Net income (GAAP) $ 2,066 � $ 5,454 � $ 5,632 � $

3,440

1

� FBT means the fringe benefit taxes on options and restricted

share units granted to employees under the WNS 2002 Stock Incentive

Plan and the WNS 2006 Incentive Award Plan (as applicable) payable

by WNS to the government of India.

Reconciliation of Basic

income per ADS (non-GAAP to GAAP) �

Three months ended �

Nine months ended December 31, �

December 31,

�

2008 � �

2007 � �

2008 � �

2007 Basic

income per ADS (excluding amortization � � and impairment of

goodwill and intangible assets, share-based compensation, FBT(1)

and minority interest share of loss) (Non-GAAP) $ 0.30 $ 0.19 $

0.78 $ 0.64 Less: Adjustments for amortization and impairment of

goodwill and intangible assets, share-based compensation, FBT(1)

and minority interest share of loss � 0.25 � � 0.06 � � 0.65 � �

0.56 Basic income per ADS (GAAP) $ 0.05 � $ 0.13 � $ 0.13 � $ 0.08

�

Reconciliation of Diluted income per ADS (non-GAAP to

GAAP) �

Three months ended Nine months ended

December 31, �

December 31, �

2008 � �

2007 � �

2008 � �

2007 Diluted income per ADS

(excluding amortization and impairment of goodwill and intangible

assets, share-based compensation, FBT(1) and minority interest

share of loss) (Non-GAAP) $ 0.30 $ 0.19 $ 0.76 $ 0.63 Less:

Adjustments for amortization and impairment of goodwill and

intangible assets, share-based compensation, FBT(1 )and minority

interest share of loss � 0.25 � � 0.06 � � 0.63 � � 0.55 Diluted

income/(loss) per ADS (GAAP) $ 0.05 � $ 0.13 � $ 0.13 � $ 0.08

1

� FBT means the fringe benefit taxes on options and restricted

share units granted to employees under the WNS 2002 Stock Incentive

Plan and the WNS 2006 Incentive Award Plan (as applicable) payable

by WNS to the government of India.

WNS (HOLDINGS) LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (Amounts in thousands, except per share

data) � �

Three months ended �

Nine months ended

December 31, �

December 31,

�

2008

� �

�

2007

�

�

2008

�

�

2007

� � � Revenue Third parties $ 133,289 $ 114,781 $ 404,250 $ 341,268

Related parties � 721 � � � 864 � � � 2,501 � � � 2,478 � � 134,010

115,645 406,751 343,746 Cost of revenue � 97,030 � � � 91,862 � � �

310,429 � � � 274,536 � � Gross profit 36,980 23,783 96,322 69,210

Operating expenses Selling, general and administrative expenses

18,902 17,777 58,403 51,282 Amortization of intangible assets 7,419

897 16,900 2,205 Impairment of goodwill and intangible assets � � �

� � � � � � � � � � 15,464 � � Operating income 10,659 5,109 21,019

259 Other (expense) income, net (4,113 ) 2,052 (5,901 ) 6,963

Interest expense �

(3,955

)

� � (21

)

� � (7,322 ) � � (23

)

� Income before income taxes 2,591 7,140 7,796 7,199 Provision for

income taxes � (705 ) � � (1,686 ) � � (2,344 ) � � (3,759 ) �

Income before minority interests 1,886 5,454 5,452 3,440 Minority

interest share of loss � 180 � � � � � � � 180 � � � � � Net income

$ 2,066 � � $ 5,454 � � � 5,632 � � $ 3,440 � � � Basic income per

share $ 0.05 $ 0.13 $ 0.13 $ 0.08 Diluted income per share $ 0.05 $

0.13 $ 0.13 $ 0.08

WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except

share and per share data) �

December 31 �

March

31 2008 2008 (Unaudited) ASSETS

Current assets: Cash and cash equivalents $ 36,628 $ 102,698 Bank

deposits and marketable securities � 8,074 Accounts receivable, net

of allowance of $7,564 and $1,784, respectively 62,221 47,302

Accounts receivable � related parties 47 586 Funds held for clients

4,909 6,473 Employee receivables 1,126 1,179 Prepaid expenses 4,440

3,776 Prepaid income taxes 3,256 2,776 Deferred tax assets� current

672 618 Foreign currency derivative contracts � current 10,184 �

Other current assets 17,959 8,596 � Total current assets 141,442

182,078 Goodwill 85,093 87,470 Intangible assets, net 227,418 9,393

Property, plant and equipment, net 54,014 50,840 Other assets � non

current 2,719 1,278 Deposits 8,420 7,391 Deferred tax assets � non

current 16,129 8,055 �

TOTAL ASSETS $ 535,235

$ 346,505 � �

LIABILITIES AND SHAREHOLDERS�

EQUITY Current liabilities: Accounts payable $ 22,905 $ 15,562

Accounts payable � related parties � 6 Long term debt � current

20,000 � Short term line of credit 5,511 � Accrued employee costs

25,215 26,848 Deferred revenue � current 6,326 7,790 Income taxes

payable 4,693 1,879 Deferred tax liabilities � current 1,489 211

Accrual for earn-out payment � 33,699 Other current liabilities

35,882 25,806 � Total current liabilities 122,021 111,801 Long term

debt � non current 180,000 � Deferred revenue � non current 3,134

1,549 Deferred rent 2,301 2,627 Accrued pension liability 2,152

1,544 Deferred tax liabilities � non current 10,709 1,834 Liability

on outstanding derivative and interest swap contracts � non current

11,818 � Minority interest 120 � � TOTAL LIABILITIES 332,255

119,355 Shareholders� equity: Ordinary shares, $0.16 (10 pence) par

value, authorized: 50,000,000 shares;

Issued and outstanding: 42,582,566

and 42,363,100 shares, respectively

6,664 6,622 Additional paid-in capital 180,182 167,459 Ordinary

shares subscribed: Nil and 1,666 shares, respectively � 10 Retained

earnings 44,471 38,839 Accumulated other comprehensive (loss)

income (28,337 ) 14,220 � Total shareholders� equity 202,980

227,150 �

TOTAL LIABILITIES AND SHAREHOLDERS� EQUITY

$ 535,235 $ 346,505 WNS (HOLDINGS)

LIMITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) (Amounts in thousands)

�

�

Nine months ended

�

December 31,

�

2008

�

�

2007

� � �

Cash flows from operating activities Net cash provided

by operating activities $ 40,441 $ 20,730 �

Cash flows from

investing activities Acquisitions, net of cash received

(291,225

)

(34,815 ) Facility and property cost (16,800 ) (21,725 ) Proceeds

from sale of assets, net 219 101 Transfer of delivery centre to

AVIVA � 1,570 Marketable securities and deposits � 7,687 � � 12,000

� Net cash used in investing activities � (300,119 ) � (42,869 ) �

�

Cash flows from financing activities Proceeds from

exercise of stock options 1,103 1,851 Excess tax benefits from

share-based compensation 1,544 1,987 Proceeds from long term debt,

net 199,438 � Initial Public Offering expenses � (150 ) Short term

borrowing availed 7,980 � Short term borrowing repaid (9,244 ) �

Principal payments under capital leases � (182 ) � (7 ) Net cash

provided by financing activities � 200,640 � � 3,681 � � � � Effect

of exchange rate changes on cash and cash equivalents (7,032 )

2,643 � Net change in cash and cash equivalents

(66,070

)

(15,815 ) Cash and cash equivalents at beginning of period �

102,698 � � 112,340 � �

Cash and cash equivalents at end of

period $ 36,628 �

$ 96,525 �

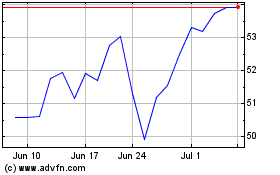

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024