WNS (Holdings) Limited (NYSE: WNS), a leading provider of offshore

business process outsourcing (BPO) services, today announced

results for the quarter ended December 31, 2007 and raised its net

income guidance for fiscal 2008. Revenue for the third fiscal

quarter was $115.6 million, an increase of 13.4% over the

corresponding quarter in the prior fiscal year. Revenue less repair

payments of $74.1 million increased 29.5% over the same period a

year ago. Revenue less repair payments for the quarter did not

include any revenue contribution from First Magnus Financial

Corporation due to its bankruptcy filing in August 2007. However,

revenue less repair payments for the corresponding quarter in the

prior fiscal year included $3.8 million of revenue from this

client. Net income for the third fiscal quarter was $5.5 million, a

decrease of 23.1% over the corresponding quarter in the prior

fiscal year. Net income (excluding share-based compensation,

related fringe benefit taxes and amortization of intangible assets)

was $8.1 million, a decrease of 8.9% from the corresponding quarter

last year. This decrease is primarily due to the appreciation of

the Indian Rupee against the US Dollar. WNS recorded a basic income

per share of $0.13. Basic income per share (excluding share-based

compensation, related fringe benefit taxes and amortization of

intangible assets) was $0.19 for the quarter. �With a solid third

quarter behind us and the continued secular growth trend in

offshore BPO, we remain focused on growth,� said Neeraj Bhargava,

Group Chief Executive Officer. �With low mortgage and banking

sector exposure, after the loss of First Magnus as a client, and a

steady flow of opportunities in other sectors we are optimistic

about growth even in a challenging economic environment.� Financial

Highlights: Fiscal Third Quarter Ended December 31, 2007 Quarterly

revenue of $115.6 million, up 13.4% from the corresponding quarter

last year. Quarterly revenue less repair payments of $74.1 million,

up 29.5% from the corresponding quarter last year. Quarterly net

income of $5.5 million, down 23.1% from the corresponding quarter

last year. Quarterly net income (excluding share-based

compensation, related fringe benefit taxes and amortization of

intangible assets) of $8.1 million, down 8.9% from the

corresponding quarter last year. Quarterly basic income per share

of 13 cents, down from basic income per share of 18 cents for the

corresponding quarter last year. Quarterly basic income per share

(excluding share-based compensation, related fringe benefit taxes

and amortization of intangible assets) of 19 cents, down from 22

cents for the corresponding quarter last year. Cash flows from

operating activities of $20.7 million for the nine months ended

December 31, 2007, down from $26.4 million for the nine months

ended December 31, 2006 Reconciliations of non-GAAP financial

measures to GAAP operating results are included at the end of this

release. Key Organizational Developments WNS earlier announced it

has strengthened its leadership team with the appointment of Alok

Misra as its new CFO. He was previously the Chief Financial Officer

of MphasiS Ltd., an EDS company. �Alok has consistently

demonstrated strong financial leadership for global services

companies,� said Mr. Bhargava. �As WNS expands its global

footprint, Alok�s significant experience and expertise will help

drive the success of the company�s overall business strategy. He is

a valuable addition to the WNS management team.� WNS last month

also announced the launch of its operation in Bucharest, Romania,

for high-end finance and accounting and customer support services.

The center will also be a hub for providing European language

services. WNS has also announced several awards during the past

quarter that recognize the company�s operational excellence and

high-quality service delivery. These awards include: Best

Performing FAO Provider by Global Services and neo IT Named as part

of The Global Services 100 list for 2008 by Global Services and neo

IT WNS Assistance recognized as the Best Accident Management

Company by the Auto Body Professionals Club, a UK automobile repair

trade organization The Best Achievement of Six Sigma in Outsourcing

by Global Six Sigma experts and practitioners The Golden Peacock

Innovation Award by The Institute of Directors, India The Supplier

Innovation Award by KLM, a key travel client Eric Selvadurai,

Managing Director, WNS Europe, awarded the �Market Maker Award� by

FAO Today magazine Fiscal 2008 Guidance WNS raises its November 14,

2007 guidance for fiscal 2008: Revenue less repair payments is

expected to be between $290 million and $295 million, in line with

the company�s previous guidance. Net income (excluding share-based

compensation and related fringe benefit taxes, amortization and

impairment of goodwill and intangible assets) is expected to be

between $34.0 million to $ 36.0 million. This represents a $1.0

million increase from the company�s previous guidance of $33

million to $35 million. �We are targeting better than expected

profits for the year due to expansion of current client

relationships, the accelerated growth of our analytics services

businesses, and an ability to control costs, which have allowed us

to weather pressure from currency appreciation and declines in

mortgage revenue,� said Mr. Bhargava. Conference Call WNS will host

a conference call on February 8, at 8 a.m. (EST) to discuss the

company's quarterly results. To participate, callers can dial

1-800-295-3991 from within the U.S. or +1-617-614-3924 from any

other country. The participant passcode is 1352836. A replay will

be made available online at www.wnsgs.com for a period of three

months beginning two hours after the end of the call. About WNS WNS

[NYSE: WNS] is a leading global Business Process Outsourcing

company. Deep industry and business process knowledge, a

partnership approach, comprehensive service offering and a proven

track record enables WNS to deliver business value to some of the

leading companies in the world. With over 17,000 employees, WNS is

passionate about building a market leading company valued by our

clients, employees, business partners, investors and communities.

For more information, please visit our website at www.wnsgs.com.

About Non-GAAP Financial Measures For financial statement reporting

purposes, the company has two reportable segments: WNS Global BPO

and WNS Auto Claims BPO. In the auto claims segment, WNS provides

claims-handling and accident-management services, in which it

arranges for automobile repairs through a network of third-party

repair centers. In its accident-management services, WNS acts as

the principal in dealings with the third-party repair centers and

clients. The amounts invoiced to WNS clients for payments made by

WNS to third-party repair centers are reported as revenue. As the

company wholly subcontracts the repairs to the repair centers, it

evaluates its financial performance based on revenue less repair

payments to third party repair centers, which is a non-GAAP

measure. WNS believes revenue less repair payments reflects more

accurately the value addition of the business process services it

directly provides to its clients. The presentation of this non-GAAP

information is not meant to be considered in isolation or as a

substitute for the company's financial results prepared in

accordance with U.S. GAAP. WNS revenue less repair payments may not

be comparable to similarly titled measures reported by other

companies due to potential differences in the method of

calculation. Safe Harbor Statement under the provisions of the

United States Private Securities Litigation Reform Act of 1995 This

news release contains forward-looking statements, as defined in the

safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These statements involve a number of risks,

uncertainties and other factors that could cause actual results to

differ materially from�those that may be projected by these forward

looking statements. These risks and uncertainties include but are

not limited to a slowdown in the U.S. and Indian economies and in

the sectors in which our clients are based, a slowdown in the BPO

and IT sectors world-wide, competition, the success or failure of

our past and future acquisitions, attracting, recruiting and

retaining highly skilled employees, technology, legal and

regulatory policy as well as other risks detailed in our reports

filed with the U.S. Securities and Exchange Commission. These

filings are available at www.sec.gov. We may, from time to time,

make additional written and oral forward-looking statements,

including statements contained in our filings with the Securities

and Exchange Commission and our reports to shareholders. You are

cautioned not to place undue reliance on these forward-looking

statements, which reflect management�s current analysis of future

events. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Amounts in

thousands, except per share data) � � Three months ended December

31, � Nine months ended December 31, 2007 � 2006 � 2007 � 2006 � �

� Revenue Third parties $114,781 $101,325 $341,268 $235,229 Related

parties 864 � 674 � 2,478 � 6,386 115,645 101,999 343,746 241,615

Cost of revenue 91,862 � 81,250 � 274,536 � 186,017 Gross profit

23,783 20,749 69,210 55,598 Operating expenses Selling, general and

administrative expenses 17,777 13,973 51,282 36,180 Amortization of

intangible assets 897 490 2,205 1,441 Impairment of goodwill and

intangible assets - � - � 15,464 � - Operating income 5,109 6,286

259 17,977 Other income (expense), net 2,052 1,331 6,963 1,250

Interest expense (21) � - � (23) � (101) Income before income taxes

7,140 7,617 7,199 19,126 Provision for income taxes (1,686) � (525)

� (3,759) � (1,418) Net income $5,454 � $7,092 � $3,440 � $17,708 �

Basic income per share $0.13 $0.18 $0.08 $0.47 Diluted income per

share $0.13 $0.17 $0.08 $0.44 Non-GAAP measure note: In addition to

its reported operating results in accordance with U.S. generally

accepted accounting principles (US GAAP). WNS has included in the

table below non-GAAP operating measures that the Securities and

Exchange Commission defines as �non-GAAP financial measures�.

Management believes that such non-GAAP financial measures, when

read in conjunction with the company�s reported results, can

provide useful supplemental information for investors analyzing

period to period comparisons of the company�s results. The non-GAAP

financial measures disclosed by the company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations to those

financial statements should be carefully evaluated. Reconciliation

of revenue less repair payments (non-GAAP) to revenue (GAAP) �

Amount inthousands � Three months ended � Nine months ended

December 31, 2007 � December 31, 2006 � December 31, 2007 �

December 31, 2006 � � � � � � � Revenue less repair payments

(Non-GAAP) 74,056 � 57,192 � 215,564 155,665 Add: Payments to

repair centers 41,589 44,807 128,182 85,950 Revenue (GAAP) 115,645

101,999 343,746 241,615 Reconciliation of cost of revenue (non-GAAP

to GAAP) � Amount inthousands � Three months ended � Nine months

ended December 31, 2007 � December 31, 2006 � December 31, 2007 �

December 31, 2006 � � � � � � � Cost of revenue (Non-GAAP) 50,272 �

36,443 � 146,354 100,067 Add: Payments to repair centers 41,589

44,807 128,182 85,950 Cost of revenue (GAAP) 91,862 81,250 274,536

186,017 Reconciliation of selling, general and administrative

expense (non-GAAP to GAAP) � Amount inthousands � Three months

ended � Nine months ended December 31, 2007 � December 31, 2006 �

December 31, 2007 � December 31, 2006 � � � � � � � Selling,

general and administrative expenses (excluding share-based

compensation expense and FBT1 (Non-GAAP) 16,653 � 13,073 � 47,367

34,311 Add: Share-based compensation expense 892 900 3,056 1,869

Add: FBT1 232 - 859 - Selling, general and administrative expenses

(GAAP) 17,777 13,973 51,282 36,180 Reconciliation of operating

income (non-GAAP to GAAP) � Amount inthousands � � Three months

ended � Nine months ended December 31, 2007 � December 31, 2006 �

December 31, 2007 � December 31, 2006 � � � � � � � Operating

income (excluding share-based compensation, amortization of

intangible assets, impairment of goodwill and intangible assets,and

FBT1) (Non-GAAP) 7,724 � 8,052 � 23,696 21,817 Less: Share-based

compensation expense 1,486 1,276 4,909 2,399 Less: Amortization of

intangible assets 897 490 2,205 1,441 Less: Impairment of goodwill

and intangible assets - - 15,464 - Less: FBT1 232 - 859 - Operating

income (GAAP) 5,109 6,286 259 17,977 Reconciliation of net income

(non-GAAP to GAAP) � Amount inthousands � Three months ended � Nine

months ended December 31, 2007 � December 31, 2006 � December 31,

2007 � December 31, 2006 � � � � � � � Net income (excluding

share-based compensation, amortization of intangible assets,

impairment of goodwill and intangible assets, and FBT1) (Non-GAAP)

8,069 � 8,858 � 26,877 21,548 Less: Share-based compensation

expense 1,486 1,276 4,909 2,399 Less: Amortization of intangible

assets 897 490 2,205 1,441 Less: Impairment of goodwill and

intangible assets - - 15,464 - Less: FBT1 232 - 859 - Net income

(GAAP) 5,454 7,092 3,440 17,708 Reconciliation of basic income per

ADS (non-GAAP to GAAP) � Three months ended � Nine months ended

December 31, 2007 � December 31, 2006 � December 31, 2007 �

December 31, 2006 � � � � � � � Basic income per ADS (excluding

share based compensation expense, amortization of intangible

assets, impairment of goodwill and intangible assets, and FBT1)

(Non-GAAP) $0.19 � $0.22 � $0.64 � $0.57 Less: Adjustments for

share-based compensation expense, amortization of intangible

assets, impairment of goodwill and intangible assets, and FBT1

$0.06 $0.04 $0.56 $0.10 Basic income per ADS (GAAP) $0.13 $0.18

$0.08 $0.47 Reconciliation of diluted income per ADS (non-GAAP to

GAAP) � Three months ended � Nine months ended December 31, 2007 �

December 31, 2006 � December 31, 2007 � December 31, 2006 � � � � �

� � Diluted income per ADS (excluding share based compensation

expense, amortization of intangible assets, impairment of goodwill

and intangible assets, and FBT1) (Non-GAAP) $0.19 � $0.21 � $0.63 �

$0.53 Less: Adjustments for share-based compensation expense,

amortization of intangible assets, impairment of goodwill and

intangible assets, and FBT1 $0.06 $0.04 $0.55 $0.09 Diluted income

per ADS (GAAP) $0.13 $0.17 $0.08 $0.44 WNS (HOLDINGS) LIMITED

CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except

share and per share data) � � As of December 31, 2007 As of March

31, 2007 (Unaudited) � � ASSETS Current assets Cash and cash

equivalents $96,525 $112,340 Bank deposits - 12,000 Accounts

receivable, net of allowance of $1,926 and $364, respectively

55,372 40,592 Funds held for clients 6,445 6,589 Employee

receivable 1,161 1,289 Prepaid expenses 4,812 2,162 Prepaid income

taxes 4,095 3,225 Deferred tax assets 800 701 Other current assets

8,301 � 4,524 Total current assets 177,511 183,422 � Goodwill

54,060 37,356 Intangible assets, net 10,184 7,091 Property and

equipment, net 53,533 41,830 Deposits 10,214 3,081 Deferred tax

assets 8,681 � 3,101 TOTAL ASSETS $314,183 � $275,881 � LIABILITIES

AND SHAREHOLDERS� EQUITY Current liabilities Accounts payable

$19,926 $18,751 Accrued employee costs 24,840 18,492 Deferred

revenue � current 9,009 9,827 Income taxes payable 2,518 88

Deferred tax liabilities 224 ? Other current liabilities 27,212 �

16,252 Total current liabilities 83,729 63,410 � Deferred revenue �

non current 1,376 5,051 Deferred rent 2,369 1,098 Accrued pension

liability 1,352 771 Deferred tax liabilities � non current 2,143 �

23 Total liabilities 90,969 70,353 Shareholders� equity: Ordinary

shares, $0.16 (?0.10) par value; Authorized 50,000,000 shares

Issued and outstanding: 42,120,137 and 41,842,879 shares,

respectively 6,574 6,519 Additional paid-in-capital 163,548 154,952

Ordinary shares subscribed, nil and 30,022 shares, respectively ?

137 Retained earnings 32,779 30,685 Accumulated other comprehensive

income 20,313 � 13,235 Total shareholders� equity 223,214 � 205,528

TOTAL LIABILITIES AND SHAREHOLDERS� EQUITY $314,183 � $275,881 1

FBT means the fringe benefit taxes on options and restricted share

units granted to employees under WNS 2002 and 2006 Incentive Award

Plan payable by WNS to the government of India.

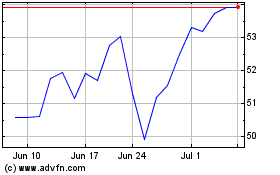

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024