WNS (Holdings) Limited (NYSE: WNS), a leading provider of offshore

business process outsourcing (BPO) services, today announced strong

results for the second fiscal quarter ended September�30, 2006.

�Our momentum continued to be very strong in the second quarter,�

said Neeraj Bhargava, Group Chief Executive Officer. �Our employee

strength grew by over 1,000 people, revenue growth was above

target, operational ramp-ups were on time and expenses under

control. We strengthened our Board and our senior management team.

All things considered, it was an excellent quarter for WNS.�

Financial Highlights: Second Quarter Ended September 30, 2006

Quarterly revenue of $86.6 million, up 76.9% from the corresponding

quarter last year. Quarterly revenue less repair payments of $53.0

million, up 52.0% from the corresponding quarter last year.

Quarterly net income of $6.0 million, up 36.7% from the

corresponding quarter last year. Quarterly net income (excluding

amortization of intangible assets and share-based compensation

expense) of $7.4 million, up 64.6% from the corresponding quarter

last year. Quarterly basic income per ADS of 16 cents, up from 14

cents for the corresponding quarter last year. Quarterly basic

income per ADS (excluding amortization of intangible assets and

share-based compensation expense) of 19 cents, up from 14 cents for

the corresponding quarter last year. Financial Highlights: Six

Months Ended September 30, 2006 Revenue of $139.6 million, up 39.4%

from the corresponding six months last year. Revenue less repair

payments of $98.5 million, up 44.8% from the corresponding six

months last year. Net income of $10.6 million, up 20.9% from the

corresponding six months last year. Net income (excluding

amortization of intangible assets and share-based compensation

expense) of $12.7 million, up 37.4% from the corresponding six

months last year. Basic income per ADS of 29 cents, up from 28

cents for the corresponding six months last year. Basic income per

ADS (excluding amortization of intangible assets and share-based

compensation expense) of 34 cents, up from 29 cents for the

corresponding six months last year. Reconciliations of non-GAAP

financial measures to GAAP operating results are included at the

end of this release. �WNS had a good quarter with robust growth in

revenue, accompanied with cost control resulting in improved

margins as measured on a revenue less repair payments basis� said

Zubin Dubash, Group Chief Financial Officer. Key Announcements

Pulak Prasad, who has served on the Board of Directors for four

years as a representative of majority shareholder Warburg Pincus,

stepped down on November�3, 2006. He was replaced by Richard Oliver

Bernays, who joined the Board of Directors as an independent member

on November 14, 2006. Mr. Bernays brings with him, more than 30

years of experience in the UK market, particularly in the financial

services industry. He is the current chairman of the board at

Hermes Pensions Management Fiscal 2007 Guidance WNS also updated

its guidance for the fiscal year ending March�31, 2007: Revenue

less repair payments revised upwards from the previously estimated

range of $205 million to $208 million. It is now estimated to be

slightly higher than $208 million. Net income guidance (excluding

amortization of intangible assets and share-based compensation

expense) remains unchanged at $30.5 million to $32.5 million

Capital expenditure for the year revised upwards from approximately

$25 million to $26 million largely because of slightly

higher-than-expected capacity additions during the year �We

continue to feel good about our guidance for the year and believe

that we are well positioned to meet our targets for fiscal 2007,�

Mr. Bhargava said. Conference call WNS will host a conference call

on Wednesday, November�15, 2006, at 7 a.m. (EST) to discuss the

company's quarterly results. To participate, callers can dial

800-295-3991 from within the U.S. or +1-617-614-3924 from any other

country. The participant passcode is 1352836. A replay will be made

available online at www.wnsgs.com for a period of three months

beginning two hours after the end of the call. About WNS WNS is a

leading provider of offshore business process outsourcing, or BPO,

services. We provide comprehensive data, voice and analytical

services that are underpinned by our expertise in our target

industry sectors. We transfer the execution of the business

processes of our clients, which are typically companies located in

Europe and North America, to our delivery centers located primarily

in India. We provide high quality execution of client processes,

monitor these processes against multiple performance metrics, and

seek to improve them on an ongoing basis. Our ADSs are listed on

the New York Stock Exchange. For more information, please visit our

website at www.wnsgs.com. About Non-GAAP Financial Measures For

financial statement reporting purposes, the company has two

reportable segments: WNS Global BPO and WNS Auto Claims BPO. In the

auto claims segment, WNS provides claims-handling and

accident-management services, in which it arranges for automobile

repairs through a network of third-party repair centers. In its

accident-management services, WNS acts as the principal in dealings

with the third-party repair centers and clients. The amounts

invoiced to WNS clients for payments made by WNS to third-party

repair centers are reported as revenue. As the company wholly

subcontracts the repairs to the repair centers, it evaluates its

financial performance based on revenue less repair payments to

third party repair centers, which is a non-GAAP measure. WNS

believes revenue less repair payments reflects more accurately the

value addition of the business process services it directly

provides to its clients. The presentation of this non-GAAP

information is not meant to be considered in isolation or as a

substitute for the company's financial results prepared in

accordance with U.S. GAAP. WNS revenue less repair payments may not

be comparable to similarly titled measures reported by other

companies due to potential differences in the method of

calculation. Safe Harbor Statement under the provisions of the

United States Private Securities Litigation Reform Act of 1995 This

news release contains forward-looking statements, as defined in the

safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These statements involve a number of risks,

uncertainties and other factors that could cause actual results to

differ materially from�those that may be projected by these forward

looking statements. These risks and uncertainties include but are

not limited to a slowdown in the U.S. and Indian economies and in

the sectors in which our clients are based, a slowdown in the BPO

and IT sectors world-wide, competition, the success or failure of

our past and future acquisitions, attracting, recruiting and

retaining highly skilled employees, technology, legal and

regulatory policy as well as other risks detailed in our reports

filed with the U.S. Securities and Exchange Commission. These

filings are available at www.sec.gov. We may, from time to time,

make additional written and oral forward-looking statements,

including statements contained in our filings with the Securities

and Exchange Commission and our reports to shareholders. You are

cautioned not to place undue reliance on these forward-looking

statements, which reflect management�s current analysis of future

events. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Amounts in

thousands, except share and per share data) � Three months ended

Six months ended September 30, September 30, September 30,

September 30, 2006� 2005� 2006� 2005� � Revenue $86,590� $48,947�

$139,616� $100,129� Cost of Revenue [refer to note below] 67,337�

35,584� 104,767� 74,320� Gross Profit 19,253� 13,363� 34,849�

25,809� Operating expenses: Selling, general and administrative

expenses [refer to note below] 12,076� 8,241� 22,207� 15,310�

Amortization of intangible assets 480� 51� 951� 119� Operating

income 6,697� 5,071� 11,691� 10,380� Other (expense) income, net

(48) (2) (81) 66� Interest expense (68) (124) (101) (261) Income

before income taxes 6,581� 4,945� 11,509� 10,185� Provision for

income taxes (557) (539) (892) (1,403) Net income 6,024� 4,406�

10,617� 8,782� Basic income per share $0.16� $0.14� $0.29� $0.28�

Diluted income per share $0.15� $0.13� $0.27� $0.26� Basic weighted

average ordinary shares outstanding 38,372,397� 31,439,757�

36,805,243� 31,325,046� Diluted weighted average ordinary shares

outstanding 41,093,046� 33,630,411� 39,521,044� 33,643,619� � Note:

Includes the following share-based compensation amounts: Cost of

Revenue 153� -� 153� -� Selling, general and administrative

expenses 757� 47� 969� 337� Non-GAAP measure note: In addition to

its reported operating results in accordance with U.S. generally

accepted accounting principles (US GAAP). WNS has included in the

table below non-GAAP operating measures that the Securities and

Exchange Commission defines as �non-GAAP financial measures�.

Management believes that such non-GAAP financial measures, when

read in conjunction with the company�s reported results, can

provide useful supplemental information for investors analyzing

period to period comparisons of the company�s results. The non-GAAP

financial measures disclosed by the company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations to those

financial statements should be carefully evaluated. Reconciliation

of revenue less repair payments (non-GAAP) to revenue (GAAP) Amount

inthousands Three months ended � � � Six months ended September 30,

2006 � September 30, 2005 � � � September 30, 2006 � September 30,

2005 � � � � � � � � � Revenue less repair payments (Non-GAAP)

$52,964� $34,838� $98,473� $68,025� Add: Payments to repair centers

33,626� 14,109� 41,143� 32,104� Revenue (GAAP) 86,590� 48,947�

139,616� 100,129� Reconciliation of selling, general and

administrative expense (non-GAAP to GAAP) Amount in thousands Three

months ended � � Six months ended September 30, 2006 � September

30, 2005 � � September 30, 2006 � September 30, 2005 � � � � � � �

� Selling, general and administrative expenses (excluding

share-based compensation expense) (Non-GAAP) $11,319� $8,194�

$21,238� $14,973� Add: Share-based compensation expense 757� 47�

969� 337� Selling, general and administrative expenses (GAAP)

12,076� 8,241� 22,207� 15,310� Reconciliation of net income

(non-GAAP to GAAP) Amount in thousands Three months ended � � � Six

months ended September 30, 2006 � September 30, 2005 � � �

September 30, 2006 � September 30, 2005 � � � � � � � � � Net

income (excluding amortization of intangible assets and share-based

compensation expense) (Non-GAAP) $7,414� $4,504� $12,690� $9,238�

Less: Amortization of intangible assets 480� 51� 951� 119� Less:

Share-based compensation expense 910� 47� 1,122� 337� Net income

(GAAP) 6,024� 4,406� 10,617� 8,782� Reconciliation of basic income

per ADS (excluding amortization of intangible assets and

share-based compensation expense) to basic income per ADS (non-GAAP

to GAAP) Three months ended � � � Six months ended September 30,

2006 � September 30, 2005 � � � September 30, 2006 � September 30,

2005 � � � � � � � � � Basic income per ADS (excluding amortization

of intangible assets and share based compensation expense)

(Non-GAAP) $0.19� $0.14� $0.34� $0.29� Less: Adjustments for

amortization of intangible assets and share-based compensation

expense $0.03� $0.00� $0.05� $0.01� Basic income per ADS (GAAP)

$0.16� $0.14� $0.29� $0.28� WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except share and

per share data) � September 30, March 31, � 2006� 2006� (Unaudited)

� ASSETS Current assets Cash and cash equivalents $ 92,238� $

18,549� Accounts receivable, net of allowance of $431 and $373,

respectively 37,501� 28,081� Funds held for clients 5,455� 3,047�

Deferred tax assets -� 353� Prepaid expenses 3,500� 1,225� Other

current assets � 6,322� � 6,140� Total current assets 145,016�

57,395� � Goodwill 36,253� 33,774� Intangible assets, net 7,938�

8,713� Property and equipment, net 39,183� 30,623� Deposits 2,450�

2,990� Deferred tax assets � 2,682� � 1,308� TOTAL ASSETS $

233,522� $ 134,803� � LIABILITIES AND SHAREHOLDERS� EQUITY Current

liabilities Accounts payable $ 22,201� $ 23,074� Accrued employee

costs 12,085� 11,336� Deferred revenue 8,502� 8,994� Income taxes

payable 517� 726� Obligations under capital leases � current 47�

184� Deferred tax liabilities 1,143� 368� Other current liabilities

� 14,210� � 8,781� Total current liabilities 58,705� 53,463� �

Obligation under capital leases � non current 17� 2� Deferred rent

917� 824� Deferred tax liabilities � non current 1,634� 2,350� �

Shareholders� equity: Preference shares, $0.15 (10 pence) par value

Authorized: 1,000,000 shares and none, respectively, Issued and

outstanding � none Ordinary shares, $0.15 (10 pence) par value

Authorized: 50,000,000 shares and 40,000,000 shares, respectively

Issued and outstanding: 39,918,332 and 35,321,511 shares,

respectively 6,144� 5,290� Additional paid-in-capital 141,814�

62,228� Ordinary shares subscribed, 163,511 and 4,346 shares,

respectively 421� 10� Retained earnings 14,721� 4,104� Deferred

share-based compensation (180) (582) Accumulated other

comprehensive income � 9,329� � 7,114� Total shareholders� equity �

172,249� � 78,164� TOTAL LIABILITIES AND SHAREHOLDERS� EQUITY $

233,522� $ 134,803� WNS (Holdings) Limited (NYSE: WNS), a leading

provider of offshore business process outsourcing (BPO) services,

today announced strong results for the second fiscal quarter ended

September 30, 2006. "Our momentum continued to be very strong in

the second quarter," said Neeraj Bhargava, Group Chief Executive

Officer. "Our employee strength grew by over 1,000 people, revenue

growth was above target, operational ramp-ups were on time and

expenses under control. We strengthened our Board and our senior

management team. All things considered, it was an excellent quarter

for WNS." Financial Highlights: Second Quarter Ended September 30,

2006 -- Quarterly revenue of $86.6 million, up 76.9% from the

corresponding quarter last year. -- Quarterly revenue less repair

payments of $53.0 million, up 52.0% from the corresponding quarter

last year. -- Quarterly net income of $6.0 million, up 36.7% from

the corresponding quarter last year. -- Quarterly net income

(excluding amortization of intangible assets and share-based

compensation expense) of $7.4 million, up 64.6% from the

corresponding quarter last year. -- Quarterly basic income per ADS

of 16 cents, up from 14 cents for the corresponding quarter last

year. -- Quarterly basic income per ADS (excluding amortization of

intangible assets and share-based compensation expense) of 19

cents, up from 14 cents for the corresponding quarter last year.

Financial Highlights: Six Months Ended September 30, 2006 --

Revenue of $139.6 million, up 39.4% from the corresponding six

months last year. -- Revenue less repair payments of $98.5 million,

up 44.8% from the corresponding six months last year. -- Net income

of $10.6 million, up 20.9% from the corresponding six months last

year. -- Net income (excluding amortization of intangible assets

and share-based compensation expense) of $12.7 million, up 37.4%

from the corresponding six months last year. -- Basic income per

ADS of 29 cents, up from 28 cents for the corresponding six months

last year. -- Basic income per ADS (excluding amortization of

intangible assets and share-based compensation expense) of 34

cents, up from 29 cents for the corresponding six months last year.

Reconciliations of non-GAAP financial measures to GAAP operating

results are included at the end of this release. "WNS had a good

quarter with robust growth in revenue, accompanied with cost

control resulting in improved margins as measured on a revenue less

repair payments basis" said Zubin Dubash, Group Chief Financial

Officer. Key Announcements -- Pulak Prasad, who has served on the

Board of Directors for four years as a representative of majority

shareholder Warburg Pincus, stepped down on November 3, 2006. -- He

was replaced by Richard Oliver Bernays, who joined the Board of

Directors as an independent member on November 14, 2006. Mr.

Bernays brings with him, more than 30 years of experience in the UK

market, particularly in the financial services industry. He is the

current chairman of the board at Hermes Pensions Management Fiscal

2007 Guidance WNS also updated its guidance for the fiscal year

ending March 31, 2007: -- Revenue less repair payments revised

upwards from the previously estimated range of $205 million to $208

million. It is now estimated to be slightly higher than $208

million. -- Net income guidance (excluding amortization of

intangible assets and share-based compensation expense) remains

unchanged at $30.5 million to $32.5 million -- Capital expenditure

for the year revised upwards from approximately $25 million to $26

million largely because of slightly higher-than-expected capacity

additions during the year "We continue to feel good about our

guidance for the year and believe that we are well positioned to

meet our targets for fiscal 2007," Mr. Bhargava said. Conference

call WNS will host a conference call on Wednesday, November 15,

2006, at 7 a.m. (EST) to discuss the company's quarterly results.

To participate, callers can dial 800-295-3991 from within the U.S.

or +1-617-614-3924 from any other country. The participant passcode

is 1352836. A replay will be made available online at www.wnsgs.com

for a period of three months beginning two hours after the end of

the call. About WNS WNS is a leading provider of offshore business

process outsourcing, or BPO, services. We provide comprehensive

data, voice and analytical services that are underpinned by our

expertise in our target industry sectors. We transfer the execution

of the business processes of our clients, which are typically

companies located in Europe and North America, to our delivery

centers located primarily in India. We provide high quality

execution of client processes, monitor these processes against

multiple performance metrics, and seek to improve them on an

ongoing basis. Our ADSs are listed on the New York Stock Exchange.

For more information, please visit our website at www.wnsgs.com.

About Non-GAAP Financial Measures For financial statement reporting

purposes, the company has two reportable segments: WNS Global BPO

and WNS Auto Claims BPO. In the auto claims segment, WNS provides

claims-handling and accident-management services, in which it

arranges for automobile repairs through a network of third-party

repair centers. In its accident-management services, WNS acts as

the principal in dealings with the third-party repair centers and

clients. The amounts invoiced to WNS clients for payments made by

WNS to third-party repair centers are reported as revenue. As the

company wholly subcontracts the repairs to the repair centers, it

evaluates its financial performance based on revenue less repair

payments to third party repair centers, which is a non-GAAP

measure. WNS believes revenue less repair payments reflects more

accurately the value addition of the business process services it

directly provides to its clients. The presentation of this non-GAAP

information is not meant to be considered in isolation or as a

substitute for the company's financial results prepared in

accordance with U.S. GAAP. WNS revenue less repair payments may not

be comparable to similarly titled measures reported by other

companies due to potential differences in the method of

calculation. Safe Harbor Statement under the provisions of the

United States Private Securities Litigation Reform Act of 1995 This

news release contains forward-looking statements, as defined in the

safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These statements involve a number of risks,

uncertainties and other factors that could cause actual results to

differ materially from those that may be projected by these forward

looking statements. These risks and uncertainties include but are

not limited to a slowdown in the U.S. and Indian economies and in

the sectors in which our clients are based, a slowdown in the BPO

and IT sectors world-wide, competition, the success or failure of

our past and future acquisitions, attracting, recruiting and

retaining highly skilled employees, technology, legal and

regulatory policy as well as other risks detailed in our reports

filed with the U.S. Securities and Exchange Commission. These

filings are available at www.sec.gov. We may, from time to time,

make additional written and oral forward-looking statements,

including statements contained in our filings with the Securities

and Exchange Commission and our reports to shareholders. You are

cautioned not to place undue reliance on these forward-looking

statements, which reflect management's current analysis of future

events. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. -0- *T WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Amounts in

thousands, except share and per share data) Three months ended Six

months ended September September September September 30, 30, 30,

30, 2006 2005 2006 2005 Revenue $86,590 $48,947 $139,616 $100,129

Cost of Revenue (refer to note below) 67,337 35,584 104,767 74,320

Gross Profit 19,253 13,363 34,849 25,809 Operating expenses:

Selling, general and administrative expenses (refer to note below)

12,076 8,241 22,207 15,310 Amortization of intangible assets 480 51

951 119 Operating income 6,697 5,071 11,691 10,380 Other (expense)

income, net (48) (2) (81) 66 Interest expense (68) (124) (101)

(261) Income before income taxes 6,581 4,945 11,509 10,185

Provision for income taxes (557) (539) (892) (1,403) Net income

6,024 4,406 10,617 8,782 Basic income per share $0.16 $0.14 $0.29

$0.28 Diluted income per share $0.15 $0.13 $0.27 $0.26 Basic

weighted average ordinary shares outstanding 38,372,397 31,439,757

36,805,243 31,325,046 Diluted weighted average ordinary shares

outstanding 41,093,046 33,630,411 39,521,044 33,643,619 Note:

Includes the following share- based compensation amounts: Cost of

Revenue 153 - 153 - Selling, general and administrative expenses

757 47 969 337 *T Non-GAAP measure note: In addition to its

reported operating results in accordance with U.S. generally

accepted accounting principles (US GAAP). WNS has included in the

table below non-GAAP operating measures that the Securities and

Exchange Commission defines as "non-GAAP financial measures".

Management believes that such non-GAAP financial measures, when

read in conjunction with the company's reported results, can

provide useful supplemental information for investors analyzing

period to period comparisons of the company's results. The non-GAAP

financial measures disclosed by the company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations to those

financial statements should be carefully evaluated. -0- *T

Reconciliation of revenue less repair payments (non-GAAP) Amount in

to revenue (GAAP) thousands Three months ended Six months ended

----------------------------------------- September September

September September 30, 2006 30, 2005 30, 2006 30, 2005

-----------------------------------------

----------------------------------------- Revenue less repair

payments (Non-GAAP) $52,964 $34,838 $98,473 $68,025 Add: Payments

to repair centers 33,626 14,109 41,143 32,104 Revenue (GAAP) 86,590

48,947 139,616 100,129 *T -0- *T Reconciliation of selling, general

and administrative Amount in expense (non-GAAP to GAAP) thousands

Three months ended Six months ended

----------------------------------------- September September

September September 30, 2006 30, 2005 30, 2006 30, 2005

-----------------------------------------

----------------------------------------- Selling, general and

administrative expenses (excluding share-based compensation

expense) (Non-GAAP) $11,319 $8,194 $21,238 $14,973 Add: Share-based

compensation expense 757 47 969 337 Selling, general and

administrative expenses (GAAP) 12,076 8,241 22,207 15,310 *T -0- *T

Amount in Reconciliation of net income (non-GAAP to GAAP) thousands

Three months ended Six months ended

----------------------------------------- September September

September September 30, 2006 30, 2005 30, 2006 30, 2005

-----------------------------------------

----------------------------------------- Net income (excluding

amortization of intangible assets and share-based compensation

expense) (Non-GAAP) $7,414 $4,504 $12,690 $9,238 Less: Amortization

of intangible assets 480 51 951 119 Less: Share-based compensation

expense 910 47 1,122 337 Net income (GAAP) 6,024 4,406 10,617 8,782

*T -0- *T Reconciliation of basic income per ADS (excluding

amortization of intangible assets and share-based compensation

expense) to basic income per ADS (non-GAAP to GAAP) Three months

ended Six months ended -----------------------------------------

September September September September 30, 2006 30, 2005 30, 2006

30, 2005 -----------------------------------------

----------------------------------------- Basic income per ADS

(excluding amortization of intangible assets and share based

compensation expense) (Non-GAAP) $0.19 $0.14 $0.34 $0.29 Less:

Adjustments for amortization of intangible assets and share-based

compensation expense $0.03 $0.00 $0.05 $0.01 Basic income per ADS

(GAAP) $0.16 $0.14 $0.29 $0.28 *T -0- *T WNS (HOLDINGS) LIMITED

CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except

share and per share data) September 30, March 31, 2006 2006

(Unaudited) ------------- ------------ ASSETS Current assets Cash

and cash equivalents $ 92,238 $ 18,549 Accounts receivable, net of

allowance of $431 and $373, respectively 37,501 28,081 Funds held

for clients 5,455 3,047 Deferred tax assets - 353 Prepaid expenses

3,500 1,225 Other current assets 6,322 6,140 -------------

------------ Total current assets 145,016 57,395 Goodwill 36,253

33,774 Intangible assets, net 7,938 8,713 Property and equipment,

net 39,183 30,623 Deposits 2,450 2,990 Deferred tax assets 2,682

1,308 ------------- ------------ TOTAL ASSETS $ 233,522 $ 134,803

============= ============ LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 22,201 $ 23,074 Accrued

employee costs 12,085 11,336 Deferred revenue 8,502 8,994 Income

taxes payable 517 726 Obligations under capital leases - current 47

184 Deferred tax liabilities 1,143 368 Other current liabilities

14,210 8,781 ------------- ------------ Total current liabilities

58,705 53,463 Obligation under capital leases - non current 17 2

Deferred rent 917 824 Deferred tax liabilities - non current 1,634

2,350 Shareholders' equity: Preference shares, $0.15 (10 pence) par

value Authorized: 1,000,000 shares and none, respectively, Issued

and outstanding - none Ordinary shares, $0.15 (10 pence) par value

Authorized: 50,000,000 shares and 40,000,000 shares, respectively

Issued and outstanding: 39,918,332 and 35,321,511 shares,

respectively 6,144 5,290 Additional paid-in-capital 141,814 62,228

Ordinary shares subscribed, 163,511 and 4,346 shares, respectively

421 10 Retained earnings 14,721 4,104 Deferred share-based

compensation (180) (582) Accumulated other comprehensive income

9,329 7,114 ------------- ------------ Total shareholders' equity

172,249 78,164 ------------- ------------ TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 233,522 $ 134,803 ============= ============

*T

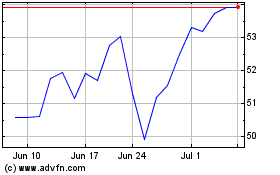

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024