UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ANNUAL REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

Commission File Number 001-13175

VALERO ENERGY CORPORATION THRIFT PLAN

VALERO ENERGY CORPORATION

One Valero Way

San Antonio, Texas 78249

VALERO ENERGY CORPORATION THRIFT PLAN

Table of Contents

All other supplemental schedules required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are omitted because they are not applicable or not required.

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

Valero Energy Corporation Thrift Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Valero Energy Corporation Thrift Plan (the Plan) as of December 31, 2022 and 2021, the related statements of changes in net assets available for benefits for the years ended December 31, 2022 and 2021, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2022 and 2021, and the changes in net assets available for benefits for the years ended December 31, 2022 and 2021, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The Schedule H, Line 4i–Schedule of Assets (Held at End of Year) as of December 31, 2022 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our

opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have served as the Plan’s auditor since 2004.

Austin, Texas

June 23, 2023

VALERO ENERGY CORPORATION THRIFT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

(thousands of dollars)

| | | | | | | | | | | |

| December 31, |

| 2022 | | 2021 |

| Assets | | | |

Investments at fair value | $ | 2,647,315 | | | $ | 3,003,204 | |

Receivables: | | | |

Notes receivable from participants | 45,163 | | | 45,585 | |

| Discretionary employer contributions | 1,425 | | | 1,085 | |

Due from brokers for securities sold | 129 | | | 513 | |

| Total receivables | 46,717 | | | 47,183 | |

Cash | 19 | | | — | |

| Total assets | 2,694,051 | | | 3,050,387 | |

| Net assets available for benefits | $ | 2,694,051 | | | $ | 3,050,387 | |

See Notes to Financial Statements.

VALERO ENERGY CORPORATION THRIFT PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

(thousands of dollars)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Additions: | | | |

| Investment income (loss): | | | |

| Interest income | $ | 540 | | | $ | 388 | |

| Dividend income | 70,133 | | | 117,279 | |

| Net appreciation (depreciation) in fair value of investments | (322,619) | | | 327,804 | |

| Total investment income (loss) | (251,946) | | | 445,471 | |

| Interest income on notes receivable from participants | 2,050 | | | 2,293 | |

| Contributions: | | | |

| Participant | 121,220 | | | 114,701 | |

| Employer | 67,733 | | | 65,355 | |

| Total contributions | 188,953 | | | 180,056 | |

| Total additions (reductions) | (60,943) | | | 627,820 | |

| Deductions: | | | |

| Benefit payments | (295,393) | | | (326,870) | |

| Net increase (decrease) in net assets available for benefits | (356,336) | | | 300,950 | |

| Net assets available for benefits: | | | |

| Beginning of year | 3,050,387 | | | 2,749,437 | |

| End of year | $ | 2,694,051 | | | $ | 3,050,387 | |

See Notes to Financial Statements.

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS

1.DESCRIPTION OF THE PLAN

General

The Valero Energy Corporation Thrift Plan (the Plan) is a qualified profit-sharing plan covering most of Valero Energy Corporation’s employees in the United States (U.S.). (See “Eligibility and Participation” below for a description of employees eligible for participation in the Plan.) The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). As used in this report, the term “Valero” may refer, depending upon the context, to Valero Energy Corporation, one or more of its consolidated subsidiaries, or all of them taken as a whole.

A portion of the Plan is designated as an employee stock ownership plan (ESOP), as defined in Section 4975(e)(7) of the Internal Revenue Code of 1986, as amended (the Code), and Department of Labor Regulation §2550.407d-6. The Plan is composed of an ESOP portion and a non-ESOP portion. The ESOP portion consists only of investments in Valero common stock. A dividend payout feature allows participants to elect to receive dividends from Valero common stock in cash as taxable distributions or to continue to have such dividends reinvested in the Plan. The designation as an ESOP has no other effect on benefits under the Plan.

The description of the Plan included in these notes to financial statements provides only general information. Participants should refer to the plan document for a complete description of the Plan’s provisions.

Plan Administration

Valero, the plan sponsor, is a multinational manufacturer and marketer of petroleum-based and low-carbon liquid transportation fuels and petrochemical products. Valero owns 15 petroleum refineries located in the U.S., Canada, and the United Kingdom with a combined throughput capacity of approximately 3.2 million barrels per day. Valero is a joint venture member in Diamond Green Diesel Holdings LLC, which owns two renewable diesel plants located in the Gulf Coast region of the U.S. with a combined production capacity of approximately 1.2 billion gallons per year, and Valero owns 12 ethanol plants located in the Mid-Continent region of the U.S. with a combined production capacity of approximately 1.6 billion gallons per year. As of December 31, 2022, Valero employed approximately 10,000 people.

Valero’s common stock trades on the New York Stock Exchange under the symbol “VLO.”

The Valero Energy Corporation Benefit Plans Administrative Committee (Administrative Committee), consisting of persons selected by Valero, administers the Plan. The members of the Administrative Committee serve without compensation for services in that capacity. Bank of America, N.A. is the trustee under the Plan and has custody of the securities and investments of the Plan through a trust. Merrill Lynch, Pierce, Fenner & Smith Incorporated, an affiliate of Bank of America, is the record keeper for the Plan.

Eligibility and Participation

Valero’s U.S. employees are immediately eligible to participate in the Plan, except for certain employees at Valero’s Port Arthur and Memphis Refineries who are only eligible to participate in the Premcor

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

Retirement Savings Plan, another plan sponsored by Valero. Participation in the Plan is voluntary; however, eligible employees are automatically enrolled in the Plan as further described under “Contributions.”

Contributions

Participants may make contributions of not less than 1 percent or more than 50 percent of their annual total salary, as defined in the plan document, immediately upon commencement of participation, subject to certain limitations under the Code.

Participants elect to make pre-tax, after-tax and/or designated Roth 401(k) contributions to the Plan. Any employee may make eligible rollover contributions and eligible Roth 401(k) rollover contributions to the Plan. Participants may recharacterize amounts from their vested account to an in-plan Roth rollover account. Former employees who retain an account balance under the Plan and who have received or who are eligible to receive a distribution from a defined benefit pension plan sponsored by Valero are also eligible to make a rollover contribution to the Plan. For the years ended December 31, 2022 and 2021, rollover contributions totaled $11.1 million and $7.3 million, respectively, and are included in participant contributions.

Each eligible employee hired or rehired on or after January 1, 2017 through December 31, 2022 was automatically enrolled in the Plan at a pre-tax contribution rate of 3 percent of their annual total salary, unless the eligible employee elected not to participate in the Plan. The automatically enrolled participant’s contribution rate will increase by 1 percent per year until a maximum contribution rate of 7 percent is reached, unless the participant elects to opt out of the automatic increases or voluntarily changes his or her contribution rate. Each eligible employee hired or rehired on or after January 1, 2023 is automatically enrolled in the Plan at a pre-tax contribution rate of 7 percent of their annual total salary, unless the eligible employee elects not to participate in the Plan. The automatically enrolled participant’s contribution rate will increase by 1 percent per year until a maximum contribution rate of 10 percent is reached, unless the participant elects to opt out of the automatic increases or voluntarily changes his or her contribution rate.

The Code establishes an annual limitation on the amount of individual pre-tax and/or Roth 401(k) salary deferral contributions. For the years ended December 31, 2022 and 2021, this limit was $20,500 and $19,500, respectively. Participants who attained age 50 before the end of the year were eligible to make catch-up contributions of up to $6,500 for each of the years ended December 31, 2022 and 2021. All or any portion of an eligible participant’s catch-up contribution can be designated as a Roth 401(k) catch-up contribution.

Valero makes an employer contribution equal to $1.00 for every $1.00 of a participant’s contributions up to 7 percent of annual total salary. All employer contributions are made in cash and are invested according to the investment options elected for the participant contributions.

Valero, at the discretion of the Valero Energy Corporation Board of Directors or such other party as designated by such Board, may make discretionary employer contributions (referred to as profit-sharing contributions prior to April 15, 2021) to the accounts of all eligible ethanol plant employees (renewables organization employees). Such contributions are allocated based on eligible compensation. For the plan

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

years ended December 31, 2022 and 2021, the Administrative Committee approved discretionary employer contributions totaling $1.8 million and $1.7 million, respectively. Of these amounts, Valero funded $1.4 million and $1.1 million, respectively, with the remaining portion being funded from forfeited nonvested accounts. Discretionary employer contributions receivable as of December 31, 2022 and 2021 were received by the Plan in March 2023 and 2022, respectively.

Participant Accounts

Individual accounts are maintained for each participant. Each participant’s account is adjusted to reflect participant contributions, employer contributions, withdrawals, income, expenses, gains, and losses attributable to the participant’s account.

Vesting

Participants are vested 100 percent in their individual participant contribution accounts at all times. Participants who are active employees and are not renewables organization employees are 100 percent vested in their employer matching contribution accounts at all times. Renewables organization employees vest in their employer matching contribution accounts at the rate of 20 percent per year and are 100 percent vested after five years of continuous service. Eligible renewables organization employees vest 100 percent in any discretionary employer contributions after completion of three years of service.

Continuous service begins the first day for which an employee is paid and terminates on the date of the employee’s retirement, death, or other termination from service. If an employee’s employment is terminated and the employee is subsequently reemployed within 12 months, the period between the severance from service and the date of reemployment is generally included in continuous service for vesting purposes. If the employee is not reemployed within one year after a severance from service date, the employee is deemed to have incurred a break in service.

Forfeitures

The Plan provides that if a participant incurs a break in service prior to becoming vested in any part of his or her employer account, the participant’s prior continuous service will not be disregarded for purposes of the Plan until the break in service equals or exceeds five successive years. Upon a participant’s termination of employment for other than death, total and permanent disability, or retirement on or after age 65, the nonvested portion of the participant’s employer account is forfeited upon distribution. In the event the participant is reemployed prior to incurring a break in service of five successive years, any amounts forfeited under this provision may be reinstated.

Employer contributions for the years ended December 31, 2022 and 2021 were reduced by $605,000 and $270,000, respectively, from forfeited nonvested accounts. As of December 31, 2022 and 2021, forfeited nonvested accounts available to reduce future employer contributions or plan administrative expenses were $398,000 and $634,000, respectively.

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

Investment Options

Participants direct the investment of 100 percent of their participant and employer contributions and may transfer existing account balances into any of the investment options offered, subject to certain restrictions. These investment options include Valero common stock, common/collective trusts, mutual funds, an interest-bearing cash account, and other self-directed investments.

Participants may not designate more than 20 percent of their contributions to be invested in Valero common stock. Transfers into Valero common stock will not be permitted to the extent a transfer would result in more than 50 percent of the aggregate value of the participant’s account being invested in Valero common stock.

Withdrawals

A participant who is a current Valero employee may make the following types of withdrawals of all or part of the participant’s respective accounts:

•one withdrawal during any six-month period from the participant’s after-tax account and rollover contribution account with no suspension of future contributions;

•one withdrawal from the participant’s employer or discretionary employer account (referred to as profit-sharing account prior to April 15, 2021) upon completion of five years or three years of continuous service, respectively, with a similar withdrawal allowed 36 months after the date of a previous withdrawal under this provision, with no suspension of future contributions;

•upon reaching age 59½, one withdrawal during any six-month period from the participant’s account and employer account; or

•upon furnishing proof of financial necessity, one withdrawal during any six-month period from the participant’s account and the vested portion of the employer account.

Distributions

Upon a participant’s death, total and permanent disability, or retirement on or after age 65, the participant or the beneficiary of a deceased participant is entitled to a distribution of the entire value of the participant’s account and employer account regardless of whether or not the accounts are fully vested. Upon a participant’s termination for any other reason, the participant is entitled to a distribution of only the value of the participant’s account and the vested portion of the participant’s employer account.

Distributions resulting from any of the above occurrences may be made in a single sum distribution in (i) whole shares of Valero common stock and cash for fractional shares and the participant’s interest in all other investments or (ii) entirely in cash. In lieu of the single sum distribution, a participant or beneficiary whose account balance exceeds $5,000 may elect to receive the value of the account in the form of (i) installments, (ii) partial distributions, or (iii) any combination of these forms, subject to certain restrictions.

The distribution of a vested account balance greater than $5,000 shall not be made without the participant’s consent. If the value of a vested account balance is equal to or less than $5,000 but greater than $1,000, the account balance may be distributed to the participant in a cash lump sum distribution

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

without the participant’s consent. If the participant does not elect to either (i) have such distribution transferred directly to an eligible retirement plan in a direct rollover or (ii) receive such distribution directly, the Administrative Committee will make a cash direct rollover of the lump sum distribution to an individual retirement account in the terminated participant’s name. A vested account balance equal to or less than $1,000 may be distributed to the participant in a cash lump sum without the participant’s consent.

Terminated participants may elect to have the Plan trustee hold their accounts for distribution to them at a date not later than April 1 of the calendar year after which they attain age 72. In this event, terminated participants continue to share in the income, expenses, gains, and losses of the Plan until their accounts are distributed.

The Plan allows participants who are called to active duty military service and who are on military leave for a period of 179 days or more to make withdrawals of all or any portion of their account.

Notes Receivable from Participants

Participants may borrow a minimum of $500. The participant must be an employee to obtain a loan. The maximum loan amount a participant may have outstanding is restricted to the lesser of:

(a)$50,000, reduced by the excess of (i) the highest outstanding balance of the participant’s loans during a one-year period over (ii) the outstanding balance of all loans to the participant on the day any new loan is made, or

(b)one-half of the current value of the participant’s vested interest in his or her Plan accounts.

The term of any loan may not exceed five years unless the loan is for the purchase of a participant’s principal residence, in which case the term of the loan shall not exceed 15 years. The balance of the participant’s account and vested portion of his or her employer account serve as security for the loan. Loans bear interest at a reasonable rate as established by the Administrative Committee, presently at prime plus 1 percent. Loan repayments of principal and interest are made through payroll deductions or as otherwise determined. Participants may have two loans outstanding under the Plan at any time.

Plan Expenses

Plan administrative expenses, including trustee fees and administrative fees, may be paid by the Plan unless paid by Valero. Valero also provides certain other services at no cost to the Plan. Investment related expenses are included in net appreciation (depreciation) in fair value of investments. Individual participant transaction fees, such as overnight delivery fees and redemption fees, are deducted from the respective participant’s account and are included in benefit payments.

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

SECURE 2.0 Act of 2022

On December 29, 2022, the SECURE 2.0 Act of 2022 (SECURE 2.0 Act) was enacted to help improve retirement savings. The SECURE 2.0 Act made wide-ranging changes, both mandatory and elective, to qualified plans and its provisions have various effective dates. Significant provisions include the following:

•increase the required minimum distribution (RMD) age from 72 to 73, effective January 1, 2023, and to age 75, effective January 1, 2033;

•reduce the excise tax for failure to take RMDs from 50 percent to 25 percent of the RMD amount that was not taken, beginning January 1, 2023; and

•require all catch-up contributions for participants with compensation of more than $145,000 (indexed for inflation) to be designated as Roth 401(k) contributions beginning after December 31, 2023.

The Plan will incorporate changes in its Plan document and administration to the extent required by the SECURE 2.0 Act.

2.BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

General

The financial statements of the Plan are prepared on the accrual basis of accounting in conformity with U.S. generally accepted accounting principles (GAAP).

Subsequent Events

Management has evaluated events that occurred after December 31, 2022 through the date these financial statements were available to be issued on June 23, 2023. Any material subsequent events that occurred during this time have been properly recognized or disclosed in these financial statements.

Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Valuation of Investments

The Plan’s investments are stated at fair value as described in Note 3.

Income Recognition

Purchases and sales of investments are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

Net appreciation (depreciation) in fair value of investments consists of net realized gains and losses on the sale of investments and net unrealized appreciation (depreciation) of investments.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are expensed when they are incurred and are reflected in benefit payments. No allowance for credit losses has been recorded as of December 31, 2022 or 2021. A loan that has been defaulted upon and not cured within a reasonable period of time may be deemed a distribution from the Plan. The loan balance is reduced and benefit payments are increased after the participant makes final withdrawal from the Plan.

Payment of Benefits

Benefits are recorded when paid.

Risks and Uncertainties

In general, the Plan’s investments are exposed to various risks, such as interest rate, market, and credit risks. These risks may be impacted by certain external financial, business, and other factors, such as the effects of economic downturns, natural disasters, pandemics, war, or hostilities. Due to the level of risk associated with certain investments, it is reasonably possible that changes in the values of investments may occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits. The impact of those risks and factors remains uncertain and depends on future events and developments.

3.FAIR VALUE MEASUREMENTS

A fair value hierarchy (Level 1, Level 2, or Level 3) is used to categorize fair value amounts based on the quality of inputs used to measure fair value. Accordingly, fair values determined by Level 1 inputs utilize unadjusted quoted prices in active markets for identical assets or liabilities. Fair values determined by Level 2 inputs are based on quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted prices that are observable for the asset or liability. Level 3 inputs are unobservable inputs for the asset or liability for which there is little, if any, market activity at the measurement date. The Plan uses appropriate valuation techniques based on the available inputs to measure the fair values of its applicable assets and liabilities. When available, the Plan measures fair value using Level 1 inputs because they generally provide the most reliable evidence of fair value.

The valuation methods used to measure the Plan’s financial instruments at fair value are as follows:

•Common stock, mutual funds, and self-directed investments are measured at fair value using a market approach based on quoted prices from national securities exchanges and are categorized in Level 1 of the fair value hierarchy.

•The cost of interest-bearing cash approximates its fair value and is therefore categorized in Level 1 of the fair value hierarchy.

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

•All common/collective trusts, including those that primarily hold investments in fully benefit-responsive contracts, are valued at the net asset value of units of the common/collective trusts as determined by the issuer of the trust based on the fair values of the underlying net assets divided by the number of units outstanding. The net asset value per unit is a quoted price in a market that is not active; therefore, these investments are classified within Level 2 of the fair value hierarchy.

The following table presents the Plan’s investments at fair value (in thousands) as of December 31, 2022 and 2021 by level of the fair value hierarchy. No investments were categorized in Level 3 of the hierarchy as of December 31, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 | | 2021 |

| Level 1 | | Level 2 | | Total | | Level 1 | | Level 2 | | Total |

| Valero common stock | $ | 441,576 | | | $ | — | | | $ | 441,576 | | | $ | 329,619 | | | $ | — | | | $ | 329,619 | |

| Common/collective trusts | — | | | 756,808 | | | 756,808 | | | — | | | 857,743 | | | 857,743 | |

| Mutual funds | 808,001 | | | — | | | 808,001 | | | 1,066,703 | | | — | | | 1,066,703 | |

| Interest-bearing cash | 92,872 | | | — | | | 92,872 | | | 63,683 | | | — | | | 63,683 | |

| Self-directed investments | 548,058 | | | — | | | 548,058 | | | 685,456 | | | — | | | 685,456 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Investments at fair value | $ | 1,890,507 | | | $ | 756,808 | | | $ | 2,647,315 | | | $ | 2,145,461 | | | $ | 857,743 | | | $ | 3,003,204 | |

The Plan’s investment in shares of Valero common stock represents 16.7 percent and 11.0 percent of total investments at fair value as of December 31, 2022 and 2021, respectively. For the years ended December 31, 2022 and 2021, dividend income included $15.0 million and $17.7 million, respectively, of dividends paid on Valero common stock. The closing price for Valero common stock was $126.86 and $75.11 on December 31, 2022 and 2021, respectively.

4.RELATED-PARTY AND PARTY-IN-INTEREST TRANSACTIONS

Administrative expenses incurred with the Plan’s trustee were not material for the years ended December 31, 2022 and 2021. Fees paid by the Plan for investment management services were included as a reduction of the return earned on each fund. In addition, the Plan allows for loans to participants and investment in Valero’s common stock. Valero, the sponsor of the Plan, provides accounting and administrative services at no cost to the Plan. These transactions are party-in-interest transactions under ERISA and are covered by an exemption from the “prohibited transactions” provisions of ERISA and the Code.

5.PLAN TERMINATION

Although it has not expressed any intent to do so, Valero has the right under the Plan to terminate the Plan at any time subject to the provisions of ERISA. In the event of any termination of the Plan or complete discontinuance of employer contributions, participants would become 100 percent vested in their employer accounts. If the Plan were terminated, the Administrative Committee would direct the trustee to distribute the remaining assets, after payment of all Plan expenses, to participants and beneficiaries in proportion to their respective balances.

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

6.TAX STATUS

The Internal Revenue Service has determined and informed the plan sponsor by a letter dated April 29, 2014, that the Plan is designed in accordance with applicable sections of the Code. Although the Plan has been amended since receiving the determination letter, the plan sponsor believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the Code, and therefore believes that the Plan is qualified and the related trust is tax-exempt.

The Plan is subject to routine audits by taxing jurisdictions. There are currently no audits in progress for any plan years.

7.RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of notes receivable from participants, benefit claims payable, and net assets available for benefits per the financial statements to the Plan’s Form 5500 Annual Return/Report of Employee Benefit Plan (Form 5500) (in thousands):

| | | | | | | | | | | | | | | | | |

| Notes

Receivable

from

Participants | | Benefit

Claims

Payable | | Net Assets

Available for

Benefits |

| December 31, 2022 | | | | | |

| Per the financial statements | $ | 45,163 | | | $ | — | | | $ | 2,694,051 | |

| Deemed distributions of participant loans | (767) | | | — | | | (767) | |

| Amounts allocated to withdrawing participants | — | | | (1,025) | | | (1,025) | |

| Per the Form 5500 | $ | 44,396 | | | $ | (1,025) | | | $ | 2,692,259 | |

| | | | | |

| December 31, 2021 | | | | | |

| Per the financial statements | $ | 45,585 | | | $ | — | | | $ | 3,050,387 | |

| Deemed distributions of participant loans | (868) | | | — | | | (868) | |

| Amounts allocated to withdrawing participants | — | | | (1,663) | | | (1,663) | |

| Per the Form 5500 | $ | 44,717 | | | $ | (1,663) | | | $ | 3,047,856 | |

The following is a reconciliation of investment income (loss) per the financial statements to the Form 5500 (in thousands):

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Investment income (loss) per the financial statements | $ | (251,946) | | | $ | 445,471 | |

Interest income on notes receivable from participants per the financial statements | 2,050 | | | 2,293 | |

| Investment income (loss) per the Form 5500 | $ | (249,896) | | | $ | 447,764 | |

VALERO ENERGY CORPORATION THRIFT PLAN

NOTES TO FINANCIAL STATEMENTS (Continued)

The following is a reconciliation of benefit payments per the financial statements to the Form 5500 (in thousands):

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Benefit payments per the financial statements | $ | 295,393 | | | $ | 326,870 | |

| Amounts allocated to withdrawing participants: | | | |

| End of year | 1,025 | | | 1,663 | |

| Beginning of year | (1,663) | | | (624) | |

| Terminated deemed distributions of participant loans | (101) | | | — | |

| Benefit payments per the Form 5500 | $ | 294,654 | | | $ | 327,909 | |

VALERO ENERGY CORPORATION THRIFT PLAN

EIN: 74-1828067

Plan No. 002

Schedule H, Line 4i–Schedule of Assets (Held at End of Year)

As of December 31, 2022

| | | | | | | | | | | |

| Identity of Issue/Description of Investment | | Current Value |

| Common stock: | | |

| * | Valero Energy Corporation | | $ | 441,576,427 | |

| Common/collective trusts: | | |

| BlackRock LifePath Index 2025 Fund | | 36,634,042 | |

| BlackRock LifePath Index 2030 Fund | | 48,605,435 | |

| BlackRock LifePath Index 2035 Fund | | 59,775,005 | |

| BlackRock LifePath Index 2040 Fund | | 56,577,250 | |

| BlackRock LifePath Index 2045 Fund | | 48,905,757 | |

| BlackRock LifePath Index 2050 Fund | | 42,807,553 | |

| BlackRock LifePath Index 2055 Fund | | 32,832,286 | |

| BlackRock LifePath Index 2060 Fund | | 21,439,855 | |

| BlackRock LifePath Index 2065 Fund | | 3,470,552 | |

| BlackRock LifePath Index Retirement Fund | | 18,031,117 | |

| Putnam Stable Value Fund | | 143,944,827 | |

| State Street S&P 500 Index Fund | | 198,487,382 | |

| Victory Small Cap Value Collective Fund | | 45,297,016 | |

| Total common/collective trusts | | 756,808,077 | |

| Mutual funds: | | |

| American Funds EuroPacific Growth Fund | | 134,608,345 | |

| American Funds Growth Fund of America | | 153,671,098 | |

| BlackRock Liquidity Funds FedFund Cash Reserve Shares | | 1,025,676 | |

| Emerald Growth Institutional Fund | | 48,005,745 | |

| Invesco Diversified Dividend Fund | | 84,645,190 | |

| Pioneer Bond Fund | | 92,548,489 | |

| Vanguard Mid-Cap Index Fund Institutional Shares | | 129,723,636 | |

| Vanguard PRIMECAP Fund Admiral Shares | | 163,772,353 | |

| Total mutual funds | | 808,000,532 | |

| Interest-bearing cash: | | |

| * | Retirement Bank Account | | 92,872,126 | |

| Self-directed investments | | 548,058,005 | |

*

| Participant loans (interest rates range from 4.25% to 8.25%; maturity dates range from January 2023 to November 2037) | | 44,395,621 | |

| | | $ | 2,691,710,788 | |

________________________________

* Party-in-interest to the Plan.

See accompanying report of independent registered public accounting firm.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Valero Energy Corporation Benefit Plans Administrative Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| VALERO ENERGY CORPORATION THRIFT PLAN |

| | | |

| | | |

| | | |

| By: | /s/ Homer S. Bhullar | |

| | Homer S. Bhullar | |

| | Chairman of the Valero Energy Corporation | |

| | Benefit Plans Administrative Committee | |

| | Vice President Investor Relations and Finance, | |

| | Valero Energy Corporation | |

| | | |

| | | |

| Date: June 23, 2023 | | | |

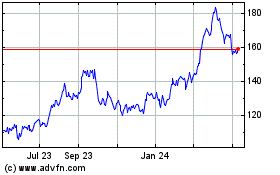

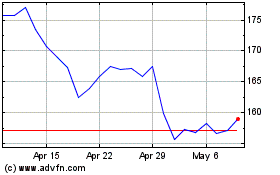

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Jul 2023 to Jul 2024