Tyson Aided by Chicken, Prepared-Food Sales

November 23 2015 - 9:30AM

Dow Jones News

Tyson Foods Inc. posted better-than-expected revenue in its

latest quarter, helped by chicken and prepared-foods sales, though

revenue at its beef and pork segments recorded drops of 7.5% and

25%, respectively.

Adjusted profit came in below analysts' forecasts.

Looking ahead to next year, the company said it expects sales of

$41 billion in the 2016 fiscal year, above expectations of analysts

surveyed by Thomson Reuters who expect $40.4 billion.

Tyson and other beef processors have been buffeted by yearslong

contraction in the U.S. cattle herd due to drought in the southern

Plains. There had been hope that supply constraints seen in the

prior quarter would ease in the latest three-month period as

feedyards sold cattle that were kept on feed for longer

periods.

Overall, the company posted a profit of $258 million, or 63

cents a share, up from $137 million, or 35 cents a share, a year

earlier. Excluding certain items, earnings were 83 cents, down from

87 cents.

Revenue climbed 4% to $10.5 billion. Analysts surveyed by

Thomson Reuters forecast per-share earnings of 88 cents a share on

revenue of $10.3 billion.

In the chicken segment, adjusted feed costs decreased $130

million during the latest quarter. The segment registered a sales

volume climb on stronger demand, the company said.

Growth in the prepared food segment was driven by the

acquisition of Hillshire Brands, the maker of Jimmy Dean

sausage.

The beef segment produced a $70 million hit on profit in the

latest quarter related to mark-to-market open derivative positions

and lower-of-cost-or-market inventory adjustments as a result of a

sharp decline in live cattle futures during September.

During the quarter, the segment posted a $33 million operating

loss, down from a $153 million profit a year earlier.

The adjusted average price in the pork segment tumbled 23%. Live

hog supplies increased, which drove down livestock cost and

adjusted average sales price. U.S. hog herds rebounded faster than

expected this year from a virus that killed millions of pigs

beginning in the spring of 2013, resulting in a supply bulge.

Last week, Tyson announced plans to close two aging

prepared-food plants, in the face of prohibitive renovation costs

and changing demand. About 880 workers would be affected by the

closures of the plants in Jefferson, Wis., and Chicago.

In August, the company announced it was closing a 400-person

beef-processing plant in Iowa, citing declining U.S. cattle

herds.

The closures come as Tyson continues to remake itself after its

2014 acquisition of Hillshire Brands Co. Shortly after the

announcement of the acquisition, Tyson announced in July 2014 that

it was closing three prepared-food plants.

In recent quarters, revenue growth in the prepared-food division

has led the company's top-line growth, primarily as a result of the

Hillshire acquisition. In the latest quarter the prepared foods

division saw sales climb 60%.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 23, 2015 09:15 ET (14:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

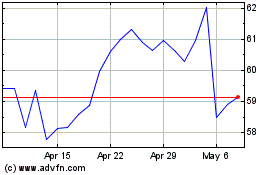

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Jun 2024 to Jul 2024

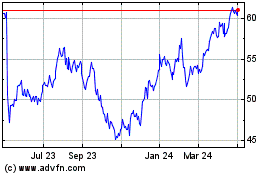

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Jul 2023 to Jul 2024