|

Summary Prospectus March 1, 2014

|

|

William Blair Commodity Strategy Long/Short Fund

|

|

|

|

|

|

|

Class N WCSNX

|

|

Class I WCSIX

|

|

Institutional Class WCSJX

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its

risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at williamblairfunds.com/prospectus. You can also get this information at no cost by calling

+1 800 742 7272 or by sending an

e-mail

request to fundinfo@williamblair.com. The Fund’s prospectus and statement of additional information, each dated March 1, 2014, as

supplemented, are incorporated by reference into this Summary Prospectus.

INVESTMENT

OBJECTIVE:

The William Blair Commodity Strategy Long/Short Fund (the “Fund” or the “Commodity Fund”) seeks long-term risk-adjusted total return.

FEES AND EXPENSES:

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees

(fees paid directly from your investment)

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class N

|

|

|

Class I

|

|

|

Institutional

Class

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

|

|

|

None

|

|

|

|

None

|

|

|

|

None

|

|

|

Redemption Fee

|

|

|

None

|

|

|

|

None

|

|

|

|

None

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your

investment)

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class N

|

|

|

Class I

|

|

|

Institutional

Class

|

|

|

Management Fee*

|

|

|

1.20%

|

|

|

|

1.20%

|

|

|

|

1.20%

|

|

|

Distribution (Rule 12b-1) Fee

|

|

|

0.25%

|

|

|

|

None

|

|

|

|

None

|

|

|

Other Expenses (includes a shareholder administration fee for Class N and Class I shares)

|

|

|

2.12%

|

|

|

|

2.13%

|

|

|

|

1.96%

|

**

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

3.57%

|

|

|

|

3.33%

|

|

|

|

3.16%

|

|

|

Fee Waiver and/or Expense Reimbursement***

|

|

|

1.82%

|

|

|

|

1.83%

|

|

|

|

1.81%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

|

|

1.75%

|

|

|

|

1.50%

|

|

|

|

1.35%

|

|

|

*

|

The Advisor contractually agreed to reduce its management fee to 1.20% of average daily net assets effective March 1, 2014.

|

1

|

**

|

“Other Expenses” are estimated for the Institutional Class shares since no shares have been issued as of the date of this prospectus.

|

|

***

|

The Advisor has entered into a contractual agreement with the Fund to waive fees and/or reimburse expenses in order to limit the Fund’s operating expenses (excluding interest, taxes, brokerage commissions, acquired

fund fees and expenses, dividend expenses on short sales, other investment-related costs and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of the Fund’s business) to 1.75%, 1.50% and 1.35% of

average daily net assets for Class N, Class I and Institutional Class shares, respectively, until February 28, 2015. The Advisor may not terminate this arrangement prior to February 28, 2015 unless the management agreement is terminated. The Advisor

is entitled to reimbursement for a period of three years subsequent to the Fund’s Commencement of Operations on April 25, 2012 for previously waived fees and reimbursed expenses to the extent that the Fund’s expense ratio is below the

expense limitation.

|

The Fund currently seeks commodities exposure through one or more total return swaps that subject the Fund to

additional fees not reflected in the Annual Fund Operating Expenses table above or the Example below. The fees of the swaps are indirect costs of investing in the Fund and will affect the Fund’s performance. The estimated cost of the

Fund’s investment in swaps during the fiscal year ended October 31, 2013 was 3.58% of average daily net assets. See page 4 of this Summary section for more details regarding the swap fees.

Example:

This example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in

other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and

the Fund’s operating expenses remain the same. The figures reflect the expense limitation for the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

Class N

|

|

|

$178

|

|

|

|

$926

|

|

|

|

$1,695

|

|

|

|

$3,717

|

|

|

Class I

|

|

|

153

|

|

|

|

853

|

|

|

|

1,578

|

|

|

|

3,498

|

|

|

Institutional Class

|

|

|

137

|

|

|

|

805

|

|

|

|

1,497

|

|

|

|

3,341

|

|

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual

fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 33% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES:

The Fund’s investment strategies seek to provide broad exposure to commodities, provide

attractive risk-adjusted returns with low correlations to traditional asset classes, maintain the inflation protection of commodities investing and profit in both up and down commodities markets. The Fund seeks to provide exposure to the commodity

trading strategies of independent commodity trading advisors (“CTAs”) selected by the Advisor, currently through derivative instruments (instruments whose values are based on, for example, indices, currencies or securities), and invests in

fixed-income securities. The Fund is classified as non-diversified.

Commodity Investments

. The Fund may invest in

commodities through derivative instruments that provide exposure to commodity trading strategies of CTAs selected by the Advisor and/or by investing in limited liability companies, limited partnerships, corporations and other pooled investment

vehicles (collectively, “Underlying Vehicles”) managed by such CTAs. To a limited extent, the Fund may also invest in commodity-linked derivatives, such as futures, based on specific commodities or commodities indices

2

and not tied to commodity trading strategies of CTAs. The derivative instruments in which the Fund invests, either directly or indirectly through investments in Underlying Vehicles, are used as a

substitute for direct investments in commodities.

CTAs to whom the Fund will have exposure generally fall within one of the following three broad

categories of managers:

Systematic:

The CTA seeks to exploit trending behavior of futures markets over

various time frames by utilizing quantitative systems.

Fundamental:

The CTA conducts deep research into

fundamental supply and demand factors that drive futures markets and uses specialized models, data sources and other tools to construct expectations of fundamental value.

Sector Specialist:

The CTA employs specialized knowledge, research and analysis systems to seek value from niche

markets.

Within these three broad categories of managers, the CTAs may employ the following strategies: trend following, trend anticipation, reversion,

breakout, pattern recognition, high-frequency trading, commodities trading, and fundamentally-based trading. Commodities to which the CTAs may seek exposure include, but are not limited to, grains, meats, energies, metals, and softs (e.g., cotton,

sugar or coffee). The CTAs execute their commodity trading strategies primarily by taking long and short positions in commodity futures or options on commodity futures. The CTAs may also use other types of derivatives including financial futures,

options, forwards and swap contracts.

While there is no limit on the number of CTAs that the Fund may seek exposure to, under normal market conditions,

the Advisor anticipates that the Fund will have exposure to between 6 and 15 CTAs. In selecting the CTAs, the Advisor considers a number of factors, including, but not limited to:

|

|

•

|

|

Quality of investment process

|

|

|

•

|

|

Organizational depth and stability

|

|

|

•

|

|

Depth of professional resources

|

The Advisor monitors the CTAs on an ongoing basis and may adjust the Fund’s exposures to

the CTAs from time to time. The Advisor seeks CTAs with well-defined strategies that are expected to exhibit low correlation to traditional market indices over the long-term and under normal market conditions. The Advisor also seeks CTAs that

display deep knowledge of and experience with the markets in which they operate and an understanding of the risks associated with investing in those markets. The Advisor monitors the market exposures of each CTA in order to manage the Fund’s

diversification in the commodities markets.

3

The Fund’s commodity investments include derivative instruments that provide exposure to trading strategies

of CTAs selected by the Advisor and/or Underlying Vehicles managed by such CTAs. The Advisor currently seeks exposure to CTA trading strategies through one or more total return swaps (each a “Swap” and, collectively, the

“Swaps”), a type of derivative instrument, based on a customized index (each an “Underlying Index”) designed to replicate the aggregate returns of the trading strategies of CTAs selected by the Advisor. A Swap is based on a

notional amount agreed to by the Advisor and the Swap counterparty, which may be adjusted from time to time. The aggregate notional amounts of the Swaps may exceed the net assets of the Fund. The Fund may request interim cash payments from a Swap

counterparty on a periodic basis representing the increase in the value of a Swap and the Fund may make interim cash payments to a Swap counterparty or post collateral in an amount representing the decrease in the value of a Swap during the term of

a Swap. Interim cash payments made by a Swap counterparty to the Fund may be subject to a fee. The Fund or a Swap counterparty may terminate a Swap with prior notice to the other party.

An Underlying Index may be calculated by a Swap counterparty or a third-party index calculation agent. In calculating an Underlying Index, the Swap

counterparty or third-party index calculation agent calculates the returns of the CTAs included in the Underlying Index based on a notional allocation to each CTA. The level of the Fund’s exposure to the commodities markets through a Swap will

depend on the notional amount of the Swap and the notional allocations to the CTAs included in the Underlying Index. The aggregate notional amounts of the Swaps and the sum of the notional allocations to each CTA included in the Underlying Indexes

may exceed the net assets of the Fund. The Advisor may add or remove CTAs from an Underlying Index or increase or decrease the weighting given to a CTA included in an Underlying Index. The weightings given to each CTA included in an Underlying Index

may differ and the exposure to each CTA trading strategy may be based on a different notional allocation.

The calculation of an Underlying Index and the

related Swap value includes a deduction for fees of the Swap counterparty as well as fixed and performance fees of the CTAs included in the Underlying Index. Because an Underlying Index is designed to replicate the returns of CTAs selected by the

Advisor, the performance of the Fund depends on the ability of the CTAs to generate returns in excess of the fees deducted from the Underlying Indexes and the Swaps. The fees of the Swap counterparties and the fixed fees of the CTAs are calculated

based on the notional amounts of the Swaps and the notional allocations to the CTAs included in the Underlying Indexes. To the extent the aggregate notional amounts of the Swaps and the notional allocations to the CTAs included in the Underlying

Indexes exceed the net assets of the Fund, the aggregate deduction for the fees of the Swap counterparties and the fixed fees of the CTAs will be greater as a percentage of the Fund’s net assets than the deduction would be if the aggregate

notional amounts of the Swaps and the notional allocations to the CTAs included in the Underlying Indexes were equal to or less than the net assets of the Fund. The calculation of an Underlying Index also may include a deduction for the performance

fees of the individual CTAs included in the Underlying Index. The deduction for performance fees in an Underlying Index is based on the performance results of each individual CTA’s trading strategy represented in the Underlying Index.

Accordingly, a performance fee for one or more CTA trading strategies represented in an Underlying Index may be deducted in calculating the Underlying Index even if the aggregate returns of the trading strategies of the CTAs included in the

Underlying Index are negative. During the Fund’s most recent fiscal year, the fees of the Swap counterparty equaled 0.50% of the aggregate notional allocations in the Underlying Index, the fixed fees of CTAs included in the Underlying Index

generally ranged from 1% to 2% of the notional allocations to the CTAs, the performance fees of CTAs included in the Underlying Index generally ranged from 0% to 25% of the returns of the CTAs, and the total fees of the Fund’s Swap were

$515,057, of which $194,287 were performance fees. The total fees of the Fund’s Swaps will vary depending on the fees of the Swap counterparties, the notional allocations to the CTAs included in the Underlying Indexes and their respective fixed

and performance fees and the performance results of the CTA trading strategies.

4

In addition to the Swaps, the use of derivatives in Underlying Vehicles by the CTAs and any other

commodity-linked derivative instruments invested in by the Fund, will also increase the Fund’s exposure to the commodities markets and, as a result, the Fund’s investment performance could be significantly impacted, both positively and

negatively, by movements in the commodities markets.

The Fund’s investments in the Swaps, any Underlying Vehicles and other commodity-linked

derivative instruments are made through William Blair CLS Ltd., a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Commodity Fund Subsidiary”). The Underlying Vehicles through which the Commodity

Fund Subsidiary may invest may include one or more Underlying Vehicles that are wholly owned subsidiaries of the Commodity Fund Subsidiary. The Commodity Fund Subsidiary may also hold fixed-income securities, some of which may serve as margin or

collateral for the Commodity Fund Subsidiary’s derivative positions. In accordance with federal income tax laws applicable to regulated investment companies, the Fund may only invest up to 25% of the value of its total assets in the Commodity

Fund Subsidiary. However, the Commodity Fund Subsidiary’s investments in the Swaps, Underlying Vehicles, which use derivatives, and investments in commodity-linked derivatives will provide the Fund with leveraged exposure to the commodities

markets in an amount greater than 25% of the value of its total assets. The Advisor, as part of its overall advisory services to the Fund, manages the investment and reinvestment of the assets of the Commodity Fund Subsidiary and administers the

affairs of the Commodity Fund Subsidiary pursuant to a separate management agreement between the Advisor and the Commodity Fund Subsidiary that contains provisions substantially similar to those applicable to management agreements for registered

investment companies under the Investment Company Act of 1940, as amended (the “1940 Act”). The Advisor receives no additional compensation for providing management and administrative services to the Commodity Fund Subsidiary. In managing

the assets of the Commodity Fund Subsidiary, the Advisor applies the Fund’s investment policies and restrictions and the Fund’s compliance policies and procedures generally as if such assets were held directly by the Fund.

Fixed-Income Investments

. Assets not allocated to the Fund’s commodity investments are invested in fixed-income securities.

The Fund’s fixed-income securities are U.S. dollar denominated and may include: (1) obligations of or guaranteed by the U.S. Government, its agencies or instrumentalities; (2) corporate debt securities issued by domestic or foreign

companies; (3) mortgage-backed securities and asset-backed securities, which are debt securities issued by a corporation, trust or custodian, or by a U.S. Government agency or instrumentality, that are collateralized (i.e., secured as to

payment of interest and/or principal) by a portfolio or pool of assets, such as mortgages, debit balances on credit card accounts or U.S. Government securities; and (4) money market instruments, including, but not limited to, those issued by

domestic companies, the U.S. Government and its agencies and instrumentalities, U.S. banks and municipalities. The Fund may invest in money market mutual funds to the extent permitted by the 1940 Act and the rules and regulations thereunder.

The Fund generally purchases investment grade fixed-income securities rated in one of the highest four categories by at least one of the following three

nationally recognized statistical rating organizations: Fitch Ratings, Moody’s Investors Service, Inc. and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. However, the Fund may also purchase below investment grade

securities (e.g., high yield or junk bonds), which are securities rated below Baa/BBB.

In choosing fixed-income securities for the Fund, the Advisor

emphasizes individual security selection, as well as shifts in the Fund’s portfolio among market sectors. To a lesser extent, the Advisor actively manages the Fund’s average duration. However, the Fund does not have limits on duration, and

the Fund’s duration will change over time. Duration measures the average period remaining until the discounted value of the amounts due (principal and interest) under an instrument are to be paid, rather than the instrument’s stated final

maturity. When applied to the Fund, for example, a portfolio duration of five years means that if interest rates increased by 1%, the value of the portfolio would decrease by approximately 5%.

5

PRINCIPAL RISKS:

The following is a summary of the principal risks associated with

an investment in the Fund. The Fund may be subject to the following risks directly through investment in individual securities or indirectly through various instruments, including derivative instruments or Underlying Vehicles.

The Fund involves a high level of risk and may not be appropriate for everyone.

You could lose money by investing in the Fund.

There can be no assurance that the Fund’s investment objective will be achieved. The Fund is not intended to be a complete investment program. The Fund is designed for long-term investors.

Aggressive Investment Technique Risk.

The Fund may use investment techniques and financial instruments that may be considered

aggressive, including but not limited to investments in the Swaps and Underlying Vehicles and the use of futures contracts, options on futures contracts, securities and indices, forward contracts, swap agreements and similar instruments. Such

techniques may also include taking short positions or using other techniques that are intended to provide inverse exposure to a particular market or other asset class, as well as leverage, which can expose the Fund to potentially dramatic losses or

gains. These techniques may expose the Fund to potentially dramatic losses in the value of certain of its portfolio holdings.

Commodities Market

Risk.

The value of the Fund’s investments may go up or down, sometimes rapidly or unpredictably. The value of an investment may decline due to factors affecting commodities markets generally or particular segments of

the commodities markets. The Advisor may favor commodities markets or asset classes that perform poorly relative to other commodities markets and asset classes. To the extent that the Commodity Fund Subsidiary’s assets are invested in

commodities markets or asset classes that underperform the general stock market, the Fund would perform poorly relative to a portfolio invested primarily in the general stock market.

Commodity Risk.

Investing in the commodities markets and investing in commodity-linked derivative instruments, such as futures

and swaps, may subject the Fund to greater volatility than investments in traditional securities. The commodities markets have experienced periods of extreme volatility and future market conditions may result in rapid and substantial valuation

increases and decreases. The value of commodities and commodity contracts may be affected by a variety of factors, including global supply and demand, changes in interest rates, commodity index volatility, and factors affecting a particular industry

or commodity, such as drought, floods, weather, livestock disease, embargos, government regulation, tariffs and taxes, world events and economic, political and regulatory developments. Certain commodities or natural resources may be produced in a

limited number of countries and may be controlled by a small number of producers. Political, economic and supply-related events in such countries could have a significant impact on the value of such commodities.

Counterparty and Contractual Default Risk.

The Fund’s investments in derivatives and other financial instruments that

involve counterparties subject the Fund to the risk that the counterparty could default on its obligations under the agreement, either through the counterparty’s failure or inability to perform its obligations or bankruptcy.

Credit Risk.

The value of the Fund’s fixed-income securities is subject to the ability of the issuers of such securities to

make interest payments or payment at maturity. The credit ratings of issuers could change and negatively affect the Fund’s share price or yield.

Currency Risk.

The value of the Fund’s portfolio may be affected by changes in exchange rates or control regulations. If a

local currency gains against the U.S. dollar, the value of the security increases in U.S. dollar terms. If a local currency declines against the U.S. dollar, the value of the security decreases in U.S. dollar terms.

6

Derivatives Risk.

Risks associated with derivatives, including futures, options,

forward foreign currency contracts and swaps, may include the risk that the derivative is not well correlated with the commodity, security, index or currency to which it relates, the risk that derivatives may not have the intended effects and may

result in losses or missed opportunities, the risk that a counterparty is unwilling or unable to meet its obligations, and the risk that the derivative transaction could expose the Fund to the effects of leverage, which could increase the

Fund’s exposure to the market and magnify potential losses. There is no guarantee that derivatives, to the extent employed, will have the intended effect, and their use could cause lower returns or even losses to the Fund. The use of

over-the-counter (“OTC”) derivatives subjects the Fund to credit risk of the counterparty. The use of certain derivatives provides exposure to the underlying market or other reference asset in excess of the cash investment of the Fund. The

use of derivatives can magnify gains and losses. Derivatives are subject to fees and other costs which are not reflected in the Annual Fund Operating Expenses table.

Derivatives are also subject to liquidity risk. Liquidity risk is the risk that a derivative instrument cannot be sold, closed out or replaced quickly at or

very close to its fundamental value. Generally, exchange-traded derivatives are very liquid because the exchange clearinghouse is the counterparty of every contract. OTC derivatives are less liquid than exchange-traded derivatives since they often

can be closed out only with the other party to the transaction. The Fund’s ability to sell or close out a position in an instrument prior to expiration or maturity depends on the existence of a liquid secondary market or, in the absence of such

a market, the ability and willingness of the counterparty to enter into a transaction closing out the position. Therefore, there is no assurance that any derivatives position can be sold or closed out at a time and price that is favorable to the

Fund.

Emerging Markets Risk.

Foreign investment risk is typically intensified in emerging markets, which are the less

developed and developing nations.

Foreign Investment Risk.

The risks of foreign investments may include less publicly

available information, less governmental regulation and supervision of foreign stock exchanges, brokers and issuers, share registration and custody, a lack of uniform accounting, auditing and financial reporting standards, practices and

requirements, the possibility of expropriation, seizure or nationalization, confiscatory taxation, limits on repatriation, adverse changes in investment or exchange control regulations, political instability, restrictions on the flow of

international capital, imposition of foreign withholding taxes, fluctuating currencies, inflation, difficulty in obtaining and enforcing judgments against foreign entities or other adverse political, social or diplomatic developments that could

affect the Fund’s investments. Foreign investments may be less liquid and their prices more volatile than the securities of U.S. companies.

Geographic Risk.

To the extent that the Fund invests a significant portion of its assets in any one country, the Fund will be

subject to greater risk of loss or volatility than if the Fund always maintained wide geographic diversity among the countries in which it invests. Investing in any one country makes the Fund more vulnerable to the risks of adverse securities

markets, exchange rates and social, political, regulatory and economic events in that one country.

Interest Rate

Risk.

Normally, the values of fixed-income securities vary inversely with changes in prevailing interest rates. The value of the Fund’s securities tends to decrease when interest rates rise and tends to increase when

interest rates fall. Securities with longer durations held by the Fund are generally more sensitive to interest rate changes. As such, securities with longer durations are usually more volatile than those with shorter durations. It is likely there

will be less governmental intervention in the near future to maintain low interest rates. The negative impact on fixed income securities from the resulting rate increases for that and other reasons could be swift and significant and negatively

impact the Fund’s net asset value.

7

Leverage Risk.

The Fund’s investments in derivatives, including the Swaps, or

exposure to derivatives through Underlying Vehicles expose the Fund to leverage inherent in such instruments. Such leveraged investments can amplify the effects of market volatility on the Fund’s net asset value (i.e., relatively small market

movements may result in large changes in the Fund’s net asset value) and make the Fund’s returns more volatile. At times, the Fund’s leveraged investments may cause the Fund’s investment exposure to exceed its net assets and

could cause the Fund to experience substantial losses, including the risk of total loss, if the market moves against the Fund. The use of leveraged investments may also cause the Fund to liquidate portfolio positions when it would not be

advantageous to do so in order to satisfy its obligations or to meet asset segregation requirements. The use of leveraged investments may also cause the Fund to have higher expenses than those of mutual funds that do not use such techniques.

Liquidity Risk.

Investments that trade less can be more difficult or more costly to buy, or to sell, than more liquid or active

investments. It may not be possible to sell or otherwise dispose of illiquid securities both at the price and within a time period deemed desirable by the Fund. The Fund’s investment in the Swaps and Underlying Vehicles are subject to liquidity

risk.

Mortgage-Backed/Asset-Backed Securities Risk.

The value of the Fund’s mortgage-backed or asset-backed securities

may be affected by, among other things, changes in interest rates, factors concerning the interests in and structure of the issuer or the originator of the mortgages, the creditworthiness of the entities that provide any supporting letters of

credit, surety bonds or other credit enhancements or the market’s assessment of the quality of underlying assets.

New Fund

Risk.

Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies, may be unable to implement certain of its investment strategies or may fail to attract sufficient

assets, any of which could result in the Fund being liquidated and terminated at any time without shareholder approval and at a time that may not be favorable for all shareholders. Such a liquidation could have negative tax consequences for

shareholders and will cause shareholders to incur expenses of liquidation.

Non-Diversified Risk.

The Fund is classified as

non-diversified under the 1940 Act. This means that the Fund may invest in securities of relatively few issuers. Thus, the performance of one or a small number of portfolio holdings may have a significant impact on the overall performance of the

Fund.

Private Placement Risk.

Investments in private placements may be difficult to sell at the time and at the price

desired by the Fund; companies making private placements may make less information available than publicly offered companies; and privately placed securities are more difficult to value than publicly traded securities. These factors may have a

negative effect on the performance of the Fund. Securities acquired through private placements are not registered for resale in the general securities market and may be classified as illiquid.

Regulatory Risk.

Future regulatory developments could impact the Fund’s ability to invest in certain derivatives. It is

possible that government regulation of various types of derivative instruments, including futures, options and swap agreements, may limit or prevent the Fund from using such instruments as a part of its investment strategies, and could ultimately

prevent the Fund from being able to achieve its investment objective. It is impossible to fully predict the effects of past, present or future legislation and regulation in this area, but the effects could be substantial and adverse. There is a

likelihood of future regulatory developments altering, perhaps to a material extent, the nature of an investment in the Fund or the ability of the Fund to continue to implement its investment strategies. It is possible that legislative and

regulatory activity could limit or restrict the ability of the Fund to use certain instruments as a part of its investment strategies. Limits or restrictions applicable to the counterparties with which the Fund engages in derivative transactions

(for example, the so-called “Volcker Rule” prescribed by the

Dodd-Frank

Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which was signed into law on July 21,

2010) could also prevent the Fund from using certain instruments, including one or more of the Swaps.

8

The Dodd-Frank Act sets forth a regulatory framework for OTC derivatives, including financial instruments, such

as swaps, in which the Fund may invest. The Dodd-Frank Act grants significant authority to the Securities and Exchange Commission (the “SEC”) and the Commodity Futures Trading Commission (the “CFTC”) to regulate OTC derivatives

and market participants, and requires clearing and exchange trading of many current OTC derivatives transactions. The implementation of the provisions of the Dodd-Frank Act by the SEC and the CFTC could adversely affect the Fund’s ability to

pursue its investment strategies. The Dodd-Frank Act and the rules promulgated thereunder could, among other things, adversely affect the value of the investments held by the Fund, restrict the Fund’s ability to engage in derivatives

transactions and/or increase the costs of such derivatives transactions.

Short Position Risk.

The Fund will incur a loss as

a result of a short position in a financial instrument if the price of the financial instrument increases in value between the date the short position is established and the date on which the Fund enters into an offsetting transaction. Short

positions may be considered speculative transactions and involve special risks. The Fund’s losses are potentially unlimited in a short position transaction.

Share Ownership Concentration Risk.

To the extent that a significant portion of the Fund’s shares are held by a limited

number of shareholders or their affiliates, there is a risk that the share trading activities of these shareholders could disrupt the Fund’s investment strategies, which could have adverse consequences for the Fund and other shareholders (e.g.,

by requiring the Fund to sell investments at inopportune times or causing the Fund to maintain larger-than-expected cash positions pending acquisition of investments). In addition, separate accounts managed by the Advisor may invest in the Fund and,

therefore, the Advisor at times may have discretionary authority over a significant portion of the assets of the Fund. In such instances, the Advisor’s decision to make changes to or rebalance its clients’ allocations in the separate

accounts may substantially impact the Fund’s performance.

Subsidiary Risk.

The Commodity Fund Subsidiary is not

registered under the 1940 Act and is not subject to the investor protections of the 1940 Act. By investing in the Commodity Fund Subsidiary, the Fund is exposed to the risks associated with the Commodity Fund Subsidiary’s investments. In

addition, the Fund has agreed with a Swap counterparty to guarantee the obligations of the Commodity Fund Subsidiary to the Swap counterparty. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the

Fund and/or the Commodity Fund Subsidiary to operate as described in the Prospectus and could adversely affect the Fund.

Swap

Risk.

Swaps that are not centrally cleared are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund. Swaps are also subject the risk that the Fund will not be able to meet

its obligations to pay the counterparty to the swap. Swap agreements may also involve fees, commissions or other costs that may reduce the Fund’s gains from a swap agreement or may cause the Fund to lose money. As described in the Principal

Investment Strategies section, the Fund currently invests through the Commodity Fund Subsidiary in one or more Swaps. The Fund’s investments in the Swaps are subject to Leverage Risk as described above because the aggregate notional amounts of

the Swaps and/or the aggregate notional allocations to the CTAs included in the Underlying Indexes may exceed the net assets of the Fund. The Fund’s returns are reduced or its losses increased by the fees associated with the Swaps, which are

the fees deducted in the calculation of the Swap values and the levels of the Underlying Indexes. The fees associated with the Swaps, which may be significant, will vary depending on the notional amounts of the Swaps, the notional allocations to the

CTAs included in the Underlying Indexes and the performance of the CTA trading strategies and are separate from and in addition to the Fund’s operating expenses shown in the Annual Fund Operating Expenses table. In addition, there is the risk

that a Swap may be terminated by the Fund or the Swap counterparty in accordance with its terms or as a result of regulatory changes as described in Regulatory Risk above. If one or more Swaps were to terminate, the Fund may be unable to implement

its investment strategies with respect to commodities investments and the Fund may not be able to seek to achieve its investment objective.

9

Tax Risk.

In order for the Fund to qualify as a regulated investment company under

Subchapter M of the Internal Revenue Code of 1986, as amended, the Fund must derive at least 90% of its gross income each taxable year from certain qualifying sources of income (“qualifying income”). The Fund’s intention to qualify as

a regulated investment company may limit its ability to make certain investments including, without limitation, investments in certain commodity-linked derivatives, since income from commodity-linked derivatives may not constitute qualifying income

to the Fund. Receipt of such income could cause the Fund to fail to qualify as a regulated investment company and be subject to U.S. federal income tax on its taxable income at corporate rates. The Fund has applied for a private letter ruling from

the Internal Revenue Service (the “IRS”) confirming that income derived from the Fund’s investment in the Commodity Fund Subsidiary will constitute qualifying income to the Fund. The IRS has currently suspended the issuance of such

private letter rulings. There can be no assurance that the IRS will grant the private letter ruling requested by the Fund. The Fund currently is relying on advice of tax counsel with respect to the tax treatment of income from the Commodity Fund

Subsidiary. Advice of tax counsel is not binding of the IRS or the courts. If the IRS does not grant the private letter ruling request, there is a risk that the IRS could assert that income derived from the Fund’s investment in the Commodity

Fund Subsidiary does not constitute qualifying income to the Fund, in which case, the Fund could fail to qualify as a regulated investment company and could be subject to federal income tax at the fund level. Should the IRS take action that

adversely affects the tax treatment of income derived from the Fund’s investment in the Commodity Fund Subsidiary, the Fund could be limited in its ability to implement its current investment strategies and the Fund may need to significantly

change its investment strategies, which could adversely affect the Fund. The Fund also may incur transaction and other costs to comply with any new or additional guidance from the IRS. The tax treatment of commodity-linked derivatives and income

from the Commodity Fund Subsidiary also may be adversely affected by future legislation, Treasury Regulations and/or guidance issued by the IRS that could affect the character, timing and/or amount of the Fund’s taxable income or any gains and

distributions made by the Fund.

Underlying Vehicle Risk.

The Underlying Vehicles in which the Fund may invest are subject

to specific risks, depending on the strategy and investment techniques employed by the CTA. These risks, as described herein, include Aggressive Investment Technique Risk, Commodities Market Risk, Commodity Risk, Derivatives Risk and Leverage Risk

and may also include Currency Risk, Emerging Markets Risk, Foreign Investment Risk, Liquidity Risk, Short Position Risk and Swap Risk. By investing in the Fund, shareholders of the Fund will indirectly bear the fees and expenses of any Underlying

Vehicles, including fees paid to the CTAs of the Underlying Vehicles, in addition to the Fund’s direct fees and expenses. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in the Underlying

Vehicles and may be higher than other mutual funds that invest directly in the types of derivatives held by the Underlying Vehicles. CTAs will charge fees for the services they provide to the Underlying Vehicles. These fees may be fixed and/or

performance-based. Fees charged by the CTAs typically are based on the leveraged account size and not the actual cash invested in the Underlying Vehicle. Fixed fees may range from 1% to 3% of the leveraged account size. To the extent the aggregate

leveraged account sizes of the Underlying Vehicles exceed the net assets of the Fund, the fixed fees of the CTAs would exceed 3% as a percentage of the Fund’s net assets. Performance-based fees may range from 15% to 30% of each Underlying

Vehicle’s returns and are computed for each Underlying Vehicle without regard to the performance of the Fund or other Underlying Vehicles. Accordingly, the Fund may pay a performance fee to a CTA with positive investment performance, even if

the Fund’s overall returns are flat or negative.

In addition, certain of the Underlying Vehicles in which the Fund may invest may be commodity

pools, which are subject to regulation under the Commodity Exchange Act and CFTC rules. Compliance with the Commodity Exchange Act and CFTC rules subjects commodity pools to additional laws, regulations and enforcement policies, which may increase

compliance costs and may affect the cost of investing in the Underlying Vehicle.

10

FUND PERFORMANCE HISTORY:

The information below provides some indication of the

risks of investing in the Fund by showing changes in the Fund’s performance and by showing how the Fund’s average annual returns for the years indicated compare with those of a broad measure of market performance. The Fund’s past

performance (before and after taxes) does not necessarily indicate how it will perform in the future. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

Annual Total Returns.

The bar chart below provides an illustration of the Fund’s performance in the calendar year since the

Fund started for Class N shares.

|

|

|

|

|

|

|

|

Highest Quarterly

Return

0.43% (3Q13)

|

|

Lowest Quarterly

Return

(1.96)% (4Q13)

|

Average Annual Total Returns

(For the periods ended December 31, 2013)

.

The table

shows returns on a before-tax and after-tax basis for Class N shares and on a before tax basis for Class I shares. After-tax returns for Class I shares will vary. After-tax returns are calculated using the historical highest individual federal

marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the

investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not

relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

Life of the Fund

(April 25, 2012)

|

|

|

Class N Shares

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

(3.60)%

|

|

|

|

(4.41)%

|

|

|

Return After Taxes on Distributions

|

|

|

(4.21)%

|

|

|

|

(4.84)%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

(2.03)%

|

|

|

|

(3.53)%

|

|

|

|

|

|

|

Class I Shares

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

(3.45)%

|

|

|

|

(4.18)%

|

|

|

|

|

|

|

Morningstar Long/Short Commodity Index*

(reflects no deduction for fees, expenses or taxes)

|

|

|

5.20%

|

|

|

|

(6.30)%

|

|

|

*

|

The Morningstar Long/Short Commodity Index is a commodity futures index that uses the momentum rule to determine if each commodity is held long, short, or flat. The momentum rule compares a commodity's price to its

12-month moving average. If at monthly rebalance a commodity price is above its 12-month moving average, the index will take a long position. If the price is below its 12-month moving average, the index will take a short position. However, if the

commodity is in the energy sector and the price is below its 12-month moving average, the index takes a flat position (position moved to cash).

|

11

There were no Institutional Class shares issued as of December 31, 2013. The returns for the Institutional

Class shares will be substantially similar to those of the Class N shares shown in the bar chart and table above because all shares of the Fund are invested in the same portfolio of securities. The annual returns of the Institutional Class shares

will differ from the Class N shares only to the extent that the expenses of the classes differ.

MANAGEMENT:

Investment Advisor.

William Blair & Company, L.L.C. is the investment advisor of the Fund.

Portfolio Manager(s).

John Abunassar, an Associate of the Advisor, Peter Carl, an Associate of the Advisor, D. Trowbridge

Elliman III, an Associate of the Advisor, Jason Moede, an Associate of the Advisor, Christopher Walvoord, an Associate of the Advisor, and Brian Ziv, a Partner of the Advisor, co-manage the Fund. Messrs. Abunassar, Carl, Elliman, Walvoord and Ziv

have each co-managed the Fund since its inception in 2012. Mr. Moede has co-managed the Fund since 2013.

PURCHASE AND SALE OF FUND SHARES:

Class N Share Purchase.

The minimum initial investment for a regular account or an Individual Retirement Account is

$2,500. The minimum subsequent investment is $1,000. Certain exceptions to the minimum initial and subsequent investment amounts may apply. See “Your Account—Class N Shares” for additional information on eligibility requirements

applicable to purchasing Class N shares.

Class I Share Purchase.

The minimum initial investment for a regular account or an

Individual Retirement Account is $500,000 (or any lesser amount if, in the Advisor’s opinion, the investor has adequate intent and availability of funds to reach a future level of investment of $500,000). There is no minimum for subsequent

purchases. The Distributor reserves the right to offer Class I shares without regard to the minimum purchase amount requirements to qualified or non-qualified employee benefit plans when an unaffiliated third party provides administrative and/or

other support services to the plan. Certain exceptions to the minimum initial investment amount may apply. Class I shares are only available to certain investors. See “Your Account—Class I Shares” for additional information on the

eligibility requirements applicable to purchasing Class I shares.

Institutional Class Share Purchase.

The minimum initial

investment is $5 million. There is no minimum for subsequent purchases. The Distributor reserves the right to offer Institutional Class shares without regard to the minimum purchase amount requirements to qualified or non-qualified employee benefit

plans when an unaffiliated third party provides administrative and/or other support services to the plan. Certain exceptions to the minimum initial investment amount may apply. Institutional Class shares are only available to certain investors. See

“Your Account—Institutional Class Shares” for additional information on eligibility requirements applicable to purchasing Institutional Class shares.

Sale.

Shares of the Fund are redeemable on any day the New York Stock Exchange is open for business by mail, wire or telephone,

depending on the elections you make in the account application.

TAX INFORMATION:

The Fund intends to make distributions

that may be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred investment plan. If you are investing through a tax-deferred investment plan, you may be subject to taxes after exiting the tax-deferred

investment plan.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES:

If you purchase shares of the Fund through

a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the

broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12

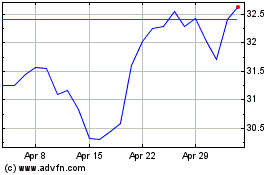

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From Jul 2023 to Jul 2024