Filed

by Southwestern Energy Company

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject

Company: Southwestern Energy Company

SEC File No.: 001-08246

Date: May 7, 2024

On May

7, 2024, Bill Way, President and Chief Executive Officer of Southwestern Energy Company (“Southwestern”) sent an email to

Southwestern employees, which contained the following:

Dear Colleagues,

Today, an

S-4 form was filed with the SEC, updating the market on the pending merger with Chesapeake. The filing contained the Executive

Officers for the new company, as well as the members of the Board of Directors.

As previously

announced, Nick Dell’Osso will serve as President and CEO. In addition, the following individuals will serve as Executive

Officers of NewCo:

| 1. | Chris

Lacy will serve as Executive Vice President, General Counsel and Corporate Secretary |

| 2. | Mohit

Singh will serve as Executive Vice President and Chief Financial Officer |

| 3. | Josh

Viets will serve as Executive Vice President and Chief Operation Officer |

Mike Wichterich from Chesapeake will serve as Chairman of the Board

of Directors. Joining the Board for NewCo will be John Gass, Catherine Kehr, Shameek Konar and Anne Taylor from Southwestern and Nick

Dell’Osso, Timothy Duncan, Benjamin Duster, Sarah Emerson, Matt Gallagher and Brian Steck from Chesapeake.

The broader

NewCo leadership team, which will be comprised of leaders from both Chesapeake and Southwestern, will be announced in the coming weeks.

Thank

you again for all you are doing to deliver on our business objectives safely and efficiently while also progressing integration

planning for NewCo. We look forward to working together with Chesapeake to build a stronger company that will play a leadership role

in accelerating America’s energy reach.

Please let me know if you have any questions.

Thanks,

Bill

CAUTIONARY

STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This

communication includes certain statements that may be deemed to be forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact or present financial information,

included in this communication that address activities, outcomes and other matters that Southwestern or Chesapeake expects, believes

or anticipates will or may occur in the future, including, without limitation, statements regarding the proposed transaction between

Southwestern and Chesapeake (the “proposed transaction”), the expected closing of the proposed transaction and the

timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt

levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future

performance, including an expected accretion to earnings and free cash flow and dividend payments, are forward looking statements. Although

we and Chesapeake believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements

are not guarantees of future performance. We and Chesapeake have no obligation and make no undertaking to publicly update or revise any

forward-looking statements, except as may be required by law.

Forward-looking

statements include the items identified in the preceding paragraph, information concerning possible or assumed future results of operations

and other statements in this communication identified by words such as “anticipate,” “intend,” “plan,”

“project,” “predict,” “estimate,” “continue,” “potential,” “should,”

“could,” “may,” “will,” “shall,” “become,” “objective,” “guidance,”

“outlook,” “effort,” “expect,” “believe,” “predict,” “budget,”

“projection,” “goal,” “forecast,” “model,” “target,” or similar words. Statements

may be forward-looking even in the absence of these particular words.

You

should not place undue reliance on forward-looking statements. They are subject to known and unknown risks, uncertainties and other factors

that may affect our operations, markets, products, services and prices and cause our actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These

forward-looking statements are based on current beliefs of the management of Southwestern and Chesapeake, based on currently available

information, as to the outcome and timing of future events. In addition to any assumptions and other factors referred to specifically

in connection with forward-looking statements, risks, uncertainties and factors that could cause actual results to differ materially

from those indicated in any forward-looking statement include, but are not limited to: the risk that Southwestern’s and Chesapeake’s

businesses will not be integrated successfully; the risk that cost savings, synergies and growth from the proposed transaction may not

be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined company or its subsidiaries

may be different from what the companies expect; the possibility that shareholders of Chesapeake may not approve the issuance of new

shares of Chesapeake Common Stock in the proposed transaction or that shareholders of Chesapeake or shareholders of Southwestern may

not approve the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied, that either

party may terminate the Merger Agreement or that the closing of the proposed transaction might be delayed or not occur at all; potential

adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of

the proposed transaction; the risk the Parties do not receive regulatory approval of the proposed transaction; the occurrence of any

other event, change or other circumstances that could give rise to the termination of the Merger Agreement; the risk that changes in

Chesapeake’s capital structure and governance could have adverse effects on the market value of its securities; the ability of

Southwestern and Chesapeake to retain customers and retain and hire key personnel and maintain relationships with their suppliers and

customers and on Southwestern’s and Chesapeake’s operating results and business generally; the risk the proposed transaction

could distract management from ongoing business operations or cause Southwestern and/or Chesapeake to incur substantial costs; the risk

of any litigation relating to the proposed transaction; the risk that Chesapeake may be unable to reduce expenses or access financing

or liquidity; the impact of COVID-19 or other diseases; the impact of adverse changes in interest rates and inflation; and the risk of

changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters. All

such factors are difficult to predict and are beyond our and Chesapeake’s control, including those detailed in our Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on our website at www.swn.com under

the “Investors” tab and on the website of the SEC at www.sec.gov, and those detailed in Chesapeake’s Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on Chesapeake’s website

at http://investors.chk.com/ and on the website of the SEC.

Should

one or more of the risks or uncertainties described above or elsewhere in this communication occur, or should underlying assumptions

prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. We specifically

disclaim all responsibility to update publicly any information contained in a forward-looking statement or any forward-looking statement

in its entirety and therefore disclaim any resulting liability for potentially related damages.

All

forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement.

Important

Additional Information Regarding the Transaction Has Been Filed with the SEC and Where to Find It

In

connection with the proposed transaction between Southwestern and Chesapeake, Chesapeake has filed with the SEC a registration statement

to register the shares of Chesapeake’s common stock to be issued in connection with the proposed transaction. The registration

statement will include a document that serves as a prospectus of Chesapeake and a joint

proxy statement of each of Southwestern and Chesapeake (the “joint proxy statement/prospectus”), and each party will

file other documents regarding the proposed transaction with the SEC. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY

STATEMENT/PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND

OTHER RELEVANT DOCUMENTS FILEDBY SOUTHWESTERN

AND CHESAPEAKE WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SOUTHWESTERN

AND CHESAPEAKE, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

After

the Registration Statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to shareholders

of Southwestern and shareholders of Chesapeake as of the record date. Investors

will be able to obtain free copies of the Registration Statement and the joint proxy statement/prospectus, as each may be amended from

time to time, and other relevant documents filed by Southwestern and Chesapeake with the SEC (when they become available) through the

website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Southwestern, including the

joint proxy statement/prospectus (when available), will be available free of charge from Southwestern’s website at www.swn.com under

the “Investors” tab. Copies of documents filed with the SEC by Chesapeake, including the joint proxy statement/prospectus

(when available), will be available free of charge from Chesapeake’s website at www.chk.com under the “Investors”

tab.

Participants

in the Solicitation

Southwestern

and certain of its directors, executive officers and other members of management and employees, Chesapeake, and certain of its directors,

executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from

Southwestern’s shareholders and the solicitation of proxies from Chesapeake’s shareholders, in each case with respect to

the proposed transaction. Information about Southwestern’s directors and executive officers is available in Southwestern’s

Annual Report on Form 10-K for the 2023 fiscal year filed with the SEC on February 22, 2024 and its amendment to its Annual Report on

Form 10-K for the 2023 fiscal year (when available), and in the joint proxy statement/prospectus (when available). Information about

Chesapeake’s directors and executive officers is available in its Annual Report on Form 10-K for the 2023 fiscal year filed with

the SEC on February 21, 2024 and its definitive proxy statement for the 2024 annual meeting of shareholders (when available), and the

joint proxy statement/prospectus (when available). Other information regarding the participants in the solicitations and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the joint

proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become

available. Shareholders of Southwestern, shareholders of Chesapeake, potential investors and other readers should read the joint proxy

statement/prospectus carefully when it becomes available before making any voting or investment decisions.

No

Offer or Solicitation

This communication

is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer

to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

Exhibit

99.A

| NewCo’s Named Executive Officers:

Nick Dell’Osso, Jr.

NewCo President and Chief Executive Officer

Mr. Dell’Osso was appointed President and Chief Executive Officer in October 2021.

He previously served as Executive Vice President and Chief Financial Officer since

November 2010. Prior to that time, he served as Vice President – Finance and Chief

Financial Officer of Chesapeake’s wholly owned midstream subsidiary Chesapeake

Midstream Development, L.P. from August 2008 to November 2010.

Before joining Chesapeake, Mr. Dell’Osso was an energy investment banker with Jefferies & Co. from 2006 to 2008

and Banc of America Securities from 2004 to 2006.

He graduated from Boston College in 1998 and earned his M.B.A. from the University of Texas at Austin in 2003.

Chris Lacy

NewCo Executive Vice President, General Counsel and Corporate Secretary

Mr. Lacy is Senior Vice President, General Counsel and Secretary of Southwestern

Energy. He joined the company in 2014 as chief litigation counsel and has held

various roles of progressively increasing responsibility. Before joining Southwestern

Energy, Chris was with Dewey & LeBouef, LLP and Ahmad, Zavitsanos, Anaipakos,

Alavi & Mensing P.C. and has nearly 20 years of experience representing clients in

the energy industry.

Chris earned his bachelor’s degree in Communication from the University of Texas and his juris doctorate degree

from the University of Houston Law Center where he graduated summa cum laude and served as a Notes and

Comments editor for the Houston Law Review.

Mohit Singh

NewCo Executive Vice President and Chief Financial Officer

Mr. Singh was appointed Executive Vice President and Chief Financial Officer in

December 2021. For the last six years, Mr. Singh has served on the executive

leadership team at BPX Energy, the United States onshore subsidiary of BP. He

most recently led the M&A, corporate land and reserves functions, having previously

served as Head of Business Development and Exploration and as Senior Vice

President – North Business Unit. Prior to joining BPX, Mr. Singh worked as an investment banker focused on

oil and gas transactions for RBC Capital Markets and Goldman Sachs.

A chemical engineer by training, he began his career at Shell Exploration & Production Company where he held

business planning, reservoir engineering and research engineering roles of increasing importance.

Mr. Singh earned a PhD in Chemical Engineering from the University of Houston, an MBA from the University of

Texas and a BTech in Chemical Engineering from the Indian Institute of Technology. |

| Josh Viets

NewCo Executive Vice President and Chief Operating Officer

Mr. Viets was appointed Executive Vice President and Chief Operating Officer in

February 2022. He most recently served as the Vice President, Delaware Basin in

the Permian Basin Business Unit for ConocoPhillips.

Mr. Viets began his career with ConocoPhillips in 2002, working in a variety of tech-nical and leadership roles in the U.S. and the United Kingdom. He has held leadership positions in operations,

engineering, subsurface and asset management. Earlier in his career, he worked as a reservoir and production

engineer supporting a diverse set of assets across the ConocoPhillips portfolio.

Mr. Viets earned a Bachelor of Science in Petroleum Engineering from Colorado School of Mines in 2001. |

Exhibit 99.B

| NewCo’s Board of Directors:

Michael A. Wichterich

Chairman of the Board

Mr. Wichterich has served as Chair of Chesapeake’s Board of Directors since October

2021. He previously served as Chair of the Board of Directors since February 2021,

and as the Company’s Interim Chief Executive Officer from April to October 2021.

Mr. Wichterich is Founder and Chief Executive Officer of Three Rivers Operating

Company LLC, a private exploration and production company with a focus in the

Permian Basin. Prior to founding Three Rivers Operating, Mr. Wichterich served as the Chief Financial Officer of

Texas American Resources, New Braunfels Utilities and Mariner Energy (NYSE: ME). Additionally, Mr. Wichterich

began his career with PricewaterhouseCoopers in its energy auditing practices. Mr. Wichterich also serves as

a board member of Grizzly Energy, Bruin E&P Operating and Extraction Oil and Gas (Nasdaq: XOG). He earned

a B.B.A. from the University of Texas.

Nick Dell’Osso, Jr.

Mr. Dell’Osso was appointed President and Chief Executive Officer in October 2021.

He previously served as Executive Vice President and Chief Financial Officer since

November 2010. Prior to that time, he served as Vice President – Finance and Chief

Financial Officer of Chesapeake’s wholly owned midstream subsidiary Chesapeake

Midstream Development, L.P. from August 2008 to November 2010.

Before joining Chesapeake, Mr. Dell’Osso was an energy investment banker with Jefferies & Co. from 2006 to 2008

and Banc of America Securities from 2004 to 2006.

He graduated from Boston College in 1998 and earned his M.B.A. from the University of Texas at Austin in 2003.

Timothy S. Duncan

Mr. Duncan has served as a member of Chesapeake Energy Corporation’s Board

of Directors since February 2021. Mr. Duncan is the President and Chief Executive

Officer and a founder of Talos Energy Inc. (NYSE: TALO), where he has also served

as a director since April 2012. Prior to Talos Energy, he was the Senior Vice President

of Business Development and a founder of Phoenix Exploration Company LP. Mr.

Duncan is an active member of the Society of Petroleum Engineers, the Independent

Petroleum Association of America, and the National Ocean Industries Association (NOIA). Mr. Duncan currently

serves as the Chairman of NOIA and he served as Vice Chairman in 2020. Additionally, he serves on the board of

the American Cancer Society CEOs Against Cancer Houston Chapter. Mr. Duncan also serves on various academ-ically-focused boards, including the College of Engineering Dean’s Advisory Council and the Foundation Board at

Mississippi State University. Mr. Duncan earned a B.S. in petroleum engineering from Mississippi State University

and an M.B.A. from the Bauer Executive Program at the University of Houston. |

| Benjamin C. Duster, IV

Mr. Duster has served as a member of Chesapeake Energy Corporation’s Board of

Directors since February 2021. He also serves as a member of the Board of Directors

of Weatherford International, plc. (Nasdaq: WFRD). Mr. Duster’s extensive experience

also includes service on the boards of Alaska Communications Systems Group, Inc.

(Nasdaq: ALSK), Netia, S.A. (Warsaw Stock Exchange: NET), RCN Corporation

(Nasdaq: RCN) and Multi-Fineline Electronics (Nasdaq: MFLX). Mr. Duster is Founder

and CEO of Cormorant IV Corporation, LLC, a consulting firm specializing in operational turnarounds and organi-zational transformations. He is a 30-year veteran of Wall Street with extensive experience in M&A and Strategic

Advisory Services in both developed and emerging markets. He earned a B.A. in Economics, with honors, from Yale

University, a J.D. from Harvard Law School and an M.B.A. from Harvard Business School.

Sarah A. Emerson

Ms. Emerson has served as a member of Chesapeake Energy Corporation’s Board

of Directors since February 2021. Ms. Emerson is currently the President of Energy

Security Analysis, Inc. (ESAI) and the Managing Principal at ESAI Energy, LLC, which

conducts research, forecasting and consulting on markets related to global petroleum,

natural gas, NGLs, alternative fuels and vehicle technologies. She joined ESAI upon

the launch of its petroleum consulting practice in 1986. Ms. Emerson also serves as

a Senior Associate at the Center for Strategic and International Studies, and she has been a Senior Fellow at the

Kennedy School at Harvard University. Additionally, she serves on the Advisory Council for the College of Arts and

Sciences at Cornell University. Ms. Emerson earned her M.A. from the Johns Hopkins Nitze School of Advanced

International Studies and her B.A. from Cornell University.

Matt M. Gallagher

Mr. Gallagher has served as a member of Chesapeake Energy Corporation’s Board of

Directors since February 2021. Mr. Gallagher most recently served as President and

Chief Executive Officer of Parsley Energy Inc. (NYSE: PE). He joined Parsley in 2010 to

build its Engineering and Geoscience Department and was named Vice President and

Chief Operating Officer in 2014. He was promoted to President and Chief Operating

Officer in 2017 before being appointed President and Chief Executive Officer in 2019.

Prior to joining Parsley, Mr. Gallagher spent five years at Pioneer Natural Resources (NYSE: PXD). Mr. Gallagher also

serves on the Board of Pioneer. He is currently President and Chief Executive Officer of Greenlake Energy Ventures

and is a Venture Partner at NGP Energy Capital. He earned a B.S. in Petroleum Engineering from the Colorado

School of Mines. |

| John D. Gass

Mr. Gass began his career in 1974 in Chevron’s Gulf of Mexico business unit in New

Orleans, and over the next 38 years held positions of increasing responsibility, including

heading the company’s exploration and production operations in southern Africa and

in Australia and Papua New Guinea. Mr. Gass served as a director of Sasol Chevron

Holdings Ltd and GS Caltex. Mr. Gass also served as a director of Weatherford Interna-tional, Ltd. from 2013 through 2019 and a director of Suncor Energy Inc. from 2014

through 2022.

Catherine A. Kehr

Ms. Kehr retired in 2006 as a Senior Vice President and Director of Capital Research

Company, a division of The Capital Group Companies, one of the world’s largest

investment management organizations and manager of the American Funds. In this

role, Ms. Kehr was responsible for investment analysis and a portfolio manager of

global energy equities. Prior to that, Ms. Kehr was an investment analyst and portfolio

manager with responsibility for global energy high yield debt. Prior to her tenure with

The Capital Group Companies, she held various managerial positions at Atlantic Richfield Company and Payden and

Rygel. In 2002, the Reuters Survey ranked Ms. Kehr among the top 10 individual U.S. fund managers. Ms. Kehr was

a director of California Resources Corporation from February 2015 through May 2017.

Shameek Konar

Mr. Konar served as Chief Executive Officer of Pilot Company (Pilot), one of the lead-ing suppliers of fuel (~1 million barrels a day) to retail and wholesale customers and

the largest operator of travel centers in North America, from 2021 through May 2023.

He also served as Chief Strategy Officer of Pilot from 2017 through 2020. During Mr.

Konar’s tenure at Pilot, he was instrumental in growing Pilot’s energy business through

the execution of several strategic acquisitions and building internal capabilities for

procuring, transporting and supplying fuel. Prior to joining Pilot, Mr. Konar served as Chief Investment Officer, Global

Head of Business Development, of Castleton Commodities International (CCI) from 2015 to 2017. From 2012 to

2015, he served as the Chief Investment Officer and member of the Management Committee of Mercuria Energy

Group (Mercuria). During Mr. Konar’s tenure at both CCI and Mercuria, he oversaw mergers, acquisitions and

operations of physical assets, including oil and gas production, ports, power plants and mines, across each firm’s

commodities merchant platforms globally. Prior to that, Mr. Konar served as Managing Director and Co-Head Global

Commodities and Principal Investing of Goldman Sachs Group (Goldman) from 2009 to 2012, where he focused on

growing Goldman’s physical natural gas and crude oil businesses. From 2003 to 2009, he worked at Constellation

Energy Group and held several positions of increasing responsibility, including as Senior Vice President of Corporate

Strategy and Development and served on the Executive Management Committee of the company. Mr. Konar began

his career in consulting, serving energy companies and working on various energy policy issues in 1995, having

worked at PA Consulting and subsequently Accenture.

Mr. Konar earned a Ph.D. in economics and finance from Vanderbilt University in Nashville and a Bachelor of Arts in

economics and mathematics from St. Stephen’s College in India. Mr. Konar sits on the advisory board of the Haslam |

| School of Business at the University of Tennessee and is a member of the board of directors of The Conservation

Fund, a non-profit organization and the Knoxville Zoo. From 2017 to 2022, he served as a director of One Map

Minerals, a privately held company focusing on the ownership of oil and gas mineral interests.

Brian Steck

Mr. Steck has served as a member of Chesapeake Energy Corporation’s Board of

Directors since February 2021. Mr. Steck is the Co-Founder and Chief Executive Office

of WhiteOwl Energy, LLC. Until August 2020, Mr. Steck served as a Partner at Mangrove

Partners, where he had worked since 2011. Previously, Mr. Steck was Head of U.S.

Equities at Tisbury Capital, and earlier in his career he spent ten years at UBS (NYSE:

UBS) and its predecessors, where he was Global Co-Head of Equity Hedge Fund

Coverage. Mr. Steck previously served on the Board of Directors of Civitas Resources, Inc. (NYSE: CIVI) and its

predecessor, Bonanza Creek Energy, Inc. (NYSE: BCEI), California Resources Corporation (NYSE: CRC) and Penn

Virginia Corporation (Nasdaq: PVAC) (now known as Ranger Oil Corporation). Mr. Steck received a B.S., with the

highest honors, from the University of Illinois at Urbana-Champaign.

Anne Taylor

Ms. Taylor retired in June 2018 from Deloitte, which she joined in 1987. She held

numerous top executive positions with that firm, including Vice Chairman and

Managing Partner of the Houston office, U.S. Chief Strategy Officer, and Global

Leader for e-business. She also was a member of the U.S. Board of Directors, where

she served on the U.S. and Global Nominating Committees, the CEO Evaluation

Committee, and chaired the Strategic Investment Committee. She also served on

the board of Deloitte Consulting LLP.

Ms. Taylor received Bachelor of Science and Master of Science degrees in Engineering from the University of Utah.

She also attended Princeton University for doctorate studies in civil engineering, where she focused on transportation

and mobility. Ms. Taylor currently serves as a director of Group 1 Automotive, Inc. and Chord Energy Corporation,

both publicly traded companies, and as immediate past chairman of the board of Central Houston, Inc., a nonprofit

organization. Ms. Taylor previously served as a director of Whiting Petroleum from 2020 to 2022. She previously

served as an executive board member of the Greater Houston Partnership and United Way of Greater Houston. |

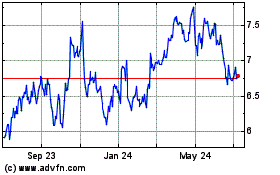

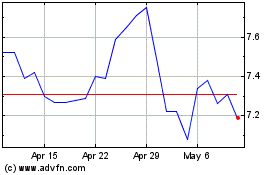

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2024 to May 2024

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From May 2023 to May 2024