SM Energy Tops Consensus - Analyst Blog

February 24 2012 - 9:45AM

Zacks

SM Energy

Company’s (SM) fourth-quarter 2011 adjusted earnings of 60

cents per share increased by over 30% from the year-ago earnings of

46 cents. The results also beat the Zacks Consensus Estimate of 56

cents.

Full-year 2011 adjusted earnings

increased nearly 87% to $2.56 per share from last year’s profit

level of $1.37.

Fourth quarter earnings recorded a

jump on the back of greater production. Production growth was

driven by robust results in the company's Eagle Ford shale and

Bakken/Three Forks programs.

Total revenue of $379.5 million

leaped 29% from $294.1 million in the prior-year quarter and

surpassed the Zacks Consensus Estimate of $347 million. Oil, gas

and natural gas liquid (NGL) production revenues contributed $396.9

million (up almost 59% year over year) to the total revenue. Total

revenues decreased compared to oil, gas and natural gas liquid

(NGL) production revenues, due to hedging losses and loss on

divestiture operations.

Full-year 2011 total revenue

increased nearly 47% to $1,603.3 million from the year-earlier

level of $1,092.8 million.

Operational

Performance

The company’s fourth-quarter

production came in at 557.9 million cubic feet equivalent per day

(MMcfe/d), up 62% year over year, and 13% above the midpoint of

management’s target range of 479–509 MMcfe/d.

SM Energy produced 313.0 million

cubic feet per day (MMcf/d) of natural gas in the quarter,

reflecting a 39% year-over-year growth. Oil production also climbed

34% year over year to 26.7 thousand barrels per day (MBbls/d).

Natural gas liquids contributed 14.1 MBbls/d to the total

volume.

Including the effect of hedging,

average equivalent price per thousand cubic feet (Mcf) was $7.58

compared with $7.98 in the year-ago period. Average realized prices

(inclusive of hedging activities) were $4.36 per Mcf of natural gas

and $80.63 per barrel of oil, down 27% and up nearly 15%,

respectively, from the comparable quarter last year.

On the cost front, unit lease

operating expense (LOE) decreased 20% year over year to 85 cents

per Mcfe in the quarter. Transportation expenses increased

substantially to 60 cents per Mcfe (from 22 cents in the year-ago

period); general and administrative expenses were 69 cents per Mcfe

(down 31%); while depletion, depreciation and amortization

(DD&A) expenses increased 9% to $3.26 per Mcfe from the

year-earlier level of $2.99 per Mcfe.

Liquidity

Operating cash flow improved to

$275.1 million during the quarter from $176.4 million in the

year-ago quarter. At the end of the quarter, SM Energy had a cash

balance of $119.2 million and long-term debt of $985.1 million,

with a debt-to-capitalization ratio of 40.2%.

Guidance

For the first quarter of 2012, SM

Energy’s production forecast is in the range of 48.5 Bcfe to 52.0

Bcfe. The company’s LOE per Mcfe will likely be in the range of 90

cents to 96 cents while, DD&A will remain in the $3.35–$3.55

range.

For 2012, SM Energy has slightly

reduced its forecast to a range of 220–227 Bcfe from 225–232 Bcfe,

to reflect the reduction of activity in the Haynesville shale

program.

SM Energy’s 2012 capital spending

is expected to remain within $1,400 million to $1,500 million.

Outlook

Denver, Colorado-based oil and gas

company, SM Energy remains proactive in its attempt to hold a

significant position in emerging shale plays and focus more on

resource, with an inventory of repeatable drilling prospects and a

high rate of return. We believe that the company’s emerging core

portfolio is a positive catalyst for visible organic growth over

the next several years.

During the year, SM Energy had set

a production growth target of 50% which it achieved by leveraging

off the considerable ground work set up in the preceding years in

the Eagle Ford as well as Bakken Three Forks programs. The company

holds an equally positive outlook for 2012 as it has the financial

strength and asset base in liquid rich plays which will facilitate

growth.

However, our long-term Outperform

recommendation stems from SM Energy’s natural gas-weighted

reserves. The company derives a significant portion of its

operating revenues from natural gas.

SM Energy’s competitor,

Range Resources Corporation (RRC) also reported

stellar fourth-quarter 2011 earnings piggybacking on higher

production level, realized prices and lower unit costs.

We currently maintain a long-term

Outperform recommendation on SM Energy. However, the company holds

a Zacks #3 Rank, which is equivalent to a short-term Hold

rating.

RANGE RESOURCES (RRC): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

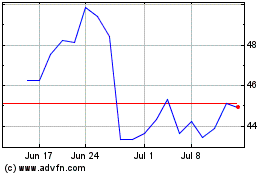

SM Energy (NYSE:SM)

Historical Stock Chart

From Apr 2024 to May 2024

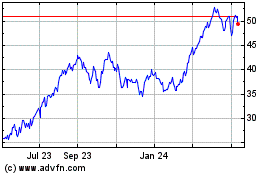

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2023 to May 2024