SM Energy Co. (SM) - Bull of the Day

January 09 2012 - 7:00PM

Zacks

We believe that

SM Energy Company's (SM) emerging core

portfolio is a catalyst for visible organic growth over the next

several years. The company's earnings in the third quarter more

than doubled from the prior-year, buoyed by higher operating

income, increased production and recognition of a gain on

divestiture activity.

The company's Eagle Ford and Bakken assets are key drivers of

liquids growth. SM Energy has significant leasehold positions in

the leading U.S. shale plays, including the Niobrara, Haynesville

and Granite Wash, which we believe will provide the company with

multiyear profitable drilling inventory.

Considering these factors, we are maintaining our recommendation

at Outperform. Our $94 price objective reflects a multiple of 13.3x

the trailing the 12-month cash flow.

SM ENERGY CO (SM): Free Stock Analysis Report

To read this article on Zacks.com click here.

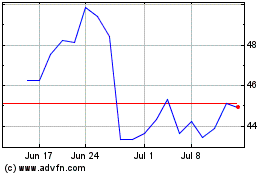

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

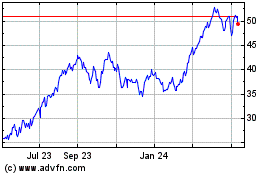

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024