SM Energy Co. (SM) - Bull of the Day

September 19 2011 - 8:00PM

Zacks

SM Energy Co. (SM) reported stellar second-quarter 2011

results, buoyed by higher production, divestitures and higher price

realization. The company also experienced a considerable 58% jump

in production volume during the quarter, exceeding its target

range.

Furthermore, SM Energy remains upbeat regarding production for

this year and the next, given impressive performances by three

Galvan Ranch Eagle Ford wells and additional capacity coming online

through 2012. We believe that the company's emerging core portfolio

is a catalyst for visible organic growth over the next several

years.

Considering these factors, we are upgrading our recommendation

to Outperform from Neutral. Our $92 price objective reflects a

multiple of 13.0x the trailing the 12-month cash flow.

SM ENERGY CO (SM): Free Stock Analysis Report

Zacks Investment Research

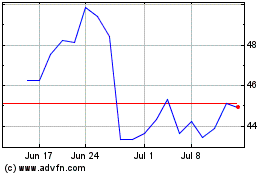

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

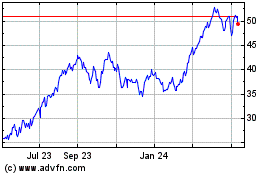

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024