Forest Beats Top and Bottom Lines - Analyst Blog

August 03 2011 - 9:15AM

Zacks

Denver-based Forest Oil

Corporation’s (FST) second quarter 2011 earnings of 36

cents per share (excluding non-recurring items), came in fairly

ahead of the Zacks Consensus Estimate of 31 cents but were below

the year-earlier numbers of 42 cents. Despite lower natural gas

price realization and net sales volumes, earnings beat our estimate

due to higher oil and natural gas liquids prices.

Total revenue in the reported

quarter increased 14.4% to $238.1 million and beat the Zacks

Consensus Estimate of $234 million.

Operational

Performance

Net sales volumes declined 27.8%

year over year organically to 334.7 million cubic feet equivalent

per day (MMcfe/d) in the reported quarter.

The average equivalent price per

Mcf (including the effect of hedging) was $6.20, up from the

year-ago realization of $5.67. Average realized natural gas price

was $4.72 per Mcf, down 0.4% from the comparable prior-year

quarter, while average realized oil price was $93.07 per barrel, up

31.4% from the year-ago quarter. Natural gas liquids (NGLs) were

sold at $36.24 per barrel, up 14.4% from second quarter 2010.

During the quarter, production

expenses increased 20.4% year over year to $1.30 per Mcfe. Unit

general and administrative expenses increased 6.5% year over year

to 33 cents per Mcfe. Depreciation and depletion expenses per unit

increased 30.3% to $1.72 per Mcfe from $1.32 per Mcfe in the

corresponding 2010 quarter.

Financials

At quarter end, Forest had $479.1

million of cash and cash equivalents with $1.87 billion of

long-term debt, representing a debt-to-capitalization ratio of

57.7% (down from 57.8% at the end of first quarter 2011).

Guidance

Forest expects net sales volume of 335–345 MMcfe/d for the second

half of 2011. Net sales volumes would comprise approximately 70%

natural gas and 30% liquids.

Management also forecasts expending

$350 million to $375 million, mainly for exploration and

development activities. As an initiative to enhance oil development

efforts, the company has increased Eagle Ford capital allocation by

$120 million in the second half of 2011. Forest also plans to begin

drilling in the Wolfcamp Shale oil play and has allocated

approximately $50 million to drill and complete six wells during

the second half of 2011 while full scale development drilling

program is expected to begin in 2012. The company will maintain its

capital spending level for the year in Granite Wash.

Forest took an important step

toward execution of the spin-off of its Canadian assets in the

second quarter.

Outlook

We like Forest Oil’s initiatives

toward increased liquids production. The company’s focus on cost

control and the upside from Eagle Ford, Granite Washand Wolfcamp

Shale position it well to weather the weakness in natural gas

prices. The company anticipates cash costs to range between $2.64

and $2.88 per Mcfe.

Forest faces tough competition from

its peers such as SM Energy Company (SM) and

Cabot Oil & Gas Corporation

(COG). Consequently, we maintain our long-term Neutral

recommendation for the stock. Forest Oil also holds a Zacks #4 Rank

(short-term Sell rating).

CABOT OIL & GAS (COG): Free Stock Analysis Report

FOREST OIL CORP (FST): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

Zacks Investment Research

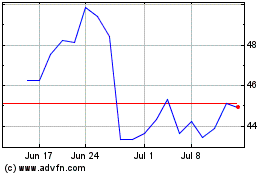

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

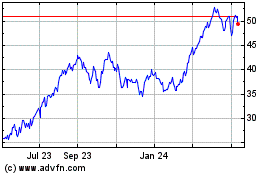

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024