Range Resources Outperforms - Analyst Blog

July 26 2011 - 9:15AM

Zacks

Range Resources

Corp. (RRC) has reported stellar second-quarter 2011

results, buoyed by higher production level and realized prices

along with lower unit costs. The company posted adjusted earnings

of 27 cents a share, substantially beating the Zacks Consensus

Estimate of 12 cents. The quarterly results improved three times

from the year-earlier profit of 9 cents a share.

Total revenue showed a 60.4%

year-over-year improvement to $306.6 million, surpassing the Zacks

Consensus Estimate of $257 million.

Operational

Performance

Production volume of 508.0 million

cubic feet equivalent per day (MMcfe/d) in the second quarter

jumped nearly 8% from the year-earlier level. Out of the total

production volume, natural gas accounted for more than 76%, while

natural gas liquids (NGLs) and oil contributed 17% and 7%,

respectively.

While natural gas and oil

production increased 2% and 4% year over year, respectively, NGLs

production surged 49%. The company’s endeavor for oil-weighted

drilling activities drove the NGL production in the quarter.

Range lost more than 100 MMcfe/d of

production when it sold its 52,000 acres of Barnett Shale

properties for $900 million on April 29, to focus on its Marcellus

shale assets. Excluding the impact of the sale, production would

have risen 33%.

Range Resources’ total price

realization for the quarter averaged $5.76 per Mcfe, up 13.6% year

over year. This was mainly attributable to a higher liquids

proportion in the total production mix and increased NGL and crude

oil prices. The average realized gas price was $4.54 per Mcf, up

almost 4% from the prior-year quarter. NGLs were sold at $50.07 a

barrel (up 35% year over year) and oil at $80.42 a barrel (up

18%).

Financials

At the end of the quarter,

long-term debt was $1,787.4 million, representing a

debt-to-capitalization ratio of 44.3% compared with 49.8% in the

prior quarter. The company spent $281.1 million in capital

expenditure (capex) in the quarter. Since it began extracting gas

from the Marcellus, Range has drilled 292 horizontal wells. Of

these, 71 are yet to be completed and 30 are awaiting pipeline

connection.

Hedging

For three consecutive quarters

starting second quarter 2011, Range has hedged 347,870 million

British thermal units per day (MMbtu/d), 318,200 MMbtu/d and

348,200 MMbtu/f of natural gas production at an average floor price

of $5.48, $5.43 and $5.33, respectively.

The company has also hedged 189,641

MMbtu/d of natural gas at an average price of $5.32 for 2012 and

160,000 MMbtu/d at an average floor price of $5.09 for 2013.

Guidance

Previously, the company had

projected 2011 production growth of 10% (including its asset sale

program). For 2012, Range Resources anticipates production growth

in the 25% to 30% range on an annualized basis, with finding and

development costs being less than or equal to $1.00 per Mcfe.

The company had also forecast its

full-year capital budget at $1.38 billion with 86% apportioned for

the Marcellus Shale play and the remaining for Midcontinent,

Appalachian and Southwest divisions. Total capex comprised $1.13

billion for drilling and recompletions, $160 million for land, $55

million for seismic and $35 million for pipelines and

facilities.

Outlook

We believe that Range Resources’

large acreage holdings will support several years of oil and gas

drilling in fast-growing fields. In a low natural gas price

environment, the company’s record production and declining unit

costs (down 9% in the reported quarter on an aggregate basis) along

with the sale of non-core properties will be beneficial over time.

In 2010, proved reserves increased 42% year over year to 4.4

trillion cubic feet equivalent (Tcfe) and the company replaced 931%

of its total production. We believe that with a robust asset base,

Range Resources remains on track to deliver 10% year-over-year

production growth during 2011.

Although we appreciate Range

Resources’ increasing focus on liquids, its natural gas weighted

production and reserve will weigh on the stock. Our long-term

Neutral recommendation for the company remains unchanged. Range

Resources holds a Zacks #4 Rank, which translates to a short-term

Sell rating.

Headquartered in Fort Worth, Texas

Range Resources is an onshore-focused exploration and production

company with operations primarily in Appalachia and the Barnett

Shale. The company competes with EQT Corporation

(EQT), SM Energy Company (SM) and Ultra

Petroleum Corp. (UPL).

EQT CORP (EQT): Free Stock Analysis Report

RANGE RESOURCES (RRC): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

ULTRA PETRO CP (UPL): Free Stock Analysis Report

Zacks Investment Research

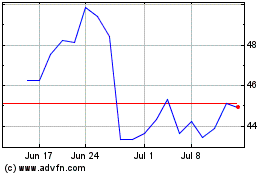

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

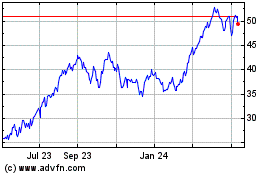

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024