Range Resources Sees Volume Expansion in Q2 - Analyst Blog

July 19 2011 - 2:30PM

Zacks

Range Resources

Corporation’s (RRC) second quarter 2011 production volume

saw an 8% improvement from the year-ago period, augmented by

superior drilling results from its Marcellus Shale and

Mid-continent properties.

The company’s second quarter

production volume of 508 million cubic feet equivalent per day

(MMcfe/d) comprise 76% natural gas, while natural gas liquids

(NGLs) and oil contributed 17% and 7%, respectively.

Range lost more than 100 MMcfe/d of

production when it sold its 52,000 acres of Barnett Shale

properties for $900 million on April 29, in order to focus on its

Marcellus shale assets. Excluding the impact of the sale,

production would have risen 33%.

The Mid-continent region

experienced a 30% increase in its quarterly production, with liquid

production growth of 20% from the year-earlier period. In its

Marcellus position, the company raised its ultimate recovery (EUR)

expectation to 5.7 billion cubic feet equivalent (Bcfe) versus its

prior expectation of 5.0 Bcfe. The upward revision in EUR is based

on production results from 103 horizontal wells that became

operational during the last two years.

The company’s total price

realization for the second quarter (including the effects of hedges

and derivative settlements) averaged $5.63 per Mcfe, up 11% year

over year. This was mainly attributable to a higher liquids

proportion in the total production mix and increased NGL and crude

oil prices. The overall price comprised NGL at $50.07 per barrel,

crude oil at $80.42 a barrel and natural gas at $4.36 per Mcf.

Range Resources displays a

diversified high-quality asset base across the

low-risk/long-reserve Appalachian assets and

large-volume/rapid-payout Gulf Coast properties. Given a dominant

presence in the Marcellus Shale play, we believe that the large

acreage holdings will support several years of oil and gas drilling

in the fast-growing fields. In a low natural gas price environment,

the company’s record production, declining unit costs and the sale

of non-core properties will be beneficial over time.

The company spent $280 million to

drill 91 wells and 4 recompletions, while achieving a 100% success

rate during the second quarter. We believe that with a robust asset

base, Range Resources remains on track to deliver 10%

year-over-year production growth (excluding the Barnett asset sale)

during 2011.

However, considering the company’s

exposure to volatile natural gas fundamentals, interest rate risks

and the uncertain macro backdrop, we maintain our long-term Neutral

recommendation. The company retains a Zacks #3 Rank (short-term

Hold rating).

Headquartered in Fort Worth, Texas,

Range Resources competes with EQT Corporation

(EQT), SM Energy Company (SM) and Ultra

Petroleum Corp. (UPL).

EQT CORP (EQT): Free Stock Analysis Report

RANGE RESOURCES (RRC): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

ULTRA PETRO CP (UPL): Free Stock Analysis Report

Zacks Investment Research

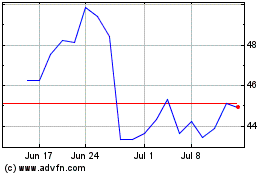

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

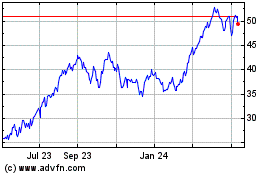

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024