SM Energy to Offload Marcellus Acres - Analyst Blog

July 19 2011 - 3:37PM

Zacks

SM Energy Company

(SM) is on track with its divestiture plan. The oil and gas company

has signed an asset sale agreement related to its entire Marcellus

position with an affiliate of Endeavour International

Corporation (END) for a total cash consideration of $80

million. The transaction, which is subject to customary closing

conditions, is slated to close in the fourth quarter of 2011.

The deal covers SM Energy’s total

leasehold acreages at McKean and Potter counties of Pennsylvania

stretching approximately 42,000 net acres as well as associated

pipeline assets. There are currently three producing wells on the

property with first quarter 2011 production of 2 million cubic feet

of oil equivalent per day (MMcfe/d). As of year-end 2010, there

were 5.6 billion cubic feet equivalent (Bcfe) of booked reserves

related to these assets, of which 50% were classified as proved

developed.

The Marcellus shale is one of the

largest natural gas finds in the United States spreading from West

Virginia and Ohio across Pennsylvania and into New York. But

environmental concerns have cropped up from hydraulic fracturing

methods used in the shale rock to extract fuel, compelling drillers

to consider moving out.

The latest move is part of the

company’s extensive plan to offload its non-core assets and comes

on the heels of two Eagle Ford Shale monetization agreements. The

company had earlier stated that it expects to raise $300–$500

million over the next 12 months either through joint venture

agreements or through asset sales, including its Marcellus shale

properties.

Recently, SM Energy shed 5,400

acres of non-producing land in the Eagle Ford Shale area of LaSalle

and Dimmit counties, Texas for about $225 million. Following this,

the company divested a 2.5% working interest in its non-operated

Eagle Ford Shale acreage in Texas to a subsidiary of Mitsui &

Co. Ltd. for $680 million.

To date, the company has closed or

entered into transactions in excess of $1 billion to fund for the

development of higher value assets in its portfolio. We believe

that SM’s emerging core portfolio will support several years of

visible organic growth. The company’s attractive oil and gas

investments, a balanced and diverse portfolio of proved reserves

and development drilling opportunities will create value for

shareholders. However, we maintain our long-term Neutral

recommendation considering the company’s natural gas-weighted

reserves and production.

SM Energy, which competes with

Ultra Petroleum Corp. (UPL), currently retains a

Zacks #3 Rank, which is equivalent to a short-term Hold rating.

ENDEAVOR INTL (END): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

ULTRA PETRO CP (UPL): Free Stock Analysis Report

Zacks Investment Research

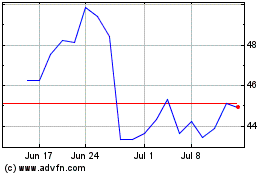

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

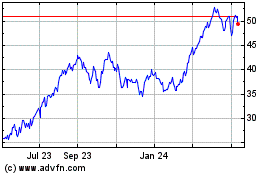

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024