SM Energy Company (NYSE: SM) today reports financial results for

the fourth quarter of 2010 and provides an update on the Company’s

operating and financial activities. In addition, a new presentation

for the fourth quarter earnings and operational update has been

posted on the Company’s website at sm-energy.com. This presentation

will be referenced in the conference call scheduled for 8:00 a.m.

Mountain time (10:00 a.m. Eastern time) on February 25, 2011.

Information for the earnings call can be found below.

MANAGEMENT COMMENTARY

Tony Best, CEO and President, remarked, “Last year was a

transformational year for SM Energy. We entered 2010 with a plan to

advance our resource plays in inventory and get them ready for

full-scale development. Our focus became centered on oil and

liquids rich plays such as the Eagle Ford shale and Bakken/Three

Forks and we saw continued success in these programs. For the year,

SM Energy replaced nearly 350% of its production organically, while

keeping a strong balance sheet. We are well positioned as we enter

2011 and we remain focused on building shareholder value with the

continued growth in our key resource plays.”

FOURTH QUARTER 2010 RESULTS

SM Energy posted net income for the fourth quarter of 2010 of

$37.1 million, or $0.57 per diluted share. This compares to $990

thousand, or $0.02 per diluted share, for the same period in 2009.

Adjusted net income for the fourth quarter was $29.7 million, or

$0.46 per diluted share, versus $20.1 million, or $0.31 per diluted

share, for the fourth quarter of 2009. Adjusted net income excludes

certain items that the Company believes affect the comparability of

operating results. Items excluded are generally one-time items or

are items whose timing and/or amount cannot be reasonably

estimated. A summary of the adjustments made to arrive at adjusted

net income is presented in the table below.

For the Three Months Ended December 31, 2010

2009 Weighted-average diluted share count (in

millions) 64.9 64.1

$ inmillions

PerDilutedShare

$ inmillions

PerDilutedShare

Reported net income $37.1 $0.57 $1.0 $0.02

Adjustments net of

tax: Change in Net Profits Plan liability ($3.0 ) ($0.05 ) $4.3

$0.07 Unrealized derivative loss $8.2 $0.13 $2.0 $0.03 Gain on

property sales ($14.7 ) ($0.23 ) ($13.8 ) ($0.21 ) Bad debt

recovery associated with SemGroup, L.P. - - ($3.1 )

($0.05 ) Adjusted net income (loss), before impairments

$27.8 $0.43 ($9.5 ) ($0.15 )

Non-cash

impairments net of tax: Impairment of proved properties $3.9

$0.06 $13.5 $0.21 Abandonment and impairment of unproved properties

($1.9 ) ($0.03 ) $15.7 $0.24 Impairment of materials inventory -

- $0.5 $0.01 Adjusted net income

$29.7 $0.46 $20.1 $0.31 NOTE:

Totals may not sum due to rounding

Operating cash flow was $176.4 million for the fourth quarter of

2010 compared to $144.2 million for the same period in 2009. Net

cash provided by operating activities was $78.7 million for the

fourth quarter of 2010 compared with $83.1 million for the same

period in 2009.

Adjusted net income and operating cash flow are non-GAAP

financial measures – please refer to the respective reconciliation

in the accompanying Financial Highlights section at the end of this

release.

SM Energy reported average daily production of 344.4 MMCFE/d for

the fourth quarter, which was above the guidance range of 305 to

330 MMCFE/d. Production growth was driven by strong results in the

Company’s Eagle Ford shale and Haynesville shale programs.

Sequentially, reported production grew 15% in the fourth quarter of

2010 over the preceding quarter.

Total operating revenues and other income for the fourth quarter

of 2010 was $294.1 million compared to $242.0 million for the same

period in 2009. In the fourth quarter, the Company’s average

equivalent price, net of hedging, was $7.98 per MCFE, which is an

increase of 4% from the $7.69 per MCFE realized in the comparable

period in 2009. Average realized prices, inclusive of hedging

activities, for the fourth quarter were $6.00 per Mcf, which was

essentially flat from the same quarter in 2009, and $70.30 per

barrel, which was an increase of 9% from 2009. SM Energy

reports its gas volumes on a “wet gas” basis, meaning that revenue

dollars associated with natural gas liquids (“NGLs”) are reported

within the Company’s natural gas revenues.

Lease operating expense (“LOE”) in the fourth quarter was $1.06

per MCFE, which is below the Company’s guidance of $1.15 to $1.20

per MCFE. This represents a 19% decrease from the $1.31 per MCFE in

the comparable period last year. Sequentially, lease operating

expense remained flat in the fourth quarter of 2010 from the third

quarter.

Transportation expense in the fourth quarter was $0.22 per MCFE,

which is within the guidance range of $0.20 to $0.22 per MCFE. The

reported per unit expense increased 10% from the comparable period

in 2009. Transportation expense also increased 22% from $0.18 per

MCFE in the third quarter of 2010. The increase in transportation

reflects the growth in production in areas where higher

transportation costs exist.

Production taxes for the fourth quarter of 2010 were $0.52 per

MCFE, which was essentially flat from the same period a year ago.

Sequentially, production taxes increased 33% from the third quarter

of 2010. This increase was the result of production tax credits

realized in the third quarter of 2010 related to severance tax

holidays. The Company’s realized production tax rate for the fourth

quarter was 6.5%, which was essentially within the provided

guidance of 7% of pre-hedge oil and natural gas revenue.

Total general and administrative (“G&A”) expense for the

fourth quarter of 2010 was $1.00 per MCFE, which is above the

guidance range of $0.88 to $0.96 per MCFE. Cash G&A expense was

$0.73 per MCFE for the quarter, compared to a guidance range of

$0.54 to $0.58 per MCFE. Non-cash G&A for the quarter was $0.16

per MCFE versus a guidance range of $0.18 to $0.20 per MCFE.

G&A related to cash payments from the Company’s legacy Net

Profits Plan (“NPP”) program was $0.11 per MCFE in the quarter

compared to a guidance range of $0.16 to $0.18 per MCFE. The total

G&A expense variance from guidance is largely the result of

higher compensation costs related to annual performance-based bonus

accruals for 2010. On a sequential basis, G&A expense increased

4% from the third quarter of 2010.

Depletion, depreciation and amortization expense (“DD&A”)

was $2.99 per MCFE in the fourth quarter of 2010, which was within

the Company’s guidance range of $2.90 to $3.20 per MCFE. DD&A

increased 4%, or $0.11 per MCFE, between the fourth quarters of

2010 and 2009. Sequentially, DD&A in the fourth quarter of 2010

decreased 2% from $3.05 per MCFE in the third quarter. The

Company’s DD&A rate is impacted by a number of factors,

including year-end proved reserves and divestitures.

PROVED RESERVES AND COSTS INCURRED

Below is a roll-forward of the Company’s proved reserves from

year-end 2009 to year-end 2010.

(BCFE) Beginning of year 772.2

Revisions of previous estimate

(engineering, price, and agedPUD locations)

24.7 Discoveries and extensions 270.2 Infill reserves in an

existing proved field 114.0 Purchases of minerals in place 0.2

Sales of reserves (86.8) Production (110.0) End of year

984.5

SM Energy’s estimate of proved reserves as of December 31, 2010,

was 984.5 BCFE, which is an increase of 27% from 772.2 BCFE at the

end of 2009. These reserves are comprised of 57.4 MMBbl of oil and

640.0 Bcf of natural gas, and are 70% proved developed, compared to

82% proved developed at the end of 2009. The before income tax

PV-10 value of the Company’s estimated proved reserves at December

31, 2010 was $2.3 billion, which was roughly $1.0 billion

higher than the prior year. Over 80% of SM Energy’s estimated

proved reserves by value were audited by an independent reserve

engineering firm.

Prices used at year-end to calculate the Company’s estimate of

proved reserves were $4.38 per MMBTU of natural gas and $79.43 per

barrel of oil, using the trailing 12-month arithmetic average of

the first of month price. These prices are 13% and 30% higher than

the prices used at the end of 2009 for natural gas and oil,

respectively.

In 2010, SM Energy realized $2.14 per MCFE in drilling finding

costs, excluding revisions, which is an improvement of 38% from

$3.44 per MCFE realized in 2009. Drilling reserve replacement,

excluding revisions, increased to 349% in 2010 from 100% in

2009.

Finding costs and reserve replacement ratios are non-GAAP

financial measures – please refer to the respective definitions in

the accompanying Financial Highlights section at the end of this

release.

Below is a table detailing the Company’s costs incurred in oil

and gas producing activities for the year ended December 31,

2010.

Costs incurred in oil and gas producing activities:

For the Year Ended December 31, 2010 (in

thousands) Development costs $299,308 Facility costs 80,328

Exploration costs 443,888 Acquisitions: Proved properties 664

Unproved properties – other

53,192

Total, including asset retirement obligation $877,380

FINANCIAL POSITION AND LIQUIDITY

As of December 31, 2010, SM Energy had total long-term debt of

$323.7 million. This was comprised of $275.7 million, net of debt

discount, related to the Company’s 3.50% Senior Convertible Notes

and $48.0 million drawn on the long-term credit facility. The

Company’s debt-to-book capitalization ratio was 21% as of the end

of the quarter.

On February 7, 2011, the Company closed the private offering of

$350 million of 6.625% Senior Notes due 2019, which are unsecured

and were issued at par value. The net proceeds will be used to

repay outstanding balances under the credit facility, fund a

portion of the Company’s 2011 capital program and for general

corporate purposes. As a result of the offering, the borrowing base

for the long-term credit facility was automatically reduced from

$1.1 billion to $1.0 billion; however, the Company’s commitment

amount under the credit facility of $678 million was not changed.

SM Energy’s debt-to-book capitalization ratio, pro forma for

this offering, would be 34%.

OPERATIONAL UPDATE

Eagle Ford Shale

SM Energy is currently operating two (2) drilling rigs on its

operated acreage in South Texas. The Company plans to increase its

operated rig count to six (6) drilling rigs by the end of 2011. A

third drilling rig is expected to arrive at the beginning of March

2011.

The Company continues to make improvements in its drilling times

in the play. During 2010, drilling time per 1,000 ft. of

penetration was reduced to 24 hours from 32 hours, a 25%

improvement. A number of pilots to test downspacing potential and

retained energy fracture stimulations are planned this year, both

of which will provide important data regarding the ultimate spacing

for the Company’s development plans.

SM Energy has previously announced its intention to sell down a

portion of its total 250,000 net acre Eagle Ford shale position.

The data room for this planned transaction opened earlier this week

and the Company expects to have an agreement completed in the

second quarter of 2011.

Bakken / Three Forks

Two (2) drilling rigs are currently operating for SM Energy in

the Williston Basin with a focus on horizontal development of the

Bakken and Three Forks formations. A third operated rig is expected

to arrive in April of 2011. The Company has increased its acreage

position in the prospective portion of North Dakota to

approximately 85,000 net acres, up from the previously reported

81,000 net acres.

Marcellus Shale Divestiture

Update

To date, the Company has not received acceptable cash offers for

its Marcellus shale position in north central Pennsylvania where it

holds the rights to approximately 43,000 net acres. SM Energy

continues to negotiate with interested parties.

Performance Guidance

The Company’s guidance for the first quarter and the full year

of 2011 is as follows:

1Q11 FY 2011 Production

(BCFE) 30 – 33 128 – 132 LOE ($/MCFE) $1.10 – $1.15 $1.07 – $1.12

Transportation ($/MCFE) $0.30 – $0.35 $0.40 – $0.45 Production

Taxes (% of pre-hedge O&G revenue) 7% 7% G&A - cash

NPP ($/MCFE) $0.16 – $0.18 $0.16 – $0.18 G&A - other cash

($/MCFE) $0.54 – $0.57 $0.55 – $0.58 G&A - non-cash ($/MCFE)

$0.12 – $0.14 $0.13 – $0.15 G&A TOTAL ($/MCFE) $0.82 – $0.89

$0.84 – $0.91 DD&A ($/MCFE) $2.95 – $3.15 $2.95 – $3.15

Non-cash interest expense ($MM) $3.6 $15.0 Effective income tax

rate range 37.4% - 37.9% % of income tax that is current Drilling,

excluding revisions - numerator defined as the sum of development

costs and exploration costs and facility costs divided by a

denominator defined as the sum of discoveries and extensions and

infill reserves in an existing proved field. To consider the impact

of divestitures on this metric, further include sales of reserves

in denominator. > Drilling, including revisions -

numerator defined as the sum of development costs and exploration

costs and facility costs divided by a denominator defined as the

sum of discoveries and extensions, infill reserves in an existing

proved field, and revisions. To consider the impact of divestitures

on this metric, further include sales of reserves in denominator.

> All-in - numerator defined as total costs incurred,

including asset retirement obligation divided by a denominator

defined as the sum of discoveries and extensions, infill reserves

in an existing proved field, purchases of minerals in place, and

revisions. To consider the impact of divestitures on this metric,

further include sales of reserves in denominator.

Reserve Replacement

Ratio Definitions:

> Drilling, excluding revisions - numerator defined as the sum

of discoveries and extensions and infill reserves in an existing

proved field divided by production. To consider the impact of

divestitures on this metric, further include sales of reserves in

denominator. > Drilling, including revisions - numerator

defined as the sum of discoveries and extensions, infill reserves

in an existing proved field, and revisions divided by production.

To consider the impact of divestitures on this metric, further

include sales of reserves in denominator. > All-in -

numerator defined as the sum of discoveries and extensions, infill

reserves in an existing proved field, purchases of minerals in

place, and revisions divided by production. To consider the impact

of divestitures on this metric, further include sales of reserves

in denominator.

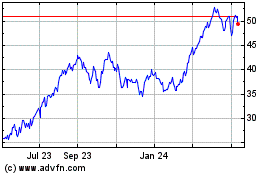

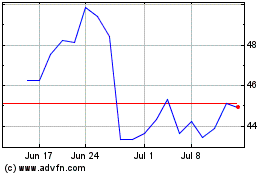

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024